Key Takeaways

-

Learn how VC fund reporting improves transparency, investor trust, and decision-making through structured, consistent performance data.

-

Discover key components of a high-quality fund report, including capital calls, distributions, and a detailed schedule of private equity investments.

-

Explore the leading industry frameworks, such as the Invest Europe reporting guidelines and IPEV valuation guidelines, to ensure accuracy and compliance.

-

Access practical VC fund reporting templates, examples, and metrics to help you streamline operations and create reports that meet investor expectations.

-

Understand how VC fund management software and VC portfolio management software simplify performance tracking, automate reporting, and enhance long-term fund transparency.

What Is VC Fund Reporting and Why It Matters

VC fund reporting is the process of documenting and sharing financial and performance data about a venture capital fund’s activities. It ensures that investors, limited partners, and stakeholders have access to accurate and timely information. Effective reporting helps investors monitor fund performance, assess risk, and maintain transparency with stakeholders.

Consistent reporting builds trust between general partners and limited partners. It supports compliance with regulations and demonstrates a commitment to responsible fund management. Many firms rely on VC fund management software to simplify this process and maintain consistent data across their portfolios. By adopting structured reporting practices early, investors can improve communication, efficiency, and decision-making.

Comprehensive reporting also plays a key role during fundraising and due diligence. Limited partners often review past reports to assess a fund manager’s track record and operational discipline. Funds with transparent, reliable reports are more likely to attract new capital. VC fund reporting is, therefore, not only a tool for management but also a competitive advantage in investor relations.

Additionally, strong reporting practices enable investors to identify trends across portfolio companies and market sectors. Over time, this data supports better forecasting and enables proactive strategy adjustments. The more detailed and structured a fund’s reporting process becomes, the greater its potential to drive value creation.

Key Components of Effective VC Fund Reporting

A comprehensive fund report includes detailed information about investments, valuations, and capital flows. At a minimum, it should outline capital commitments, capital calls, distributions, and fund expenses. The inclusion of a schedule of investments private equity provides a clear snapshot of where capital has been deployed and how each investment is performing.

VC fund performance metrics such as internal rate of return (IRR), multiple on invested capital (MOIC), and total value to paid-in (TVPI) are crucial indicators of success. These metrics help investors evaluate fund efficiency and compare performance against benchmarks. Reporting that is both detailed and consistent allows investors to make data-informed decisions and build confidence among stakeholders.

It is also important to include narrative context alongside financial data. Performance commentary helps limited partners understand the reasoning behind valuation changes, new investments, or exits. A clear explanation of portfolio strategy, market dynamics, and outlook turns a static report into a valuable communication tool.

Common VC Fund Reporting Frameworks and Standards

Reporting frameworks and valuation standards bring structure and reliability to fund reporting. They ensure that the information presented is accurate, comparable, and aligned with industry norms. The Invest Europe reporting guidelines offer best practices for presenting fund data in a consistent format, allowing investors to compare funds more effectively.

Valuation methodologies based on IPEV valuation guidelines ensure that portfolio assets are fairly assessed and aligned with recognized principles. Accounting for private equity funds, PwC emphasizes the importance of maintaining consistent accounting methods across different reporting periods. Following these established frameworks helps investors ensure compliance, accuracy, and clarity in financial communication.

Incorporating recognized frameworks also helps build investor confidence and reduces the risk of misinterpretation. Adhering to these standards signals operational maturity and professionalism, which is especially important for emerging managers who are developing their reporting processes for the first time.

Examples and Templates for VC Fund Reporting

For investors looking to improve their reporting practices, examples and templates can serve as valuable resources. A best VC fund reporting PDF can demonstrate what a professional and comprehensive report should look like. Using a free VC fund reporting template provides a foundation for structuring fund data clearly and efficiently.

Many investors seek a VC fund reporting example PDF or a VC fund reporting PDF download to better understand standard formatting and required sections. Those looking for open resources can use a VC fund reporting PDF free download or a VC fund reporting sample PDF as a reference point for building internal reports.

Templates are available in multiple formats to suit different workflows. For instance, a VC fund reporting template Excel helps automate calculations, while a VC fund reporting template free download can be customized to meet specific fund structures. Similarly, a VC fund reporting template PDF ensures a polished presentation for stakeholder distribution, and a VC fund reporting template Word allows for easy editing and collaboration. These materials make it easier for investors to produce consistent, professional, and comparable reports.

