Blog

Fundraising

Resources related to raising capital from investors for startups and VC firms.

All

Fundraising Metrics and data Product Updates Operations Hiring & Talent Reporting Customer Stories

founders

Fundraising

What are the Advantages of Angel Investors?

Raise capital, update investors and engage your team from a single platform. Try Visible free for 14 days.

What are the advantages of angel investors?

When trying to get investors to fund your company, you should know that funding comes in a variety of flavors. You will have access to different types of investors depending on your industry, company stage, and size. A common question we receive when talking with new founders is about the difference between varying types of investors. In this post, we’ll explain the the differences between angel investors and venture capitalists and the advantages of angel investors.

Angel investors and venture capitalists have many things in common. In principle, VC’s and angels perform like functions – they invest in your company in exchange for a percentage of ownership. The amount of money they give and the total number of shares they take is dependent on their valuation of your company. To better understand the advantages of angel investors and VCs, we need to take a look at the differences between angels and VCs.

Angel Investors vs. Venture Capitalists

VC funds are often organized under the limited partnership (LP) model. They raise large sums of money from institutions – such as pension funds, endowments, and family offices, then invest that money in exchange for a share of the return & management fees (see this excellent article by Elizabeth Yin for a deeper explanation on how VC’s make money).This gives them incredible leverage and financing power, but often leaves them under the watchful eye of LP’s who want a return on schedule.

Angel investors usually operate under a different model. Most tend to be high net worth individuals, and in many cases have built and exited a company themselves. They need to be accredited investors who can stomach the inherent risks involved with early stage startups.

Because angel investors tend to have smaller sums to invest than VC funds, you’ll often find them in Pre Seed and Seed rounds. VC’s tend to participate across all rounds, but typically only they can afford to play the game in Series B and beyond, as the shear amount of money required tends to be out of the range of most angels.

How Angels and VCs Can Help

Angel investors can often play a role in providing crucial company building guidance in the early days. Because they tend to arrive on the scene early, they stand to make a massive return if your company succeeds. VC’s can be equally helpful, and they’ll sometimes place a member of their fund on your board who can assist in guiding the direction of your company. And, if you’re successful after raising funding from them, they’ll often provide and help orchestrate follow on investments as you continue to grow.

While you can benefit from raising from both angels and VC’s, it’s important that you be careful and seek to partner with investors who are high integrity. Some VC’s are known for asking CEO’s to step down the moment that things don’t go well, while angels can try to become too involved in the operation. There’s an apocryphal quote about the average founder / investor relationship being longer than the average marriage – we recommend keeping that in mind when doing diligence on your angel investors and venture capitalists.

Advantages of Angel Investors

While you can benefit from raising from both angels and VC’s, it’s important that you be careful and seek to partner with investors who are high integrity. Some VC’s are known for asking CEO’s to step down the moment that things don’t go well, while angels can try to become too involved in the operation. There’s an apocryphal quote about the average founder / investor relationship being longer than the average marriage – we recommend keeping that in mind when doing diligence on your angel investors and venture capitalists.

What Kind of Money Do You Want?

Not all investments are created equally. Do you want an investor that will write you a check and leave you alone? Are you interested in ‘smart money’ that will help you build your company? Do you want mentorship in exchange for a board or advisory seat? No one can answer these questions for you, but it’s important to keep it them mind when evaluating the pros & cons of angel investors vs venture capitalists. Fundraising is one of the hardest jobs in the world – you should try to make it worth it.

To learn more about fundraising, subscribe to our weekly newsletter here.

founders

Fundraising

Pitch Deck 101: The Go-to-Market and Customer Acquisition Slide

Over the last few months we’ve directly helped a few of our customers with their venture fundraise. One of the questions that continues to come up is, “how should I display my sales and marketing plan in my pitch deck?”

In order to best help our customers, we’ve set out to research and find out how to best display go-to-market strategies.

Your Business Model

Your business model often goes hand-in-hand with your go-to-market and customer acquisition strategy. At the end of the day, an investor needs to make a return on their investment. In order to do so, investors need to clearly understand how your company will make revenue.

In the Guy Kawasaki pitch deck template, Guy suggests sharing your business model in slide 5 and following that with your marketing and customer acquisition plan in slide 6.

Assuming you have a solid understanding of your business model, you’ll need to clearly articulate how you will acquire new customers and retain existing customers.

Your Go-to-Market Strategy

Being able to show a repeatable and efficient process for acquiring new customers is a must. Investors want to make sure that they will not be throwing their money down the drain. Going into a pitch with potential investors you need to understand your go-to-market strategy like the back of your hand.

Make sure your GTM strategy slide is easily digestible and can be easily understood without added context.

Still developing your GTM strategy? Check out how Nick Loui, CEO and Founder of PeakMetrics, found their first customers below:

Customer Acquisition Costs & Strategy

One of the key metrics that investors will want to understand is your costs to acquire a new customer. (Learn more about CAC here).

It is important to demonstrate to your investors that your customer acquisition costs are less than your customer lifetime value. This will help showcase your path to profitability.

Ablorde Ashigbi is the Founder and CEO of 4Degrees. Earlier this year, Ablorde wrapped up a round of financing for 4Degrees. We went ahead and asked Ablorde what tips he has for founders looking to showcase their CAC in a pitch deck. His response:

Don’t present CAC without a corresponding view of LTV

Don’t present a blended CAC (including both organic and paid – only include conversions that came from paid channels)

For earlier stage companies, payback period equally (maybe more) important than pure LTV / CAC

When it comes to presenting your GTM strategy and customer acquisition costs it all comes down to simplicity. An investor should be able to take a look at your slide and know exactly how your business functions.

