Introduction

ARR, or Annual Recurring Revenue, is a key metric for SaaS startups to understand and track. At a high level, ARR is the annual revenue a startup can expect to make. Zooming in, there are a few more layers that define what ARR really is. Understanding ARR and how to calculate it is critical as you build a successful SaaS startup.

Related Resource: Our Ultimate Guide to SaaS Metrics

What is ARR (Annual Recurring Revenue) for a Startup?

For a startup, ARR, or Annual Recurring Revenue is the profit that they can expect to make in any fiscal year period. However, there are a few requirements that need to be considered for a profit number to truly be ARR. For starters, the revenue model for the startup should be subscription-based, meaning that the product sold is not a one-time purchase but rather a recurring cost.

This subscription should be an annual one but can be fulfilled via a variety of billing structures such as monthly billing, bi-annually, or annual payments. The cost of the subscription should be in a dollar amount and always converted into an annual amount. One-off transactions for your products do not count towards ARR.

For a startup, ARR is so important because it contributes to their overall valuation. Investors, no matter what stage of startup you are at, will expect founders to know, understand, and track their startup’s ARR. Additionally, because it’s only a number made up of annualized subscription-based profit, ARR will be a distinct, different number than accountings revenue.

Why do startups like ARR?

Not only is ARR a metric that all investors expect startup founders to know and track, it’s also a favorable metric for founders beyond just pleasing investors. A few reasons why startups like ARR as a metric include:

- Forecasting and Growth Planning: Company planning is typically done on an annual basis so when revenue is measured with ARR, it makes company planning that much easier. ARR can help inform not only the annual budget but ARR growth predictions as well. A clear forecast can allow leadership to make smarter, more tactical growth moves around hiring, raising rounds of funding, and eventually, exiting or going public with their business. Related Resource: Building A Startup Financial Model That Works

- Customer Payments: With annual subscriptions, customers are only responsible for a single bill every year. This makes the headache of billing, potential delays in customers’ paying, and chasing down revenue that much easier. When the bill is 1x a year for each customer, it’s a huge time saver and allows for more on-time payments by customers and more predictable work for the finance teams at startups. Related Resource: Customer Acquisition Cost (CAC): A Critical Metrics for Founders

- Standardized Subscription Terms: Naturally, with software sales, there may be some negotiations around term length for various customers. Most companies have a standard term they prefer (2 years, 18 months, 12 months). With ARR, regardless of term length, each customer’s payments are standardized to one year. This means that payments will always be billed in 12-month increments so all customers produce annual revenue for the business and all billing and contracts are treated the same. Startups love this again for the simplicity for finance teams but also for predictability of growth.

Why do investors like ARR?

As noted earlier, investors value ARR as a key metric when evaluating startups and their founders as potential investments. A few reasons why investors like ARR as a metric are:

- Revenue Predictability: This is a big factor for investors to feel confident about an investment. If a product comes with a monthly commitment instead of yearly or a business operates solely on 1-time purchases, this can be a red flag for investors in the business-to-business space. With annualized revenue, there is no risk for seasonality to a product or slow months where monthly or 1-time revenue can not be relied on. With ARR, investors can be ensured that there is clear profitability on an annual basis which provides more security for their investment.

- Competitive Landscape Insight: In competitive spaces, investors want to align themselves with the company and product that will ultimately come out on top. It can be hard for investors to evaluate the true best investment in a crowded space where all companies are growing their customer base and employee base and seemingly showing positive growth every year. ARR can help investors understand who the true rocket ships are in a space by understanding the annual revenue growth over time. A dip in ARR year over year can be a red flag but growing ARR even when bringing on new investors that change valuations are a huge positive for investors in evaluating a competitive space. Related Resource: How to Model Total Addressable Market (Template Included)

- Ease of Business Valuation: At the end of the day, a steady increase in recurring revenue reassures investors that they will most likely see a return on an investment in your business. ARR is critical because just as it allows founders to plan for the predictable growth for their business, it allows investors to more easily and accurately predict what the value of a business will be based on its ARR growth in 5, 10, 20 years post their investment. A multiple of ARR is a clear way for investors to predict an accurate valuation of a startup’s business and make smart investment decisions.

Related Resource: The Understandable Guide to Startup Funding Stages

How to Calculate ARR

Knowing ARR is the annual recurring revenue for your business over a 12 month period, it may seem like a straightforward metric to calculate. That’s not necessarily the case. ARR can look differently depending on the company. There is nuance to how it is calculated for every business.

