Venture capital portfolio management software has become an indispensable tool for investors seeking to streamline their fund operations and enhance visibility into their investments. In an increasingly complex financial landscape, venture capital requires precise tracking, deep analytics, and agile decision-making. This is where specialized software steps in, providing an integrated platform that simplifies portfolio oversight and ensures seamless communication between stakeholders.

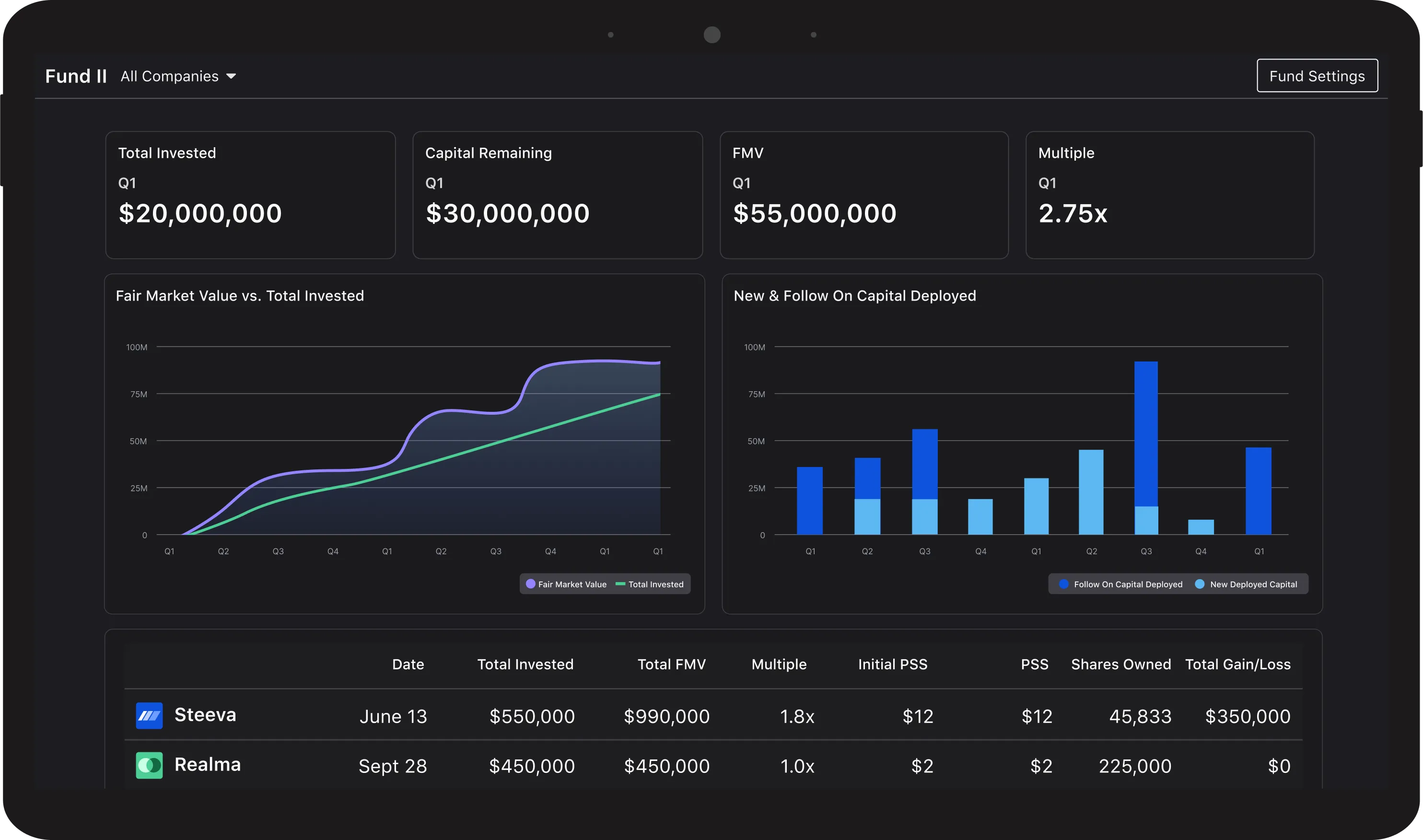

At its core, venture capital portfolio management software helps investors monitor the performance of each investment in real time. It centralizes data from various sources, offering dashboards that visualize the health of a venture capital portfolio. This software not only improves accuracy but also reduces administrative overhead, enabling investors to focus on strategic decision-making rather than being bogged down by manual processes. The rise of sophisticated venture capital management software reflects the growing need for transparency, speed, and scalability within the investment landscape.

Core Features of the Best Venture Capital Portfolio Management Software

Choosing the best venture capital portfolio management software is critical for investors who want to maintain a competitive edge. The top vc portfolio management software platforms come equipped with a suite of features designed to meet the demands of modern fund management. These tools include real-time reporting, capital call tracking, and customizable dashboards that provide deep insight into each portfolio company's performance.

Fund management software also plays a pivotal role by offering automated compliance tracking, document management, and waterfall calculations that ensure precise distributions. For investors managing multiple funds, scalability is a must-have, and the best venture capital portfolio management software seamlessly handles fund hierarchies and complex ownership structures. Integration with accounting platforms and CRM systems further streamlines operations, reducing friction between data sources and providing a single source of truth.