Under the current circumstances and in the wake of larger companies failing to find profitability, a financially responsible customer acquisition strategy is more important than ever. If you have your own tips for presenting your GTM and customer acquisition strategy, we’d love to hear it. Shoot a message to marketing at visible dot vc.

Related Resource: Customer Acquisition Cost: A Critical Metrics for Founders

founders

Fundraising

Reporting

6 Components of a VC Startup Term Sheet (Template Included)

Term sheets can be intimidating as a first-time founder. As it is likely the first time you’ve seen a term sheet, the intricacies of the deal can be difficult to understand. You can spend hours trying to understand a term sheet and what exactly makes up a “good” term sheet. As the team at YC writes, “we’ve noticed a common problem: founders don’t know what “good” looks like in a term sheet.”

If you’re looking for a breakdown of a term sheet specific to Series A, check out our blog post, “Navigating Your Series A Term Sheet.”

In order to help founders best understand their term sheets, many firms and individuals have come up with their own term sheet templates. In fact, many investors and founders now use a 1-page term sheet template. Check out our breakdown of term sheet components with a few templates below.

As a note, this is not legal advice and we suggest consulting with your lawyer while reviewing your term sheet.

Related Resource: How to Choose the Right Law Firm for Your Startup

VC Fundraising Timeline

As we often write about at Visible, we believe a startup fundraise shares a lot of characteristics of a B2B sales funnel. In the most simple breakdown — at the top of the funnel you are bringing in new investors, in the middle you are nurturing them through investor updates and meetings, and at the bottom, you are signing term sheets and building relationships with new investors.

Kicking off a VC Fundraise

Once you have formed your company and launched/are preparing to launch a product you may decide to pursue venture fundraising (to learn more about determining if VC funding is right for you, check out this post). Before kicking off a fundraise, especially at seed stages and later, you likely have some form of product-market fit.

Finding Investors

If you’ve decided VC funding is right for your business. You’ll need to start finding investors to “fill the top of your funnel.” Check out Visible Connect, our free investor database, to filter and find the right investors for your business. If you’re earlier in your company lifecycle and want to find angel investors, check out this post.

Pitching Investors

Once you start reaching out to investors (via cold email or warm intros) you’ll begin a series of meetings and pitches with the hopes of moving them down the funnel. Check out our template and guide for pitch decks here.

Related Reading: How to Write the Perfect Investment Memo

Due Diligence and Final Steps

If an investor is interested in moving forward, you will likely begin due diligence where they will audit your data, get feedback from customers and investors, and confirm their conviction in your company. If they decide to move forward, next comes a term sheet.

Term Sheet

At the end of a fundraise comes the term sheet. Assuming both parties are happy with the terms, you’ll be able to onboard your new investor.

6 Components of A VC Term Sheet

Liquidation Preferences

Liquidation preference is simply the order in which stakeholders are paid out in case of a company liquidation (e.g. company sale). Liquidation preference is important to your investors because it gives some security (well, as much security as there is at the Series A) to the risk of their investment. If you see more than 1x, which means the investor would get back more than they first invested, that should raise a red flag.

To learn more about liquidation preferences check out this article, “Liquidation Preference: Everything You Need to Know.”

Dividends

In the eyes of an early-stage investor, dividends are not a main point of focus. As Brad Feld puts it, “For early-stage investments, dividends generally do not provide “venture returns” – they are simply modest juice in a deal.” Dividends will typically be from 5-15% depending on the investor. Series A investors are looking to generate huge returns so a mere 5-15% on an investment is simply a little added “juice.”

There are 2 types of dividends; cumulative and non-cumulative. YC warns against cumulative dividends; “the investor compounds its liquidation preference every year by X%, which increases the economic hurdle that has to be cleared before founders and employees see any value.”

Conversion to Common Stock

Common practice will automatically convert preferred stock into common stock in the case of an IPO or acquisition. Generally, Series A investors will have the right to convert their preferred stock to common stock at any time. As Brad Feld puts it, “This allows the buyer of preferred stock to convert to common stock should he determine on a liquidation that he is better off getting paid on a pro-rata common basis rather than accepting the liquidation preference and participating amount.”

Voting Rights

On a Series A term sheet, the voting rights simply states the voting rights of the investor. Generally, your Series A investors will likely receive the same number of votes as the number of common shares they could convert to at any given time. In the Y Combinator example, as with most term sheets, this section can include some technical jargon that is not easy to understand.

The most important vetoes that a Series A investor usually receives are the veto of financing and the veto of a sale of the company.

Board Structure

One of the more important sections when navigating your Series A term sheet is the board structure. Ultimately, the board structure designates who has control of the board and the company. How your Series A investors want to structure the board should be a sign of how they perceive you and your company.

The most “founder-friendly” structure is 2-1. A scenario in which 2 seats are given to the common majority (e.g. the founders who control a majority of the common stock) and 1 given to the investors. This allows founders to maintain control of their company.

On the flip side, there is a 2-2-1 structure (2 founders, 2 investors, 1 outside member). In this scenario, it is possible for the founders to lose control of the company. While a common structure, be sure that the board structure is in line with conversations while fundraising. As Jason Kwon of YC puts it, “So when an investor says that they’re committed to partnering with you for the long-term – or that they’re betting everything on you – but then tells you something else with the terms that they insist on, believe the terms.”

Drag Along

As defined by the Morgan Lewis law firm, “Drag along is the right to obligate other stockholders to sell their securities along with securities sold by the investor.” Drag along rights give investors confidence that founders and the common majority will not block the sale of a company. While there is no way around drag-along rights, some people will suggest that founders negotiate for a higher “trigger point” (e.g. ⅔ votes as opposed to 51%).

