Key Takeaways

-

Discover how the best VC fund software streamlines fund management by centralizing data, automating reporting, and improving transparency across venture capital portfolios.

-

Learn why modern venture capital firms rely on VC fund management software and fund modeling software to forecast performance, reduce errors, and make data-driven investment decisions.

-

Explore practical tips for evaluating free VC fund software download options while understanding the trade-offs in scalability, data security, and integration.

-

Understand how building an effective VC stack with portfolio management and private equity fund management software enhances collaboration, compliance, and fund performance.

-

See how adopting the best VC fund management software positions venture capital firms for long-term efficiency, investor trust, and competitive advantage in a data-driven market.

Understanding VC Fund Software

Venture capital investors manage complex portfolios, monitor performance metrics, and communicate with limited partners regularly. VC fund software helps simplify these processes by offering a centralized system for data management, reporting, and collaboration. For any venture capitalist, efficiency and clarity are key. VC fund management software provides a structure to handle multiple funds, track commitments, and gain insights into portfolio performance.

The right technology reduces manual work and eliminates the need to switch between spreadsheets or disconnected systems. It allows venture capital firms to focus more on investment decisions and less on administrative tasks. Whether managing a small seed fund or a large institutional portfolio, modern venture capital tools provide the infrastructure to operate with precision and transparency.

In addition to streamlining daily operations, VC fund software also helps ensure data consistency across teams. When multiple people contribute to fund performance reports, inconsistent data entry can lead to confusion or errors. A unified software platform standardizes these inputs and ensures everyone has access to the same, up-to-date information. This foundation makes fund management not only faster but also more accurate.

What Makes the Best VC Fund Software

The best VC fund software balances usability, performance, and scalability. It should simplify complex investment workflows, not add unnecessary steps. Fund managers often look for solutions that automate reporting, track capital calls, and consolidate portfolio data.

When evaluating the best VC fund management software, it helps to consider how well it integrates with existing systems. Many firms now rely on a combination of tools referred to as their vc stack. This might include financial modeling, reporting, and communication platforms working together to provide a complete overview of fund health. Effective VC portfolio management software also supports audit readiness and compliance, helping firms maintain trust with limited partners.

Another key consideration is scalability. As a fund grows, so does the complexity of its data. The best vc fund software should be able to support larger fund sizes, multiple entities, and growing teams without requiring a full system overhaul. It should also provide clear visibility into both fund-level and portfolio-level metrics, allowing managers to quickly identify trends or underperforming investments.

Finally, user experience matters. The best systems offer intuitive interfaces that minimize training time and make onboarding easy. If the software is difficult to use, it risks becoming underutilized, even if it has advanced capabilities. The most effective vc fund software combines powerful analytics with ease of use, ensuring adoption across the entire team.

Benefits of Using VC Fund Management Software

VC fund management software provides multiple advantages beyond basic administration. It enables faster access to portfolio insights and creates a single source of truth for all financial data. Automated calculations reduce errors and make performance tracking more reliable.

One significant advantage is the ability to use fund modeling software for forecasting. By modeling different scenarios, venture capital teams can make data-driven decisions and anticipate returns under varying market conditions. Private equity fund management software extends these capabilities further by supporting firms that manage multiple fund types or co-investment structures.

