Key Takeaways

-

Discover the top venture capital firms actively investing in Paris, from early-stage specialists like Kima Ventures to global leaders such as Partech and Serena Capital.

-

Learn how to navigate Paris’s unique fundraising landscape, including typical timelines, due diligence expectations, and local investor preferences from seed to Series A.

-

Understand how to combine public funding from Bpifrance with private capital to accelerate your startup’s growth while maintaining financial flexibility.

-

Explore key Paris startup resources such as Station F, HEC Incubator, and France Digitale to expand your network, find mentors, and meet investors.

-

Access practical, actionable advice to structure your round, localize your pitch, and build investor relationships with tools like Visible to streamline your fundraising process.

Paris has become one of Europe’s most active startup hubs, with deep pools of capital, strong technical talent, and a dense network of funds, accelerators, and corporate partners. For founders raising in Paris, the ecosystem rewards clear traction, disciplined unit economics, and credible go-to-market plans, with many investors comfortable leading or co-leading seed to Series A rounds.

This guide shows you who is actively investing in Paris, how to position your raise, and where to build your network. You will find a ranked list of top venture firms, including their current focus areas, recent deals, stage preferences, and contact information. You will also gain practical insight into local norms, standard diligence questions, and timelines, as well as a curated map of accelerators, public programs, coworking spaces, and pitch events to help you build momentum.

Top Venture Capital Firms in Paris Actively Investing

Elaia

About: Elaia is a full stack tech and deep tech investor. We partner with ambitious entrepreneurs from inception to leadership, helping them navigate the future and the unknown. For over twenty years, we have combined deep scientific and technological expertise with decades of operational experience to back those building tomorrow.

Partech

About: Partech is a global tech investment firm headquartered in Paris, with offices in Berlin, Dakar, Dubai, Nairobi, and San Francisco. We bring together capital, operational experience and strategic support for the entrepreneurs we back from seed through to growth stage. Born in San Francisco 40 years ago, today we manage €2.7B AUM and our current portfolio of 220 companies in 40 countries, across 4 continents.

Thesis: We invest from €200K to €50M in a broad range of technologies and businesses for enterprises and consumers, from software, digital brands and services to hardware and deep tech, across all major industries. Specialties: Digital Media, Internet, E-commerce, IT enabled services, Mobile services, Software, Venture Capital, entrepreneurs, management firm, and investing.

Alven

About: We focus on SaaS, Fintech and Frontier Tech, Gaming, Developer Tools

Kima Ventures

About: Kima Ventures promotes the growth of startups, supporting them in the fastest and most effective ways.

XAnge

About: XAnge is a BCorp-certified early-stage investment fund with €700 million under management, based in Paris, Berlin, and Brussels. Its investment team backs European entrepreneurs who aim to transform everyday life through technology, investing between €500,000 and €M10 from the seed stage onwards. With an investment thesis focused on making technology accessible to the many, XAnge invests in sectors such as deeptech, health, fintech, SaaS, and e-commerce.

Serena Capital

About: Serena Capital caters to technology companies with seed, early, and later stage venture investments. Investment strategy: We handpick on average four to five teams per year and focus on helping them reach their maximum potential. We are not looking for early exits. We back Europe-based entrepreneurs willing to build continental or worldwide category leaders. We strongly prefer to lead or co-lead rounds.

Thesis: Serena was founded by entrepreneurs on the belief that your VC should work for you and not the way around. We are not industry-specific as long as your business model is scalable and your product is digital. We have a special affection for DeepTech, enterprise software, marketplaces, and entertainment.

ISAI

About: Our Venture Capital fund invests early on in the development curve of companies, quite often after a business angel round. We lead or co-lead the first institutional round of financing.

Breega

About: We partner with outliers rewriting the rules of Digital, Climate, and Deep Tech from pre-Seed to Series A+ across Europe and Africa.

Thesis: Breega’s mission is to provide founders with fair financing, real mentoring and accessible experts, propelling today’s startups into tomorrow’s scale-ups.

Ventech

About: Ventech is a global early-stage VC firm based out of Paris, Munich, Berlin, Helsinki, Shanghai and Hong Kong with over €900m raised to fuel globally ambitious entrepreneurs and their visions of the future positive digital economy. Since inception in 1998, Ventech has made 200+ investments

Thesis: We are sector agnostic and looking at everything within the digital economy. We like companies with strong underlying technology.

Focus: SaaS, Deep Tech, ConsumerInvestment Geography: Europe, China

Check Size: $120K - $5.80M

Daphni

About: Daphni is a venture capital fund investing in user-oriented, early stage startups with the European DNA and strong international ambition.

IRIS

About: IRIS is a leading venture capital and growth firm investing in tech platforms in Seed, series A, Late-stage and Growth. Our team of local experts based in Berlin, Munich and Paris has invested over a billion euros in more than 350 innovative companies across the world.

Newfund

About: Newfund is an entrepreneurial VC firm dedicated to financing seed-stage startups that are driving global change. It comes with principles.

Thesis: We are a first check fund, so we are often the first institutional capital. We begin by writing $250k to $2M checks in pre-seed and seed rounds and can follow on in subsequent rounds.