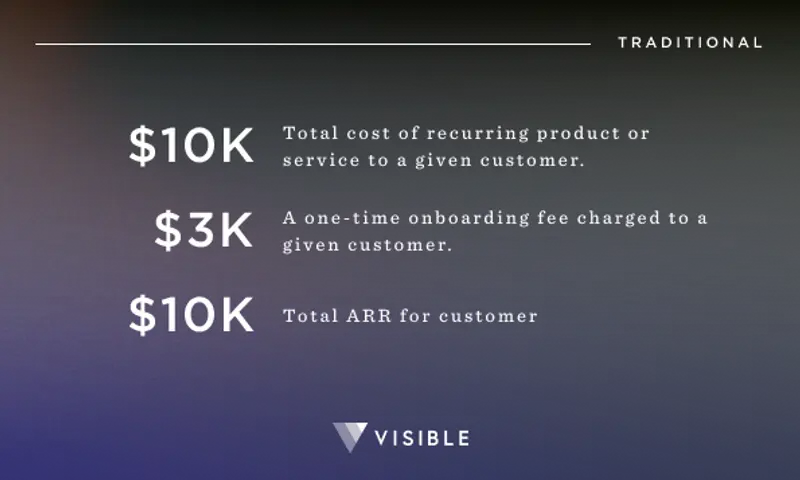

Traditional ARR Calculation

Traditionally ARR is calculated for standard annual contracts where a client commits for a 1-year term. The ARR is the total cost of the recurring product or services (what would be billed again after 1 year if the customer chooses to subscribe for another year of product). So if your product is $10,000 dollars annually but you also charge a $3,000 onboarding fee. The ARR on that customer deal would just be $10,000. The 3k is not included as it is not recurring and is only a 1-time fee.

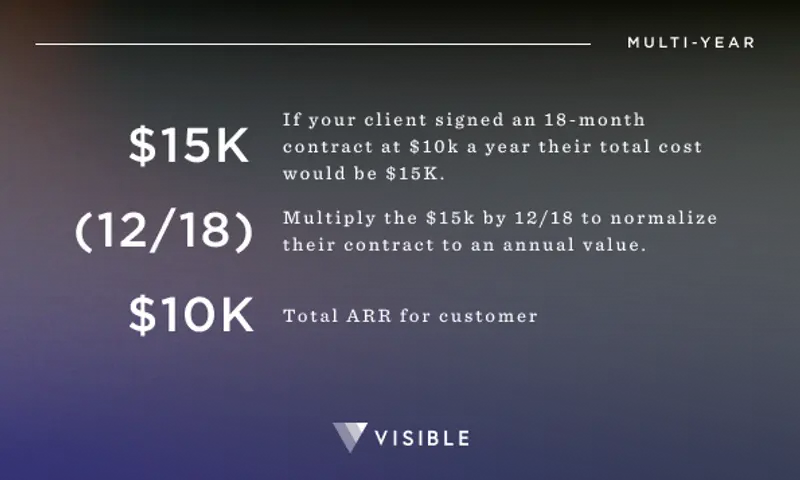

Multi-Year Contract ARR Calculation

If you have a customer that opts in upfront for a multi-year contract, meaning they won’t be up for renewal or re-subscription until that first multi-year contract is complete, this gets factored into the ARR calculation.

Sticking with our example, the recurring fee of your product is 10k a year. If a customer signs up for a 3-year contract, the ARR is found out by multiplying the annual cost by the number of years (10k x 3) and then dividing that total by the number of years (30k / 3) leaving the ARR at $10,000.

This only gets tricky when the contract is not a straightforward multi-year contract but rather a contract length with a number of months that doesn’t quite add up to exact years. If your client has signed up for an 18-month term at 10k a year. The total cost of the product will be multiplied by the result of 12 divided by 18. $15,000 x (12/18) =$10,000 ARR. For a 15 month contract it would read: $12,500 x (12/15) = $10,000 ARR and so on.

