This guide incorporates content from Visible’s webinar on the same topic hosted with guest Sara Zulkosky from Recast Capital. You can watch the full recording here.

Raising a venture fund is hard. General Partners (GPs) first have to find and then nurture relationships with potential investors, also known as Limited Partners (LPs). Then they have to build a persuasive enough case as to why the LP should entrust them as stewards of the LP’s capital for about 10 years — that’s the timeline if things go according to plan. When looking at it from this perspective, it makes sense why the VC fundraising process can take a year or in some cases even a few years.

Now throw in the challenge of not having prior experience raising a fund and the pursuit of becoming a GP sounds even more daunting. However, with the help of programs like Recast Capital and VC Labs, emerging managers have access to more support than ever to close on their first, second, or third fund.

Plus, according to a report from Cambridge Associates emerging managers are outperforming established funds which bodes well for GPs trying to make their case to LPs.

This article breaks down the fundamentals of raising a venture fund for emerging managers.

Understanding Different Types of LPs

Just like when starting a company, it is critical for GPs to find product market fit for their fund. The customers of the fund are LPs who are not only looking for a return but oftentimes are also interested in market insights, access to deal flow, and even impact. To set yourself up for success in finding the right LPs, it’s crucial to invest in getting to know your customers and their pain points.

Diana Murakhovskaya (The Artemis Fund) recommends…

“…ask questions like a startup would do if they were doing customer discovery. You need to learn about them (LPs) first. What drives them? What are they interested in besides returns? Treat LPs as individuals and not just a check.”

(Source: How to Source and Connect with LPs).

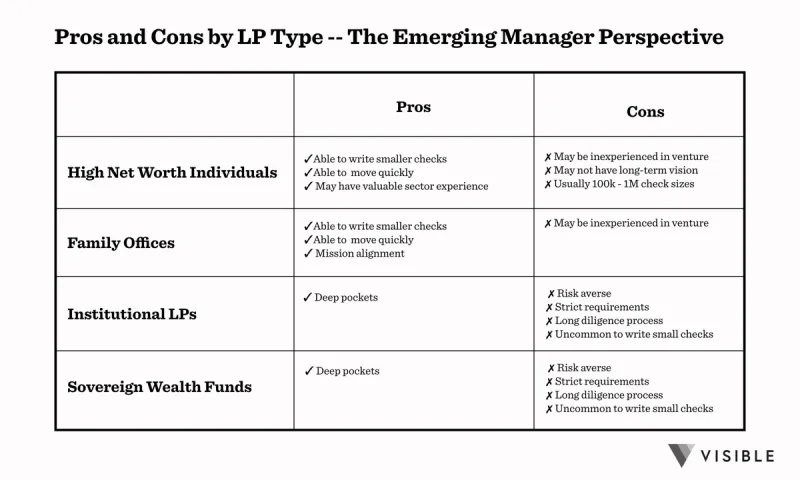

There are four major types of LPs that exist: High Net Worth Inviduals, Family Offices, Institutional LPs (including pensions and endowments), and Sovereign Wealth Funds.

The chart below outlines the Pros and Cons of the different LP types from the perspective of an emerging manager.

To summarize, high-net-worth individuals and family offices are typically the best fit for emerging managers. They’re more nimble and able to write smaller check sizes which is good because the typical fund size for emerging managers according to Recast Capital is $10 – $30 M. (Source: Webinar Recording Fundraising Best Practices for Emerging Managers)

Alternative LP types that shouldn’t be ruled out and that are becoming more common include corporations, banks, and fund of funds. Sara Zulkosky from Recast Capital encourages emerging managers to widen their lens a bit and consider exploring these alternative types of LPs.

How to Find LPs

Tap into Your Immediate Network

A great place to start fostering relationships with potential investors is by tapping into your current network. Communicate your goals and why you’re passionate about them with people already in your network but be sure to avoid violating General Solicitation laws. Don’t approach these conversations with a check in mind but rather to seek feedback on your thesis and approach. Even if no one in your immediate network may be able or interested in investing in your fund, there may be people willing to make an introduction to someone who is.

Foster Your Peer Network

Building out your peer network is important not only for fundraising but also for knowledge exchange, support, and emotional well-being — as stated before — fundraising is challenging and it’s helpful to have others in your corner who understand what you’re going through.

While GPs targeting the exact same sector, stage, and thesis might be considered competition, any GP with an adjacent approach can be a great source of support and even introductions.

Consider joining different communities of emerging managers such as Recast Capital, VC Lab, Women in VC, All Raise, or starting your own round table if you don’t already have a peer group in place.

The maxim holds true that rising tides raise all ships.

Use LinkedIn

LinkedIn is a powerful tool to find new contacts and leverage your existing network. While Family Offices are traditionally opaque, an easy search for ‘Family Office’ or ‘Private Family Office’ in people’s job titles results in people supporting different functions of this type of investor. From there, it’s always best to see who your second-degree connections are to understand if someone can make a warm introduction on your behalf or as Sara Zulkosky stated it’s also ok to “shoot your shot” and send a cold message.

