Blog

Reporting

Resources to help level up your investor reporting.

All

Fundraising Metrics and data Product Updates Operations Hiring & Talent Reporting Customer Stories

investors

Reporting

Metrics and data

The Best Practices for VC Portfolio Data Collection

As more capital flows into venture as an asset class, investors are increasingly competing for LP dollars and space on the cap table from the best founders they work with.

Gone are the days when capital is enough of a differentiator for a VC fund to get on a hot startup’s cap table. Considering the average VC + Founder relationship is 8-10 years (longer than the average marriage in the US) — founders are beginning to look for a true partner out of a VC fund.

In order for a VC fund or emerging fund manager to stand out among other funds, they need to have the data and systems in place.

LPs have increasingly higher expectations for fund performance while founders have increasingly higher expectations for VC funds.

About this Report

The goal of this report is to break down the best practices we see hundreds of VC use to collect and share their portfolio data. We outline best practices related to:

Market Data Overview

Timing of Data Requests

Number of Metrics to Collect

Most Common Metrics

The Founder Experience

Qualitative Questions

Minimum Viable Data Request

Company Success = Fund Success

Venture capital funds are only as successful as their portfolio companies. There are few people who have been in a founder’s shoes and can help them navigate the challenges they are facing. However, investors are in a unique position as they’ve likely seen many portfolio companies and potential investments face the same challenges.

In order to best help portfolio companies, investors need to have a strategy in place to collect both qualitative and quantitative data from their portfolio companies.

Collecting a few KPIs and company asks is a great place to start (more on this later in the report). At the same time, there is a balance between helping and being a burden on a portfolio company.

Download our report to learn some simple best practices so you can collect the data you need without burdening your portfolio companies

founders

Fundraising

Hiring & Talent

Reporting

Operations

Metrics and data

Our 7 Favorite Quotes from the Founders Forward Podcast

In 2020 we launched the Founders Forward Podcast. The goal of the podcast is to enable founders to learn from their peers and leaders that have been there before. Over the last 7 weeks our CEO, Mike Preuss, has interviewed a different founder or startup leader every week.

Related Resource: 11 Venture Capital Podcasts You Need to Check Out

Here are some of our favorite quotes and takeaways from the first 7 interviews:

Lindsay Tjepkema, Founder of Casted

Our first episode of the Founders Forward was with Lindsay Tjepkema. Considering she is a podcasting expert, we figured there could not be a better first guest. We chat all things podcasting and alternative media types. However one of the tidbits we found most interesting was Lindsay’s outlook on venture fundraising. Oftentimes fundraising can be a frustrating journey but Lindsay views the process as an opportunity to promote her business and tell her company’s story. Give the full episode a listen here.

Amanda Goetz, Founder of House of Wise

House of Wise is Amanda’s second go as a startup founder. However things are no less difficult than her first time around. Her first journey was spent worrying about legal aspects and the basics of getting her business running. That was easy with House of Wise but she has faced new challenges (and opportunities) during her second journey. Give the full episode a listen here.

Jeff Kahn, Founder of Rise Science

Jeff has 10 years of sleep science experience and research. Before starting Rise Science Jeff spent time publishing academic articles and supporting world-class athletes and teams with better sleep. Jeff Kahn is a true expert in all things sleep. During our interview with Jeff, we chatted about how sleep can improve a founder’s leadership skills and productivity. Give the full episode a listen here.

Aishetu Dozie, Founder of Bossy Cosmetics

Aishetu Dozie started her career in banking and eventually made the transition to starting a cosmetics company. Just like any founder, her first time journey has been full of highs and lows. Aishetu, like many founders and leaders, has struggled with imposter syndrome. We love her thoughts below on how she has tackled imposter syndrome. Give the full episode a listen here.

Kyle Poyar, Partner at OpenView Ventures

OpenView Ventures is credited with coining the term “Product-Led Growth.” As Kyle and the team at OpenView continue to help SaaS companies grow and become market leaders he has seen it all. From the early days of defining PLG and the impact of COVID-19 Kyle is full of first-hand stories and the data to back it up. Check out how Kyle defines and thinks about PLG below. Give the full episode a listen here.

Yin Wu, Founder of Pulley

Yin Wu has been through Y Combinator 3 times and has successfully exited 2 companies. Over the course of her founder journey it is safe to say that she has spent a good amount of time fundraising and chatting with investors. Yin likes to bucket investors into 3 categories to structure who she should be chatting with and raising from. Give the full episode a listen here.

Cheryl Campos, Head of Venture Growth at Republic

Over the past 3 years, the funding options for startups have continued to transform. Over her 3 years at Republic, Cheryl has watched as the market has changed and crowdfunding has become a more viable option. Check out Cheryl’s thoughts on the new funding options below. Give the full episode a listen here.

We have plenty of new episodes recorded and ready to share in 2021.

founders

Fundraising

Reporting

RSUs vs RSAs: What’s the difference?

What is a restricted stock unit?

Restricted Stock Units or RSUs are forms of compensation issued to employees by an employer founder. This compensation is issued in restricted company shares. Shares are restricted because their value is limited by a vesting plan. After a set amount of time laid out in a vesting plan occurs, a certain amount of shares becomes accessible and valuable. RSUs give employees interest in a company but will not be worth their full value until the full vesting period is complete. RSUs will always have value due to their underlying shares.

What is a restricted stock award?

Restricted Stock Awards or RSA’s are given to the employee on the day they are granted. They do not have to be earned via a vesting schedule like RSUs do. The employee “owns” the stock associated with the RSA on the grant date. However, they may still have to purchase them, depending on the nature of the offer. This purchase contingency is why RSAs are considered “restricted stock”.

RSUs vs RSAs for startups

Overall, restricted stock in the form of RSUs or RSAs can be a value-add for startups and a great way to incentivize talent employees to join the team. RSUs are not purchased at grant date but instead have a timed vesting period as well as other vesting conditions before they are owned outright. RSAs are purchased on the grant date but still typically have time-based vesting conditions. Unvested RSUs are given up when an employee is terminated and RSAs are available for repurchase when an employee is terminated. RSAs are typically granted to early employees before funding rounds with additional equity payouts and RSUs are typically granted to employees after funding is taken on.

What the differences are important to understand

RSUs and RSAs are two common terms to understand in the startup landscape. RSU stands for “Restricted Stock Unit” and RSA stands for “Restricted Stock Award”. Understanding the difference is key when building and operating a startup.

While both RSUs and RSAs are forms of restricted stock, they are different and serve different purposes. In general, restricted stock is owned from the day it is issued and does not need to be purchased. However, because it is restricted, it needs to be earned.

How do restricted stock units work?

