Blog

Fundraising

Resources related to raising capital from investors for startups and VC firms.

All

Fundraising Metrics and data Product Updates Operations Hiring & Talent Reporting Customer Stories

founders

Fundraising

Mike’s Note — Is Debt the New Black?

It seems like the Twittersphere is ablaze with the idea of debt entering the market as a financing vehicle. Check out Alex Danco’s, “Debt is Coming” blog post if you missed it…Tyler Tringas and Earnest Capital have an entire fund devoted to this thesis. I’m sure there are a ton more blogs, Substacks and Tweets about it now.

These ideas mainly pertain to SaaS. The tl;dr is that the last 15 years have paved the way to build and scale a SaaS company for next to nothing while recurring revenues are (hopefully) predictable. If both of these things are true, isn’t equity an incredibly expensive thing to give away?

I suspect we’ll see more debt funding vehicles enter the market for all stages of growth. Getting started? You could use a credit card. A couple thousand in MRR and want to go full time on a side project? Take a look at Earnest Capital. $50k in MRR? Check out Lighter Capital or Stripe Capital. >100k? Private Equity and Banks will be happy to help.

At the end of the day, more options = better deals for founders so I’m a fan. However, does debt come with operational expertise? Can it help you hire? Navigate strategic decisions? I think Alex Taussing has a great response in his newsletter Capital Stack with, “My hope is that operators will constrain its use to areas where debt is a more natural fit.”

Have you taken any debt? Considering it? Any other ideas? Share your ideas below.

Last Weeks Note – Do you Sleep? I got some great reactions to the Sleep note last week. Here are some of my favorite responses.

For the sleep matter, I often feel the Hustle porn trend induces a huge bias. While we hear from folks working 100h a week that feel in their good right to brag about it, it obfuscates a huge part of the founders, realizing how much sleep & good personal equilibrium matters but that won’t brag about it.

Well that’s interesting! Just knocked together a little chart based on that DoD study. Assuming at 10 hour day, and that a person is just as enthusiastic and focussed about being at work as anywhere else (unrealistic) then yes in theory someone could extend their working day another 4 hours per day. Might explain the stereotype of the startup founder working well into the night without realizing for days on end, while there is a productivity loss, if you do it for a few days you can still come out ahead. That’s if i’ve done the math right of course!

It’s 12:46 am. I’m writing code. Should I be writing code? ever? no. But we’re behind on a deadline for an important customer, so here I am. I’ve crushed 2 critical tickets since I put my kids to bed.

I use the Withings Sleep Tracker to measure my sleep (it sits under my mattress). I’ve seen repeatedly that it is the most important variable in my control that affects everything in my life from personal wellbeing, through to cognitive ability. It’s been elevated to a level it deserves.

founders

Fundraising

Operations

Mike’s Note — Raising too much?

I’m going to start writing a weekly note (at least try!). Inspired from my great friend Max Yoder — make sure to check out his weekly note if you want to do better work.

I’ll focus on something that caught my eye in the startup space, an interesting data set and/or anything that I think can give founders a better chance of success. If you unsubscribe, I totally understand but my goal is to make this as valuable as possible.

Have you seen the latest buzz about founders wishing they had retained more ownership? Sam Altman from YC tweeted it here. The takeaway is founders feel like they dilute too much early on. Sam also thinks that founders dilute themselves 2x more for the same level of progress they used to 10 years ago. Suhail (Mixpanel founder) has a great response in his tweet. In short, he encourages founders to raise less money at a lower valuation early on. Easier said than done! I do love his mention of thinking through the preference stack. I think it’s incredibly important to model out how the preference stack impacts outcomes and decision for founders. Speaking of doing more with less. Can you guess which companies financials these are before going public.

If you guessed Google, you are correct. How much did they raise to get to this point? Only $25M. A little different than today’s climate.

Curious, have you felt like you’ve given up too much of your business?

founders

Fundraising

Reporting

Upside.fm Podcast: Powering Communication for Founders and Investors

Upside is a podcast about startup investing outside of silicon valley. Our founder, Mike Preuss, was able to sit down with the hosts at Upside and discuss all things founder and investor relationships.

If you’re interesting in learning more about Visible, investor communication, and portfolio management give the episode a listen. From the Upside blog, you can find the recap of the episode below:

AD: Finding experienced employees for your new business with Integrity Power Search (5:23)

Mike’s background and entrepreneurship experience (7:56)

Orr Fellowship (11:17)

Managing a remote culture, different time zones, and off-sites (12:44)

Initial problem and genesis of Visible (18:38)

Changing the product from investors to founders (21:53)

Finding clients (26:07)

Tracking metrics and data (or lack thereof (30:05)

Visible using Visible (32:38)

Money model (36:13)

Investors’ and founders’ access to information (43:13)

Visible’s potential in a downturn or recession (46:31)

founders

Fundraising

How to Effectively Find + Secure Angel Investors for Your Startup

Generally, we discuss what it takes to raise venture capital on the Founders Forward blog. However, there are a number of other types of investors and capital. All of which serve different purposes and can help different businesses in different ways. Angel investors are an integral part of the “startup ecosystem” and can be a valuable source of capital to take your business to the next level. So how do you find an angel investor for your startup?

What is an angel investor?

Both angel investors and venture capitalists offer a form of equity financing but there are a few key differences that will help you determine if you should approach angel investors. The main difference is where their capital comes from.

An angel investor is generally a wealthy individual who is looking to invest spare cash in an alternative investment. On the flip side, a venture capital firm is backed by limited partners who are expecting substantial returns in a certain period of time. This means that an angel investor may have alternative motives (personal interest in the problem, product, founders, etc.) whereas a venture capital firm is focusing on maximizing their returns.

With the different expectations in returns also comes a difference in check size and resources. An angel investor will typically write a check for anywhere from $1,000 to $100,000 (maybe more in some cases). As for venture capitalists, they will likely write a check from $100,000 to $5M+. If you’re not growing at hypergrowth speeds or do not need a huge check to grow your business, angel investors are likely a great option for your business.

However, smaller checks are not necessarily a bad thing. As Kera DeMars of Hustle Fund puts it, “it’s often easier to convince a bunch of people to write small checks rather than a few people to write huge checks.”

Recommended Reading: The Understandable Guide to Startup Funding Stages

Angel Investors vs. Venture Capitalists

VC funds are often organized under the limited partnership (LP) model. They raise large sums of money from institutions – such as pension funds, endowments, and family offices, then invest that money in exchange for a share of the return & management fees (see this excellent article by Elizabeth Yin for a deeper explanation on how VC’s make money). This gives them incredible leverage and financing power, but often leaves them under the watchful eye of LP’s who want a return on schedule.

Angel investors usually operate under a different model. Most tend to be high net worth individuals, and in many cases have built and exited a company themselves. They need to be accredited investors who can stomach the inherent risks involved with early stage startups.

