Key Takeaways

-

Discover how the best fund management software helps venture capital firms track portfolios, monitor performance, and report to limited partners with ease.

-

Learn which core features, like real-time analytics, automated investor reporting, and seamless integrations, set top investment management tools apart.

-

Understand the pros and cons of free vs. paid portfolio management software and when it makes sense to upgrade.

-

Get practical tips for choosing software that fits your VC firm’s size, growth stage, and reporting needs.

-

Explore emerging trends such as AI-driven analytics and cloud-based platforms that are shaping the future of fund management.

Finding the Best Fund Management Software for Your VC Firm

Managing a venture capital (VC) fund requires precision, efficiency, and the right technology. As firms oversee multiple investments, track fund performance, and report to limited partners (LPs), having the best fund management software can make all the difference.

From portfolio tracking to investor reporting, modern software solutions streamline critical workflows. Below, we’ll explore what to look for in fund management software, the pros and cons of free vs. paid options, and more.

Why Venture Capital Firms Need Specialized Fund Management Software

Venture capital investing is unique compared to other asset classes. Unlike traditional asset management, VC firms invest in startups with unpredictable growth trajectories, manage multiple funding rounds and deal structures, report to LPs with detailed portfolio insights, and sometimes need real-time data on fund performance.

Generic investment management software doesn’t always meet these needs. That’s why many VC firms seek investment portfolio management software specifically designed for venture capital workflows. With the right tools, investors can better manage due diligence, track returns, and communicate effectively with stakeholders. This is why a top investment management software company should tailor solutions specifically for venture capital firms.

“Over 235 venture firms have embraced data, automation, and AI to drive better decisions, stronger returns, and leaner teams — yet only 40% believe they are fully leveraging automation, data, and AI in their operations.” Data-Driven VC Landscape Report 2025, Vestberry

Key Features to Look for in Fund Management Software

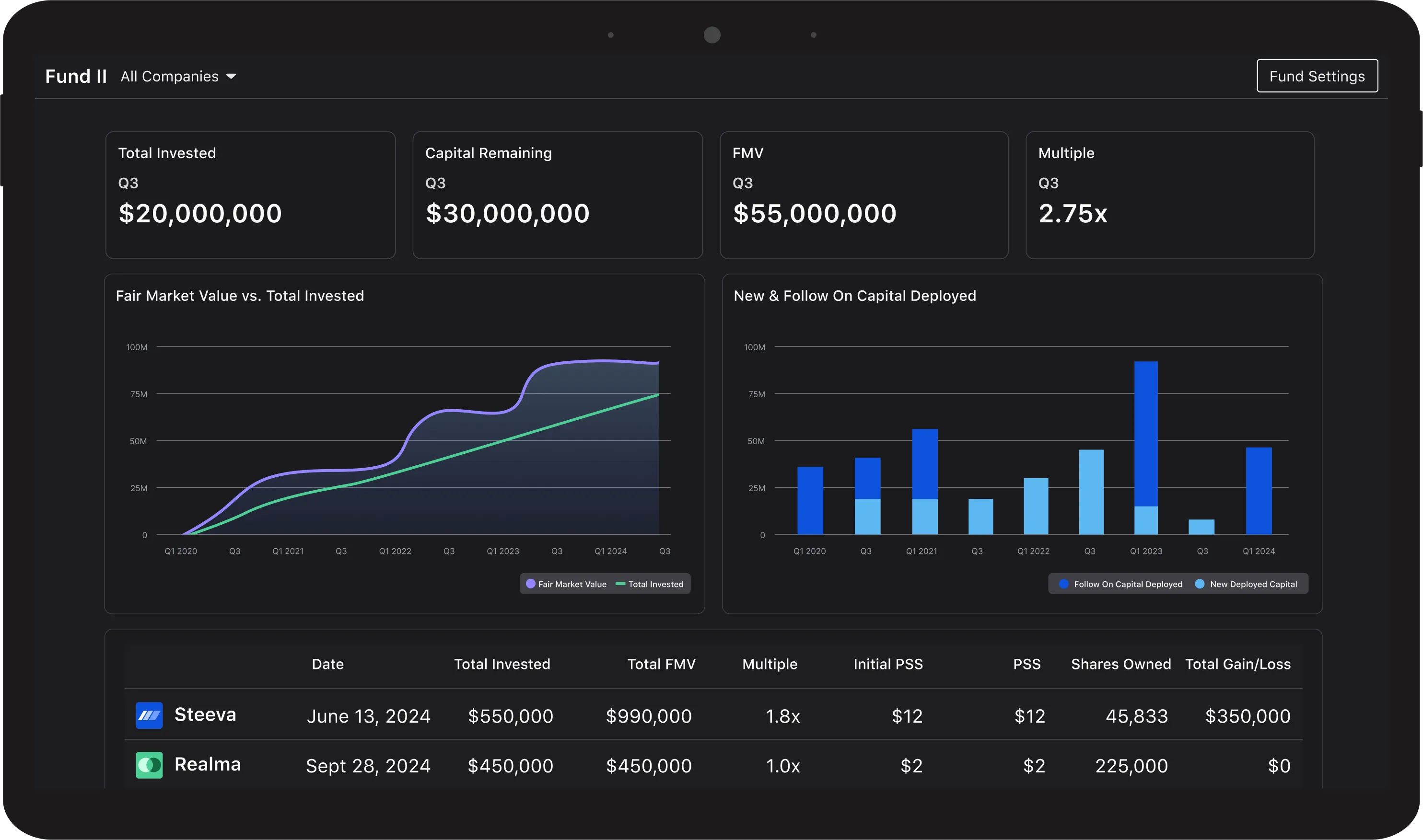

The best fund management software should offer portfolio tracking and analytics. Tracking startup investments across multiple funding rounds is critical. The best portfolio tracker should provide real-time insights into valuation changes, key performance metrics, and return projections. Many VC firms also look for the best portfolio tracker app to access data on the go.