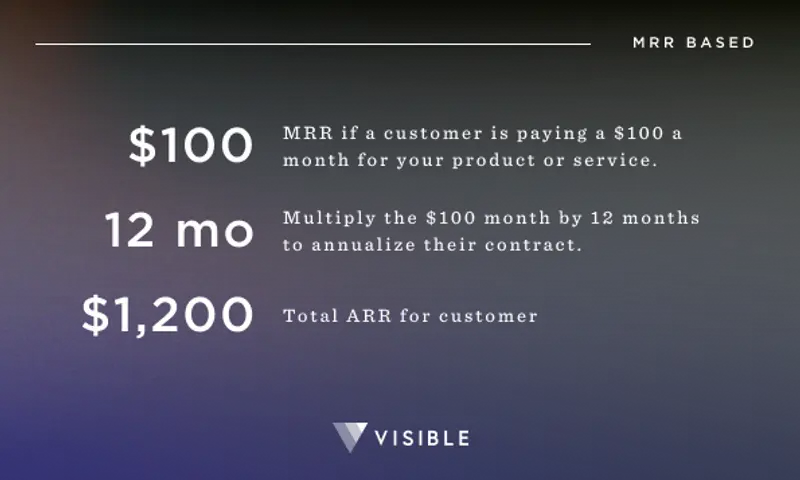

MRR Based ARR Calculation

Monthly Recurring Revenue or MRR is income a business can count on receiving every single month. Similar to ARR, it is on a recurring basis however the outcome is a 30 day period vs. an annual period. In some cases, MRR can be used as a basis for ARR calculation.

If your company operates a subscription business where the standard term is monthly (maybe with an upfront commitment of 6 months for example) your MRR can be used to estimate ARR for forecasting purposes. Simply take your total MRR (found the same way you would find traditional MRR, just looking at it month over month) and multiply by 12. So if a customer is paying for a product that is $100 a month, the ARR on that contract would be $100 x 12 = $1,200 ARR.

Common Mistakes Calculating ARR

While overall ARR might seem like a pretty straightforward metric to calculate, many startup leaders make a few common mistakes early on when pulling together ARR calculations. A few of the most common mistakes seen when calculating ARR include:

Including Free Trials

Time granted to a customer to use a product for free or at a temporary trial-period discount, regardless of how long, should not be included in ARR calculations. These should be treated as one-off payments. When the trial converts to an annual subscription, that cost can be used to calculate ARR but only if it is converted to a recurring subscription.

Not Factoring in Discounts

Often, discounts are offered for a portion of a contract to incentive partnership, however, discounts can affect your final ARR. If a customer has a discount for their first year or for any duration of their contract, it needs to be reflected in the ARR. So if the discount is 25% off for the first year bringing a cost down to $750 from a 1k list price, that needs to be reflected in the ARR and $750 should be used as the calculating number. If the discount is only for a set year, upon renewal, the full price can be used for ARR but not before then.

Treating Late Payments like Churn

If a customer is late on a payment, they haven’t churned so their contract should still be included towards ARR. The only difference the company might see here is when the payment hits the bank account but the commitment to a yearly contract is still in place so deals with late payments should be included in ARR calculations.

Other common nuances that should be included in ARR calculations include lost payments from churned customers, upsells on current customer subscriptions, downgraded subscriptions. Common nuances that should not be included in ARR calculations include set-up fees, account adjustments, or any other non-recurring charge.

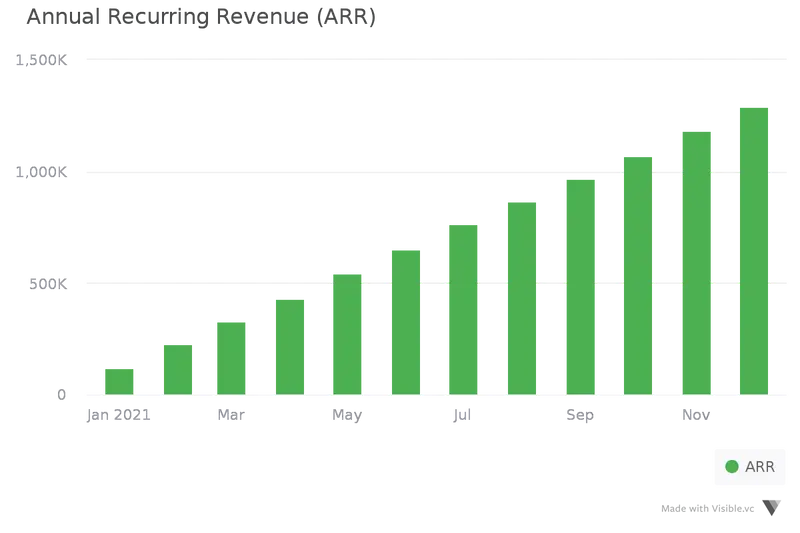

Track ARR and other KPIs with Visible

ARR is a crucial metric for any successful startup founder and team to master. Calculating ARR can help founders and executives plan for growth, make accurate forecasts, showcase more predictable revenue for investors, standardize their subscription terms, and increase the valuation of their business.

An accurate calculation of ARR can be tricky but is a critical skill to learn. Visible can help founders and investors alike keep track of ARR and a handful of other metrics in a clean, painless, and delightful way. Check out how Visible helps with metric tracking for SaaS businesses here.