Investors who use templates save time while maintaining accuracy and consistency. Standardized templates also simplify the process of comparing data across different reporting periods or between multiple funds. As the industry evolves, templates continue to adapt to include new types of information, such as environmental, social, and governance (ESG) metrics or diversity reporting, which are increasingly important to institutional investors.

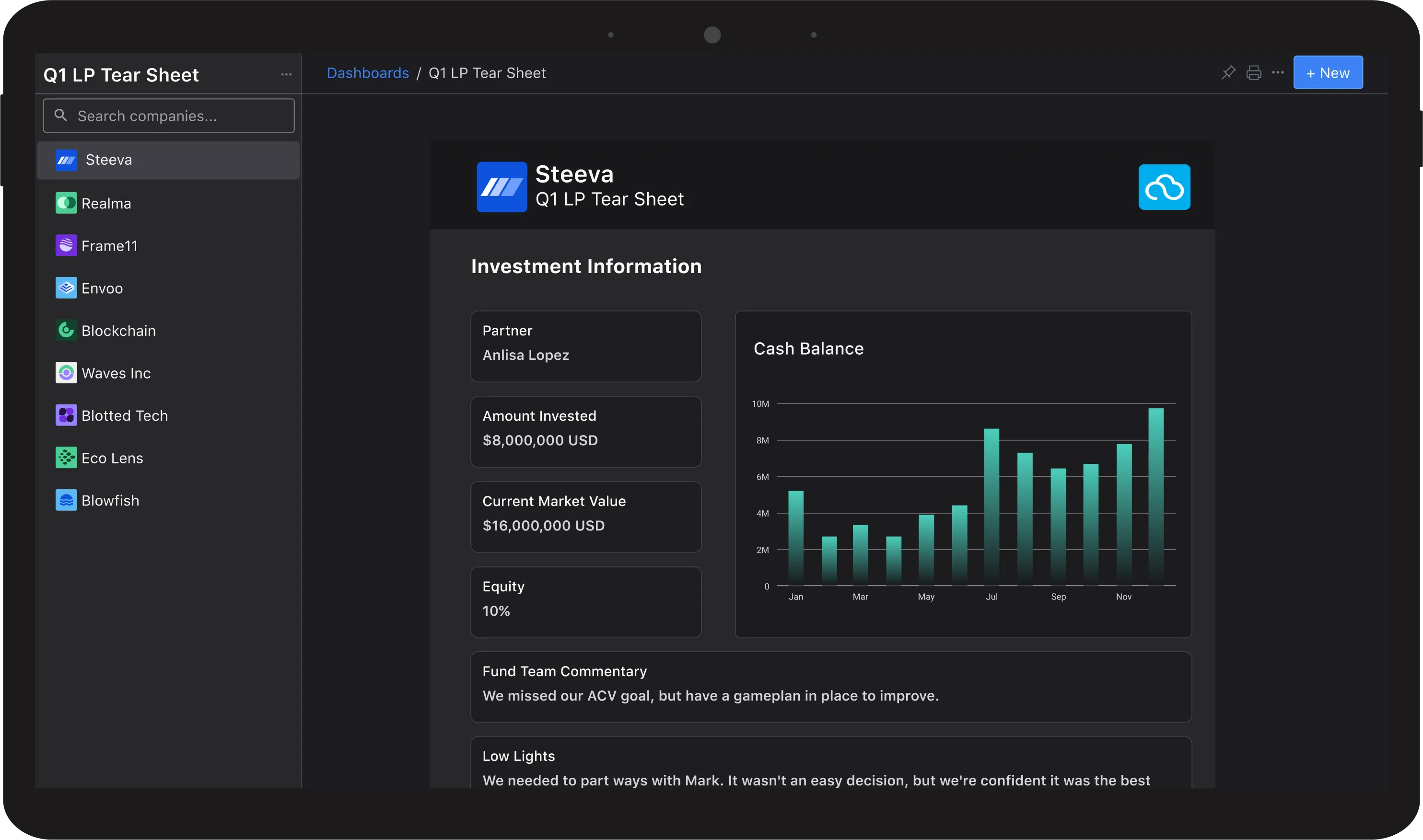

Including visual aids, charts, and summaries within these templates can further enhance clarity. Well-designed reports help stakeholders quickly grasp fund performance trends, capital movements, and value creation strategies. Visual consistency across reports also communicates professionalism and attention to detail.