You can learn more about drag along clauses in this post, Demystifying the VC term sheet: Drag-along provisions.

VC Term Sheet Examples

The Y Combinator Term Sheet Template

With thousands of investments under their belt, Y combinator is always a great place to start when looking for startup best practices. The team at YC put together an awesome 1 page term sheet template (with a focus on Series A) that any founder can use. While your actual term sheet may look different the Y Combinator Term Sheet template is a great place to get familiar with the subject.

YC does a great job of breaking down the different components and laying out terms and language that founders should keep their eye out for. Check out their term sheet template here.

Buffer Series A Term Sheet

The team at Buffer raised a $3.5M Series A back in 2014. Check out the signed term sheet and the terms from their raise here.

VC Term Sheet Templates

As term sheets are a necessary part of any fundraise there are hundreds of templates and examples to choose from by the investors, founders, and lawyers that have been there before. Check out a few popular templates below:

The One Page Term Sheet Template from Ben Milne

Ben Milne, Founder of Dwolla, has spent his fair share of time navigating term sheets. Ben is a Midwest founder and has seen the amount of time midwest founders and investors waste negotiating term sheets. As he put it, “Midwest investors and founders lose a lot of time trying to figure out the term sheet. Sometimes, they lose even more time deciding what the terms should be.”

In order to help bring some guidance to both startups and investors, Ben put together a one-page term sheet template. You can check out the template below:

You can check out the one-page term sheet template from Ben Milne in this blog post.

The NVCA Term Sheet Template

The National Venture Capital Association recently released their latest version of their term sheet template. As the team put at NVCA wrote, “The Enhanced Model Term Sheet allows an investor to draft term sheets while comparing terms against market benchmarks. Version 2.0 is powered by a database that now includes more than 100,000 venture transactions, representing over 40,000 investors with a combined network of over $1 trillion in assets under management.”

Check it out and download the template here.

Let Visible Help

We are here to help with any fundraise. Use our free investor database, Visible Connect, to kick off a raise. From here, use our fundraising CRM as you move investors through your funnel and sign a term sheet. Start your free trial here.

founders

Fundraising

Fundraising Levers — Managing the Supply & Demand of Your Startup’s Fundraise

Elizabeth Yin is the Founder and General Partner at Hustle Fund (and one of our favorite follows on Twitter). A few weeks back she Tweeted that fundraising is all about managing the supply and demand. As she put it, “Supply of your round. Demand from investors.” (To pick Elizabeth’s brain on the matter, we hosted a webinar with her last week. Check out the recording here.)

Before I dive into what this is, let’s take a step back. Fundraising is all about supply and demand.

Supply of your round. Demand from investors.

It’s hard to control demand from investors. But you can constrain the supply in your round to get it done.

— Elizabeth Yin (@dunkhippo33) May 29, 2020

Rewind to your Economics 101 course and you’ll remember the supply and demand curve all too well. To jog your memory, “The price and quantity of goods and services in the marketplace are largely determined by consumer demand and the amount that suppliers are willing to supply. Demand and supply can be plotted as curves, and the two curves meet at the equilibrium price and quantity.”

So what does this have to do with startup fundraising? Well, a lot actually.

Managing the Demand from Investors

Managing the demand for your round from investors can be difficult. If you don’t have the combination or product, market, or team that an investor is looking for, drumming up demand might be difficult. However, there are a few levers you can pull to generate demand and encourage investors to move faster.

If you look at your startup through the eyes of the investor, most of the time it is not beneficial for them to make an investment now. They will only benefit from waiting to see more data to make a more informed decision on your investment in 6 months. As Elizabeth explains, “It is your job as a founder to build impetus for investors to move now.” You want them to feel like the deal won’t be on the table in 6 months.

The best way to do this is to generate demand from a large group of investors. This means that you are running a strong process and talking to as many investors as possible to drum up demand. This will create a fear of missing out for investors as you continue to push forward with meetings and new investors. As Elizabeth Yin puts it, “you want investors to be afraid of each other.”

Constraining the Supply of Your Round

When it comes to raising a smaller round drumming up demand almost feels impossible. At earlier stages, you likely lack a product or strong traction metrics that forces investors to move fast. Additionally, you’ll likely be talking to smaller investors and cashing smaller checks that don’t create the urgency for larger firms to jump in before the round is closed.

Tranche Strategy

One way Elizabeth Yin suggests to constrain the supply of your round is by using a tranche strategy. “As an example, Elizabeth uses a seed company going out to raise $2M total. This company may go out and raise a smaller tranche to create some demand from investors to move quickly. For example, if the smaller tranche is $500k investors may have a fear they will miss out as it is a smaller size round that is easier to raise. From here, it is a lot easier to go to larger investors as you can create some urgency around the round as you’ve already raised $500k.”

Ask around and see what your founder and investor think about trying a tranche strategy. While some investors may not agree with a tranche strategy it is up to you as a founder to make the decision that is best for your business. Tranches can certainly be a powerful way to manage the supply and demand of your round.

Take on Your Investors in Sets

Another strategy to constrain supply and build demand is by taking on your investor meetings in sets. As the team at First Round Review puts it, “There’s nothing worse than the perception of an over-shopped deal, as VCs relish having the inside scoop on an exciting company. Group investors in batches to better evaluate and select them, like a surfer scanning sets of waves that move toward the shore.”

Regardless of how you look at it, fundraising essentially turns into a founders full time job. By accepting this, you’ll be able to stack your meetings for a full schedule. This will allow you to talk to new investors regularly and build a strong process. As you continue to escalate conversations with different investors, this will also create a sense or urgency that the deal is moving forward and now is the time to get in on the terms.

Fundraising is hard in good times and challenging times. By building a process and understanding what levers you can pull you will only increase your odds of a good raise.