Tips for Cold Emails:

- Keep it short, sweet, and to the point.

- Always take the time to personalize it when you can.

- Flattery works. We’re all human and we all like it when people take the time to get to know what interests us.

Use Databases

While not free, if you can get access to PitchBook or Prequin these can be good sources to better understand the investment activity of LPs. You’ll be able to get an understanding of which LPs invested in certain funds (if it was disclosed) and for how much.

Drawing LPs to you

Some LPs seek out GPs so it’s a great idea to create thought leadership content that demonstrates your expertise. These can be articles that communicate your conviction around your thesis and the sectors in which you’re investing.

It’s also a great idea to share this content with LPs via email after you meet with them to stand out from other GPs.

While some GPs have created a robust social following by investing in content for twitter and LinkedIn, Sara Zulkosky stated this isn’t necessary and you should choose activities that are aligned with your personal brand and your fund’s brand.

Keeping Track of LPs

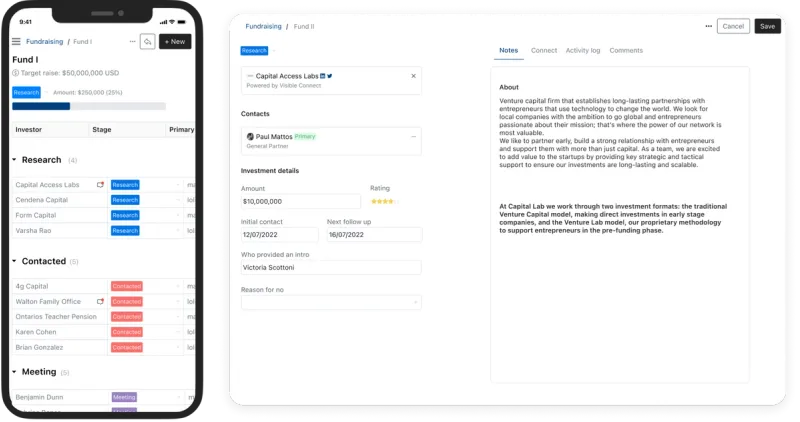

We’ve covered how to find LPs in general and which types of LPs at a high level might make sense for your fund. These potential investors should be considered your ‘top of funnel’ LPs and you should keep track of them in the first stage of your fundraising pipeline. Learn how to build a fundraising pipeline in Visible here.

Visible recommends tracking LPs in 6-8 pipeline stages to stay organized.

In this article Roseanne Wincek at Renegade Partners shared she used the following pipeline stages for her fundraising process:

- Cold Lead

- Warm Lead

- Scheduling

- First Meeting

- Data Room

- Second Meeting(s)

- References

- Docs

Learn about how to keep track of LP’s in your fundraising pipeline in Visible by booking some time with our team.

How to Qualify LPs

Next, it’s important to qualify LPs based on certain criteria to make sure you’re running an efficient fundraising process. Appropriately qualifying LPs will save both you and LPs a lot of time in the long run.

Here are some example criteria you can use to qualify LPs:

- Check Size — Make sure the LP is able to write check sizes that will work for the size of the fund you’re raising

- Thesis of Firm — Understand whether the LPs have a vested interest in your space

- Room for Emerging Managers — Newer LPs often have more open slots for emerging managers as a part of their investment strategy

- Vision Alignment — Does the LP understand and align with your vision

What does an ‘Ideal’ LP look like

While the points above are mandatory to appropriately qualify an LP, here are some other traits to look for in an ideal LP.

- They’re someone you’d want to engage with regularly for at least 10 years.

- They’re able to be patient with returns.

- They can offer valuable support in a way that will benefit you or your fund.

What to Ask During a First Meeting with an LP

The first meeting is not just for the LP to get to know you — it’s also a great time for you to show you’ve done your homework by asking thoughtful questions to the LP.

Sara from Recast Capital’s advice to GP’s..

“You should always feel comfortable asking LPs questions to start the conversation and LPs should always be willing to answer them…Don’t feel shy. Definitely ask these questions because you’ll get a very good sense a few minutes in whether this is worth your time.”

Here is a list of example questions GPs should feel comfortable asking LPs in a first meeting:

- Could you tell me more about your investment strategy?

- Where do you want to be spending your time as it relates to your investment strategy?

- What’s the size of your private portfolio?

- Are you currently making new commitments?

- What’s your typical check size?

- What does your process look like to invest in an emerging manager?

- Have you ever invested in an emerging manager?

- What’s the smallest fund you’ve invested in?

The LP Diligence Process

The length of the diligence process depends on the LP organization and how much red tape there is internally. If an organization is small, nimble, and enthusiastic about your fund, it could take just a month but this is rare. The diligence process from Institutional LPs usually takes about 6 months. It can take even longer if advisors and consultants are involved.