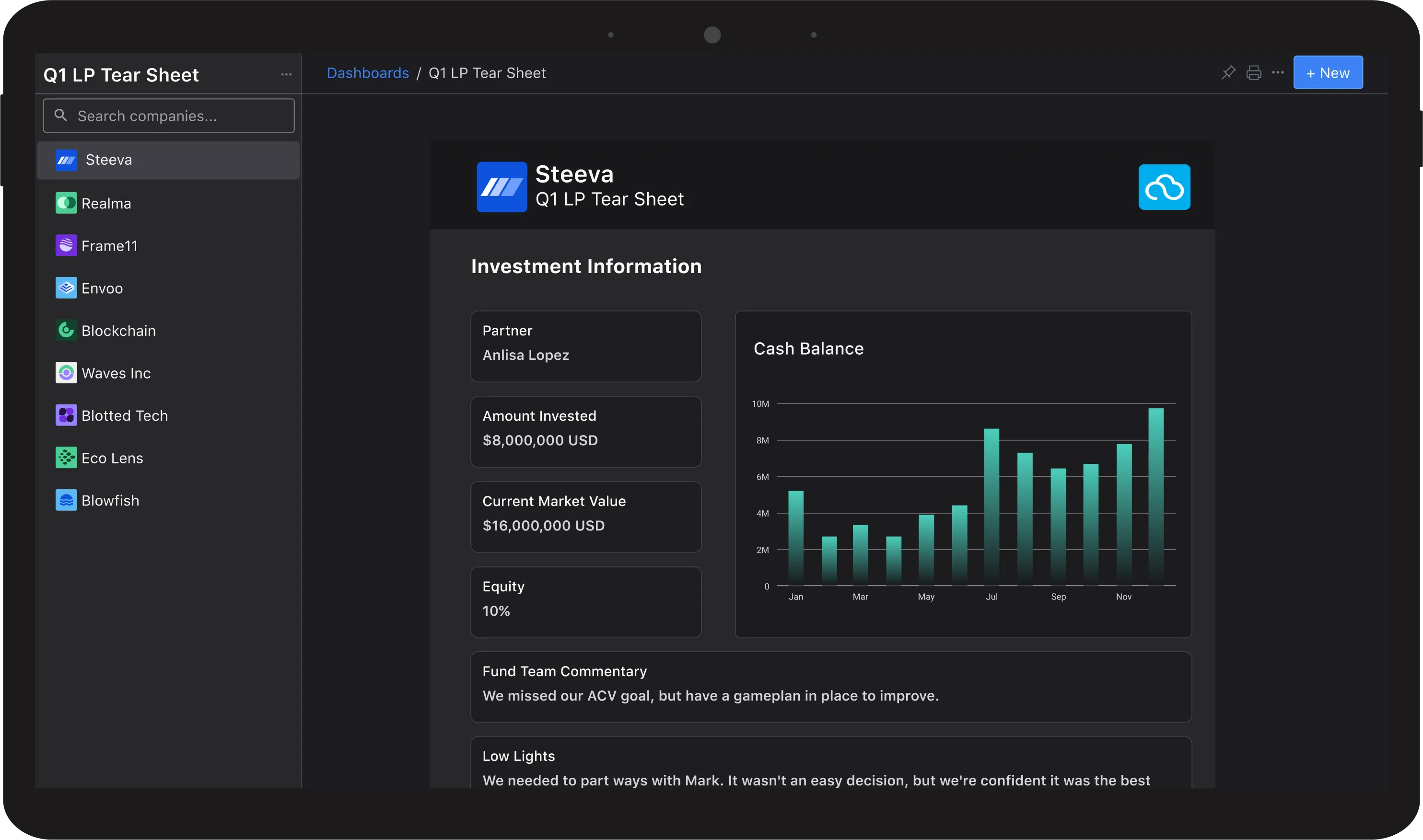

VC fund software also improves investor relations. Limited partners increasingly expect transparency and real-time updates. Software that provides dashboards or secure reporting portals helps investors see performance data directly, reducing the back-and-forth communication and improving trust.

Another benefit is compliance management. Regulations around fund reporting and data protection continue to evolve. VC fund management software can automate parts of these processes, ensuring that financial statements and investor reports meet regulatory requirements without manual oversight. This reduces both operational risk and the time spent preparing audits.

Beyond these operational gains, the use of software also enhances a firm’s ability to raise new funds. Investors tend to favor firms that demonstrate clear reporting and strong internal processes. A structured approach powered by technology signals professionalism and preparedness, two traits that help attract new limited partners and institutional investors.

Exploring Free and Downloadable VC Fund Software Options

For new or smaller venture capital firms, exploring free tools can be an accessible way to get started. There are versions of vc fund software free for download that offer basic functionality, such as portfolio tracking and reporting templates. However, users should understand the trade-offs.

Free platforms might lack data encryption, integration capabilities, or customer support. When using vc fund software free download options or even a vc fund software free download pdf version, data privacy becomes a key concern. Similarly, vc fund management software free download or vc fund management software download files can be a good way to test features, but they may not scale with fund growth.

Free versions often serve as introductions to more comprehensive systems. While a best vc fund software free edition might allow investors to experiment with reporting or analytics, it will likely come with limitations on user seats, storage, or customization. Still, for early-stage funds managing a small number of investments, this can be a valuable entry point.

Firms evaluating free vc fund management software should also test compatibility with their existing data formats. The ability to export reports, upload spreadsheets, or integrate with other tools ensures that switching to a paid platform later on is smooth and cost-effective. The goal is to test the workflow without disrupting core fund operations.

Even when using a free version, it is worth reviewing the vendor’s privacy policy and data storage practices. Ensuring the protection of sensitive financial data is essential at every stage, especially when testing software downloaded directly from the internet.

Evaluating and Reviewing VC Fund Management Software

Choosing the right tool requires careful consideration. A thoughtful approach starts with understanding current challenges, whether it’s manual reporting or difficulty tracking investments across multiple portfolios. Reading a vc fund management software review can help investors compare real user experiences and identify reliable options.

Evaluation should focus on accuracy, speed, customization, and support. Firms should also look at how the best vc fund software free trials compare with premium offerings. While some tools offer limited-time access, others provide full versions with optional upgrades. A clear comparison helps venture capital teams understand which solutions best fit their workflows and long-term growth plans.