Because angel investors tend to have smaller sums to invest than VC funds, you’ll often find them in Pre Seed and Seed rounds. VC’s tend to participate across all rounds, but typically only they can afford to play the game in Series B and beyond, as the shear amount of money required tends to be out of the range of most angels.

Recommended Reading: Venture Capitalist vs. Angel Investor

Step-by-step guide for finding and securing angel investors

Considering the wide range of people who can be angel investors and their check sizes and interest there are many ways to find and approach angels. Here are a few of our favorite approach to finding angel investors:

1. Ask friends and family first

As Elizabeth Yin writes, “There are lots of rich people worldwide — they don’t even have to be super rich. There are lots of angels who can write you a $1k-$10k check. Angels may not know they are angels. It’s your job to plant the seed in their heads that you are open to an investment from them!” When searching for angel investors it is generally best to start with the people already in your network.

2. Tap into your personal and professional network

Don’t be afraid to ask someone in your network for an introduction. Past co-workers or investors likely have their own professional network and can open doors to new potential investors. Part of raising angel capital is stepping out of your comfort zone, and as Elizabeth Yin puts it, “embracing the awkward.” If someone in your network passes, quickly move on to the next opportunity instead of wasting time continuing to pitch someone who passed.

Related Resource: Top 6 Angel Investors in Miami

3. Signup for an account with Angelist

Angel investors tend to network and create their own communities. One quick way to find angels outside of your immediate network is to turn to the internet to hunt down angel groups A slightly different approach is to find a syndicate. As AngelList defines it, “a syndicate is a VC fund created to make a single investment. They are led by experienced technology investors, and financed by institutional investors and sophisticated angels.” AngelList is a great source for finding syndicates and angel groups.

Related Reading: How To Find Private Investors For Startups

4. Join the Angel Capital Association

As written on their website, “CA is a professional society of accredited angel investors who make up the world’s most prolific early-stage investment class. The association is the largest professional development organization for angel investors in the world deploying more than $650 million in early-stage capital each year. ACA provides an insider perspective that can help you make smart investment decisions.”

Learn more about Angel Capital Association and the perks for founders here.

5. Leverage social media

Many investors spend time on social media — especially Twitter and LinkedIn. You can leverage social channels to get in front of angel investors. Investors typically need multiple data points to make an investment. By interacting on social media, you’ll be able to build up those “data points” so when the time comes to raise they will already be familiar with you and your business.

Who can become an angel investor?

Just about anyone can be an angel investor. Typically speaking an angel investor has to be an accredited investor. As Investopedia puts it, “to be an accredited investor, a person must have an annual income exceeding $200,000, or $300,000 for joint income, for the last two years with the expectation of earning the same or higher income in the current year.”

One of the interesting aspects of raising angel capital is that everyone around you has the chance to be an investor. With the introduction of equity crowdfunding (more on this later) the scope of angel investors has been opened even further.

What do angel investors look for?

Angel investors can be interesting because they may not be motivated purely by returns. Sometimes angel investors are attracted to a market, a personal interest, or even just want to back a friend or family member.

With that being said, it is still vital to be able to portray that you are building a sustainable business that can generate returns and compete with their other investments. At the end of the day, an individual investor has countless options for where they should invest their money. You need to be able to paint a picture of why they should allocate their money in your business as opposed to public markets, real estate, and other traditional investment opportunities.

ROI

Like most investors, angels are looking for a return on their investment. Motives might differ than a traditional venture capitalists, but at the end of the day they’ll want to see how they can make a return on their investment.

A reliable leadership team

Angel investors want to know that they are investing in a reliable leadership team. This means they will properly communicate, lead, and build their startup.

Early growth and traction

If an angel wants ROI, they’ll want to see that you have the data and business plan to generate returns. Like VCs, angels will use data and traction to make their investment decision.

A scalable and effective business plan

Also going hand-in-hand with generating a return, is a scalable business plan. Angels will want to understand how your business scales and what it looks like at different points in the future.

How much do angel investors typically invest?

The typical investment amount from an angel investor varies quite a bit. Angel investors will invest anywhere from $1,000 to $1,000,000+. However, the average check size hovers around $25,000 to $100,000.

There are a few ways to approach the wide range in check sizes. On one hand you can talk to as many angels as possible and pick up smaller checks to build your round. This obviously can be more time consuming and requires you to keep more stakeholders in the loop. However, it is generally an easier decision for someone writing a $5,000 check as opposed to a $100,000 check.

On the flip side, you can target a couple of larger angel investors and spend your time targeting a few large checks to close your round.

What are the benefits of angel investors?

Angel investors can often play a role in providing crucial company-building guidance in the early days. Because they tend to arrive on the scene early, they stand to make a massive return if your company succeeds. VCs can be equally helpful, and they’ll sometimes place a member of their fund on your board who can assist in guiding the direction of your company. Check out some of the benefits of raising from angel investors below:

Build momentum during a raise — angel investors can be a great first check and help build momentum during a fundraise

Introductions to other investors — angel investors tend to know other individuals that might be willing to invest in your company or help in key areas

Silent investor — some angel investors tend to be more hands-off than VCs (which can be a pro or con depending on your business.

How to pitch angel investors

If you can find an angel investor that fits in with your company ethos they can be incredibly valuable for you as an advisor and source of capital.

Check out how Jonathan Gandolf, CEO of The Juice, found warm intros to potential investors below:

Find Their Motivation

As we mentioned earlier, often times angel investors have an alternative motive outside of profit. A lot of the time they may be investing because of the founders, a personal interest in the problem, or an interest in the market/business model. With that being said, it is important to tailor your pitch to what motivates your angel investors. A pitch to a venture capitalist often times will focus on the economics and ability to create returns but a pitch to an angel investor may differ quite a bit.

Iterate Your Pitch

You’ll want to be sure to iterate on your pitch for each angel investor. After your first meeting if you find they have an affinity for your founding team, you may want to build your pitch around the team. If you find they have a personal interest in the problem you are solving, build your pitch around your solution. Note: is vital to let angel investors know the risks associated with backing a “startup.” This is especially true if it is their first time investing in a private company.

Provide Status Updates

Angel investors are ultimately risking their own money for your business and it is your duty to keep them involved throughout the process. It does not have to be an in-depth dive into your business start by sending them status updates during and after your fundraise. We suggest including things like wins/losses, high level metrics, priorities, etc. Remember if your investor has a certain motivation behind their investment feed into that when updating them. If they have experience in the market or field you may want to make specific asks where they are qualified.

Keep your investors up to date with Visible

Once an investor writes a check it is your responsibility to keep them engaged with your company. At the end of they day they should be the ultimate evangelist for your company so it is vital you communicate and have a transparent relationship. Depending on their check size and involvement with the business will dictate how much you should share with them.

However, if it is someone that wrote a smaller check size it may make sense to send a less involved Update. This allows you to keep them in the loop but avoid the additional questions and confusion that may come with sharing too much information. In a “lighter” version of an Update we’d suggest sharing a couple key things:

Major milestones — share your big wins from the past quarter. This can be a new customer, round of funding, or just anything you are proud of.

