Key Takeaways

-

Portfolio monitoring software helps venture capital firms track, analyze, and manage investments with real-time data and automated reporting.

-

Replacing spreadsheets with a dedicated platform streamlines investor updates, reduces manual errors, and highlights trends across fast-moving startup portfolios.

-

Key features like risk assessment, funding round tracking, and dynamic performance dashboards give VCs the insights needed for confident, data-driven decisions.

-

Free tools can support small, early-stage funds, but scaling firms benefit from premium solutions offering AI analytics, deeper integrations, and advanced LP reporting.

-

Modern portfolio monitoring platforms integrate with accounting and CRM systems, ensuring seamless workflows and accurate, investor-ready insights.

-

Adopting advanced software positions VC firms to react quickly to market changes and maximize returns as their portfolios grow.

Portfolio Monitoring Software for Venture Capital Firms

What Is Portfolio Monitoring and Why Does It Matter?

Portfolio monitoring is the process of tracking, analyzing, and managing investments within a venture capital (VC) firm's portfolio. It ensures that investments are performing as expected, helps firms identify trends, and provides data-driven insights for better decision-making.

Without an effective portfolio monitoring system, VC firms may struggle with inefficient data collection, fragmented reporting, and missed opportunities for growth. Portfolio monitoring software addresses these challenges by automating data collection, streamlining reports, and offering real-time financial insights. While private equity (PE) firms also use these tools, the focus below is on how venture capital investors can maximize returns through strategic portfolio monitoring.

Understanding Portfolio Monitoring: Meaning and Key Functions

Portfolio monitoring refers to the structured approach of evaluating investments based on key performance indicators (KPIs), financial metrics, and market trends. For VC firms, this involves tracking revenue growth, customer acquisition costs, runway, and funding rounds. By leveraging portfolio monitoring software, firms can transition from manual data entry and spreadsheets to automated systems that deliver real-time performance insights.

Unlike private equity firms, which often have more control over their investments, VC firms need to monitor high-growth startups that operate in fast-moving industries. As a result, their portfolio monitoring strategies require a more agile approach, with tools that provide immediate updates on startup financial health, funding stages, and operational progress. Investment portfolio management software enables firms to analyze startup valuations, track financial health, and make data-backed investment decisions.

