Portfolio Management: What it is and How to Scale it at Your VC Firm

What is VC Portfolio Management?

Portfolio Management in Venture Capital is a process used by VC investors with the ultimate goal of protecting and increasing the value of their investments. Proper portfolio management is a cumulation of intelligent decision-making, information analysis, and resource commitment all aimed at achieving the value increase and stability in a range of investments.

Portfolio Management within the VC context generally consists of the following:

Market Research and Oversight

Venture capitalists need to be extremely savvy and up-to-date with the most relevant and real-time information about the industries they investment in. Typically, VC firms specialize in a particular type of investment (pre-seed, seed, later stage, etc) and sometimes they are industry specific (B2B Saas, B2C, EnviroTech, FemTech). Therefore, the portfolio that a VC is managing may encompass many different industries. Investors should aim to understand the most up-to-date research on how each industry and market is growing and changing. This helps investors make smart initial investment decisions, inform follow-up funding decisions, and appropriately advise on timely exit strategies.

Risk Profiling

VC investing is a risky business. However, a clear understanding of how long it will take to gain a return on an investment is critical for investors and goes hand in hand with market research when setting up a portfolio management strategy. VCs need to profile the level of risk of each investment with an informed understanding how long it will likely take to get their initial investment back (typically 3-7 years) and how likely they are to 10x their investment. The balance of quick return with high potential is critical to consider when managing new investments in a VC portfolio.

Exit Strategies

As a VC is first making an investment, they typically write into their investment strategy how they hope to exit the business. This plan includes identifying exit targets and appropriate negotiation engagements in best and worst-case scenarios for the business. Strategies might be mergers, acquisitions, buyouts, or public offerings. An ideal exit strategy is important to outline as a part of a portfolio management strategy. This helps investors better mitigate risk and understand the potential outcomes and value of a portfolio.

Related resource: What is Acquihiring? A Comprehensive Guide for Founders

How Exactly Does Portfolio Management Work?

More experienced venture capitalists will use their past experiences to determine patterns in investment strategies and the most effective way to interpret different potential investment outcome scenarios. Ultimately, portfolio management in Venture Capital comes down to understanding the delicate balance of qualitative and quantitative information about the investments in a portfolio.

Portfolio management internally within a VC fund consists of market research and oversight, risk profiling, and formulating numerous potential exit strategies. In order to work through these steps, a VC will need updated information from their portfolio companies on a regular basis. VCs are looking for a mix of metrics and qualitative data from their portfolio.

If you’re a VC looking to streamline the way you collect data from your portfolio companies, check out What Metrics Should I Be Collecting from my Portfolio Companies.

Collecting Portfolio Data in Visible

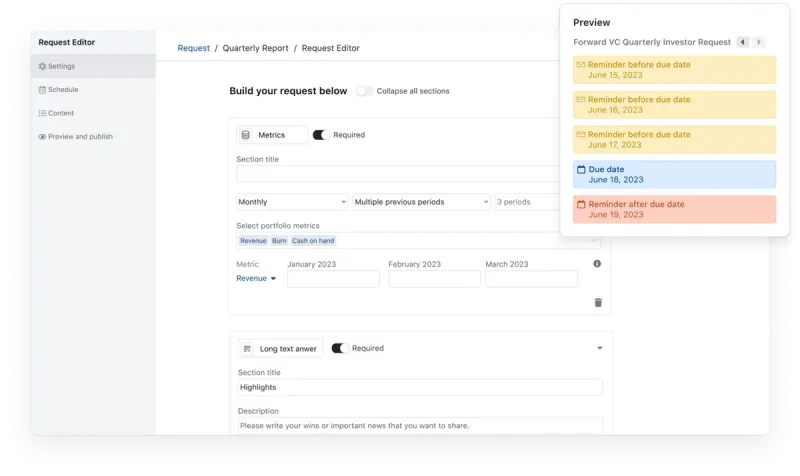

70% of the 350+ funds using Visible are requesting data from companies on a quarterly basis. Learn more about portfolio monitoring in Visible.

Check out an Example Request in Visible.

Portfolio Management Metrics

Of course, there are metrics that are commonly tracked amongst VC portfolio companies to help VCs stay on top of their portfolio performance. A couple of the key metrics and areas we generally see VCs focused on:

Financials and cash position

A VC wants the honest truth about how their companies are positioned financially. They will want to know metrics such as Cash Balance, Burn Rate, Runway, and Gross Profit. Investors may also ask for the forecast for these metrics. This information helps a VC determine whether they’re likely to reserve cash for a follow-up investment in a company and what a potential exit strategy might be.

Related Resources: Which Metrics Should I Collect from My Portfolio Companies?

True North KPIs

Depending on the type of business a company is operating, their ‘True North’ KPIs will differ. A company’s true north KPIs should be the key performance indicators that are guiding the business every single day. Beyond revenue goals, examples of other KPIs could be active users, a customer net promoter score, active customers, or average contract value. These KPIs will help a VC determine how the company is performing versus sector benchmarks.