Where you need help — let angels know where they can be of help to your startup. Don’t be afraid to ask for introductions to customers, potential hires, and other investors.

Key Metrics — share 1 or 2 of the key metrics behind your business. They should already be familiar with these metrics and should not come as a shock when they see a chart.

Not all investments are created equally. Do you want an investor that will write you a check and leave you alone? Are you interested in ‘smart money’ that will help you build your company? Do you want mentorship in exchange for a board or advisory seat? No one can answer these questions for you, but it’s important to keep it them mind when evaluating the pros & cons of angel investors vs venture capitalists. Fundraising is one of the hardest jobs in the world – you should try to make it worth it.

founders

Fundraising

All Encompassing Startup Fundraising Guide

Startups are in constant competition for two resources: capital and talent. Without capital, a business fails to exist. Without talent, a business fails to flourish.

This guide is intended to help you understand the venture markets and improve your likelihood of raising venture capital. We will cover the history of venture capital, the investor thought process, finding and pitching investors, sharing data and documents, closing your new investors, and building strong relationships to help with future fundraises. Note: You can find the resources (blogs, podcasts, videos, books, etc.) used to fuel this guide in the resources tab located in the top right.

If you’ve raised venture capital before, you already have some combination of a great product, a highly functioning team, and a growing market. Before we jump into these aspects, we need to take a step back and study the history of venture capital.

As recent as the 1990s, the venture capital space was dominated by a few large firms that did incredibly well. Capital was enough of a scarcity that it was a differentiator for these large firms. As the internet skyrocketed in the 90s and early 2000s, in turn the cost of starting a company started to decline (and still is today). Fast forward to 2005, and Y Combinator is started. Y Combinator cracked the code on scaling entrepreneurship and used their founder and investor network to help more companies succeed.

Since the inception of Y Combinator, thousands of VC firms have started and have drastically changed the space. Capital alone is no longer a sufficient differentiator for a VC firm. Firms have started to specialize in specific verticals, offer extensive resources to their portfolio companies, and have created their own “secret sauce” for yielding the best returns.

That brings us to today, where it is easier to start a company, yet harder to build a company than ever before. Access to capital can be the difference maker between a startup thriving or joining the startup graveyard. Below we will share the tips and tricks to systemize your fundraising process to better increase your odds of raising venture capital.

Further reading and resources to help you learn more about venture capital:

[Video] The Founder’s Guide to Investor Communication and Fundraising

Types of Venture Capital Funds: Understanding VC Stages, Financing Methods, Risks, and More

Are you ready to raise capital?

First things first, you need to ask yourself, “are we ready to raise venture capital?” Or better yet, “what do I have to offer a potential investor?” As we previously mentioned, to raise venture capital you need some sort of combination of a compelling market, qualified team, or strong product.

Understanding How VCs Work

To understand if you’re ready to raise venture capital, you need to understand how VC firms function and how you can fit into their larger vision. In simplest terms, VCs go through a consistent life cycle that goes something like this: raise capital from LPs, generate returns through risky venture investments, generate returns in 10-12 years, and do it again.

Easy, right? Actually, quite the opposite. A median VC fund is generally not a great investment for limited partners. Just as companies are in competition for venture capital, venture capitalists are in competition for capital from limited partners. In short, LPs are institutional investors (University endowments, foundations, pension funds, insurance companies, family offices, sovereign wealth funds, etc.) looking to create excess returns by investing in VC firms (generally a small % of their overall investment strategy).

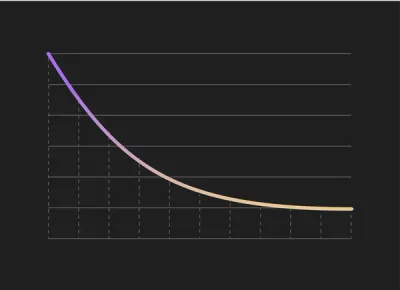

According to Scott Kupor, “If you invested in the median returning VC firm, you would have tied up your money for a long time and have generated worse results that the same investment in Nasdaq or S&P 500.” So why would an LP invest in a VC firm at all? Because VC returns follow a power law curve; a small % of firms capture a large % of industry returns. In simpler terms, LPs are in pursuit of VCs generating excess returns who are in pursuit of investing in companies that can offer huge returns. Which brings us to our next point…

A Compelling Market

VC fund returns are not the only place we see a power law curve throughout the fundraising process. The breakdown of a VC funds individual investment returns follows a power law curve as well. It might look something like this. Long story short, VCs are in search of home runs, not singles and doubles, to create the excess returns for their LPs.

The best chance of being one of these companies that creates the huge returns for a fund, have a compelling market. As Scott Kupor, Managing Director at a16z puts it, “Everything starts and ends with addressable market.” As a founder, it is your duty to model the total addressable market and paint a picture of how you will penetrate the market to become a “home run” investment. Without a compelling market, a VC fund will have a tough time justifying making an investment in your company. With that being said, if a market is not big enough right now, strong and innovative companies can find and create new ones (E.g. Uber’s TAM).

Markets fluctuate and you may have an investor that invests in specific products or teams to differentiate themselves.

The Product

On the flip side, there are investors who will base their investment decision of the product. No matter how big the market or strong the team, some investors will tout that a strong product is all that matters. The idea being that a strong and innovative product will sell itself and will have the ability to create new markets. As Peter Thiel states, “If your product requires advertising or salespeople to sell it, it’s not good enough.”

The Team

While the team may have no direct attribution to how large of returns your company can generate, it can display your ability to execute on the vision. Having a well experienced team is a great way to portray your credibility. Some very early stage investors, such as the Hustle Fund, may even place the most stress on the team when making an investment decision. As Elizabeth Yin of the Hustle Fund puts it, “of the two things I am most interested in for early stage investments is the assessment of the team… how well do they know the market? Are they executing?, etc.”

So the question is not, “are we ready to fundraise?” It should be, “do we have the market, product, or team to warrant an investment from an investor?” If so, it is time to get started on the fundraising process.

Further reading and resources to help you determine if you’re ready to raise venture capital:

[Video] How to Raise Capital in 15 Days: Debt vs. Equity Financing

The Free Visible Total Addressable Market Template and Evaluation Model

Finding the Right Investors

When you’ve determined you are ready to raise capital, you’ll find that the fundraising process often mirrors a traditional sales process. Like any sales process, the fundraising process starts by finding qualified investors (leads) that you’ll build a relationship with the end goal of them writing a check.

Fundraising is often compared to a cocktail party, when the waiter comes around with a tray of snacks, you should always take one. You’ll never know when the waiter will make it back to you. The same with VC capital. However, it is important to remember that the average VC + Founder relationship is 8-10 years so you’ll want to make sure you’re starting with the right people to build a valuable and long-term relationship.