RSUs became popular in the early 2000s after a variety of executive fraud scandals occurred across the market. With it’s vesting limitations, RSUs have become a popular option for compensating leadership and early employees without the risk of providing full stock upfront.

RSUs give an employee interest in company stock but they have no tangible value until vesting is complete and typically vesting plans are staggered so that only a certain percentage of shares vest at a time. For example, if an employee has a 4 year vesting period with a 1 year cliff, they would only walk away with 25% of their promised shares after a year of employment (or none if they leave or are terminated prior). RSUS are also structured with limits in case termination occurs that can override vesting or cliff rules. The restricted stock units are assigned a fair market value when they vest. When RSUs finally vest, they are considered income, and a portion of the shares is withheld to pay income taxes. When the employee receives the remaining shares and can sell them. If an employee is terminated, they keep any of their vested shares but the company can purchase back the unvested shares.

Like any potential compensation option, RSUs have pros and cons to their structure and offering.

Some Pros of offering RSUs include:

Long Term Incentive – because of the standard vesting period of 4 years, generous RSU packages can be helpful in incentivizing top talent to stick around longer, put in more effort to grow the company, to ultimately claim their full offering of stock at the highest possible value.

Low-Impact: The admin work and back-end management of RSUs is minimal compared to other, more complicated stock incentive plans. RSUs also allow a company to defer issuing shares until the vesting schedule is complete. This helps delay the dilution of its shares.

Related Resource: Everything You Should Know About Diluting Shares

Some Cons of offering RSUs include:

No Dividends: Because actual shares are not allocated, RSUs don’t provide dividends to the stock holders. However this means that the employer issuing the RSUs needs to pay dividends in an escrow account that can help offset withholding taxes or be reinvested. This is something to keep in mind as a potential founder offering RSUs.

Income Restrictions: RSUs aren’t taxable until they vest. So employees can’t pay taxes before vesting as the IRS doesn’t consider unvested RSUs to be tangible property.

Shareholder Voting Rights: RSUs don’t grant the shareholder voting rights or input into the company until they are fully vested.

How do restricted stock awards work?

Restricted Stock Award shares are given to the employee on the day they are granted. While RSUs are more commonly awarded to general employees, RSAs are more common with early employees at a startup before the first round of equity financing. Instead of a timed out vesting period that portions out the stock like in an RSU, an RSA is the lump sum awarded on one date (although that may still be time-based).

Vesting still applies in a different way to RSAs. Vesting only impacts a receivers RSAs if they are terminated or leave the company allowing the company to potentially purchase back the shares. The vesting is less about the employee owning the stock as the RSA is owned but about the ability to retain what is owned. However, there are usually time-based rules associated with RSAs so that the shares may expire if certain requirements, specifically financial requirements, aren’t reached. Most companies have vesting schedules in place to prevent individuals from joining a company, receiving their RSA award, and leaving immediately.

Most RSA pros and cons are fairly similar to RSUs as RSAs are simply another form of restricted stock.

How are restricted stock units taxed?

With restricted stock, it’s important to consider two types of taxes: regular income tax and capital gains tax. Taxing on restricted stock is complex but the basic underlying factor of income still applies – anything that a company pays an employee is taxable.

For RSUs, regular income taxes are paid when the recipient shares vest.

How are restricted stock awards taxed?

For RSAs, the receiver has to pay for them outright so when the vest date rolls around there are no additional taxes to pay on the shares themselves unless they change value. The RSA receiver will only need to pay taxes on the gains in value of the shares. The tax on gains between grant date and vesting will be income tax. The tax on gains between vesting and sale of those shares will be capital gains tax.

An election called the 83(b) election can be selected on a tax form which means the recipient can pay all their ordinary income tax upfront. The 83(b) election is eligible for RSAs not RSUs.

founders

Reporting

5 Takeaways From Our CEO On The Stride 2 Freedom Podcast

Last week, Mike, our CEO, joined Russell Benaroya on Stride Services’ “Stride 2 Freedom Speaker Series,” where every week Russell interviews people who can help you move your business faster. Russell and Stride have been longtime users of Visible & great partners to work with. On this episode, Mike & Russell discuss Visible’s recent developments, the relationship driven nature of venture capital, and why people invest in lines rather than dots. You can listen here.

Related Resource: 11 Venture Capital Podcasts You Need to Check Out

VC is a Relationship Driven Business

Venture capital investments take a long time to reach maturity. In many cases, an investor is “hitching a wagon to you for the next 10+ years.” You need to show that you’re trustworthy and working for the long term to persuade an investor to take a chance on your company.

Good Communication Has a High ROI

At Visible, we like to say that communication saves startups, but it can also help startups get off the ground. Mike mentions that it’s rare that an investor will write a check based on a single interaction. However, investors are able to see your growth if you have past investor updates that you can share to show your progress over time. They’ll also feel good about your level of transparency, and believe that you’ll keep them in the loop too if they decide to invest.

Relationships Are Built On Lines, Not Dots

You need to show consistent improvement over time when fundraising. It’s impossible to build an accurate judgement of a business or an individual with only a handful of scattered data points. Long term relationships are built through consistency of character, and long term businesses are built by consistent iteration and effort. You can impress people by showing how you’ve developed over time, regardless of where you currently stand. It’s crucial to focus on lines, rather than dots when building investor relationships.

Good Leaders Care About the Team

What does Mike wish people asked him more about? The team. Startups are built by teams, not just founders. When asked about how we built our newsletter to nearly 20,000 subscribers, Mike recognized that the credit belongs to Matt (who runs marketing here at Visible), rather than himself. The more that a founder can celebrate a team & lead effectively, the better they will perform in the long term.

The Startup Ecosystem is Increasingly Global

While Silicon Valley will likely remain the primary startup hub in the US for the foreseeable future, the emergence of new startup ecosystems around the world are beginning to attract new founders and investors. At Visible, we’re fortunate to help thriving entrepreneurs from around the world, and Mike has been personally exposed to many startup ecosystems around the US. With the rise of remote work during the pandemic, founders are re-evaluating whether or not they need to remain in the traditional startup cities. As a globally distributed team ourselves, we can verify that A+ talent exists in every corner of the world. Founders everywhere are waking up to this trend – expect to see more startups founded worldwide, not just in northern California.

investors

Reporting

Operations

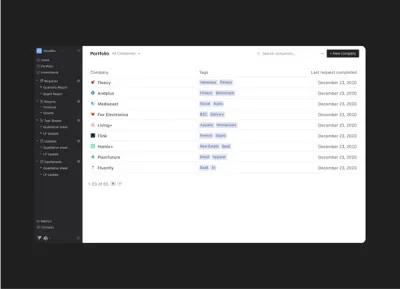

Best Practices for Portfolio Management

Getting regular, high quality, and actionable data from portfolio companies is important. It allows you to make better decisions, support your portfolio, share insights with portfolio company founders, report to LPs and more.