Raise capital, update investors and engage your team from a single platform. Try Visible free for 14 days.

founders

Fundraising

7 Fundraising Takeaways From Our Webinar with Elizabeth Yin

Last week, we had the opportunity to talk to Elizabeth Yin of Hustle Fund. Elizabeth Yin is a co-founder and General Partner at Hustle Fund, a pre-seed fund for software entrepreneurs. Previously, Elizabeth was a partner at 500 Startups where she invested in seed stage companies and ran the Mountain View accelerator. In a prior life, Elizabeth co-founded and ran an adtech company called LaunchBit.

Our CEO, Mike, and Elizabeth chatted about all things related to fundraising. Elizabeth shared what she has seen in the VC market over the past few months and how founders can manage the supply and demand of their round. Check out the video recording or our favorite takeaways below:

Now is Actually a Good Time to Raise

Fundraising in good times and bad times is challenging. Fundraising over the past few months could almost feel impossible. Elizabeth saw her portfolio companies attempt to raise in early April and most struggled as larger firms slowed investment at the start of COVID. However, investors, both large and small, are quite active again. With US states beginning to open and more investors comfortable with making remote decisions investment activity has been picking up pace. With the uncertainty of a future lockdown in the US it may also be a good idea to raise now.

As Elizabeth puts it, “now is actually a good time to raise, especially from local investors.” In fact, Hustle Fund has even increased investment over the past 2 months.

Bifurcation of Terms

As Elizabeth puts it, “terms have been weird.” Elizabeth has been seeing a bifurcation of terms over the last few months. On one side, you have well networked founders raising at very high valuations similar to 2019. On the flip side, you have less networked founders raising at quite low valuations.

Why Invest Now?

When going out to raise it is important to understand how investors think to improve your odds of success. One of the first questions an investor will ask themselves is, “Why should I invest now?” However, most of the time “now” is not a great time for investors to make an investment. Generally, it is most beneficial for an investor to drag their feet as they can get more information and data.

So how do you make investors move faster? You need to make an investor feel like they cannot wait 6 months because the valuation will change and the deal won’t be on the table. As Elizabeth said, “your job is to generate demand on your deal from other investors… you want investors to basically be afraid of each other.” You can do this by running a strong process and talking to a LOT of investors.

Tranches Can Be Useful

When going out to raise a seed round it is difficult to get people to move faster on the deal. You have a large supply of your raise with little demand. At the earliest stages, investors rarely feel motivated to move quickly as the deal may still be on the table in 6 months. To help with this, Elizabeth suggests reducing the “supply of your round” using tranches.

As an example, Elizabeth uses a seed company going out to raise $2M total. This company may go out and raise a smaller tranche to create some demand from investors to move quickly. For example, if the smaller tranche is $500k investors may have a fear they will miss out as it is a smaller size round that is easier to raise. From here, it is a lot easier to go to larger investors as you can create some urgency around the round as you’ve already raised $500k.

While Elizabeth may be a black swan when it comes to her thoughts on tranches, it can certainly be a powerful way to manage the supply and demand of your round.

Customer Discovery… with Investors

If you are struggling to drum up any interest from investors you likely need to improve different aspects of the business. Feedback from investors can be a valuable asset for prioritizing your time. Elizabeth suggests harnessing customer development strategies when it comes to investors. While you may not hear back from most investors, getting feedback and data points from investors that rejected your company can be incredibly valuable. If you start to see a theme in why investors said no, that is a good indicator of where you need to improve your business.

Founders Should Fundraise Full Time

Elizabeth suggests that her founders do fundraising full time (when they set out to raise). This means that you are not working directly on the business. In a good raise, it can take anywhere from a few weeks to a few months to close your round. Juggling this and making sure the needle still moves without you there is challenging. Elizabeth promotes stacking your meetings so you may have 20+ meetings in a week as opposed to a handful. In the beginning, this is a great way to create urgency with investors. If you are taking second meetings and have a docket full of investor meetings, investors may feel the heat and move quicker.

Interested in joining our next webinar? Subscribe to the Founders Forward to stay up-to-date with our upcoming webinars.

founders

Fundraising

Fundraising in Today's Environment With Elizabeth Yin

Fundraising is hard. Fundraising in the current environment can almost feel impossible. Being able to bring capital in to grow your business is a skill that all founders should hone.

In this webinar you’ll learn:

How the state of the venture capital has changed over the last 6 months

How fundraising has changed over the last 6 months

How to create supply and demand while fundraising

How VCs think and work so you can better your odds of raising

founders

Fundraising

The Guy Kawasaki Pitch Deck

Are you building your first pitch deck? The Guy Kawasaki pitch deck is a great place to start. It is not easy getting started on a pitch deck for you startup.A great pitch deck is concise, but thorough, informative, but not boring, simply designed, but with personality. Although you have a wealth of knowledge on your startup and market it is often intimidating trying to get everything you want to say in just a few slides. Enter: the Guy Kawasaki Pitch Deck Template.

Who is Guy Kawasaki?

Guy Kawasaki is a marketing specialist. He worked for Apple in the 1980s and is responsible for marketing the original Macintosh computer line in 1984. Guy is infamous for coining the term evangelist in marketing. He might be most famous for his simple pitch deck template and the 10/20/20 rule of Powerpoint and pitch decks.

What is the 10/20/30 Rule of PowerPoint?

What is the 10/20/30 rule of PowerPoint. The 10/20/30 rule is a presentation rule coined by Guy Kawasaki. As he wrote, “It’s quite simple: a PowerPoint presentation should have ten slides, last no more than twenty minutes, and contain no font smaller than thirty points.” The 10/20/30 rule is a great place to start when you are evaluating what should be in your pitch.