We suggest starting with your “Ideal Investor Persona.” This is a firm or person, that is highly targeted in all facets of your business. We suggest starting with qualities below:

Location – Where are you located? Do you need local investors? Or maybe you are looking for connections and networks in strategic geographies.

Industry Focus – What type of company are you? Where should your future investors/partners be focused? e.g. If you’re a B2B SaaS company don’t waste your time with marketplace focused investors. Mark Suster suggest that it is best to prioritize investors with companies in your space.

Stage Focus – What size check/round are you raising? e.g. If you’re raising a $1M seed round avoid a firm with $2B AUM. If you’re raising a $30M round avoid a firm with $75M AUM.

Current Portfolio – How is the rest of their portfolio constructed? If current companies are doing well, there may be less pressure to exit so they can return funds to their LPs. If current companies are performing poorly, there may be more pressure for you to exit so they can return as much as possible their LPs.

Fund Age — How long ago did they raise their current fund? How many investments have they made? If the fund is young, there will be less pressure to exit and a higher likelihood of them having capital saved for a future round. If the fund is older, they may feel pressure from their LPs and may be looking for an exit as soon as possible.

Deal Velocity – Are you in need of capital as soon as possible? Or are you taking your time and looking for strategic investors? Varying investor’s have different philosophies for the velocity they’re making deals. Point Nine Capital and Kima ventures are both regarded as top firms in Europe. However, Point Nine makes ~10 investments a year whereas Kima makes 1-2 investments a week.

Motivators – Who are the firm’s limited partners? What do want to get out of your investors and what do they want to get out of you? Do they need to match your values and culture?

Once you’ve determined someone that meets your “ideal investor persona” you’ll need to do everything in your power to get a meeting with them. In fact, many VCs will use your ability to get their attention and set a meeting as a gage for your “hustler” prowess. Cold emails, your network, and events are all great ways to get a meeting.

Regardless of how you get a meeting, it is vital to do your research beforehand. Start with current connections and do what you can to get an introduction. Other founders and current investors are a great source for finding new investors. Go into the first meeting full of knowledge and ready to question investors.

Further reading and resources for finding the right investors:

Our Free Fundraise Tracking Tool

How To Find Private Investors For Startups

How Rolling Funds Will Impact Fundraising

Startup Syndicate Funding: Here’s How it Works

Pitching Your Company Effectively

Just landed your first meeting? Great! But the pitching does not start yet. Many founders will walk into their first meeting and immediately start flipping through their deck and give the same presentation to each investor. However, you need to remember you are selling your company and want to make sure your pitch is as tailored as possible to each investor.

The first meeting should be most valuable for you as a founder. This is your opportunity to ask questions so you can figure out their pain points, figure out their motives, and other nuanced things you may not be able to find in internet research to tailor your pitch for future meetings.

As Elizabeth Yin, Founder of the Hustle Fund puts it, “Your job in the first meeting with a potential investor is to ask a lot of questions – ala customer development style – to understand how you might be able to tie your story to their problems and interests. And so your pitch should not be stagnant, and although you may have created a deck before the meeting, it’s important to tie your talking points together as a solution to the problems you learn about in that meeting.”

If you’ve done your research and asked the right questions, you’ll be armed with the information you need to effectively pitch your company. At the end of the day, pitching is storytelling and it is your job to figure out how each potential investor fits into the narrative. If done correctly, you’ll be able to control the conversation and better your chances of setting future meetings.

Further reading and resources for pitching your company to investors:

[Video] The Founder’s Guide to Investor Communication and Fundraising

Data, Documents, and Due Diligence

Once you’ve determined an investor is the right fit for your company, you’ll need to share data and different documents with your investors.

Data & Metrics

At some point throughout the process, investors will need to see the metrics behind your business. You should have a deep understanding of your key metrics and have them ready to share at any time. Generally, we’ll see that metrics potential investors want to see fit into one of the following categories:

Growth & Financials — This more often than not comes in the plan of a business/financial model and historical data. Show them a strong financial model that creates growth for the business and returns for them and their LPs.

Margins — Margins on your product is a large part of the path to profit and returns for your investors. Investors generally have a % they are looking for in the back of their mind.

Customers — Your customers are your business. Clearly showing potential investors that you can attract, convert, retain, and engage your customers is vital. This can come in the form of customer satisfaction surveys, net promoter score, and retention rates.

Documents & Due Diligence

Going from “I’d like to close” to actually closing is a big difference. When facing due diligence it is important to be prepared, understand the process, and do your part to speed up the process as much as possible.

There are a number of different corporate documents, protocols, references, etc. that you’ll need during the due diligence process. To learn more about the specific documents head over to our fundraising resources section.

Signaling most certainly matters throughout this process. You’re likely only meeting a few times before jumping into a 8-10 year relationship so everything will be magnified throughout the process. Be prepared and transparent throughout the due diligence to help avoid speed bumps and start your relationship off on the right foot.

Further reading and resources for sharing data, decks, and documents:

Our Free Guide for Building Your Financial Model

Nurturing for Later Rounds

Inevitably, you’ll hear a slew of “no’s” and maybe’s” throughout the fundraising process. An investor “no” can always be turned into a “yes” at a future date. As you would nurture a lost deal in a sales process, the same should be done with your potential investors.

If you’ve asked the right questions, you should have a good idea of what they’re excited about and be ready to pull the trigger to pick the conversation back up. How exactly do you keep potential investors engaged? We have found it best to send out a short update on the state of the business and industry. Share a promising metric or two showing strong growth in the business and any significant wins/improvements. If possible, address any concerns with the industry, team, product, etc. that you have discussed in the past with numbers. Hundreds of emails land in investor’s inboxes so be sure to include a quick snippet of what your company does and any personal notes.

By building a strong relationship with potential investors, it will make it that much easier when you set out to raise at a future date. Most importantly, make sure you are armed with the right information and data to stay top of mind.

Startup Funding Tracking

We’ve talked with a lot of founders who have raised money, and we continue to hear the same things: Fundraising is a difficult and time-consuming process, one that is often unstructured and chaotic. Done poorly, it can cost startup leaders countless hours of valuable time—not to mention their valuable sanity.

One of the key challenges of the fundraising process is it is non-linear. Seasoned founders will tell you that fundraising is essentially a sales process, requiring a founder to prospect, nurture and move potential investors through a “pipeline.” While this is true, it doesn’t tell the full story.

Most sales interactions have a natural order to them, an order that both sides generally understand. The fundraise process? Not so much. There is no proven playbook for getting funded, because every company is different, and so is every investor. Often, these interactions need to be managed on a case-by-case basis.

When managing a fundraise, a little structure goes a long way. We’ve built our Fundraising CRM to help founders track their fundraise simply, but effectively. Use it properly, and you’ll be on well your way to completing your round.