This practice should also be highly valuable for founders. They should be able to share wins, challenges and get help from you, their stakeholder. It should only take them 3 minutes to complete (if not, either something may be wrong with the request or structurally wrong with the company).

Below are some best practices to make sure you get:

Timely information (e.g. 100% completion)

Structured data(comparing apples to apples)

Actionable insights (how can we help companies)

Timing & Cadence

Same time every period

Set the expectation that you will be sending a request the same time every month. e.g. your request will be due the 20th post month or quarter end. Don’t randomly switch between the 10th, the 30th, etc. Founders will not have an expectation and know they can submit whenever they want.

Luckily Visible makes this easy for you. You’ll be to set you schedule and we take care of all emails, due dates and reminders.

Appropriate Cadence

We recommend the following cadences. This is 100% customizable as every fund is different.

Weekly – Accelerators in Cohort

Monthly – Pre-Seed, Seed, Series A

Quarterly – Series B & later

Request Content

Less is more.

Don’t send a request asking for every metric under the sun. Only get the information you truly need. If you are truly providing value back to the founders, then start small, get a rhythm and expand the data.

Metrics

5-15 Metrics.

Depending how closely you work with companies, ask for 5-15 metrics and no more.

Use a metric description!

If you are asking for Burn and don’t provide context, you might get 15 different variations. Should it be negative? Should it be trailing 3 months or current month? Should it include financing? Be descriptive about what you want. **Here is our Metric Library** that has some helpful descriptions.

Qualitative Info

How can you help?

Always make sure to use a qualitative section to see how you can best help the portfolio. Also let the founder share their wins and challenges if it makes sense!

Rollout

Let your current (and new) portfolio companies know to expect a regular request from you and what to expect.

Intro Template

Feel free to use our Intro Copy Template if you need some inspiration.

Custom Domain

All of your requests will come from you. However, with Visible you can fully white label the request emails so they come from your email and domain.

founders

Reporting

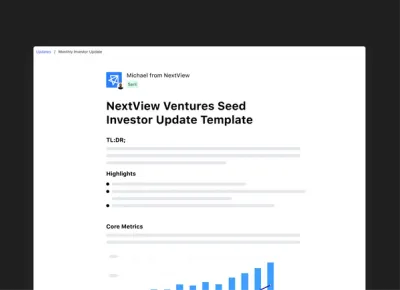

NextView Ventures Seed Investor Update Template

NextView Ventures is a hands-on seed venture capital firm based in Boston. The team at NextView makes 10-12 investments a year so its fair to say they’ve seen their fair share of investor update email templates. David Beisel, Partner at NextView, recently put together a great seed investor update template for startup founders.

As David Beisel, partner at NextView Ventures, wrote in his investor update post, “First and foremost, investors (whether they say it or not) prefer over communication of what’s happening at the company, both the good and the bad. And a regular update with candor about what is going well and what is not signals an orientation towards transparency, which in turn engenders trust. This trust can yield benefits later on if the company faces a challenging situation in which it requires to raise more capital outside a position of strength.”

By building trust, this will only unlock further benefits down the road. When you stay top of an investor’s mind they will be more inclined to help with networking, hiring, fundraising, decision making, and more. You can check out the NextView seed stage update template below or continue reading for a deeper breakdown of the template.

The Seed Stage Investor Update Template

As David writes in his post, “In terms of form, we recommend an update email that is short and sweet. After all, the goal is to have investors actually read it!” The seed stage investor update template from NextView is similar to the other seed stage templates we have seen in the past. The template is largely broken down into the easily digestible sections below:

TL:DR;

The TL:DR; section is used to give a short and sweet overview of the entire update. This can include a sentence or two overview of the last period with a bullets highlighting key initiatives and specific areas where you need help.

Highlights

The highlights section is exactly what it sounds like; a section to showcase your team’s wins over the last period. Make sure to share goals that you achieved or other company and team initiatives that are moving your company forward.

Core Metrics

Include 3 to 5 key metrics that are related to the success of your business. Your investors should be familiar with your metrics and should know what to expect here. With each metric be sure to include a chart or visualization and a brief recap of the last period’s performance.

Challenges

Arguably the most difficult section to craft, this can also be one of the most important sections for your investors. Mentioned where you missed the mark and what your plans are for improving this moving forward. Investors know that building a startup is hard and are fully expecting challenges and road bumps along the way.

Goals

This section should lay out your major company goals over the next few weeks or months. You will want to be sure to revisit these goals in a future update.

Asks and Thanks

Use this section to call out specific people, investors and teammates, that went above and beyond over the past few weeks or months. This will not only make the person feel good but will also motivate others to help in the future.

Finances

Share the vital metrics to your companies financial health. David encourages founders to share cash in bank, runway, and burn rate. If anything unexpected happened over the past period, be sure to call it out. Bonus points if you include a financial document or link to a spreadsheet.

We hope this template is helpful. To learn more about best practices for sending regular investor updates, check out our template library here.

founders

Fundraising

Reporting

6 Components of a VC Startup Term Sheet (Template Included)

Term sheets can be intimidating as a first-time founder. As it is likely the first time you’ve seen a term sheet, the intricacies of the deal can be difficult to understand. You can spend hours trying to understand a term sheet and what exactly makes up a “good” term sheet. As the team at YC writes, “we’ve noticed a common problem: founders don’t know what “good” looks like in a term sheet.”

If you’re looking for a breakdown of a term sheet specific to Series A, check out our blog post, “Navigating Your Series A Term Sheet.”

In order to help founders best understand their term sheets, many firms and individuals have come up with their own term sheet templates. In fact, many investors and founders now use a 1-page term sheet template. Check out our breakdown of term sheet components with a few templates below.

As a note, this is not legal advice and we suggest consulting with your lawyer while reviewing your term sheet.

Related Resource: How to Choose the Right Law Firm for Your Startup

VC Fundraising Timeline

As we often write about at Visible, we believe a startup fundraise shares a lot of characteristics of a B2B sales funnel. In the most simple breakdown — at the top of the funnel you are bringing in new investors, in the middle you are nurturing them through investor updates and meetings, and at the bottom, you are signing term sheets and building relationships with new investors.

Kicking off a VC Fundraise

Once you have formed your company and launched/are preparing to launch a product you may decide to pursue venture fundraising (to learn more about determining if VC funding is right for you, check out this post). Before kicking off a fundraise, especially at seed stages and later, you likely have some form of product-market fit.

Finding Investors

If you’ve decided VC funding is right for your business. You’ll need to start finding investors to “fill the top of your funnel.” Check out Visible Connect, our free investor database, to filter and find the right investors for your business. If you’re earlier in your company lifecycle and want to find angel investors, check out this post.