Investment portfolio management software extends beyond numbers, offering qualitative insights such as founder updates and board meeting notes. By consolidating all this information, investors can make informed decisions more quickly and confidently. In today’s venture capital world, where timing and precision are everything, having robust, comprehensive software is no longer a luxury—it’s a necessity.

Why Free Portfolio Management Software Isn’t Always the Best Choice

The allure of free portfolio management software is undeniable, especially for new investors or smaller funds looking to minimize overhead costs. However, while venture capital portfolio management software free download options offer basic tracking capabilities, they often fall short when it comes to handling complex fund structures and delivering advanced analytics.

One key limitation of venture capital portfolio management software free tools is their lack of customization. Most free versions are designed for general portfolio tracking, making them ill-suited for the unique needs of venture capital investors who require nuanced insights. Additionally, security and compliance are often compromised in free software, posing risks to sensitive investor and portfolio company data.

The functionality of vc fund software free versions typically caps at basic performance metrics and manual data entry, which can quickly become cumbersome as a fund grows. While free solutions such as portfolio tracking software free versions may provide a good starting point, serious investors eventually find themselves migrating to more comprehensive tools that offer enhanced reliability and deeper analytics.

Thus, while free options might seem appealing initially, their limitations can hinder growth and operational efficiency. For investors aiming to scale effectively and maintain a competitive advantage, investing in robust venture capital portfolio management software is a smarter long-term strategy.

The Role of VC Fund Software in Fund Operations

VC fund software plays a central role in the day-to-day operations of venture capital firms. Beyond simple portfolio tracking, this software ensures that funds remain compliant, audits are smooth, and investors receive timely, accurate updates. Modern vc fund software also assists with capital calls, distribution notices, and regulatory reporting, automating tasks that were traditionally manual and error-prone.

One of the primary advantages of fund management software is its ability to centralize all fund-related activities. From onboarding new investors to executing exit strategies, the software provides a single platform that keeps all stakeholders aligned. Best vc fund software solutions also incorporate risk management tools, which are invaluable for identifying potential pitfalls early and strategizing accordingly.

Fund operations are becoming increasingly complex as venture capital expands globally. With investments spanning multiple jurisdictions, having vc fund software that supports multi-currency accounting and regional compliance is crucial. Investors benefit from a transparent and efficient operation, ensuring that no detail falls through the cracks.

Enhancing Visibility and Decision-Making with Portfolio Monitoring

A well-maintained portfolio is only as effective as the monitoring system behind it. Understanding “portfolio monitoring meaning” is essential for investors who want to stay ahead of market trends and make data-driven decisions. Portfolio monitoring refers to the continuous assessment of each asset's performance, identifying opportunities for value creation and pinpointing risks that need mitigation.

Portfolio tracking software free options often provide basic monitoring capabilities, but advanced investment portfolio management software takes it a step further. These tools offer predictive analytics, scenario modeling, and automated alerts that keep investors informed about critical developments. By leveraging sophisticated portfolio monitoring, investors gain a clearer picture of portfolio health and can react promptly to any changes.

The ability to access real-time data is invaluable in venture capital, where market dynamics can shift rapidly. Advanced venture capital portfolio management software ensures that investors not only track performance but also interpret trends and forecast future outcomes. This enhanced visibility empowers investors to make proactive decisions, ultimately improving fund performance and investor confidence.

How to Choose the Best Venture Capital Portfolio Management Software

Selecting the right software requires a thoughtful approach. Investors should first assess their fund’s size, complexity, and growth trajectory. The best venture capital portfolio management software is scalable, secure, and user-friendly, ensuring it can evolve alongside the fund.

Key criteria to consider include integration capabilities, as the software should seamlessly work with existing accounting and CRM systems. Robust reporting features are also vital, offering granular insights into both financial and operational performance. The best vc fund software platforms provide dedicated customer support, helping investors troubleshoot issues quickly and efficiently.

Data security and compliance are non-negotiable, particularly as regulatory requirements tighten across the venture capital space. Investors should prioritize software that adheres to industry best practices in data protection and compliance monitoring. Lastly, user experience matters; intuitive interfaces can reduce the learning curve and ensure widespread adoption across the investment team.

Choosing the right venture capital portfolio management software sets the foundation for operational excellence and strategic agility, positioning investors for long-term success.

Future Trends in Venture Capital Portfolio Management Software

The landscape of venture capital portfolio management software is rapidly evolving, driven by advances in technology and changing investor expectations. Artificial intelligence is at the forefront of this transformation, enabling predictive analytics that help investors anticipate market movements and optimize asset allocation.

Automation is also reshaping fund management. Tasks that once required manual intervention—such as capital calls and compliance tracking—are now automated, reducing errors and freeing up valuable time for strategic initiatives. Another emerging trend is the integration of environmental, social, and governance (ESG) metrics into venture capital management software, reflecting the growing importance of responsible investing.

Investment portfolio management software is increasingly designed with flexibility in mind, allowing investors to customize dashboards and reports to suit their specific needs. Mobile access is another key development, empowering investors to monitor their portfolios from anywhere in the world.

As competition intensifies, staying ahead requires leveraging the latest technology. Venture capital portfolio management software will continue to evolve, offering more intelligent, agile, and investor-friendly solutions that redefine how venture capital is managed.