How the CRM Works

The Fundraising CRM is free for all users. To get started with your raise, login to your Visible account and check out the “Fundraising section”

To help get started, we include generic pipeline stages that are easily customizable to fit the needs of your fundraise. We’ve included what we have found to be the most common stages for an investor:

Research — Any new investor that you’re prospecting, or has contacted you, but has yet to discuss potential investment.

Contacted — Any investor that you’ve emailed or called to discuss the opportunity to invest in your business.

Meeting — Any investor that has agreed to sit a meeting. From here, you can continue to move through the funnel or move directly to “Keep in Touch” or “Passed” depending on the meeting outcome.

Light Diligence — Any investor that has expressed serious interest in your business and has started to perform due diligence on your company.

Partner Meeting — Any investor that would like to bring in the partners of the firm to get sign off from the remaining partners.

Term Sheet — Congratulations! Any investor that has extended a term sheet to fund your startup.

Closed — Any investor that has wired the money to your business.

Keep in Touch — Any investor that has passed on your business for the time being. We suggest keeping these investors in the loop with brief milestone Updates throughout your startup’s journey.

Passed — Any investor that has permanently passed. This is a firm that you feel is unlikely to invest in the future.

A crucial part of the fundraising process is keeping your eyes on communication and making sure you’re nurturing investors through the funnel, especially if you have a lengthy fundraising cycle. The notes section of each contact can be used to keep tabs on your communication and meetings with different investors. We hope this tool will help simplify your fundraising process and get funded faster.

Startup Fundraising Resources

At certain points in a company’s life, fundraising becomes a full time job for the founders or CEO. That is, of course, in addition to all the other full time jobs that come along with being a startup founder — hiring, selling, cleaning up dirty dishes. Constant outreach, pitching, deck revisions, not to mention the time spent answering diligence requests.

One of our goals at Visible is to improve the fundraising process for companies and there are a ton of other great tools and resources that focus on the same thing. We’ve curated 100s of fundraising articles and resources for our Founders Forward Newsletter. You can find our favorite startup fundraising resources below:

Startup Funding Tools

Foresight

Product, market and team get a lot of investors excited but not having your numbers down is a dealbreaker and hints at a lack of professionalism. Foresight helps you make sure you know your numbers as well as any CFO or accountant would. By the way, we spoke with Taylor Davidson, founder of Foresight, to get some insight into his best practices for building a great startup financial model.

Visible

Hey! That’s us! As we mentioned above, we offer a fundraising CRM to help founders track their fundraise from start to finish. Visible is the best way to report your performance numbers to your potential investors, helping you combine data, visualizations, and narrative to tell a compelling story about the growth of your business.

Startup Fundraising Content

Venture Deals: Be Smarter Than Your Lawyer and VC

This is, without a doubt, the best book you can read on venture financing. Buy it for yourself and for every single person on your team.

The 20 Minute VC Podcast

We’ve talked before about the importance of thinking like an investor. This interview podcast gives you a look inside the thought process for investors like Mark Suster, Kanyi Maqubela, and Aaron Harris.

Elizabeth Yin Blog

Elizabeth Yin is a co-founder and General Partner at Hustle Fund, a pre-seed fund for software entrepreneurs. Previously, Elizabeth was a partner at 500 Startups where she invested in seed stage companies and ran the Mountain View accelerator. Elizabeth covers the ins and outs of venture fundraising on her blog.

The Fundraising Wisdom That Helped Our Founders Raise $18B in Follow-On Capital

One of our favorite post covering how to run a successfully fundraising process. The post from the team at First Round reviews surveys founders that have raised $18B+ of combined capital. They also introduce the idea of “taking on investors in sets” which we believe to be a key component of running a good process.

Berkshire Hathaway’s Letters to Shareholders

While he is known as an investor, Buffett is also an entrepreneur whose Shareholder letters are a masterclass on how to attract and retain long-term investors for your business. For a free compendium of Buffett resources, check out BuffettFAQ

Founders Forward Newsletter

We search the web for the best tips to attract, engage and close investors, then deliver them to thousands of inboxes every week. Subscribe for the Founders Forward Newsletter here.

Startup Fundraising Platforms

SeedInvest

For high-growth companies with proven traction, SeedInvest is a great platform to connect with over 14,000 individual accredited investors.

Angellist Funds

Raising on Angellist – where many top investors run what are known as “Syndicates” – can be a great way to tap into a network of well connected VCs, Entrepreneurs, and Angels.

Seedrs

Seedrs has helped European companies of all sizes – from idea stage to the publicly traded firms – raise capital more efficiently.

Kickfurther

If your company is dependent on effective inventory purchasing and management then Kickfurther, where you leverage backers and people who love your brand to fund inventory purchase orders, can be a great place to look.

Republic

Since the SEC enacted the Title III of the JOBS Act a majority of the US population can invest in startups for the first time. In order to allow more investors to invest in more startups, the team at Republic built a platform for startups to raise capital from the new found investors.

Earnest Capital

Earnest Capital provides early-stage funding, resources and a network of experienced advisors to founders building sustainable profitable businesses.

Startup Fundraising Fun

The Pro Rata Newsletter

“Dive into the world of dealmakers across VC, PE and M&A. By Dan Primack, the best-sourced deals reporter on Earth.”

Related Resource: 7 Essential Business Startup Resources

founders

Fundraising

First Meeting with a Potential Investor? Ask These 5 Questions

As a founder, landing your first meeting with an investor is an exciting experience. You’ve got your deck together and a talk track ready to go. You’re ready to walk in, paint your picture, and walk out with plans for your next meeting. However, we often see pitches can go off the rails and it can be easy to lose control of the conversation. But the first conversation should be most valuable for you as a founder.

The average VC + Founder relationship is 8-10 years so it is important to make sure that you’re building a relationship with the right people. As Elizabeth Yin, Founder of the Hustle Fund, puts it, “an experienced fundraiser knows that the goal in going into your first fundraising meeting is to ask lots of questions and walk away understanding what next steps make sense.”

While it can be intimidating questioning an investor, the following questions should help you start your own due diligence and tailor your pitch for future meetings.

How old is the fund?

It is important to understand where a fund is at in its lifecycle. In general, a fund lifecycle is 10-12 years. After the 10-12 years a VC fund is expected to return capital to its investors (limited partners). If a fund is getting older, they may feel more pressure to generate quick returns to please their limited partners. This pressure could be passed down to you and could force you into an early exit.

If a fund is younger, they are likely ready to deploy capital and will have additional capital set aside for your future rounds.

How is the rest of the portfolio performing?

Remember that VC funds have pressure to generate returns for their LPs. Say a fund has raised $100M and owns 10% of each investment on average. Their LPs are likely expecting a minimum of a 5x return which means the portfolio would need a cumulative exit value of roughly $5B ($5B x 10% = $500M). So what does this mean?

If you are the single shining star in the portfolio, there could be a misalignment of incentives. You could have the ability to exit for a life-changing outcome but your investors need a larger exit so they could block the sale. On the flip side, you could get pressured into an early exit. If the rest of the fund is performing well, you may have more slack and be able to take your time as the rest of the fund can generate substantial returns as well.

