What to Include in a Data Room for Investors: Essential Guide for Startups

Creating a comprehensive data room for investors is crucial for startups aiming to secure funding efficiently. A well-organized data room not only streamlines the fundraising process but also impresses potential investors by providing easy access to essential documents and financial metrics, which they will ask to see.

Andrea Funsten is an investor at Basecamp Fund so it is safe to say she has seen her fair share of startups. An easy way to impress Andrea and get her to move forward with the deal quickly? A data room.

As Andrea Tweeted, “Even as early as the seed stage, an organized data room can make you stand out from the crowd. Sharing a list below of items that I received this week from a founder who is ~2 months away from raising. Left me so impressed and eager to move fast on the deal.”

Related Resource: You can now build and share your data room with Visible. Give it a free try here.

This guide will explore what should be included in a startup data room, why having an investor data room is beneficial, and how to set up an effective data room for your fundraising needs. Whether preparing for your first round of funding or looking to improve your existing data room, this article will provide valuable insights and best practices to help you stand out to investors.

What is a Data Room?

A data room is a secure online repository used by startups and businesses to store, manage, and share critical documents with potential investors, partners, and stakeholders. This virtual space enables startups to present vital information in an organized and accessible manner, ensuring that investors have all the necessary data to make informed decisions.

The primary purpose of a data room is to facilitate the due diligence process during fundraising. By having a well-structured data room, startups can efficiently provide investors with access to financial records, legal documents, market research, and other essential materials. This not only speeds up the fundraising process but also demonstrates the startup's professionalism and preparedness.

A data room is particularly beneficial for startups as it allows them to control the flow of information, maintain confidentiality, and track investor engagement. With all important documents centralized in one secure location, startups can easily manage updates and ensure that investors always have access to the most current data. In summary, a data room is an indispensable tool for any startup looking to streamline their fundraising efforts and build trust with potential investors.

Why Startups Need a Data Room

A startup data room is invaluable for any company seeking to raise capital and attract investors. By organizing and centralizing all critical documents, a startup data room streamlines the fundraising process, builds investor confidence, and enhances overall efficiency. Here are some additional reasons why a startup data room is essential:

Facilitating Due Diligence

- Efficient Information Sharing: During the due diligence process, investors will request various documents to assess the startup's viability. A startup data room allows you to quickly fulfill these requests by providing easy access to financial records, legal documents, market research, and other essential materials. This efficiency helps maintain momentum in the fundraising process and keeps potential investors engaged.

- Reducing Redundancy: Instead of responding to individual document requests, you can direct all potential investors to your startup data room. This reduces redundancy and ensures that all parties are working with the same information. It also minimizes the risk of errors or discrepancies in the shared data.

Related resource: Startup Due Diligence: What Every Founder Needs to Prepare For

Related resource: How to Get Your Startup Ready for Investors’ Operational Due Diligence

Enhancing Professionalism and Preparedness

- Demonstrating Organization: A well-organized data room demonstrates to investors that your startup is professional and prepared. It shows that you have taken the time to compile and organize your documents, which can instill confidence in your business operations and management team.

- Creating a Positive Impression: Investors are more likely to trust and invest in startups that can efficiently provide comprehensive and accurate information. A data room that is easy to navigate and contains all necessary documents creates a positive impression and sets your startup apart from competitors.

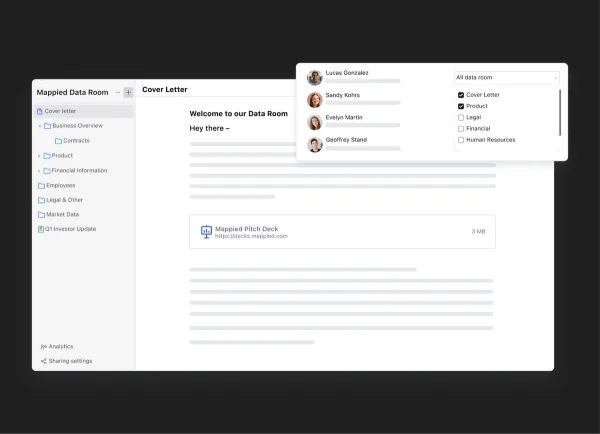

Ensuring Information Security

- Controlled Access: A startup data room offers robust security features to protect sensitive information. By using a secure online platform, such as Visible, startups can control who has access to their documents and track investor engagement. This ensures that confidential information is only shared with authorized parties, maintaining the integrity and confidentiality of your data.

- Monitoring Investor Engagement: Visible provides analytics that lets you see which documents are being viewed in your data room and by whom. This information can be invaluable in understanding investor interest and identifying which aspects of your business attract the most attention.

Supporting Long-Term Growth

- Scalability: As your startup grows, your data room can evolve to accommodate new documents and information. This scalability ensures that the data room remains relevant and useful throughout different stages of fundraising and business development. Whether you are raising a seed round or a Series B, your data room can adapt to your changing needs.