Key Features of Portfolio Monitoring Software

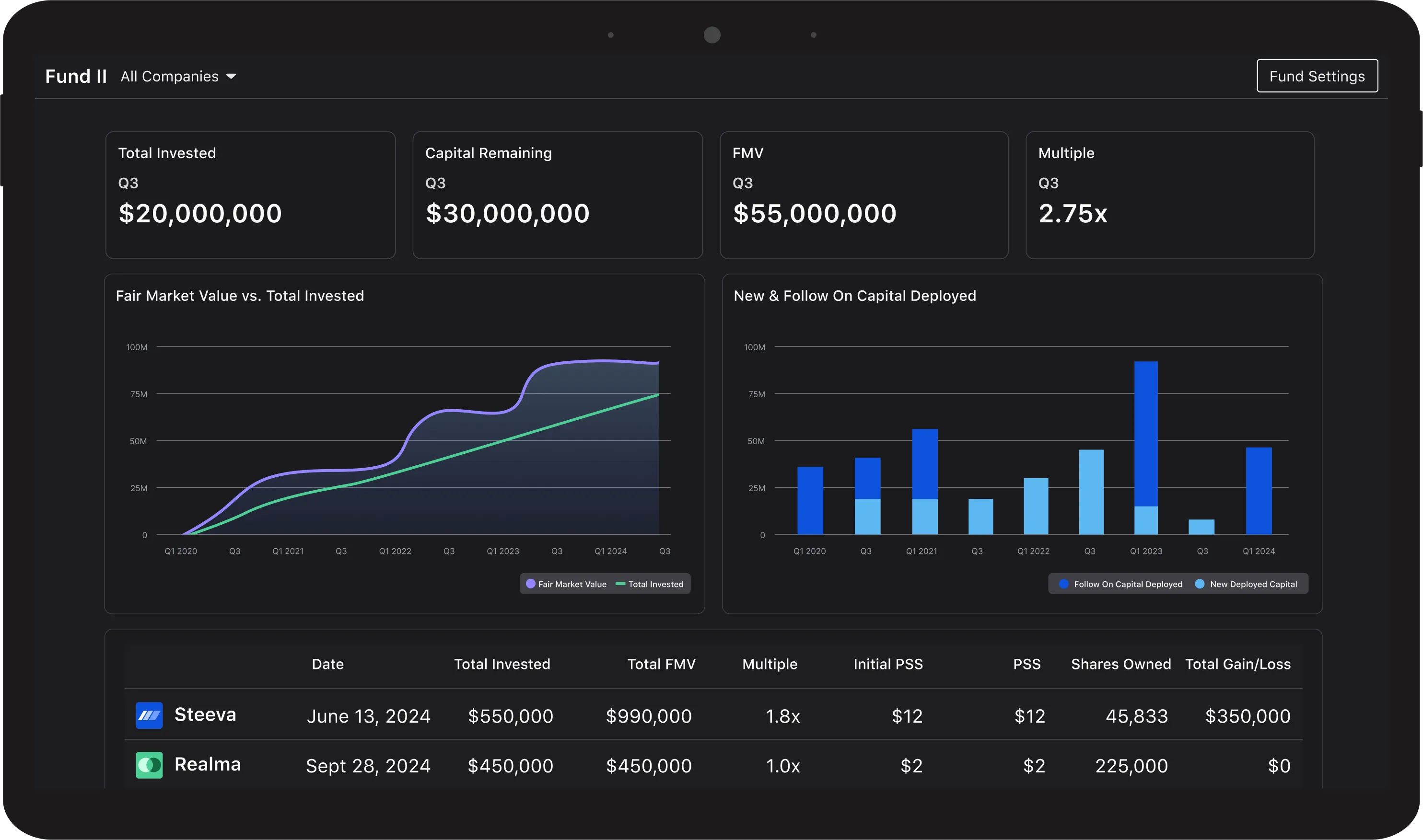

When choosing the best portfolio monitoring software, VC investors should prioritize features that enhance efficiency and accuracy. Real-time reporting allows investors to make decisions based on the latest data rather than outdated reports. Data visualization simplifies complex financial information, making it easier to identify trends and evaluate startup performance.

Risk assessment tools play a crucial role in helping investors understand the financial health of portfolio companies, identifying potential challenges before they become critical. Investor reporting features automate report generation, ensuring that limited partners (LPs) and other stakeholders receive clear, consistent, and timely updates. Deal tracking capabilities allow VCs to monitor their investments from initial funding to potential exit. The best portfolio tracker solutions enable firms to streamline these processes while reducing manual effort.

While private equity firms often have different tools for leveraged buyouts, VC firms benefit from software that is built for startup investment tracking and early-stage portfolio management. Portfolio management software for private equity often includes different features, and VCs can benefit from tools that focus on growth-stage startup performance and valuation tracking as well.

Free vs. Paid Portfolio Monitoring Software: What’s Best for Your Firm?

Venture capital firms must determine whether free or paid portfolio monitoring software aligns with their needs. Free portfolio management software can be useful for emerging VC firms that manage a small number of investments. These tools provide basic tracking capabilities, simple reporting, and some data visualization options. Those searching for user opinions often check free portfolio management software Reddit discussions to learn about community-recommended solutions.

However, as firms scale and require deeper insights, paid software solutions become essential. Premium portfolio monitoring software provides AI-driven analytics, enhanced LP reporting, and advanced data integrations with accounting and CRM platforms. Many investors looking for free solutions turn to portfolio monitoring software free Reddit discussions to explore recommendations from other professionals.

The best free portfolio management software can help new firms manage their investments, but for firms handling multiple rounds of funding and increasing portfolios, a paid tool provides more comprehensive insights and automation. The best portfolio monitoring software private equity firms use often includes elements that may not be necessary for early-stage investors. However, tools tailored to venture capital focus on funding round tracking, valuation trends, and startup growth metrics.

“The number of truly data-driven VC firms has jumped to 235, and nearly 65% of them use at least one internally built tool across their tech stack—including portfolio monitoring and back-office systems.” - Vestberry, 2025 Data-Driven VC Landscape Report

How Venture Capital Firms Use Portfolio Monitoring Software

Venture capital firms use portfolio monitoring software to track startup progress, assess financial performance, and optimize investment strategies. These tools help investors measure key startup metrics, benchmark performance against industry standards, and make data-driven decisions about follow-on investments.

For venture capitalists, effective portfolio monitoring enables them to:

- Analyze Funding Rounds: Track how startups move through different financing stages, from seed to Series A and beyond.

- Monitor Revenue and Growth Metrics: Assess key indicators such as monthly recurring revenue (MRR), customer lifetime value (LTV), and burn rate.

- Generate LP Reports: Automate investor updates to provide transparency and build stronger relationships with limited partners.

- Identify Risks and Opportunities: Detect red flags early and capitalize on growth trends.