Related Resources: Startup Metrics You Need to Monitor

Ownership and Cap Table Data

If a VC is looking to make a new investment, an important component they will consider for their portfolio management is how much ownership they will have in the company. A founder seeking investment should be transparent about what percent of the company is available in exchange for investment (if any) and how much is already taken. In addition to a clear ownership breakdown, a company should share information about its securities (stock options etc..). This information will be extremely relevant as the VC determines how to structure a potential investment deal.

Portfolio Management Qualitative Information

Collecting the metrics and quantitative data is only part of the portfolio management process. We also see investors collect a number of different qualitative fields to help them better understand how a company is performing. A couple of examples below:

Wins from the Previous Period

Founders shouldn’t be shy. Companies should be sure to highlight their most recent, and impressive wins as a company. This will energize and excite a VC who is determining which of their current companies they may want to make a follow-on investment into. Investors will also likely use this information when deciding whether to introduce a company to a potential follow-on investor. When investors make intros to other investors, they’re putting their social capital on the line. Companies who have instilled confidence in their current investors are more likely to get intros to follow on funders.

The VC Advantage

Venture capitalists take portfolio management so seriously because they of course want to see their portfolio investments succeed and make money. Therefore, outside of putting down the initial investment, venture capitalists usually incorporate many other touchpoints and opportunities to help their investments succeed. Outside of the fiscal advantage VC investments provide, a close relationship with investors and VCs can be a competitive advantage that makes or breaks a company.

Ultimately, VCs want to help their portfolio companies because it helps them. In addition to actively monitoring the metric performance of their portfolio, VCs want to offer assistance in any way that they can to give their investments a competitive advantage. These competitive advantage points are also a part of a successful portfolio management strategy. VCs help their portfolio companies in a variety of ways:

- Taking action on metrics – As mentioned above, VCs are continuously monitoring their portfolio investments. VCs analyze their companies’ profits, customer churn, average deal size, and more. An informed VC can provide insights and advice to companies to help them improve their performance metrics. Drawing form experience managing other investments, they will have insight into what works and what to avoid or change in order to succeed.

- Hiring decisions – VC partners are often ex-founders who have successfully built and exited one ore more companies. They are experienced in hiring founding teams and can help advise what roles are the most critical to higher first. Additionally, VCs networks are deep and wide. A founder may have the chance to hire a seasoned CFO or CMO through an intro from a VC. Hiring the right people is critical to the success of early stage companies and leaning on a VC partner to do so may allow a founder to access talent that wouldn’t have otherwise been interested in their company. (Relevant resource: 5 Ways to Help Your Portfolio Companies Find Talent)

- Fundraising assistance – Fundraising is exhausting but necessary as companies aim to quickly scale their business. After partnering with a VC for an early round, investors want to ensure the right investment partners come onboard for later rounds. If a company is on track to succeed, leaning on existing VC relationships to find additional investors is a smart idea. An existing VC will want to work with other firms or angels they get along with or align with ideologically and will often go above and beyond to help you make new connections and raise a new round of funding. (Relevant resource: How to share your fundraising pipeline with your current investors)

- Strategic product decisions – With a close eye on the market, a VC can be a good sounding board for what pivots or iterations to make to a company’s product. It’s easy for founders to get stuck in a silo, only focusing on the details of their product. A VC can provide helpful advice on what decisions to make that better keep in mind the market and competitors, even providing tough love on what product decisions might not be right.

Related Resources: How to Lead a Portfolio Review Meeting for VC’s

How Visible Can Help

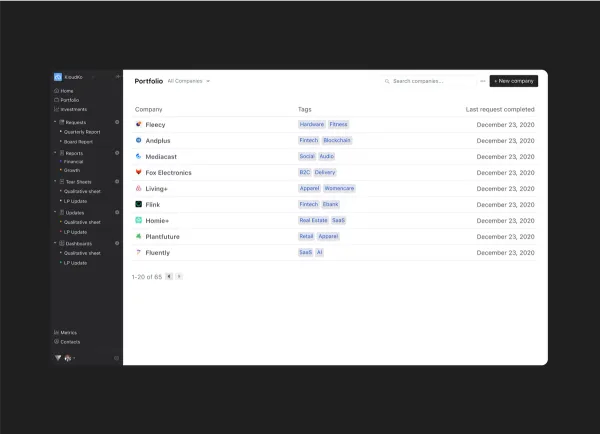

Investors of all stages are using Visible to streamline their portfolio monitoring and reporting processes. Visible helps investors streamline the way they collect data from their founders on a regular basis and provides data visualization and reporting tools.

Over 400+ Venture Capital investors are using Visible to streamline their portfolio monitoring and reporting. Learn more.