Pitching Investors

Once you start reaching out to investors (via cold email or warm intros) you’ll begin a series of meetings and pitches with the hopes of moving them down the funnel. Check out our template and guide for pitch decks here.

Related Reading: How to Write the Perfect Investment Memo

Due Diligence and Final Steps

If an investor is interested in moving forward, you will likely begin due diligence where they will audit your data, get feedback from customers and investors, and confirm their conviction in your company. If they decide to move forward, next comes a term sheet.

Term Sheet

At the end of a fundraise comes the term sheet. Assuming both parties are happy with the terms, you’ll be able to onboard your new investor.

6 Components of A VC Term Sheet

Liquidation Preferences

Liquidation preference is simply the order in which stakeholders are paid out in case of a company liquidation (e.g. company sale). Liquidation preference is important to your investors because it gives some security (well, as much security as there is at the Series A) to the risk of their investment. If you see more than 1x, which means the investor would get back more than they first invested, that should raise a red flag.

To learn more about liquidation preferences check out this article, “Liquidation Preference: Everything You Need to Know.”

Dividends

In the eyes of an early-stage investor, dividends are not a main point of focus. As Brad Feld puts it, “For early-stage investments, dividends generally do not provide “venture returns” – they are simply modest juice in a deal.” Dividends will typically be from 5-15% depending on the investor. Series A investors are looking to generate huge returns so a mere 5-15% on an investment is simply a little added “juice.”

There are 2 types of dividends; cumulative and non-cumulative. YC warns against cumulative dividends; “the investor compounds its liquidation preference every year by X%, which increases the economic hurdle that has to be cleared before founders and employees see any value.”

Conversion to Common Stock

Common practice will automatically convert preferred stock into common stock in the case of an IPO or acquisition. Generally, Series A investors will have the right to convert their preferred stock to common stock at any time. As Brad Feld puts it, “This allows the buyer of preferred stock to convert to common stock should he determine on a liquidation that he is better off getting paid on a pro-rata common basis rather than accepting the liquidation preference and participating amount.”

Voting Rights

On a Series A term sheet, the voting rights simply states the voting rights of the investor. Generally, your Series A investors will likely receive the same number of votes as the number of common shares they could convert to at any given time. In the Y Combinator example, as with most term sheets, this section can include some technical jargon that is not easy to understand.

The most important vetoes that a Series A investor usually receives are the veto of financing and the veto of a sale of the company.

Board Structure

One of the more important sections when navigating your Series A term sheet is the board structure. Ultimately, the board structure designates who has control of the board and the company. How your Series A investors want to structure the board should be a sign of how they perceive you and your company.

The most “founder-friendly” structure is 2-1. A scenario in which 2 seats are given to the common majority (e.g. the founders who control a majority of the common stock) and 1 given to the investors. This allows founders to maintain control of their company.

On the flip side, there is a 2-2-1 structure (2 founders, 2 investors, 1 outside member). In this scenario, it is possible for the founders to lose control of the company. While a common structure, be sure that the board structure is in line with conversations while fundraising. As Jason Kwon of YC puts it, “So when an investor says that they’re committed to partnering with you for the long-term – or that they’re betting everything on you – but then tells you something else with the terms that they insist on, believe the terms.”

Drag Along

As defined by the Morgan Lewis law firm, “Drag along is the right to obligate other stockholders to sell their securities along with securities sold by the investor.” Drag along rights give investors confidence that founders and the common majority will not block the sale of a company. While there is no way around drag-along rights, some people will suggest that founders negotiate for a higher “trigger point” (e.g. ⅔ votes as opposed to 51%).

You can learn more about drag along clauses in this post, Demystifying the VC term sheet: Drag-along provisions.

VC Term Sheet Examples

The Y Combinator Term Sheet Template

With thousands of investments under their belt, Y combinator is always a great place to start when looking for startup best practices. The team at YC put together an awesome 1 page term sheet template (with a focus on Series A) that any founder can use. While your actual term sheet may look different the Y Combinator Term Sheet template is a great place to get familiar with the subject.

YC does a great job of breaking down the different components and laying out terms and language that founders should keep their eye out for. Check out their term sheet template here.

Buffer Series A Term Sheet

The team at Buffer raised a $3.5M Series A back in 2014. Check out the signed term sheet and the terms from their raise here.

VC Term Sheet Templates

As term sheets are a necessary part of any fundraise there are hundreds of templates and examples to choose from by the investors, founders, and lawyers that have been there before. Check out a few popular templates below:

The One Page Term Sheet Template from Ben Milne

Ben Milne, Founder of Dwolla, has spent his fair share of time navigating term sheets. Ben is a Midwest founder and has seen the amount of time midwest founders and investors waste negotiating term sheets. As he put it, “Midwest investors and founders lose a lot of time trying to figure out the term sheet. Sometimes, they lose even more time deciding what the terms should be.”

In order to help bring some guidance to both startups and investors, Ben put together a one-page term sheet template. You can check out the template below:

You can check out the one-page term sheet template from Ben Milne in this blog post.

The NVCA Term Sheet Template

The National Venture Capital Association recently released their latest version of their term sheet template. As the team put at NVCA wrote, “The Enhanced Model Term Sheet allows an investor to draft term sheets while comparing terms against market benchmarks. Version 2.0 is powered by a database that now includes more than 100,000 venture transactions, representing over 40,000 investors with a combined network of over $1 trillion in assets under management.”

Check it out and download the template here.

Let Visible Help

We are here to help with any fundraise. Use our free investor database, Visible Connect, to kick off a raise. From here, use our fundraising CRM as you move investors through your funnel and sign a term sheet. Start your free trial here.

founders

Fundraising

Reporting

Dr. Dan — The Burdensome Investor

Raising capital is hard. Raising capital during a pandemic can feel impossible. As we discussed with Lolita Taub in our webinar last week, more founders are looking for alternatives to venture capital.

Founders are looking to solutions like Pipe, Earnest Capital, ClearBanc, Angels, Friends & Family, among others. Raising from angels and friends/family came into focus during our webinar with Lolita. Note: Check out our “How to Find Angel Investors” guide if you’re searching for angels for your business.

Friends and family often make for an easier fundraising process. Less stringent due diligence combined with less pitching can make friends and family be an attractive option. However, a friend or family member could be less startup savvy than a traditional VC and can become a burden to you and your business.

Internally we call the burdensome investor, “Dr. Dan.” Maybe a family member or friend invested in your business but calls every week for status updates or to ask questions about a metric, etc. With the investor + founder relationships (8-10 years) lasting longer than the average U.S. marriage it is important that you are taking on investors that you can build a relationship with. So how do you approach a potential “Dr.Dan?”