We look for founders with global ambition and skin in the game. Similarly, our GPs are the main investors in our own funds. We play the same game as our founders.

Jolt Capital

About: Jolt Capital SAS is a fully independent Private Equity firm authorized and regulated by AMF (Autorité des Marchés Financiers) that specialises in Technology, targeting investments into companies with revenues between €10m and €50m. Jolt Capital generates returns for its investors by enabling mid-sized technology-rich companies with strong fundamentals to execute their growth strategies, in sectors that offer good exit potential across software and hardware alike (cybersecurity, sensors, photonics, industrial processes, new energy systems, applied AI, robotics...) In providing growth capital to our portfolio companies (from €10M to €50M in tranches), we transform their value by enabling them to reach critical mass and supporting their growth in new global markets, new product markets and via new acquisitions & build-ups, while mitigating risks.

Karot Capital

About: Karot Capitalis an innovation-driven VC that will focus on investments of €300k to €2m in Seed and Series A rounds. Karot Capital will target companies with a finalized product/service generating early sales.

Thesis: Backing Founders' vision, believing innovation can sprout anywhere.

Future Positive Capital

About: Future Positive Capital invests in companies that leverage advanced science & deep technologies to solve the world's most pressing problems.

Raising Capital in Paris: What Founders Should Expect

How Paris Funding Works in Practice

Paris has its own investor landscape. Early-stage leads are active here. Corporate venture units in Paris also play a role in the energy, mobility, telecom, and health sectors. Decisions are made through partner-led discussions or investment committee meetings at Paris firms.

Fundraising timelines in Paris have specific rhythms, plan for average weeks from introduction to term sheet. August and late December are slower. September to November and February to June are the faster months. Bank holidays and school breaks affect scheduling.

Public Money Is Part of the Stack in Paris

Bpifrance offers instruments that founders use. Innovation loans and guarantees are common with seed rounds. Deeptech Plan supports lab spinouts and hardware milestones. Bpifrance also co-invests alongside venture capital firms.

Sequence venture capital and public funding carefully. Begin Bpifrance applications when you start term sheet negotiations. Understand the required documents and approval steps. This helps you avoid common delays in closing your round.

Paris-Specific Diligence Norms

Partners in Paris check local references. They use networks from grandes écoles, alumni, and operators. They prefer product depth and technical credibility over pure market hype.

Data room expectations in France include specific items. Key performance indicators and contracts are reviewed. Have French legal documents ready, such as company statutes, cap tables, and stock option details.

Sector Heat Tied to Paris Ecosystem

Paris has specific sector strengths. AI and data benefit from talent density from institutions like INRIA and Polytechnique. AI investors in Paris request particular milestones at the seed and Series A stages.

Connect your pitch to how Paris funds evaluate each sector. For climate and industrial tech, demonstrate how your plan aligns with France's 2030 objectives and energy transition programs, and specify the pilots or grants you are targeting. If you are in fintech and payments, secure a local banking partner early and explain how you handle PSD2 and SEPA requirements. For digital health, map your reimbursement path in France and line up hospital pilots or clinician champions.

Round Construction in Paris

In Paris, most seed and Series A rounds have one clear lead investor and one or two followers. Some local funds prefer to lead, while others join as co-investors. Angel operators and small syndicates often participate to add expertise or open doors.

Before you start, define the check size and ownership you are targeting at the seed and Series A stages. Calibrate these against recent Paris rounds so your ask feels grounded. Ensure your BSPCE plan (a special type of employee stock warrant unique to France), board structure, and governance terms align with local norms to expedite partner approval.

Legal and Administrative Realities

Paris venture capital firms prefer specific company setups. The SAS structure is standard. Stock option plans and founder vesting norms are common. Ensure your legal setup matches these expectations.

Banking and payments involve local banks. Understand the time it takes for know-your-customer checks. Paris investors also consider grant and credit tax items, such as the R&D tax credit, when evaluating your company.

Paris Success Patterns to Emulate

Study local case snapshots. Learn what Paris-grown companies did right on pilots, hiring, and capital stacking. Understand how they used public programs and corporate partners to reduce risk before Series A.

Founder Resources and Networking in Paris

Anchor Incubators and Accelerators

- Station F: The world’s largest startup campus that offers desks, mentors, partner VCs, and frequent pitch events.

- HEC Incubator: Rolling, bespoke program with hands-on coaching, a pool of mentors, and access to HEC’s alumni investor network.

- Agoranov: Publicly supported deep-tech incubator with a strong track record (Doctolib, Criteo alumni), emphasis on science/tech transfer, IP strategy, and structured mentorship.

Government and Public Funding (Non-Dilutive)

- Bpifrance: Core partner for French startups, innovation grants, reimbursable advances, bank loan guarantees, and co-investment. Typical early tools include innovation aid (subsidies/advances), PGE-type guarantees, and co-financing of R&D. Expect structured applications and milestone tracking.

- Paris&Co: City-backed innovation agency running thematic innovation platforms, testbeds with corporates, and soft-landing programs. Useful for pilots and first customers in Paris.