By only allowing for 10 slides you’re required to have a hyper-focus on what truly matters to your business. Of course, every business is different. Some may require more than 10 slides and some may even require less. However, start with the 10/20/30 rule and see what you need to add or subtract from there. Before even getting too deep in the weeds by laying out your 10 slides you’ll have a skeleton of what your presentation will look like.

The Guy Kawasaki Pitch Deck

To go along with the 10/20/30 Rule, Guy also has a pitch deck template that he uses for lay out the 10 slides for a pitch. It looks something like this (originally from our pitch deck guide):

Pitch Deck Slide 1

The first pitch deck slide of your business pitch is straightforward. A simple slide that shares your company name and contact info. Use this slide to set the stage for your pitch deck design.

Pitch Deck Slide 2

The second pitch deck slide consist of what problem you are solving. This can take form in what the opportunity is or what the pain your potential customers are feeling.

Pitch Deck Slide 3

The third pitch deck slide should explain the value proposition that you are offering. This explains the direct value that your customers receive when choosing your product or solution. This is where your business pitch template will come in handy as your describe your value.

Pitch Deck Slide 4

The fourth pitch deck slide explains what differentiates your solution than others in the market. Guy Kawasaki suggests using a visual pitch deck design here by using images, charts, and diagrams of your “secret sauce.”

Pitch Deck Slide 5

The fifth pitch deck slide should contain your business model. This shows how you are, or plan, to make money. Another slide where knowing your business pitch will be vital.

Pitch Deck Slide 6

The sixth slide should contain your plan for acquiring customers. This slide will share how you can effectively find new customers and the costs associated.

Pitch Deck Slide 7

The seventh pitch deck slide should show what the market looks like. This includes your competitor landscape. Guy suggests that “the more the better” for this slide.

Pitch Deck Slide 8

The eighth pitch deck slide should be a highlight of your management team. Include a brief profile of your company’s managers and any other associated stakeholders. This can include your investors, board members, and advisors.

Pitch Deck Slide 9

The ninth pitch deck slide should contain your financial projections and key metrics. The key to building a business is generating revenue and having a financial plan to effectively scale and grow. Use a top-down, not bottoms-up, projection to wow your investors. A visual pitch deck design will also help here by using charts to make your projections easy-to-understand.

Pitch Deck Slide 10

The last pitch deck slide should be an overall timeline of your business. Where have you been in the past? What are the major accomplishments you’ve achieved so far? Where is your business headed and will the person you are pitching fit into this timeline?

While every business differs, the Guy Kawasaki pitch deck template is a great place to start. Lay out your pitch using his style and see what you think. From here you can tailor it to your businesses’ needs. Once you’ve got your pitch deck in place, it is time to kick off your fundraise. Check out our guide on fundraising to make sure you’re making the most of your fresh pitch deck.

founders

Fundraising

Reporting

Dr. Dan — The Burdensome Investor

Raising capital is hard. Raising capital during a pandemic can feel impossible. As we discussed with Lolita Taub in our webinar last week, more founders are looking for alternatives to venture capital.

Founders are looking to solutions like Pipe, Earnest Capital, ClearBanc, Angels, Friends & Family, among others. Raising from angels and friends/family came into focus during our webinar with Lolita. Note: Check out our “How to Find Angel Investors” guide if you’re searching for angels for your business.

Friends and family often make for an easier fundraising process. Less stringent due diligence combined with less pitching can make friends and family be an attractive option. However, a friend or family member could be less startup savvy than a traditional VC and can become a burden to you and your business.

Internally we call the burdensome investor, “Dr. Dan.” Maybe a family member or friend invested in your business but calls every week for status updates or to ask questions about a metric, etc. With the investor + founder relationships (8-10 years) lasting longer than the average U.S. marriage it is important that you are taking on investors that you can build a relationship with. So how do you approach a potential “Dr.Dan?”

Set Expectations Early

As we previously mentioned, a friend/family or angel investor may not be as startup sophisticated as your traditional VC. Sometimes an inexperienced investors’ expectations may be wildly different from reality. It is your job as a founder to make sure a potential angel investors expectations and reality are aligned.

Before you cash a check, make sure that these investors are aware of the realities of investing in a startup. Make it clear how and when they will hear from you, what the possible outcomes are, and where their capital will be going. Even though someone is an “accredited investor” they are investing their own money and it could be a considerable chunk of their savings.

Explore Other Options

If you’re talking to a potential “Dr. Dan” you may need to weigh other funding options. As we mentioned at the beginning of the post there are quite a few alternatives for raising capital. While the most ideal is using customer revenue to fuel growth, that is generally not an option for most startups — especially early stage.

There are countless alternatives and more popping up every day. You can check out a few of our favorite alternatives here.

Trust Your Gut

As Lolita Taub put it in our webinar, “You just have to hustle and do what you need to do for your business.” At the end of the day, only you know what the right decision is for your business. If you’re in dire need of capital, it may be worth the burden of bringing on a “Dr. Dan.” If you’re in a good spot financially, it may be time to re-evaluate and take your time to explore other funding options.

There are countless pros of bringing on a new investor — capital, new networks, fresh eyes, etc. On the flipside, an angel or family/friend investor can quickly become burdensome if they are inexperienced or unsure of what to expect from you. Remember bringing on a new investor means bringing on a new business partner for the foreseeable future — only you know what the right decision is for your business.

Already have angel investors? Send them a quick Update to let them know how your business is doing.

founders

Fundraising

The First-Time Founder's Guide to Fundraising With Lolita Taub

Fundraising is hard. Fundraising in the current environment as a first-time founder can feel impossible. Being able to bring capital in to grow your business is vital during these trying times.