Set Expectations Early

As we previously mentioned, a friend/family or angel investor may not be as startup sophisticated as your traditional VC. Sometimes an inexperienced investors’ expectations may be wildly different from reality. It is your job as a founder to make sure a potential angel investors expectations and reality are aligned.

Before you cash a check, make sure that these investors are aware of the realities of investing in a startup. Make it clear how and when they will hear from you, what the possible outcomes are, and where their capital will be going. Even though someone is an “accredited investor” they are investing their own money and it could be a considerable chunk of their savings.

Explore Other Options

If you’re talking to a potential “Dr. Dan” you may need to weigh other funding options. As we mentioned at the beginning of the post there are quite a few alternatives for raising capital. While the most ideal is using customer revenue to fuel growth, that is generally not an option for most startups — especially early stage.

There are countless alternatives and more popping up every day. You can check out a few of our favorite alternatives here.

Trust Your Gut

As Lolita Taub put it in our webinar, “You just have to hustle and do what you need to do for your business.” At the end of the day, only you know what the right decision is for your business. If you’re in dire need of capital, it may be worth the burden of bringing on a “Dr. Dan.” If you’re in a good spot financially, it may be time to re-evaluate and take your time to explore other funding options.

There are countless pros of bringing on a new investor — capital, new networks, fresh eyes, etc. On the flipside, an angel or family/friend investor can quickly become burdensome if they are inexperienced or unsure of what to expect from you. Remember bringing on a new investor means bringing on a new business partner for the foreseeable future — only you know what the right decision is for your business.

Already have angel investors? Send them a quick Update to let them know how your business is doing.

founders

Reporting

Mike’s Note — Investor NPS

How likely are you to refer your current lead investor(s) to fellow founders? Let us know through this NPS form. Answers are 100% anonymous.

We keep hearing from founders wanting a “Glassdoor for investors.” There is a lot to unpack there. e.g. How do you:

Keep founders safe through anonymity but validate the information is accurate?

Remove bias if a founder is an upset that an investor says no? (Which they do 99% of time)

Until then, I am curious to see what the response rate is. If you are comfortable just select 1-10.

founders

Reporting

Operations

Operations

Do You Have a Stakeholder Management Strategy?

All eyes are on leaders in a time of uncertainty. How a leader acts, presents themselves, and communicates echoes throughout the organization (and any outside stakeholders).

Having a stakeholder management strategy in place is a surefire way to give a sense of unity and direction to all of your stakeholders; especially in a time of turmoil. A stakeholder management strategy generally relates to individual projects or campaigns. However, a founder can use a stakeholder management plan to oversee their communication.

As the team at MindTools writes, “Stakeholder management is the process of maintaining good relationships with the people who have the most impact on your work. Communicating with each one in the right way can play a vital part in keeping them on board.”

The goal of your startup stakeholder communication plan should be to give everyone the information they need to understand direction, goals, and to feel a sense of cohesiveness. For a startup, we can boil down a stakeholder management strategy into 5 unique groups: team, investors, board of directors, advisors/mentors, and customers.

As a CEO or Founder it is your job to set the tone for communication and delegate or own different stakeholder groups as needed. Here are a couple of things to keep in mind when setting a stakeholder management and communication strategy:

Keep it Predictable

When it comes to setting up a stakeholder management strategy one of the key components is to keep it as predictable as possible. Set a specific cadence with each stakeholder group so they can expect when they’ll be receiving an email update, phone call, report, etc.

Not only will a predictable cadence help your stakeholders, it will help you as a founder as well. We have found that by committing to a schedule it will help hold you accountable and build good habits. If you’re looking for an easy way to get started with a team communication strategy, check out our “Friday Note” template.

Apples to Apples

We often preach that it is vital to keep things consistent from update to update, especially when communicating with your investors. The same can be said when developing your stakeholder management strategy. If you commit to sharing a certain metric or context, be sure to keep it consistent throughout.

If you are sharing a certain metric, lay out how it is calculated in your first correspondence and stick to it. Questions and a lack of trust will start to form if the calculations or metrics you are sharing begin to change on a regular basis.

Set the Tone

As we mentioned earlier, a stakeholder management strategy is intended to help your different stakeholder groups understand direction, goals, and feel a sense of cohesiveness. In turn, this should also increase productivity and allow employees and stakeholders to build trust with their leaders.

When a founder or leader takes an action, it often reverberates throughout the organization. Keep this in mind when setting up a management and communication strategy for different stakeholder groups. If you want to establish a certain value or action in your company, your stakeholder management strategy is a great place to start.

A Note on Remote Work

In the wake of recent turmoil, more companies are transitioning to remote work. When working remote for the first time, having a sound stakeholder management and communication strategy is more important than ever. There is not such thing as too much communication, especially when all of your stakeholders are feeling the stress and anxiety of our current situation. To learn more about remote work, check out our 9 favorite posts here.

If you think you’re ready to implement a stakeholder communication and management strategy, head over to our Update Template Library to see examples for how to best communicate with your investors, team, board members, and more.

founders

Reporting

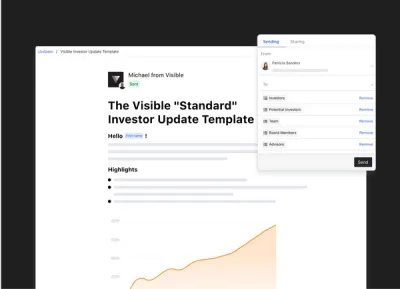

Sending Your First Investor Update Using Visible

Why Send Investor Updates

Investor updates can help in a number of ways. We’ve laid out some of the top reasons for sending investor Updates below. To learn more about why you should send investor updates, head here or visit the Visible Blog.

Communication saves companies

If your investors don’t know what’s going on in your business, they don’t know how to help. Investors provide more than capital. They offer advice, expertise, introductions, and more.

Accountability and trust

Proactive communication builds trust. When investors are kept in the loop they are more likely to help. You’ll always be top of mind for introductions, customer referrals and potential hires.

Follow-on funding

Follow on funding is imperative for success. Current investors provide signal, can lead rounds or can step in to bridge a financing. Make sure your current investors are allocating future capital by demonstrating your commitment to transparent communication and good governance.

Below are the steps for getting successfully set up on Visible to send your first Investor Update. Have a question or need a hand with anything? You can reach out by using the Intercom chat messenger located in the bottom right of you screen.

Starting with Metrics

Sharing metrics allows investors to understand how your business is performing. If a certain metric or KPI is down, don’t be afraid to share this — it happens. In fact, investors can likely offer help to turn things around.