While private equity firms may focus on operational efficiencies and leverage, VC firms need software that allows them to manage multiple high-risk, high-reward investments effectively. Portfolio monitoring private equity tools may have different needs, but venture capital firms still require investment management software that can analyze startup growth and track funding rounds effectively.

Choosing the Best Portfolio Monitoring Software for Your Needs

Selecting the right portfolio monitoring software requires careful consideration of several factors. Ease of use is essential, as investment teams need intuitive dashboards and seamless navigation. Integration capabilities with financial and CRM systems ensure smoother workflows. Reporting features help maintain strong relationships with LPs, while scalability ensures that the software can grow alongside the firm.

For budget-conscious firms, the best portfolio monitoring software free tools offer a starting point. However, those looking for long-term efficiency often turn to investment management software companies that provide advanced solutions tailored to VC needs. Some portfolio monitoring software private equity free solutions are available, but VC firms must ensure that their chosen software can handle the dynamic and fast-paced nature of startup investing.

The Future of Portfolio Monitoring in Venture Capital

As the venture capital landscape becomes increasingly competitive, firms must adopt modern portfolio monitoring solutions to stay ahead. The rise of AI-powered analytics, real-time data integrations, and automation is transforming how VCs manage their investments.

For those just getting started, portfolio monitoring software free download options can offer a basic introduction to investment tracking. However, as firms grow and manage larger portfolios, premium solutions provide the depth and efficiency needed to make data-driven investment decisions. The best free portfolio management software can serve as an entry point, but firms will likely need to upgrade as their investment strategies become more complex.

By leveraging the right tools, venture capital firms can enhance their portfolio monitoring jobs, improve decision-making, and ultimately drive stronger returns for their investors. Whether firms start with a free tool or invest in premium investment portfolio management software, the right technology can transform how VCs track and manage their investments effectively.

Frequently Asked Questions

What is portfolio monitoring software and why is it important for venture capital firms?

Portfolio monitoring software automates the tracking and analysis of startup investments. It provides real-time performance data, streamlines investor reporting, and helps venture capital firms identify trends, manage risk, and make data-driven follow-on investment decisions.

What key features should the best portfolio monitoring software include?

The best portfolio monitoring software offers real-time reporting, customizable dashboards, risk assessment tools, and automated investor updates. Seamless integrations with accounting and CRM platforms ensure accurate data collection and efficient workflows for venture capital teams.

Are there free portfolio monitoring software options for emerging VC firms?

Yes. Free portfolio monitoring software can support smaller venture capital firms with basic capabilities. These free solutions can work for early-stage VC funds managing a modest number of portfolio companies before upgrading to a premium platform as their needs grow.

How does portfolio monitoring software differ from traditional portfolio management tools?

Portfolio monitoring software is built specifically for venture capital firms that need to track fast-moving, high-growth portfolios. Unlike generic portfolio management tools designed for slower-paced private equity or wealth management, it delivers real-time performance data, dynamic valuation tracking, and automated investor reporting. These capabilities scale with your fund, from the first investments to multi-fund operations, so even established VC firms gain the depth and speed required to stay competitive.

What advantages do paid portfolio monitoring solutions provide over free tools?

Paid portfolio monitoring software transforms portfolio oversight from simple tracking into a powerful decision engine. Advanced analytics and AI-driven insights uncover trends you can act on immediately, while automated, investor-ready reporting strengthens LP relationships. Seamless integrations with accounting and CRM systems eliminate manual data entry and ensure accuracy. As your fund grows, whether in deal volume, assets under management, or complexity, a paid platform scales effortlessly, giving every stage of your venture firm the speed and clarity needed to compete and win.

How do venture capital firms use portfolio monitoring software for investor relations?

Venture capital firms rely on portfolio monitoring software to turn raw performance data into polished, investor-ready insights. Automated LP reports and real-time dashboards keep limited partners informed without the usual spreadsheet scramble, while built-in analytics highlight progress and risk. The result is consistent, transparent communication that deepens trust and streamlines every quarterly or annual update.

Can portfolio monitoring software integrate with existing financial systems?

Yes. Leading solutions integrate with accounting tools, CRM systems, and data visualization platforms. These integrations automate data entry, ensure accuracy, and allow investment teams to view portfolio metrics alongside financial records in real time.

What should VC firms consider when choosing the best portfolio monitoring software?

Key considerations include ease of use, scalability, integration capabilities, and the quality of reporting features. Venture capital firms should select a platform that supports startup-focused metrics, accommodates growth, and aligns with their specific investment strategies.