Related Reading: Understanding Power Law Curves to Better Your Chances of Raising Venture Capital

Who are your investors?

Understanding where your potential investors’ capital is coming from will help you understand their behavior. VCs raise capital from Limited Partners (LPs). Generally, LPs are institutional investors like university endowments, foundations, pension funds, insurance companies, family offices, sovereign wealth funds, etc.

A firm usually keeps the names of their LPs under wraps but this can be a sign of their openness and transparency (remember… 8-10 years, you want to build this relationship on trust).

What happens if you lose all of the capital you invest?

Everyone is generally aware that a VC investment is very risky. Your potential investors should understand that there is a chance they’ll lose all of their investment but press on this issue. As Jason Lemkin simply states, “If they look too nervous, find another.”

Can you help us with our next round?

Outside of having their own additional capital to invest in your next round you’ll also want to understand how a firm can help you with other investors. Try to understand what companies they have helped make introductions for and what % of their portfolio has gone on to raise future capital. Don’t be afraid to do your own digging and reach out to founders of companies in the portfolio to understand how the firm helped throughout their fundraising process.

While they are hundreds of questions you could ask a potential investor we have found that the 5 above will help understand their behavior and decision-making process. Once you have these answers, it will be easy to go back to the drawing board and (1) decide if you’re ready to enter an 8-10 year relationship and (2) tailor your pitch for future meetings.

founders

Fundraising

How Employees Think About a Fundraise

As a founder, the day-to-day can often feel like a juggling act. Constantly, trying to optimize time between building a product, growing revenue, attracting capital, and delighting employees. At the end of the day, one could argue that the overall health of the business comes down to attracting capital and retaining employees. Without capital, a business fails to exist. Without talent, a business fails to flourish.

When a founder sets out to raise capital it can often feel like a siloed process where the rest of the company has little to no knowledge of the status. However, a company’s ability to fundraise is often one of the only external benchmarks a startup employee may have. So how do employees think about the company’s fundraise? And what does it mean for a founder?

Finding the Right Valuation

For a startup employee, measuring their company’s success can be difficult. More times than not, an employee’s only external benchmarks are how much capital their company has raised and at what valuation. Employees use their company valuation as a measurement for their overall company success and in turn their desire to stay and grow at the company.

It is the founder’s duty to find the right balance between the company, investor, and employee needs. When there is high demand for a round, it can be easy to raise at the highest valuation possible. If you overvalue the company, you’ve raised the bar for what it takes to clear the valuation bar for your next round. If you undervalue the company, employees may start to wonder if things are actually going well.

Inevitably, a company’s valuation will eventually meet the true worth of the company. Deciding how to portray and manage this is in the hands of the founders. At the end of the day, employees will want to see the valuation of the company moving up and to the right.

Raising the Right Amount

With a valuation comes the amount fo capital the company actually needs to raise. Most employees would be thrilled to open Crunchbase and see news that their company raised a huge round. However, this may not be in the best interest of the business. When a founder thinks about how much to raise, they need to keep their next 12 to 24 months in mind.

As Scott Kupor, Managing Director at Andresseen Horowitz puts it, “Raise as much money as you can that enables you to safely achieve the key milestones needed to raise your next round of fundraising.” Remember that raising too much money can be death for startups as they recklessly burn capital. Scarcity is the mother of invention. However, raising too little money at an aggressive valuation can weaken ambition to hit big goals in a short amount of time.

Just like everything in a founder’s day to day work, fundraising is about finding the right balance. It is the duty of the founder of balance the needs of their company, their employees, and their investors. Want to learn more about raising capital? Check out our other fundraising posts.

founders

Fundraising

Understanding Power Law Curves to Better Your Chances of Raising Venture Capital

The ideas below are largely based off of Scott Kupor’s new book, Secrets of Sand Hill Road: Venture Capital and How to Get It. We highly recommend giving it a read!

If you’ve read our blog before you know we often compare a fundraising process to a traditional sales process. You might find potential investors to fill the top of the funnel, set meetings and build relationships with future investors in the middle of the funnel, and eventually close them at the bottom of the funnel. Throughout a traditional sales process one of the first things a seller does, is finding the motivators behind a buyer’s decision to make a purchase.

However, we often see founders forego the research to understand an investor’s motivation. Sure, they’ve got to return capital to their investors. But how do they raise capital for their fund and who are their investors?

Understanding the Limited Partner and VC Relationship

A VCs job is to raise capital from limited partners, generate returns in 10-12 years, and do it again. Venture capital firms are funded by limited partners (LPs). LPs are generally institutional investors like university endowments, foundations, pension funds, insurance companies, family offices, sovereign wealth funds, etc. These institutional investors often have much larger funds and use a small % (typically 5%) of their investment capital to diversify with venture capital funds.

Historically, a VC fund is generally not a great investment. According to Scott Kupor, “If you invested in the median returning VC firm, you would have tied up your money for a long time and have generated worse results that the same investment in Nasdaq or S&P 500.” So why would an LP invest in a VC fund at all?

The Power Law Curve

VC funds do not follow a normal distribution, they follow a power law curve. For the sake of this post, a power law curve is when the distribution of returns is heavily skewed. Or simply put, a small % of firms capture a large % of industry returns.

This means that a small % of VC funds take home a large % of venture returns. VCs are constantly working to make their way into the “winning” part of the curve so they can continue to attract capital from limited partners.

How does a VC fund become a “winner?” The best VC funds portfolio returns also follows a power law curve. A small % of a VC funds investments will yield the majority of their returns. What does all of this mean for a founder?

Why the Market Matters

VCs are in pursuit of investments that will yield massive returns for their LPs. Generally speaking, this conversation starts and ends with total addressable market. Without a compelling market, a company is capped by the returns they can generate. This does not mean that the market has to be big now, but has the chance to develop into a major market (check out this example on Uber’s TAM). Check out our free guide for modeling your TAM here.

Why the Fund Age Matters

When raising capital, be sure to ask investors questions about the age of their fund and the capital they’ve committed. Remember that a VC generally returns funds to their LPs in 10-12 years. If their fund is getting older in age, they may feel pressure to create returns for their LPs. This pressure may be passed down to portfolio companies and could force you into an early exit.

A younger fund will feel less pressure to generate returns and will likely have capital set aside for a follow on round. A younger fund may be eager to put capital to work and will help speed up the fundraise as well.

Why the Portfolio Performance Matters

It is also important to understand how the rest of the portfolio is performing. Are there a number of standout companies? Would you be the standout company? If the overall fund is performing well, your likelihood of raising capital at a future date is higher. If the overall fund is performing poorly, you may be pushed to exit so they can generate returns for their LPs.