In general, we suggest keeping the metrics you share consistent. You know your business best, so what financials and KPIs to share will vary. If you’re looking for more on what metrics to share check out the Founders Forward Blog here.

To get started with metrics and charts in Visible, click the “Metrics” tab towards the bottom of the left hand side navigation. If you do not use any of our data sources, we suggest getting started with a Google Sheet or User Provided metrics.

For this example, we’ll walk you through getting a Google Sheet connected. The video below will walk you through connecting Google Sheets.

We are using this Google Sheet in our example. Feel free to make a copy (using this link) to follow along at home! We suggest keeping the date + metric format and swapping out metric names where you would like.

You can find a more involved article for getting started with Google Sheets here and articles for connecting other integrations here.

Charting Your Data

Once you have your metrics and data in Visible, it is time to start creating charts. We suggest creating charts in a dashboard to start. You’ll be able to select any of your dashboard charts when you craft your Updates.

From a dashboard, click “+” button followed by “Chart” as shown below:

Screen Recording 2020-03-17 at 02.01 PM.mov

Once you’ve opened the chart builder. Select what metrics you’d like to pull into the chart. You can select as many metrics as you’d like from any data source! For this example, we’ll be creating a chart with Revenue and Total Expenses.

Screen Recording 2020-03-17 at 02.11 PM.mov

A couple of tools/tips when using the chart builder:

Enhance Individual Metrics — If you click on a metric from the chart builder, you’ll be able to enhance your metrics with our business intelligence layer, chart colors, aggregation, and chart the metric on the Y-axis.

Options Tab — From the options tab of the chart editor, you can edit the visualization and settings of the chart. From the top half you can change the chart title and chart type. Moving down you can pick the metric name or date to show on the x-axis, show data labels, show data markers for line charts, and set a y-axis scale.

In the bottom half of the options tab, you can change the display frequency, pick a time period to display the data, and add in goal lines.

Add Annotations — To add text annotations directly to a chart, click on any data point and select “Add Annotation” when you have the chart builder open. You can add up to 100 characters.

Creating Your First Update & Using the Editor

Now that you’ve got a hang for creating charts, it is time to create your first Update! To get started, click the “+” sign next to Updates in the left hand side navigation. You will have the option to use a blank Update or start with one of our Update Templates.

Screen Recording 2020-03-17 at 02.14 PM.mov

For this example, we’ll walk through our basic investor update template.

This a rough guideline of what we have found to be best practices for sharing investor Updates. Feel free to make any changes to the Update Template that you would like.

With Updates you can include and combine any of the following components:

Text with rich formatting

Images

Charts

Side-by-side charts

Tables

Files

Line breaks

Check out the video below for a quick breakdown of our Update Editor:

Rich text — Simply highlight text to expose our editor. Create bulleted and numbered lists, create merge tags, and hyperlink text from here as well.

Build and include charts — Connect data and build charts. To include a chart in an Update, hit enter on your keyboard and you will see an option to add a component to the right side. Select an existing chart or build a new one directly in an Update. You can include as many charts as you’d like as well as tables and side-by-side charts.

Files and Images — To include a file or image, click enter and you will see an option to add a component to the right side (same as a chart). Select the image or file icon to embed either directly in your Updates.

Sharing Your Qualitative Data

You’ll notice in our standard investor Update template it is broken into a few key qualitative sections:

Highlights — Always start with the good news! Briefly recap your company highlights, including things like goals hit or exceeded, new key hires, product updates, etc. Anything that made the previous month great.

Lowlights — Next, include some areas where you struggled or could use some help. Noting the steps you’re taking in response is even better, as investors will see you reacting to tough situations and moving forward. Transparency is key!

Asks — Potentially the most important part of your update! Here is where you can leverage your investors and get the help you need. Make specific asks that investors can easily respond to by drawing on their networks, experience and advice.

Thanks — Giving credit where credit is due is important. This is where you can call out team members who went above and beyond in the previous month. Also, specifically call out any investor who responded to your previous month’s asks, or helped you in another way. Nothing wrong with creating a little peer pressure for your other investors!

Customer Story — Investors love to see customer reactions to your product or company. Include customer feedback, social media mentions or anything that highlights how you’re impacting your buyers.

Monthly Metrics — Finally, include the key data your investors want to see. This will vary from company to company, but we recommend all companies track Revenue, Burn, Cash in Bank. Include everything you think investors will want to see, but don’t go overboard with unimportant numbers. If you aren’t sure what charts/metrics to include, just ask!

Sending Your Update

Once you’ve got your charts and qualitative sections dialed in it is time to share your Update with your investors.

There are 3 main ways to share an Update; email, link, and Slack. To get started with all 3, click the “Send” button in the top right corner. From here, you’ll be able to share via email in the “Sending” tab and/or setup a link/Slack share in the “Sharing” tab.

Screen Recording 2020-03-17 at 02.26 PM.mov

A couple of things to note when sending Updates:

Create Contact Lists — By clicking “Contacts” in the left side navigation, you’ll be able to create segmented lists. For example, you could create a list of “Investors” that has all of your investors. Instead of adding individual contacts, you can add a list. Learn more here.

Stats — After you send an Update, we’ll display engagement stats. View clicks, opens, and “reactions” to your Updates. Learn more here.

Reactions — Reactions are a simple thumbs up icon at the bottom of your Update that investors can click to acknowledge they’ve read your Update. Think something similar to a like on Facebook or Twitter. Lear more here.

We hope this guide was helpful! If you have any questions or need a hand with anything don’t hesitate to reach out via email or by sending a message using the Intercom chat in the bottom right corner.

If you’re ready to take your reporting to the next level be sure to check out our Founders Forward Blog and Update Template Library.

founders

Fundraising

Reporting

Y Combinator Investment Memo Template

Raise capital, update investors and engage your team from Visible. Use the YC Investment Memo Template to get started.

Memos are a clear and concise document to lay out strategic vision, rationale, and expectations (in case you missed it, we wrote about the importance of memos earlier this week). We found the Y Combinator Investment Memo to be particularly interesting.

The YC Investment Memo

Memos have been something that most of us likely associate with VC funds writing for a prospective investment. The YC memo flips this idea on its head. In the YC Series A Guide, they share an investment memo template aimed towards founders. YC suggests sending your memo to investors in advance of a meeting to set the tone for the conversation. The idea is that by articulating your own memo, you can:

“Clarify your own company’s pitch and story”

“Incept your vision of the memo into their (potential VCs) brains.”

To give you an idea of what a memo may look like, we turned it into a Visible Update Template.

Pitch Deck vs. Memo

Using a memo to power a fundraise is an interesting idea. As YC suggests, founders that are strong writers may benefit from using a memo. The pitch deck has always been the go-to form for sharing data but Billy Gallagher of Rippling makes the case for using a memo in tandem.