- France 2030: Calls for projects in strategic sectors (AI, health, climate, industry). Competitive, but meaningful tickets for deep tech and industrialization.

Coworking Hubs and Communities

- Station F: Day passes/events even if you’re not a resident; strong density of founders, angels, and visiting VCs.

- The Family alumni network: While the accelerator pivoted, the alumni and events ecosystem remains a valuable network for intros and content; check meetup circuits and online communities for spin-off events.

Communities and Peer Groups

- France Digitale: Founder/ investor association hosting FDDay and policy roundtables; useful for ecosystem visibility and intros.

- Business Angel networks: France Angels and Paris Business Angels (PBA) are two of the most well-known.

- FrenchFounders: A global network for French-speaking entrepreneurs and executives, with a strong presence in Paris. They offer exclusive events, networking opportunities, and a platform for members to connect and share insights.

- La French Tech: A government-backed initiative to promote the French startup ecosystem. They organize numerous events, provide resources, and connect founders with investors, mentors, and corporate partners. Their website serves as a valuable hub for discovering local events and initiatives.

- Meetup groups: Paris has a vibrant Meetup scene with groups dedicated to specific technologies, industries, and founder interests. Searching on Meetup for relevant keywords.

Practical Networking Playbook

- Language: Most investor meetings can be conducted in English; however, translate your one-pager and key metrics into French for angel investors and public partners.

- Follow-up discipline: Paris is relationship-driven, a crisp monthly update email (wins, metrics, hiring, asks) compounds. Use Visible to standardize and share a consistent investor update link.

Find investors in Paris with Visible

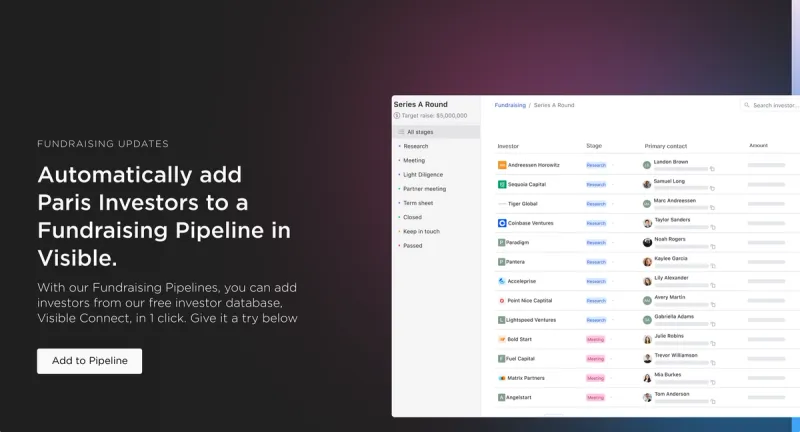

As we previously mentioned, a venture fundraise oftentimes mirrors a traditional B2B sales and marketing funnel. Just as sales and marketing teams have dedicated tools to track their funnel, shouldn’t founders have dedicated tools to manage their most important asset – equity?

With Visible, you can track and manage every part of your fundraising funnel.

- Find investors at the top of your funnel with Visible Connect, our free investor database

- Add them directly to your fundraising pipeline directly in Visible

- Share your pitch deck and data room with investors in your pipeline

- Send updates to current and potential investors to keep them engaged with the progress of your business.

Take your investor relations to the next level with Visible. Give Visible a try for free.

Frequently Asked Questions

What makes Paris a strong location for venture capital funding?

Paris has become a leading European hub for venture capital, supported by a deep pool of technical talent, active early-stage investors, and strong public funding programs like Bpifrance. Its ecosystem encourages innovation across AI, fintech, and deep tech, making it ideal for founders seeking scalable growth.

How can startups raise venture capital in Paris?

Startups can raise venture capital in Paris by building early traction, refining their go-to-market plan, and targeting funds aligned with their stage and sector. Most rounds include a lead investor and one or two co-investors, with timelines typically spanning 8–12 weeks from introduction to term sheet.

Which venture capital firms are most active in Paris?

Leading venture capital firms in Paris include Partech, Elaia, Serena Capital, XAnge, and Alven. These firms invest across software, fintech, deep tech, and SaaS, providing capital and hands-on support to founders from seed through growth stages. Many also have international networks that help startups scale globally.

How do public funding programs like Bpifrance support Paris startups?

Bpifrance provides innovation loans, grants, and co-investments that complement private venture capital. Founders often combine Bpifrance funding with VC rounds to extend runway and de-risk milestones. Starting applications early, ideally during term sheet discussions, helps avoid delays and ensures alignment between public and private investors.

What sectors are attracting the most VC investment in Paris?

AI, fintech, digital health, and climate tech are the most active venture capital sectors in Paris. Investors look for startups with strong technical credibility, regulatory alignment, and ties to France’s 2030 innovation and energy transition goals. Deep tech and data-driven companies are particularly well-supported by local research institutions.

How can founders find and connect with Paris investors?

Founders can use tools like Visible Connect to identify venture capital firms and track investor engagement. Networking at hubs like Station F, Paris&Co events, and France Digitale meetups also helps founders connect with active investors and ecosystem partners in the Paris startup community.