In this webinar, you’ll learn:

How will COVID-19 impact the fundraising environment

How to split focus between fundraising and cash efficiency

How to conduct pre-fundraising research

How to build relationships with potential investors

How to manage and track my fundraise

How to raise as an underestimated founder

founders

Fundraising

Operations

Mike's Note — It is easier to change your preferred airline than it is your cap table

Seth Godin wrote “beware of experience asymmetry.” Reading his post, I thought about the time I got my first mortgage. I remember thinking, Am I getting a good rate? How much house should I buy versus how much house can I buy? It was stressful. I felt vulnerable. The internet and publicly available data helped me call around and shop rates. (I still would have paid handsome money for a local guide.)

Seth calls out venture capital in his post. This is an important place to get a local guide. In my opinion, the best local guide is another venture firm. This may sound counterintuitive, let me explain. If you’re looking to make a deal, having more than one venture firm in the mix will help you get a truer understanding of your market value and secure the fairest terms.

If you have more than one venture firm looking at your business, congrats. You are in rare air. Most are lucky to even get one interested. In those less-competitive cases, it’s still important to find a local guide. It could be a fellow founder, angel investor, trusted advisor, or a blog post from 2012.

Regardless of your path, always surround yourself with local guides for the various stages of your business. When fundraising, run a process with multiple firms and always do your homework on potential investors. Call up the companies in their portfolio that weren’t home runs. You will learn a lot.

It is hard to turn down money but sometimes you might want to because it is much easier to change your preferred airline than it is your cap table.

founders

Fundraising

Operations

Investor NPS: How likely are you to refer your current lead investor to fellow founders?

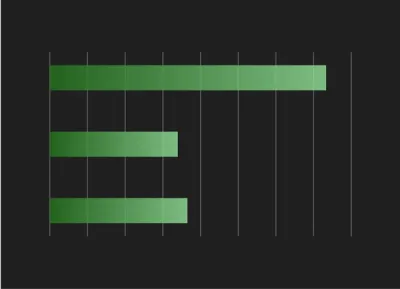

Last week, our CEO surveyed founders asking them, “How likely are you to refer your current lead investor(s) to fellow founders?” in his weekly note.

The results from the survey are below:

The Investor NPS

An NPS score of 23 falls below the average for the airline industry. Not a great industry to be compared to in terms of customer satisfaction scores.

Granted, there can be quite a bit of bias when surveying a founder asking their opinion of an investor (e.g. passed on a round). Nonetheless, founders are clearly looking for more out of their investors.

Once a check is cashed, there is no turning back. With the average length of a founder + investor longer than the average marriage in the U.S. (8-10 years) it is important for both founders and investors to strive for a strong relationship. Founders will get out of their investor relations what they put into it. At the end of the day, the investor and founder relationship comes down to communication, starting from the first fundraising meeting to company exit.

Before a fundraise, a founder should have a set of expectations from their investors outside of capital. It is the duty of the founder to communicate and gauge this during conversations and pitches. Easier said than done. Determining what investors to talk to, how to talk to them, and what to expect from them is a difficult process for founders.

Fundraising is an Asymmetric Experience

Fundraising is an asymmetric experience. Investors see hundreds of deals a year where founders may only talk to a handful of investors in a year. Investors are strapped with an abundance of data used during the decision-making process. As Seth Godin writes,

“In these asymmetric situations, it’s unlikely that you’re going to outsmart the experienced folks who have seen it all before. It’s unlikely that you’ll outlast them either.

When you have to walk into one of these events, it pays to hire a local guide.”

Our goal is to uncover more data, advice, and resources to become a “local guide” for founders to lean on during the fundraising process. In order to do so, we’ve started laying the ground work with Visible Connect, our community-sourced investor database. We will be able to uncover things like investor NPS with Visible Connect and create more symmetry in the fundraising process.

Find Investors with Visible Connect

Interested in learning more? Check out the Visible Connect database here.

founders

Fundraising

Checking Out Venture Capital Funding Alternatives

Over the last few years there has been an explosion of alternative financing options to venture capital. There are a number of interesting alternatives to venture capital that each have their own pros and cons. Today, these alternative options are becoming more widely available to companies at every stage.

In an effort to help founders sort through different funding options, we’ve shared a few of our favorites below.

Pipe

Pipe is one of the newer and most interesting options. Pipe is a non-dilutive financing option for SaaS startups. As their website puts it, “Pipe turns MRR into ARR.” So how does it work? Pipe looks at your monthly contracts and offers a cash advance on the annual value of those contracts. In turn, they will take a small % of that contract for offering the cash advance.

For example, if you have a customer paying $1000/mo then the annual value would be $12,000. Let’s assume they are taking 10% (purely a guess, we are not sure what the actual terms are) that would result in $10,800 in cash ($12k*90%).

This allows SaaS companies to get cash up front and hold in their bank account or use for customer acquisition. Presumably, their % take is less than what most SaaS companies offer for an annual discount as well. Learn more about Pipe here.

Earnest Capital

Earnest Capital provides early-stage funding, resources and a network of experienced advisors to founders building sustainable profitable businesses. Earnest Capital uses their own financing instrument called a Shared Earnings Agreement (SEAL). Essentially, SEALs are geared towards bootstrapped companies who are profitable or approaching profitability.

The SEAL is a form of profit sharing where Earnest receives a share of “Founder Earnings.” This is essentially leftover profit after founders receive modest salaries, dividends, and retained earnings. Earnest also takes an equity percentage but it is reduced as more profit is shared.

David Cummings, Founder of Atlanta Tech Village, summed it up nicely by saying, “This model is better for using cash flow to grow in the near-term (payments are only required if profit is distributed) but more expensive in the long term if everything works out.”