It is also helpful to conduct internal tests with a small group of users before a full rollout. This allows teams to evaluate how well the software handles real data, supports collaboration, and integrates with accounting systems. Feedback from team members ensures that the selected platform meets both operational and strategic needs.

Security should be another top priority. Fund data often includes sensitive financial information and investor details. Firms should verify that any vc fund management software complies with industry security standards, including encryption and role-based access controls. These precautions protect both the firm and its investors.

Finally, ongoing training and support are key to long-term success. Even the best vc fund management software will underperform if users are not fully trained or engaged. Regular updates, tutorials, and customer service access help ensure teams continue using the platform effectively as the firm grows.

Building an Effective VC Stack

An effective vc stack combines the right tools for fund administration, performance tracking, and reporting. For example, vc portfolio management software works alongside fund modeling and analytics tools to form a cohesive ecosystem. This structure enables real-time insights into fund performance, simplifying how data flows between investors, analysts, and partners.

Every venture capitalist benefits from having a unified system that minimizes data silos. When software integrates properly, firms can automate repetitive tasks, maintain consistent reporting standards, and make better investment decisions. The right vc stack transforms complex fund operations into manageable, measurable processes that drive long-term success.

Firms building their technology stack should start by identifying core needs. For instance, if the main challenge is tracking fund performance, vc fund management software and fund modeling software should be prioritized. If communication with investors is the bottleneck, then reporting and relationship management tools might come first. Building gradually allows firms to scale their vc stack without unnecessary expense.

Integration is also key to a strong technology foundation. Connecting systems that handle accounting, performance analytics, and portfolio updates ensures accuracy across all departments. This connectivity leads to better reporting, faster updates, and a smoother experience for both general partners and limited partners.

Firms should also regularly review their vc stack to ensure it remains aligned with strategic goals. As teams grow, new technologies may replace older ones. A proactive approach to evaluating software keeps the stack modern and ensures that venture capital firms continue operating at peak efficiency.

Final Thoughts on the Future of VC Fund Software

Technology continues to shape how venture capital firms operate. VC fund software has evolved from simple spreadsheets to sophisticated platforms capable of handling every aspect of fund management. As the industry becomes more competitive, digital tools give venture capital firms an edge through data visibility and faster insights.

The best vc fund management software helps firms deliver accurate reporting, maintain transparency, and operate efficiently at scale. From startups to established private equity groups, adopting these tools supports smarter decision-making and better investor relationships.

In the years ahead, artificial intelligence and predictive analytics will likely become standard features within vc fund software. These tools will help venture capitalists forecast returns, identify emerging opportunities, and optimize capital deployment in real time. Cloud technology will continue to improve collaboration, making it easier for global teams to work seamlessly across regions and time zones.

Every venture capitalist seeking long-term efficiency should consider how technology can strengthen their operations today and in the years ahead. Implementing the right systems early creates a competitive advantage, allowing firms to scale with confidence, maintain transparency, and build lasting relationships with investors.

Frequently Asked Questions

What is VC fund software and why do venture capital firms use it?

VC fund software helps venture capital firms manage portfolios, track performance, and automate reporting. It replaces manual spreadsheets with centralized systems that improve accuracy, transparency, and efficiency. This type of software allows investors to make faster, data-driven decisions while maintaining clear communication with limited partners.

How does VC fund management software improve investor reporting?

VC fund management software automates investor reporting by consolidating financial data, capital calls, and portfolio updates into one platform. Reports can be generated instantly and shared securely, giving limited partners real-time visibility. This automation reduces administrative work and enhances trust between venture capital firms and their investors.

What features should I look for in the best VC fund software?

The best VC fund software includes tools for performance tracking, fund modeling, and compliance management. Look for scalability, integration with accounting systems, and intuitive dashboards. These features help venture capital firms streamline fund operations, improve decision-making, and maintain transparency across investors and stakeholders.

Are there free VC fund software options available?

Yes, several free VC fund software options are available for smaller firms or new venture capital managers. These free downloads typically include basic reporting and portfolio tracking features. However, they often have limited functionality, storage, or support, so firms should evaluate whether free tools meet their long-term needs.

What is the difference between VC fund software and private equity fund management software?

VC fund software focuses on early-stage investments and startup portfolios, while private equity fund management software is built for larger, mature company investments. Both systems streamline reporting, performance analysis, and compliance. Venture capital firms often use a combination of both as their investment strategies expand.

How does VC fund software fit into a firm’s overall technology stack?

VC fund software is a core component of a firm’s vc stack, integrating with accounting, analytics, and communication tools. Together, these systems form a connected infrastructure for fund management. This integration helps venture capital firms improve data consistency, automate workflows, and operate with greater efficiency across their teams.