Understanding the motives behind a VCs investment process is an easy way to conduct your own due diligence on potential investors. Remember that fundraising starts and ends with relationships. To find the right investors for your raise get started with Visible Connect, our investor data base. Give it a try below:

Be prepared, do your research, and ask the right questions to make sure you’re building relationships with the right people.

founders

Fundraising

How to Find Investors

6 Effective Ways to Connect With Investors

One of the first questions on a startup owner’s mind is how to find investors. Angel investors, grants, venture capital: all of it goes towards making sure that your business can grow and thrive. Finding funding is one of the most pressing concerns for a startup, especially a new company. And it can be difficult to know where to start.

How to find investors to start a business will vary depending on the type of business you have, as well as the type of funding you’re looking to procure. You may need to change your strategies depending on your industry, the size of your business, and your business model. There are certain types of funding that are more useful depending on the type of business.

Yet regardless of the type of business you have, there are specific things that your business will need to do to ready itself to procure investors. To find investors, you’ll need to have a clear and concise business plan, in addition to current financials. Your financial statements will need to be accurate and timely, as you have to show that your company is stable.

Related Resource: 6 Helpful Networking Tips for Connecting With Investors

Related Resource: How to Find Venture Capital to Fund Your Startup: 5 Methods

Learn more about finding the right investors for your business below:

1) Use a Powerful Online Platform

When searching for investors the best place to start is with the resources that are immediately available to you. Thankfully for startup founders, there is countless platforms, lists, and databases full of active startup investors. At Visible, we offer a free investor database, Visible Connect, with the data and information founders need to build out their fundraising pipeline. Give it a try here.

Related Resource: How To Find Private Investors For Startups

2) Get Your Startup at a Networking Event

After you’ve done some preliminary research, it is time to hit the ground running and get in front of the investors that you believe are the best fit for your business. One of the most common ways to find investors is by attending a networking event. Startup networking events have become very common and can be found in most major cities.

Related Resource: Investor Relationship Management 101: How to Manage Your Startups Interactions with Investors

Related Resource: 7 of the Best Online Communities for Investors

3) Reach Out to Friends and Family Members

If you’ve determined that venture capital or particular investors might not be best for your business you can turn to friends and family (or angel investors). Approaching friends and family can be a delicate situation and needs to be treated thoughtfully. Learn more about raising capital from friends and family in our guide below:

Related Resource: 7 Tips for Raising a Friends & Family Round

4) Network Online Using Social Media

Startup investors are notorious for their use of Twitter and other social media platforms. Social media, especially Twitter, can be a powerful tool for a founder looking to find an introduction to an investor. If you find an investor you have on your target list is a frequent Twitter user, don’t be afraid to Tweet at them or reach out via direct message.

5) Utilize a Crowdfunding Platform

As the startup space continues to grow so do the funding options available to startup funders. Over the past decade, crowdfunding has taken the funding world by storm. While it is not for every business, crowdfunding can be a valuable tool. Learn more about raising crowdfunding below:

Related Resource: How to Raise Crowdfunding with Cheryl Campos of Republic

6) Apply for an Incubator Program

As put by the team at Investopedia, “An incubator firm is an organization engaged in the business of fostering early-stage companies through the different developmental phases until the companies have sufficient financial, human, and physical resources to function on their own.”

Incubators can be a valuable tool for startups looking to work through the early phases of building their business and model. Oftentimes, this comes with a built-in network of startup investors and opportunities to pitch them for future investment.

How to Find Angel Investors

How do you find angel investors? They may be closer than you think. Angel investors are usually your very first investors, and many of them come from your family and friends. An angel investor is simply an individual who has money to invest: they invest it directly through you. Often, angel investors are available even when you can’t get venture capital or a traditional bank loan.

Angel investors have numerous advantages. They are less likely to have strict requirements. They are more likely to loan you affordable money — either at low interest rates, or for a small share in your business. While traditional investors often require that you have a proven business model and financial statements to match, angel investors simply need to believe in your business.

When courting investors from family and friends, you’re working with those who already know you best. These are individuals who know that you’re trustworthy, that you are confident and capable, and that you have a solid business idea on your hands. Rather than having to prove yourself through business proposals and raw numbers, you can instead bank on their familiarity with yourself as an entrepreneur.

If there are no prospective investors in your immediate family or friend group, you can begin networking with those you know. By letting the people you’re close to know that you’re in need of funding, you may be able to connect with a friend-of-a-friend or a more distant family member. This is an opportunity not only for you but for them. If you truly believe in your business, then you know that you’ll be able to pay the money back and more.

And an angel investor doesn’t necessarily need to be someone you know. There are networks of angel investors online who are specifically looking for opportunities, though they may be more difficult to court than someone you have a prior existing relationship with. An angel investors network will connect you to a broad spectrum of investors, often who specialize in different types of business.

If you cannot find angel investors, you may need to instead turn to venture capital or a bank. But this is going to take a lot more work. You may need to fund your business yourself until you can prove that it has revenue-generating potential, or you may need to grow slowly as you prove yourself capable of dealing with conventional credit lines and debt.

Angel investors are by far the easiest way to aggressively grow your business, and they should be courted whenever possible. But because it relies upon knowing someone who has the cash to invest — or at least finding someone through someone you know — it can be a challenge.

Related Resource: How To Write the Perfect Investor Update (Tips and Templates)

How to Find Small Business Grants

If you’re unable to find an angel investor, a small business grant may be a better solution. Small business grants are grants awarded to small business owners in specific locations, industries, or of particular demographics. These grants are intended to encourage the health of small businesses: a successful small business is often foundational to a local economy’s strength.

Most small business grants have fairly specific restrictions. There are grants for rural businesses, technology-focused businesses, and innovative businesses. A business must often write a grant proposal which outlines why the business needs the grant, why they are worthy of the grant, and what they will do with the grant money. This is very much like a proposal for a loan.

However, as long as the small business meets the terms of the grants, it doesn’t need to pay the grant money back: the grant money is gifted to the business to help it grow. Grant proposal writing is a fairly niche specialization, so many businesses (especially startups) may want to hire a grant writer to complete their proposal. There’s no limit to the number of grants a business can apply for; small business owners may want to apply for as many as they feel qualified for.

Connect With More Investors With Visible

Connecting with the right investors is crucial to funding success. In order to better help with your fundraise, we’ve got you covered.

Related Resource: A Step-By-Step Guide for Building Your Investor Pipeline

Find the right investors for your business with our investor database, Visible Connect. Add them directly to your fundraising pipelines in Visible, share your pitch deck, and send investor Updates along the way. Give Visible a free try for 14 days here.

founders

Fundraising

Reporting

3 Key Takeaways from our Series A Webinar

Last week, we hosted a webinar on how to raise a Series A. In it, Zylo CEO & Co-Founder Eric Christopher and I shared tactics and advice on how to make sure your Series A raise is a successful one. If you made it, thanks! We had a great turnout of engaged audience members. If you weren’t able to make it, you can check out the recording below:

Today, I want to share three key takeaways from the webinar, in the hopes that they might help you raise your next funding round.