Billy Gallagher shares a few key advantages to a memo that we’ve summarized below:

It is standalone — By sending a memo in advance you do not have to worry about the investors missing any context. Investors will be able to read and digest the memo on their own. Opposed to a pitch deck that may require a pitch and narrative around different components.

Less time — A memo will allow investors to quickly pass or take the next meeting. This way you can spend time on the firms that are truly interested.

Helps GP Pitch — At the end of a process a GP will have to pitch their other partners on why their fund should make an investment. By writing your own memo, it will make sure that the GP is properly presenting your company and idea to their peers.

We are not suggesting that every company suddenly start sending memos to kickoff an investor meeting. However, there are clear advantages and an interesting tool that more founders should study. If a memo sounds like a good fit for you and your company, give it a shot!

If you’re interested in learning more fundraising tips, be sure to subscribe to our weekly Founders Forward Newsletter.

founders

Fundraising

Reporting

Founders — are you sharing memos?

This won’t be the first or last time we write this: being a startup founder is hard. On top of your day-to-day tasks you have to worry about your customers, employees, and investors. You can often feel like you’re buried when balancing the communication and relationships with all of your stakeholder groups. Concisely sharing strategy with your stakeholder groups is an effective way to set expectations and build relationships.

One tool we’ve seen pop up more frequently in the last few weeks are strategic memos. Memos are a clear and concise document to lay out strategic vision, rationale, and expectations. We’ve shared 3 different “memos” below that can be used for your investors, team, and executives.

Y Combinator Fundraising Memo

In case you missed it, YC recently published a Series A Fundraising Guide. The guide is full of useful information covering every aspect of a fundraise. One of the areas we found to be most interesting was the idea of writing and sharing an investment memo.

YC makes the case that founders should write an investment memo is two-fold. First, it can set up a meeting with a potential investor nicely when sent in advance. Secondly, it helps you as a founder clarify your pitch, thoughts, and rationale. As the team at YC writes, “A memo is particularly effective if you can write well. It stands better on its own as the deck (sent ahead of time) can miss context provided by your voiceover. Founders tell us that memos sent before meetings in place of a deck provided the necessary to set up an engaged conversation from the outset.”

They go on to share a template of a memo that you can find here. We’ve turned it into an Update Template so you can share it out via email or link!

Executive Team Strategic Memo

Andy Johns is a seasoned startup professional and currently a partner at Unusual Ventures. Andy recently published a blog post, A Simple Tool for Managing an Executive Staff as a First-Time CEO, to help first time founders deal with their first executive hires. As Andy points out, managing an executive can be quite different than managing team individuals.

“An executive’s job is to focus primarily on taking strategic risks. Each year, they should identify 2–3 major initiatives, large enough in impact to shape the direction of the company and enforce great execution against those initiatives. This is in contrast to non-executives, who you want to be focused primarily on tactical execution.”

So how does a founder enforce execution against those initiatives? Andy suggests having your executives fill out a quick memo template for your executives to share with you. As Andy puts it, “Ideally, what they come back with is a strategy that has 2–3 major initiatives that they find are important, along with a list of success metrics and resources they need to get it done.”

Once a founder gets a strategic memo from each executive it makes forming strategy and roadmap for the company as a whole easier. These memos can be used to fuel your strategic and financial plan for the year, create performance plans with executives and individuals, and the kickoff discussion points for annual planning.

Check out the strategic memo template from the team at Unusual Ventures here.

The EVERGOODS Product Brief

The last memo is slightly different than the first two. EVERGOODS is a small equipment and apparel company based out of Bozeman, MT. EVERGOODS has a strong focus on building an incredible product and puts a great deal into R&D and perfecting every minor detail of their products (a couple of gear junkies on the Visible team can attest to this).

As the founders, Jack and Kevin, put it, “Our experience lies in product design, development, R/D, and manufacturing for the likes of GORUCK and Patagonia. We believe in product and the processes of doing the work ourselves. Each project is an exploration, and ultimately a discovery, aided by our triumphs and our failures. This evolution inspires us and is at the heart of EVERGOODS.”

Being gear junkies and product focused ourselves, we found their product brief to be interesting and useful to more than equipment and apparel companies. While it may not translate directly to every industry, their brief is a great tool to help product-focused founders understand why and how they are building certain products and features.

Check out the product brief memo from EVERGOODS here.

Each template above serves a different purpose. While each template may be entirely different they all have one thing in common: clear and concise communication. Setting up a system to properly share strategy and rationale in a concise way will not only strengthen relationships but keep all of your key stakeholders aligned.

Do you have a memo or strategic doc that you share with your stakeholders? We’d love to check it out. Shoot us a message to marketing at visible dot com.

founders

Reporting

Webinar Recap: Alternatives to Venture Capital with Tyler Tringas of Earnest Capital

We recently hosted a webinar with Tyler Tringas, General Partner at Earnest Capital, covering alternative financing options available to startups. During the webinar Mike, our CEO, and Tyler covered the current state of venture and SaaS markets, all things Earnest Capital, and SEALs. In case you missed it, check out the recording and our favorite takeaways below.

Financial –> Production Capital

One of the driving forces behind the Earnest Capital Investment Memo is the notion that software is entering the deployment age (read more about the deployment age in the investment memo here). In short, Tyler explains the deployment age as a time when products, software in this instance, can and should be distributed to every corner of the economy. This creates a new software category where niche and sustainable business can succeed as opposed to the winner take all software companies we’ve seen in the past.

Generally speaking, venture capital has been the default funding option for software companies but as we enter the deployment age there will be a need for a new form of funding. As a result, the type of capital companies need is shifting from financial capital to production capital (Enter: Earnest Capital).

The Peace Dividend of SaaS Wars

Another key driver to Earnest Capital Investment Memo is the idea of “The Peace Dividend of SaaS Wars.” The idea is that when countries are at war they will throw money to escalate and create new technologies. An example Tyler gives is the development of synthetic rubber during WWII. After the war, synthetic rubber could be applied to consumer goods.

So how does this relate to SaaS? Investors and early leaders are throwing money to create new technologies in the winner take all SaaS markets. As a result, it is less capital intensive than ever before to start a new business. Tyler mentions that software companies can be started on a free Heroku plan where in the past you’d need to buy your own servers and space. In turn, this helps companies attack markets with a smaller total addressable market and may not be a fit for venture capital.

The New American Dream

Entrepreneurship is in decline in the US. Tyler believes that one major component of the decline is because, “the major area for new entrepreneurship, software and software-enabled businesses, has no default form of aligned funding.” In the past (think 1970s or 80s), an entrepreneur may have had experience or been highly qualified in a field, went to the bank for funding, and likely built physical locations. But with no physical collateral for a software company, who is supplying the funding to grow these companies? Another sign of a need for a new form of financing.