- Flexibility: A startup data room can be customized to fit the specific needs of your business and investors. You can add or remove documents as necessary, ensuring that your data room always contains the most relevant and up-to-date information. This flexibility allows you to respond to investor feedback and tailor your data room to different fundraising scenarios.

Benefits of an Investor Data Room

Building momentum in a fundraise, especially at the early stages, can almost feel impossible. Having your documents and assets in one place is a surefire way to speed up the process as much as possible. Unfortunately for founders, different investors will want to see different documents throughout a fundraise. In order to best prepare for one-off requests, it is vital to have all of your materials in 1 place to speed things up.

- One central spot where all of your most important documents live

- A forcing function to prepare the required materials before a fundraise

- Easily share documents with investors

- Track how specific investors are engaging with your fundraising materials.

A few more detailed benefits of a data rooms include:

- Streamlined Fundraising Process: A startup data room software centralizes all necessary documents in one secure location, making it easy to share information with potential investors. This reduces the back-and-forth communication typically required during due diligence, speeding up the fundraising process and allowing startups to focus on their core business activities.

- Enhanced Investor Confidence: Having a well-organized startup data room demonstrates professionalism and preparedness. Investors are more likely to trust and invest in startups that can efficiently provide comprehensive and accurate information. This transparency can set a startup apart from competitors and create a positive impression.

- Improved Information Security: A startup data room offers robust security features to protect sensitive information. By using a secure online platform, startups can control who has access to their documents and track investor engagement. This ensures that confidential information is only shared with authorized parties.

- Efficient Due Diligence: During the due diligence process, investors often request various documents to assess the startup's viability. A startup data room can quickly fulfill these requests by providing easy access to financial records, legal documents, and other essential materials. This efficiency can help maintain momentum in the fundraising process.

- Centralized Document Management: Startups often need to update their documents as new information becomes available. A startup data room allows for easy document management and ensures that all stakeholders have access to the most current data. This reduces the risk of sharing outdated or incorrect information.

- Scalability and Flexibility: As a startup grows, its data room can evolve to accommodate new documents and information. This scalability ensures that the data room remains relevant and useful throughout different stages of fundraising and business development.

Should I Have an Investor Data Room?

Before putting together your investor data room you need to ask yourself, “Should I have a data room?” The idea of data rooms is widely debated between VCs and founders. As seen above, access to a data room allowed Andrea to move quickly on her deal. On the flip side, Mark Suster claims that “you should never have a data room.” Why?

Mark makes the case that a data room actually slows down the process. After meeting with an investor for the first time they may ask for a data room, hem and haw over the details, and delay giving a solid yes or no for as long as possible.

However, there are clear advantages to using an investor data room. If done correctly, a data room can field most questions and due diligence that investors will have. In a world that continues to move away from in-person events, the ability to control the story of your data and startup is vital. The scale at which you can contact and answer questions from potential investors will allow you to focus on other aspects of your business — not just fundraising.

If you have a line of investors out the door eager to write a check — sure, you can probably skip the data room. If you’re like the 99% of companies speaking to countless investors and pressing to close your round, you may benefit from a structured and scalable way to share your data. Learn more about why you should have a data room from Elizabeth Yin of Hustle Fund below:

If you have decided a data room is right for your company, the question now becomes “How and what should be in my investor data room?”

What Should Be in My Investor Data Room?

Deciding what to include in your investor data room can be intimidating. You don’t want to include too much or too little. Remember the goal is to be more efficient to speed up your fundraise. However, most investors will be looking for similar things in a data room.

It is important to share what feels right to you — some blanket tips/best practices:

- Do not over-share information

- Share the most up-to-date information

- Well-organized and easy to navigate

Every business is different. These are simply suggestions for what founders can include in a data room. For example, a Series A company might have more robust financials and documents to include compared to a pre-revenue company. Check out a few suggestions for what to include in a data room below (we recommend each major section being a main folder with sub-folders underneath).

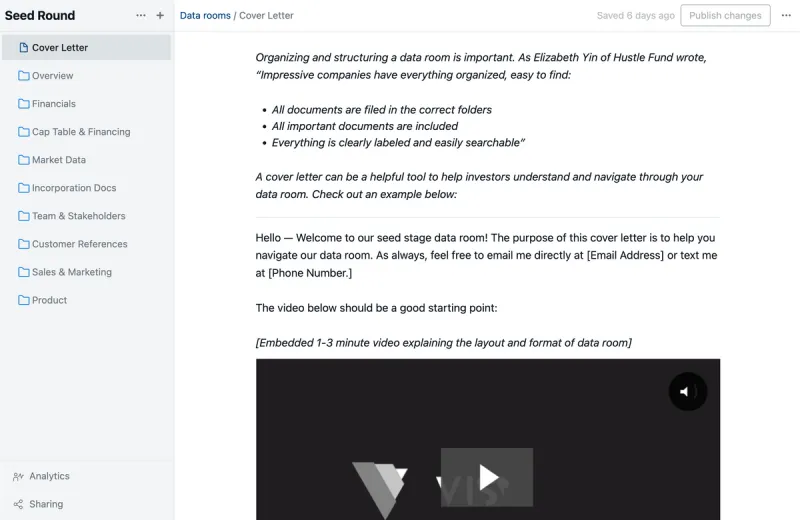

Overview Folder & Documents

As we mentioned above, organization is crucial for a successful data room. Having an overview folder with key information is a great way to set the tone. You can include a cover letter to help lay out the data room, your most recent pitch deck, and term sheet.