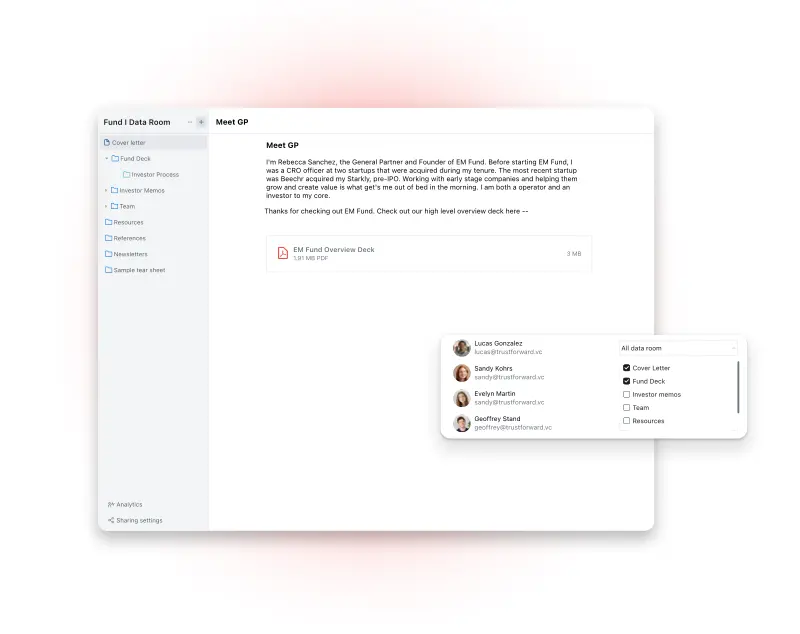

Do your part to keep the diligence process streamlined by having your LP Data Room set up in advance.

Related resource: What to Include in your LP Data Room.

Visible supports Data Rooms for Emerging Managers — learn more.

Nurturing Relationships with LPs

It’s important to remember that LP’s have a lot of inbound interest to manage. For this reason, it’s a great idea to go the extra mile to stand out to LPs by following the tips below.

Demonstrate you’re an excellent communicator

It’s a great idea to get into the habit of sending monthly fundraising updates to potential LPs that you’d like to build deeper relationships with. Check our Visible’s LP Fundraising Monthly Progress Update for inspiration.

Here’s what Elizabeth “Beezer” Clarkson, Partner at Sapphire Partners and institutional LP had to say about best practices for reaching out, building, and maintaining relationships with institutional LPs…

“Clear and consistent communication is imperative in helping create a strong GP/LP relationship. LPs want to know you’re in touch with your portfolio and you have a full assessment of its health: cash runway, pacing information, ownership, who was in the round, why you did the deal, how you found it, and how the company is doing. Some folks do routine newsletters, Zooms, or recordings – whatever works for you. Once a quarter is sufficient, and it’s always good to offer to stop by and visit when in town.”

(Source: “Ask an LP” with Beezer from Sapphire Partners)

Prove your sector expertise by sharing thought leadership content

Sara Zulkosky from Recast Capital recommends taking the time to write your own thought leadership pieces that focus on the sectors that you want to invest or your thesis.

Include these articles in your monthly updates or send a one-off email to an LP after a meeting to further demonstrate your expertise.

You can also use the content you’ve written as a reason to follow up with an LP who may have ghosted you after a first meeting. “I wanted to follow up with a recent article I wrote that was a continuation of the conversation we had last month…”.

Do what you say you’re going to do

LPs are only human after all and every single one of us respects the people in our lives who are true to their word. If you said you were going to do something or follow up with a resource, do it. This is both a powerful and easy way to build rapport.

Use Visible’s fundraising CRM to stay on top of when it’s time to follow up with a contact. Learn more here.

Know your metrics like the back of your hand — and how to communicate them

Even if this is the first time you’re raising a fund you will be expected to understand the core VC Fund Metrics and why they matter to LPs. Take the time to make sure you understand your fund model in and out and how the variables affect return possibilities.

Related Resource: VC Fund Performance Metrics 101 (and why they matter to LPs)

Add bottom-of-the-funnel LPs to current LP Updates

And finally, a suggestion from Sara at Recast is to add the LPs with a serious interest, your ‘bottom of funnel’ LPs, to your current committed LP communication list. It’s a great way to make them feel special (because they are) and bring them into the folds of how you communicate and what you share with current LPs.

Concluding Thoughts

Raising a venture fund, especially for first-time managers, can seem like a daunting challenge. However, over time emerging managers are being recognized by both Limited Partners and startup founders as the best way to bring about positive change in the venture industry.

Visible provides professional fundraising tools for ambitious fund managers with its Emerging Manager Fundraising Toolkit.