Using Technology to Simplify Reporting and Analysis

Technology plays a growing role in modern fund reporting. Digital tools can automate data entry, streamline updates, and reduce manual errors. VC portfolio management software enables investors to track fund performance across multiple dimensions, from cash flow management to portfolio company metrics.

Similarly, VC fund management software provides dashboards that help investors visualize portfolio performance in real time. These systems allow general partners to manage capital calls, analyze valuations, and prepare reports efficiently. By integrating technology into reporting workflows, investors can save time and ensure data accuracy across all reporting periods.

Modern reporting tools also support collaboration among fund teams and limited partners. Automated notifications, interactive dashboards, and secure document sharing make it easier to distribute information and maintain transparency. By reducing administrative burden, technology allows investment professionals to focus more on strategy and value creation.

Another benefit of digital reporting tools is scalability. As funds grow and portfolios expand, automated systems ensure that reporting remains accurate and consistent. Technology reduces the likelihood of data discrepancies, ensuring that fund managers can respond quickly to investor requests.

Advancements in artificial intelligence and data analytics are also shaping the future of VC reporting. Predictive tools can identify performance patterns and highlight potential risks earlier in the fund cycle. By embracing these technologies, fund managers can strengthen their decision-making and deliver deeper insights to investors.

Improving Fund Transparency and Investor Confidence

Accurate and consistent reporting builds credibility and strengthens investor relationships. A well-organized report demonstrates operational excellence and reinforces an investor’s commitment to transparency. Over time, clear reporting practices lead to better communication, stronger fundraising outcomes, and higher confidence among limited partners.

Investors who track and share clear VC fund performance metrics can identify areas for improvement, forecast outcomes, and refine their strategies. In an increasingly data-driven investment landscape, strong VC fund reporting practices are essential for maintaining accountability, improving efficiency, and achieving long-term success.

Fund transparency also supports compliance and regulatory readiness. Well-documented data ensures that all activities can be audited and verified when necessary. As investors demand greater visibility into fund operations, transparency becomes not only a reporting requirement but a strategic advantage.

Ultimately, VC fund reporting is more than a routine exercise. It is a communication tool that reflects the integrity, expertise, and discipline of the fund manager. By leveraging best practices, adopting standardized frameworks, and integrating technology, investors can elevate their reporting process and deliver the clarity that modern investors expect.

Frequently Asked Questions

What is VC fund reporting and why is it important?

VC fund reporting is the process of sharing detailed financial and performance data about a venture capital fund with investors. It improves transparency, supports compliance, and helps limited partners evaluate returns and risks. Accurate reporting builds trust and enables better decisions across all stages of fund management.

What should be included in a VC fund report?

A complete VC fund report should include capital commitments, capital calls, distributions, expenses, valuations, and a schedule of investments. It should also feature VC fund performance metrics, such as IRR, MOIC, and TVPI, supported by clear commentary that explains fund performance and portfolio developments.

How do the Invest Europe Reporting Guidelines help VC fund managers?

The Invest Europe reporting guidelines provide a consistent framework for presenting fund information. They help VC fund managers ensure accuracy, comparability, and transparency across reports. Following these guidelines allows investors to benchmark performance and understand a fund’s results in a standardized, industry-recognized format.

What are the benefits of using VC fund management software for reporting?

VC fund management software automates data collection, tracks performance, and generates real-time reports. It reduces manual effort, minimizes errors, and provides dashboards for monitoring key VC fund performance metrics. These tools help fund managers improve efficiency and maintain transparency with limited partners.

Where can I find templates for VC fund reporting?

Investors and fund managers can find a VC fund reporting template Excel, PDF, or Word format to standardize reporting. These templates outline sections for performance data, valuations, and portfolio updates, helping users create professional, consistent, and compliant reports that align with industry standards and investor expectations.

What are the IPEV Valuation Guidelines and how do they apply to VC fund reporting?

The IPEV valuation guidelines establish fair value principles for valuing private equity and venture capital investments. Applying these standards ensures that VC fund reporting reflects realistic and consistent valuations of assets. They promote transparency, comparability, and credibility in fund reporting, which strengthens investor confidence and compliance.