Related Resource: How to Write a Cover Letter for Your Data Room

Financials & Cap Table

To start, you will want to include the basics for your fundraise. This includes your deck, basic financials (cash metrics, OpEx, etc.), projections for the following year, and your cap table. Be sure to include any happenings and commitments for the current round as well. All of these things should be easily accessible for you and should require minimal effort to get them together.

The team at Corl suggests including the following documents as well:

- Voting agreements

- Investor rights agreements

- First refusal & co-sale agreements

- Stock purchase agreements

- Capitalization table

- Any documents/details on previous raises

Related Resource: The Startup Metrics Potential Investors Want to See

Market Data & Research

This section is intended to show you have a deep understanding of your market and your immediate competitors. Include any first-hand market research or public reports that are relevant to your market. You will also want to share a competitive analysis showcasing different price points and feature differences.

As Andrea Funsten wrote, “include a competitive Landscape Tracking Sheet – a list of companies that they are tracking, some that are not on the market yet. I love that they were not afraid to share this and were extremely thorough.”

Incorporation Docs

Investors will want to quickly glance at incorporation docs to make sure your company is set up for success. A couple of example docs that are worth including

- Amended and restated articles of incorporation.

- Bylaws

- Business certificates

- Tax IDs

Team & Stakeholders

This is exactly what is sounds like, a section to highlight your team members. This should also show the exact titles, salaries, and job description for current team members.

Also use this as a section to showcase where your next hires will be. This will not only help share the vision of the team you are building but can also allow investors to jump in and help hire from their network. To go above and beyond, you can also include things like onboarding documents to offer a glimpse of your culture and hiring process. A couple of example ideas:

- Employee contracts

- Team overview

- Onboarding documents

- Info on current board members

- Past board decks

Related resource: The Startup’s Guide to Investor Agreements: Building Blocks of VC Funding

Past investor Updates

Not only will including past investor updates help them assess the growth of the business, it is a surefire way to show you take investor communication and transparency seriously. As Andrea Funsten Tweeted, “Recent investor updates for the last 6 months. Helps me not just gauge the level of transparency that they have with their investors (sharing the bad just as much as the good) but I can see the progression over time.”

Customer References

During due diligence, investors will likely want to understand how your customers view your company. You can include a customer references and referrals section in your data room to help demonstrate how much your customers love your company.

Marketing materials

This can be a quick section showcasing your brand and marketing vision. Include your pitch deck as well as a deck you may share with customers. The team at Corl suggests sharing a 1-pager on your brand and marketing vision here as well.

Related Resource: Are Your Marketing Efforts Really Enabling Sales Performance?

Product

Some companies might want to include a section about their product or service. This can include anything from a demo video to IP information and patents. Check out a few examples of what you might want to include with your product folder below:

- IP information

- Demo video

- Technology (APIs, integrations, roadmaps, etc.)

What else?

These are the basics to get you started with your data room. While different investors may want to see different things, these should give you a solid start. You may be asked to include things like intellectual property, technology stacks, and more company documentation.

Related resource: Investor Agreement Template for Startup Founders

What Shouldn’t Be Included in My Investor Data Room

As a founder it is important to control your story during a fundraise. To help with this it is important to make sure what your investors are seeing and engaging with throughout a fundraise. Certain data or documents without context can be dangerous to a raise so it is important to keep tabs on what is in your data room. A few things that might not be worth including in an investor data room:

- Documents that aren’t vital to investors for decision making

- Sensitive information or data that might require additional context

- Documents that are not important to the stage an investor is at in the journey – for example, if they are only taking a coffee meeting, limit what you are sharing with them.

Build Your Data Room With Visible

At Visible, we oftentimes compare a fundraise to a B2B sales and marketing funnel. At the top of your funnel, you are finding new investors. In the middle, you are nurturing and pitching potential investors. At the bottom of the funnel, you are working through diligence and ideally closing new investors.

With the introduction of data rooms, you can now manage every aspect of your fundraising funnel with Visible.

- Find investors at the top of your funnel with our free investor database, Visible Connect

- Track your conversations and move them through your funnel with our Fundraising CRM

- Share your pitch deck and monthly updates with potential investors

- Organize and share your most vital fundraising documents with data rooms

Beyond DocSend: Exploring Innovative Document Sharing Platforms for Modern Teams

Manage your fundraise from start to finish with Visible. Give it a free try for 14 days here.