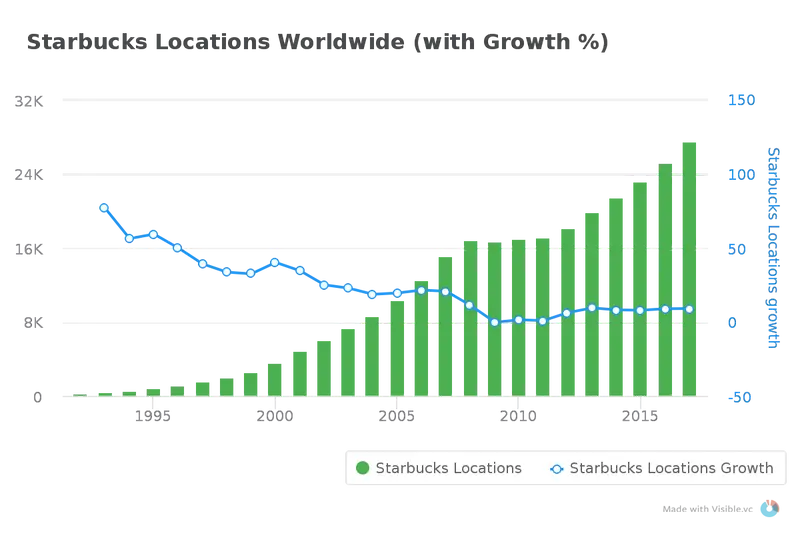

Howard Schultz recently announced that he will be stepping down as executive chairman of Starbucks; exactly 26 years after their initial public offering. In 26 years as a public company, Howard helped transform Starbucks from a small coffee chain into a global brand with over 27,000 locations.

In our newest investor letter, we can take a look at the 1992 Starbucks Shareholder Letter; their first as a publicly traded company. With no mentions of mobile ordering, international expansion, or Unicorn Frappuccinos it is remarkable to see the growth that Starbucks experienced with Howard Schultz at the helm. Expanding from 154 to 27,000+ locations two things have stayed true throughout; Starbuck’s commitment to their people and their coffee.

All of the charts, images, quotes, and emphasis below were added by us. You can find the original 1992 Starbucks Shareholder Letter here.

The 1992 Starbucks Shareholder Letter

TO OUR SHAREHOLDERS:

Every successful business has its competitive advantage. At Starbucks we have two: Our coffee and our people. Since our inception in 1971, Starbucks has been based on an unrelenting (some would say fanatical) devotion to providing its customers with the best possible cup of coffee.

In Howard’s last shareholder letter (2016) this still rings true. Starbucks has continued to double down on enhancing the lives of their “partners” and the communities where they live and work.

One indicator of this passionate commitment is the question we ask ourselves whenever we assess our efforts: are they as good as the coffee? Our retail stores are intended to be environments worthy of housing the finest coffees which nature and skilled human labor can provide. Dedication to quality, in the cup, is what Starbucks is all about.

At the time of their IPO Starbucks was doing ~100,000 transactions at their retail stores a week. As of 2016? 85M+ transactions a week across their retail stores. In addition to their focus on people, Starbucks has scaled their transactions while staying true to their focus on quality coffee. Below is an excerpt from Howard’s letter to partners announcing his departure:

“Sourcing and roasting the highest quality arabica coffee will always be our heritage. Never stop reaffirming Starbucks leadership position in all things coffee. I can think of no better expression of this than our Reserve stores.”

A look inside the experimental Starbucks Reserve in Chicago.

Many of the specifics that make our company seem unique to others are, to our way of thinking, simply natural, even inevitable, consequences of this core attitude and aspiration. Quality coffees are grown, roasted, brewed, by quality people, and the welfare of the people, the planet and product are inextricably linked. Our “employees” are called partners, and this is literally true, since every individual is offered stock options.

We seek to seamlessly interweave variables that ensure quality for the customer with literal ownership in the company. We want to be the employer of choice in each market in which we do business. In order to achieve this goal we pay fairly, provide benefits to all whether part-time or full-time, and encourage individuality and open communication. Our environmental commitment begins with recycling and conserving wherever possible.

We donate coffee locally in every market, providing homeless shelters and hospices better coffee for free than many of our competitors offer at full price. We are also entering our second year as the West Coast’s largest corporate donor to CARE, the international aid and development organization. Starbucks, together with its customers, funds CARE programs in the coffee producing countries of Indonesia, Kenya and Guatemala, with an emphasis on disease prevention and increased literacy for children. This year has been an exceptionally rewarding one.

We achieved sales of $93,078,000 which were up 61.5% from 1991. We opened 53 new stores, including ones in our newest markets of San Diego, San Francisco and Denver.

To no surprise, Starbucks has not been able to sustain their growth rate after raising $25M+ from their IPO but have continued to grow store locations at a steady rate. In 2017 more brick-and-mortar stores closed since the start of the “Great Recession” (2007), yet Starbucks added 2,250 net new store locations over the course of the year. The commitment to their people, coffee, and culture has continued to resonate with customers around the world.

Also, we earned $4,104,000 after tax which represented a 70.4% increases versus a year ago. Lastly, Starbucks’ entrance into the world of publicly-owned companies this June was profoundly significant, both within the company and for the specialty coffee industry as a whole. It is an affirmation of our leadership position, but it is first and foremost a powerful demonstration of what can result from the joining together of great people and great coffee.

Howard Schultz

chairman, president, and chief executive officer