Tyler argues that, “building, owning (and possibly someday selling) a profitable remote software business is the new American Dream.” Entrepreneurs can employ 15-20 people, distribute their profits amongst employees, and still create huge economic impacts for themselves and those involved with the business.

Shared Earnings Agreement

Tyler discovered that the traditional financing options for early stage investors (SAFEs, convertible notes) are not aligned with “Earnest” founders so they create a new financial product: Shared Earnings Agreement. Tyler discusses why they created the SEAL in the webinar and dives into a few of the key components. If interested in learning more about SEALs, we suggest checking out this post.

Send Updates to Potential Investors

Tyler briefly touches on the importance of sending investor updates. Tyler mentioned that he has seen investor updates as the best tactic they have seen in use to help companies fundraise. If Earnest speaks with a company they are interested in but are not quite ready to invest, they’ll ask to be sent updates about the business. From here, Earnest can be in the loop and ready to make an investment as soon as possible.

Check out the Founder Summit

Earnest Capital is hosting a summit for founders and startup leaders in Mexico City in March. The summit is intended to allow founders to meet and network as oppose to another conference full of presentations. If you’re a founder and interested in learning more about the summit, check it out here.

Q&A

Mike and Tyler tried their best to answer all of the questions at the end of the webinar. For the questions they did not get to, you can check out Tyler’s answers inline below:

Q: I assume that at least some incumbents/market leaders will try to meet growth expectations by appealing and selling to niche audiences. How much weight does this threat carry in your investment decisions? If it’s not a threat, why not?

A: Competition from large incumbents is definitely not something we outright ignore, it’s just that we try to dramatically lessen the risk by backing founders tackling markets that just wouldn’t move the needle for a $10B or 100B+ firm even they came in and took 100% of the market. That said it certainly can still happen. I don’t think we have a special sauce for that scenario other than to encourage founders to lean in to their startup competitive advantages. One thing we do is encourage founders to not try to make themselves seem bigger than they are (don’t use the “Royal We” if it’s actually just You). It’s surprising how much some customers really want to support an independent small brand. The Basecamp folks are putting on a masterclass on how to counterpunch on BigCos like Google with this

Q: How does Earnest protect itself from a business defaulting on quarterly shared earnings payments?

A: Pretty much the only “investor right” we ask for in our investment docs are the right to inspect the books. Many founders just go ahead and give us access to their Quickbooks. Which is how we would address some kind of fraud or misrepresentation of Founder Earnings. At another level it’s quite hard to accidentally “default” in the sense of being unable to make a payment, since the Shared Earnings are always a % of Founder Earnings, the business should have generated the cash to make the payment (in contrast to debt where a payment is due whether you have the profits to pay for it or not). Lastly if a company has the Founder Earnings but just refuses to pay, we are somewhat protected by the fact that a) the company is obviously doing well and therefore is valuable and b) not making Shared Earnings payments keeps our implied % of a sale higher, so the founder is kinda shooting themselves in the foot if they ever intend to sell the business, we’ll likely get more money from the higher % of the sale than they would have paid out in Shared Earnings along the way. All about aligning incentives!

Q: The required “hit rate” for a SEAL portfolio to work is really high (given the capped return + long time horizon): How do you think about this question? Do you have a target % of startups that must “survive” to get a return?

A: It is higher than you would see in a traditional seed VC portfolio, but our theory is that the failure rate is not a law of startup physics but rather the whole venture strategy ratchets up both a) the chance of being a unicorn and b) the chance of failure. We don’t know what the typical failure rate is for a basket of highly filtered and selected, post-revenue bootstrapped businesses, but our basic bet is it’s much much higher than is typical in venture. I go into this in some detail here.

Q: For your portfolio companies, to what extent do they also have other investors beyond the founding bootstrappers? What is your range of size of investment and also the range of time horizon to large-scale recurring revenue?

A: We have done a mix of being the first/only investor in a company, leading a round where several angel investors co-invest with us, and a few deals where we co-invested with other investors (least likely for us, but does happen). We’re open to anything but have a slight preference to be the first/only just because it’s so much easier to close (can be as fast as 2 weeks). As of this moment, we invest $50k-$250k which may increase over time. As a fund, ideally we would love to see business mature and get to real profitability in 7-10 years but we are early-stage, long-term investors and understand that timeline is out of our control.

Q: Tyler mentioned a mix of outside capital and sweat equity, however Earnest and other micro-VCs only seem to want to invest in products that are built and have traction. How do I get help building an MVP? I’m a technical founder so I can write code, but trying to do everything myself is taking forever.

A: Yea, I have to concede that one of the main advantages the venture model has over ours (similar funding for bootstrappers ideas) is that pre-seed VCs have a model where they can invest at the “idea stage”… because we are not unicorn hunting, we also can’t take the very high risk of investing pre-product pre-launch. One of the main effects of the Peace Dividend that I talk about is that it’s now pretty reasonable to bootstrap, as a side project, a real product to real revenue from real customers. So as an investor, I (and many others) now really have to wait until that stage because so many entrepreneurs are getting there without funding. Some good resources would be some of my Micro-SaaS blog posts (microsaas.co), Indiehackers.com, and Makerpad (makerpad.co) for tips on building an MVP for business ideas without writing a ton of code.

founders

Reporting

Community Templates: Malomo’s Weekly Investor Update

Our Community Templates are a collection of Update Templates created by our customers, partners, and friends. If you’d interested in showcasing your Update Template send a message to marketing@visible.vc

Community Spotlight

Company Name — Malomo

Description —Malomo is a seed-stage, SaaS company based in Indianapolis, IN providing shipment tracking software for ecommerce brands

Stage — Seed

Capital Raised — $600k

Market/Business Model — SaaS, E-Commerce

The Investor Update Template

If you’re a seed stage, SaaS founder this is a great template to get you started. Yaw, the CEO and Founder, of Malomo shares the Update below on a weekly basis followed by a longer form Update on a monthly basis. For a seed or earlier stage company a weekly investor Update can be a valuable resource for your company.

A weekly Update gives you an added opportunity to leverage your investors and use their experience, network, and knowledge to help with early company decisions. Talk to your investors and see if they’d be interested in a more frequent Update. You may not need to send a weekly investor update to your entire investor list. If you have investors that are not as hands on or close to the business it may be best to only share a monthly or quarterly Update with them.

You can view and use the Template below:

Thanks to Yaw for taking the time to share his template. If you’re a founder, investor, or company operator and would like to share your Update Templates send us a message to marketing@visible.vc

Unlock Your Investor Relationships. Try Visible for Free for 14 Days.

Start Your Free Trial