We highly encourage checking out the SEAL document and the Earnest Capital investment Memo (it is a long read but well worth it). We also recorded a webinar with Tyler Tringas, Founder of Earnest Capital, that you can watch here.

Corl

Rather than explaining it ourselves we’ll let the Corl website explain what they do. “Corl uses machine learning to analyze your business and expedite the funding process. No need to wait 3-9 months for approval. Find out if you qualify in 10 minutes.

Corl can finance up to 5x your monthly revenue to a maximum of $1,000,000. Payments are equal to 1-10% of your monthly revenue, and stop if the business buys out the investment for 1-3x the investment amount.”

Learn more about Corl and how to apply here.

Clearbanc

“Clearbanc offers funding from $5,000 to $10 million in exchange for a steady revenue share of their earnings until it’s paid back plus a 6 percent fee.” ClearBanc is known for their ability to make an investment in just minutes via their “20 minute term sheet.”

Clearbanc is a great option for companies already generating money and are looking to ramp up growth (especially direct-to-consumer companies). Currently, ClearBanc only invests in eCommerce and consumer SaaS companies that meet these minimum requirements:

“Average monthly revenue of $10,000”

“6 months of consistent revenue history”

“Business must be incorporated

Learn more about Clearbanc and their requirements/process here.

These all have the ability to help different companies in different ways. As more alternative funding options come to market, more founders and companies will succeed. Hopefully this will lead to more entrepreneurs starting companies and raising some form of capital.

If you have an experience with a venture capital alternative or can vouch for another option to add to our list send us a message to marketing@visible.vc

founders

Fundraising

What is Pre-Seed?

If you’ve been following along at home it may feel like seed rounds are exploding in size. However, this is not just a feeling but a fact. Not long ago, it felt like $500k to $1M was getting up there in size for a seed deal. Fast forward to today and we are seeing seed deals pop up well in excess of $5M.

As Elizabeth Yin, Founder of Hustle Fund, put it, “I’m seeing massive party rounds here in San Francisco — $3 million – $5 million seed rounds. Sometimes $10 million rounds right out of the gates! My friend, a fantastic serial entrepreneur with an exit, raised $8 million recently at $30 million+ post-money valuation with only a very early version of a product. Investors literally threw money at her and her round was oversubscribed.”

Defining exactly what a seed round is today has become more subjective. You’ll often see companies raise a pre-seed, a seed plus, or seed extension, etc. The explosion of the traditional seed round size has cemented the rise of the pre-seed round. No doubt the pre-seed round has been around for years but is becoming more prevalent.

What is Pre-Seed

Put simply, “a Pre-Seed round is a pre-institutional seed round that either has no institutional investors or is a very low amount, often below $150k.” The pre-seed round gives a startup the opportunity to continue developing a product and create a plan to generate significant revenue.

How to Raise a Pre-Seed Round

If you set out to raise a pre-seed round a few things must be true:

You have some proof of concept or early product

The market has desired some form of need for a product/solution

One of the interesting aspects of raising a pre-seed round is the lack of traction and metrics you will likely have. A later stage fundraise will likely revolve around metrics, financials, and data (on top of your product, market, and team) but a pre-seed round will revolve around concepts and vision.

The lack of traction will also add an extra focus on the founding team. If you have no traction but a proven track record it will ease the decision making process for a pre-seed investor. If you have no traction and no track record, raising a pre-seed round will be even more difficult. Your ability to pitch and demonstrate your ability to build a product and model your total addressable market are a must.

Successfully closing a pre-seed round is just the start of your startup journey. Being able to deploy the capital to build a product, sell to customers, and attract top talent will be vital to raising future rounds (seed, series a, etc.).

If you’re just getting started with your pre-seed pitch, be sure to check out our other fundraising content. Good luck!

founders

Fundraising

Reporting

Founders — are you sharing memos?

This won’t be the first or last time we write this: being a startup founder is hard. On top of your day-to-day tasks you have to worry about your customers, employees, and investors. You can often feel like you’re buried when balancing the communication and relationships with all of your stakeholder groups. Concisely sharing strategy with your stakeholder groups is an effective way to set expectations and build relationships.

One tool we’ve seen pop up more frequently in the last few weeks are strategic memos. Memos are a clear and concise document to lay out strategic vision, rationale, and expectations. We’ve shared 3 different “memos” below that can be used for your investors, team, and executives.

Y Combinator Fundraising Memo

In case you missed it, YC recently published a Series A Fundraising Guide. The guide is full of useful information covering every aspect of a fundraise. One of the areas we found to be most interesting was the idea of writing and sharing an investment memo.

YC makes the case that founders should write an investment memo is two-fold. First, it can set up a meeting with a potential investor nicely when sent in advance. Secondly, it helps you as a founder clarify your pitch, thoughts, and rationale. As the team at YC writes, “A memo is particularly effective if you can write well. It stands better on its own as the deck (sent ahead of time) can miss context provided by your voiceover. Founders tell us that memos sent before meetings in place of a deck provided the necessary to set up an engaged conversation from the outset.”

They go on to share a template of a memo that you can find here. We’ve turned it into an Update Template so you can share it out via email or link!

Executive Team Strategic Memo

Andy Johns is a seasoned startup professional and currently a partner at Unusual Ventures. Andy recently published a blog post, A Simple Tool for Managing an Executive Staff as a First-Time CEO, to help first time founders deal with their first executive hires. As Andy points out, managing an executive can be quite different than managing team individuals.

“An executive’s job is to focus primarily on taking strategic risks. Each year, they should identify 2–3 major initiatives, large enough in impact to shape the direction of the company and enforce great execution against those initiatives. This is in contrast to non-executives, who you want to be focused primarily on tactical execution.”