Fund performance monitoring is essential for reporting and strategic decision-making. Best investment portfolio management software platforms offer detailed fund analytics, cash flow tracking, and benchmarking tools.

Investor reporting and communication are crucial since LPs expect transparency. The best fund management software enables automated reporting, custom dashboards, and real-time data sharing. Investment management software companies prioritize investor relations tools to keep stakeholders informed.

Compliance and audit features ensure venture capital firms meet regulatory requirements. Software should include built-in compliance checks, audit trails, and integration with accounting platforms.

Integrations with other VC tools are necessary for maximizing efficiency. Investment portfolio management software should integrate with CRM platforms, deal flow management tools, and accounting software.

Free vs. Paid Fund Management Software – What’s Right for Your Firm?

Not every VC firm has the budget for premium software. Many early-stage investors explore free portfolio management software before committing to paid solutions. Free fund management software comes with no upfront costs, provides basic portfolio tracking and reporting, and allows firms to test features before upgrading. However, it also has limited data integrations, fewer investor reporting capabilities, and restricted scalability for larger funds.

For firms managing a single fund or a handful of deals, the best free portfolio management software may be sufficient. However, scaling VC firms often transition to paid solutions to unlock advanced features. If you’re looking for an option to try, check out best fund management software free download options available in 2025.

How to Choose the Best Fund Management Software for Your VC Firm

Selecting the right software depends on your firm’s specific needs. A small, early-stage fund may not require the same tools as a multi-billion-dollar firm. Ensure the software aligns with your portfolio structure. Venture capital firms managing institutional investors often need top investment management software companies that provide automated investor updates and compliance tracking. Software should seamlessly connect with your existing tools, from accounting software to deal-tracking platforms. As your firm grows, you’ll need software that can support more deals, more LPs, and more complex fund structures.

For firms hesitant about committing to a paid tool, exploring what is the best free portfolio tracker can be a starting point.

VC professionals frequently discuss software solutions on platforms like Reddit. Many investors look for tools recommended by their peers. Recurring themes from these discussions include the importance of user-friendly interfaces, the need for customizable LP reporting, and the trade-offs between free and premium platforms. If you’re evaluating options, checking community discussions on best investment portfolio management software can provide valuable insights.

The Future of Fund Management Software for Venture Capital Investors

The venture capital industry is rapidly evolving, and so is fund management software. Some trends shaping the space include AI-powered analytics, which is becoming a core feature of investment management software companies, helping firms identify risks and opportunities faster. Enhanced collaboration tools are improving LP communication and internal deal discussions as more investors work remotely. The shift to cloud-based platforms is making portfolio management software for private equity and venture capital more accessible, secure, and scalable. These advancements ensure that VC firms can operate with greater efficiency and transparency.

Making the Right Choice for Your VC Firm

The right fund management software can be a game-changer for VC firms, offering better data visibility, enhanced LP communication, and seamless portfolio tracking. For firms just starting, testing best fund management software free download options can provide a solid foundation before transitioning to a premium platform. Ultimately, the best choice depends on your firm’s specific needs, investment style, and reporting requirements. By leveraging the latest best investment management software companies, VC firms can streamline operations and focus on what truly matters—identifying and supporting the next wave of high-growth startups.

Frequently Asked Questions

What is the best fund management software for venture capital firms?

The best fund management software offers robust portfolio tracking, automated investor reporting, and seamless integrations with accounting and CRM tools. Top options provide real-time performance analytics, compliance features, and scalability to handle multiple funds, helping VC firms streamline operations and improve transparency with limited partners.

How can fund management software strengthen relationships with limited partners (LPs)?

Modern fund management software provides automated reporting, customizable dashboards, and real-time portfolio data. These features give LPs clear, timely insights into fund performance, fostering trust and transparency. By delivering professional, data-rich updates, VC firms can deepen investor confidence and build long-term partnerships.

How does investment portfolio management software benefit venture capital investors?

Investment portfolio management software centralizes data, tracks valuations across funding rounds, and provides detailed analytics. For VC firms, it simplifies due diligence, improves investor communication, and ensures compliance. This allows partners to make informed decisions faster and maintain clear, real-time insights into fund performance.

What features should VC firms look for in fund management software like Visible?

VC firms benefit most from software that delivers automated LP updates, dynamic portfolio dashboards, and powerful data integrations. Visible offers real-time performance tracking, customizable investor reporting, and seamless connections to CRM and accounting tools, ensuring firms can share accurate insights and communicate with limited partners effortlessly.

Can free portfolio management software scale with a growing VC firm?

Free tools might be able to handle a single fund or a small portfolio, but often fall short. Limited data integrations and reporting options make it difficult to manage multiple LPs or larger fund structures. Scaling firms typically need paid investment management software to meet investor expectations.

What is the difference between private equity and venture capital fund management software?

Both manage alternative investments, but VC software focuses on early-stage startup tracking, multiple funding rounds, and real-time valuation changes. Private equity portfolio management software often emphasizes buyouts, mature company performance metrics, and more extensive financial modeling.

How do integrations enhance fund management software performance?

Integrations with CRMs, accounting systems, and deal flow tools reduce manual work and data duplication. For VC firms, seamless connections ensure accurate reporting, faster investor updates, and better collaboration across teams, making fund management software more efficient and reliable.

How can fund management software streamline due diligence for VC investments?

Fund management software centralizes key financial and performance data, making it easier to evaluate potential investments and monitor existing portfolio companies. With integrated reporting and analytics—like those offered by Visible—VC firms can quickly assess risk, track KPIs, and share insights with partners or limited partners during the due diligence process.