So how does a founder enforce execution against those initiatives? Andy suggests having your executives fill out a quick memo template for your executives to share with you. As Andy puts it, “Ideally, what they come back with is a strategy that has 2–3 major initiatives that they find are important, along with a list of success metrics and resources they need to get it done.”

Once a founder gets a strategic memo from each executive it makes forming strategy and roadmap for the company as a whole easier. These memos can be used to fuel your strategic and financial plan for the year, create performance plans with executives and individuals, and the kickoff discussion points for annual planning.

Check out the strategic memo template from the team at Unusual Ventures here.

The EVERGOODS Product Brief

The last memo is slightly different than the first two. EVERGOODS is a small equipment and apparel company based out of Bozeman, MT. EVERGOODS has a strong focus on building an incredible product and puts a great deal into R&D and perfecting every minor detail of their products (a couple of gear junkies on the Visible team can attest to this).

As the founders, Jack and Kevin, put it, “Our experience lies in product design, development, R/D, and manufacturing for the likes of GORUCK and Patagonia. We believe in product and the processes of doing the work ourselves. Each project is an exploration, and ultimately a discovery, aided by our triumphs and our failures. This evolution inspires us and is at the heart of EVERGOODS.”

Being gear junkies and product focused ourselves, we found their product brief to be interesting and useful to more than equipment and apparel companies. While it may not translate directly to every industry, their brief is a great tool to help product-focused founders understand why and how they are building certain products and features.

Check out the product brief memo from EVERGOODS here.

Each template above serves a different purpose. While each template may be entirely different they all have one thing in common: clear and concise communication. Setting up a system to properly share strategy and rationale in a concise way will not only strengthen relationships but keep all of your key stakeholders aligned.

Do you have a memo or strategic doc that you share with your stakeholders? We’d love to check it out. Shoot us a message to marketing at visible dot com.

founders

Fundraising

Our Favorite Takeaways from the YC Series A Guide

With the seed to series A conversion rate estimated to be under 20% having the right resources, framework, and mind set for conducting your series A fundraise are vital. The team at Y Combinator recently published a thorough guide on raising your Series A that helps lay out every step of the process. The guide is full of helpful tidbits so we pulled our favorite takeaways and shared them below.

Consistency with Metrics

As most fundraising related articles will tell you, having your metrics in place before a fundraise is required for a successful fundraise. As they simply put, “if you don’t know your metrics cold, you’re not ready to fundraise.” The YC guide takes a deep dive here but also focuses on the importance of consistency with your metrics.

The decision to invest in a Series A round is likely still a gut instinct for investors. You have more data than your seed round but likely just a few months so being able to demonstrate consistency and emerging trends is key. Always know your metrics off the back of your hand so when things start clicking you can kickoff your fundraise with conviction.

Managing Your Relationships

Just like we’ve covered in the past, fundraising starts by building relationships. This is over the course of the 6-12 months prior and should not be confused with your formal fundraise. YC suggests building out a sales/investor funnel to manage the process. Just like a sales process it starts by building a list, getting connections, having conversation, then starting regular conversation if it makes sense.

Once you push investors towards the bottom of the funnel you will likely have formed a strong relationship, know one another’s expectations, and have built up the excitement to pull the trigger when you’re ready to launch your Series A raise.

The team at YC found that, “On average, we found that companies that raised A’s started with coffee meetings with at least 30 individual investors.” You are likely talking to 50, if not 100+, different investors throughout a fundraise so having a system in place is key. Check out our free Fundraising CRM to help keep tabs on the process.

How Much Should I Raise?

The requirements/size of a Series A feel more subjective than ever before. There are not cut and dry guidelines for what revenue, traction, metrics, etc. you need to have. The average round size for a YC company last year was $9M. However, we’ve seen Series A rounds ranging from $200k to $50M over the past year and seed rounds that have exceeded their $9M average.

The team at YC summed it up perfectly by saying, “You should raise the minimum amount you need to hit your Series B milestones, typically ~3-5x your current numbers. We suggest picking a single number, not a range. Ranges look indecisive and investors will assume that your numbers can flex, so pick the amount you actually need.”

Sharing (the right) Data

One of the things we get asked about most is when and how you should share data with potential investors. While it can be intimidating to question or reject a potential investors requests, YC offered a tip we found to be very useful — “A good strategy is to ask the investor what question they are trying to answer by requesting information. This can help you (1) figure out a more efficient way to answer their question and (2) suss out if they are only trying to create busy work.”

Own the Schedule

When it comes to scheduling meetings and running the actual fundraising process, YC is adamant about batching your meetings. For example, having all of your partner meetings within as 1 or 2 week window. The idea being that (1) investors will make offers around the same time and (2) they will not be able to collude and/or see other investors passing. Additionally, this gives you a chance to quickly iterate on their pitch and spend more time on the day-to-day of their business.

However, this is easier said than done. YC warns that founders will often let the first meetings drag out for months or on the flip side; founders will create a tight timeline by accident. Losing track and control of your schedule is an easy way to kill a fundraise.

Raising Money Isn’t the Goal

One of my favorite lines from the guide comes towards the end; “If you’ve succeeded in raising an A, there’s one final challenge: remembering that raising money isn’t the goal.” Raising a Series A is an incredible feat and one that very few companies will get to. However, it does not make your company a success. Successful founders will remember why they raised their Series A and set their eyes on tackling the goals they laid out during their fundraise to begin with.

If you’re interested in reading more about raising your Series A, be sure to check out our Series A Funding Guide.

Unlock Your Investor Relationships. Try Visible for Free for 14 Days.

Start Your Free Trial