How to know if you’re ready to raise?

Series A readiness is a difficult thing to pin down. So much depends on your specific situation: the industry you’re in, the product you’ve built, your business model. A good breakdown of specific numbers you should be hitting can be found here, but even that list isn’t universal.

As a general rule, though, you’ll know you’re probably ready to raise your Series A when you have these three things: an engine, healthy metrics, and a compelling story to tell.

“An engine” refers to a predictable engine for acquisition. Acquisition of what, exactly, will depend on your company; it could be users, customers, revenue, etc. The important thing is, do you have a predictable way to acquire more?

Healthy metrics refers to three general patterns: accelerated growth, low churn, and efficient acquisition. If your metrics demonstrate all three of these things, you’ll be very attractive to potential investors.

The third item is this: can you tell a compelling story? This is potentially the most important item of the three. Every investor wants to invest in a good story. If you can effectively communicate what you’ve done so far, then paint a clear picture of what the future will look like if you keep succeeding, you’re likely to have success with your raise. If an investor likes the sound of that future and they believe you can make it happen, they’ll invest.

Before you raise, commitment is key

If you think your company is ready to raise a Series A, the first thing you have to do is prepare yourself. You have a lot of hard work ahead of you.

A Series A raise takes, on average, about 5.5 months to complete. That’s a lot of time where your focus will be outside of the day-to-day of your business. You’re also going to face a lot of rejection—the most common answer after pitching an investor, after all, is “no.”

A CEO/Founder who is undertaking a Series A round needs to be fully prepared to do so—committed to seeing it through, confident in their pitch, and always working with a specific goal in mind. Before diving into your Series A raise, you need to make sure you’re prepared for what it means.

Don’t forget about your current investors

Your current investors can be absolutely essential in closing your Series A round—whether they participate in the round or not.

If your current investors choose not to follow on—for whatever reason—they can still be a huge help to you as you raise your round. They can provide everything from pitch feedback to warm introductions to other investors who might be a better fit.

These are just three takeaways from our webinar on raising your Series A round, but there’s plenty more content where that came from. Check out the recording below:

founders

Fundraising

Reporting

Tips from YC: Using Asks, Metrics, and a Recap to Power Your Investor Updates

Y Combinator has funded over 1900 startups since their inception in 2005. In the process of funding those startups, YC receives thousands of investor updates on an annual basis. As Aaron Harris, Partner at YC, puts it, “At YC, we get lots of updates from our alums. There seems to be a correlation between quality and frequency of updates and the goodness of the company and founders.”

Over the past year, we’ve had thousands of founders share Updates with their investors and other stakeholders. While investor updates come in all different shapes and sizes, we’ve found that most, if not all, include some form of the following: a quick recap of the last month, metrics and KPIs, and specific asks for your investors. To this point, Aaron Harris of YC suggests using the same components but has interesting thoughts about the order of these components what specific information should be shared.

Metrics & KPIs

Metrics and KPIs are included in almost every Update template we’ve seen come across our table. Including your key metrics with growth percentages is widely expected. Aaron Harris suggests sharing your KPIs and growth percentages first when reporting to your investors. Sharing high-level growth metrics and financial status metrics are what you are looking for here. Examples include revenue, cash in bank, and burn rates. No matter what you decide to share, make sure the metrics are defined and explained to your investors and repeated on a monthly basis.

Targeted Asks

Making targeted asks to your investors is arguably the most impactful part of an investor update. If engaged properly, investors are more than a source of capital. They have experience, advice, and networks you can leverage. Don’t be afraid to ask your investors help with closing deals, finding talent, and future fundraising. Regardless if you put asks first or second in order, Aaron recommends putting it as close to the top as possible to make sure your investors see it and can help where needed.

Quick Recap

Interestingly, Aaron suggests putting the qualitative recap of your month towards the bottom of your investor update. While we often see founders lead with a recap, ending with a recap will ensure that your investors see both your metrics and targeted asks. Make this as short as possible and be sure to only add things that are vital to your success. At the end of the day, investors are busy and you want to make sure they read your entire update.

These are just a few elements to consider when deciding on the structure of your investor update. To see these elements in context or create an update yourself, check out our Y Combinator update template below.

Check out an example of the Y Combinator Investor Update Here >>>

founders

Fundraising

Tips for Creating an Investor Pitch Deck

What is a Business Pitch Deck

Overview

A pitch deck is a vital part of a successful fundraise. Nurturing and constantly communicating with your investors and potential investors throughout the process can double your chances of raising follow-on funding. Founders and other startup leaders choose Visible for their investor reporting because we make it dead-simple to compose, distribute and track all of your updates in one place.

Being able to quickly and effectively pitch your business or product is vital to raising capital, attracting talent, and closing customers. A pitch deck should tell a compelling story and give reason for outside stakeholders to invest their time, money, and resources into your business. There are numerous free pitch deck presentation templates available online. To enhance your presentation further, utilizing the best pitch deck software can provide advanced design features and customization options. Below, we highlight our favorite free pitch deck templates and examples.

Recommended Reading: The Understandable Guide to Startup Funding Stages

What is a Business Pitch? A Business Pitch Template for Success.

A business pitch is a presentation to a group of stakeholders, mainly investors, but can also include potential customers, team members, and potential hires. A business pitch can be given in many forms including a pitch deck, email, PDF, or an impromptu conversation. Once you have a business idea you most likely work on putting together a business plan. Once you have a business plan in place it is time to get a pitch dialed for your startup.

The most effective business pitches include a combination of the forms listed. Everyone in your business should be able to pitch your business in some form (e.g. elevator pitch). So what makes up a great business pitch template?

First, make sure your business pitch is concise and easy-to-understand. You should be able to pitch your business in a few sentences and should be easy to understand what your business does. Everyone in your organization should be able to complete a simple pitch of your business.

Second, you need to answer this question; who is your audience? You need to tailor your business pitch to who are you pitching. Think about what you are trying to accomplish and what the person’s ultimate end goal is. If you’re pitching an investor, why should they give your business money? If you’re pitching a customer, why should they pick your solution over other options? If you’re pitching a potential hire, why should they pick to work for you over a different company?

Create a business pitch template to make sure everyone in your business can tell the same story and pitch your business in an effective manner. Below we lay out a free pitch deck template that will help turn your business pitch into a compelling story.

Related Resource: Investor Outreach Strategy: 9 Step Guide

How to Build Your Investor Pitch Deck (A Best Practices Template)

The free pitch deck template here is largely based off of the Guy Kawasaki Pitch Deck Template. Guy’s free pitch deck template is a great start for putting together your pitch deck then tailoring it to your needs. The pitch deck design is built for a total of 10 slides. Below are the pitch deck design and slides that Guy recommends using to pitch your business or product.

Download our free pitch deck template here or below:

Related resource: 23 Pitch Deck Examples

Pitch Deck Slide 1: Company Information

The first pitch deck slide of your business pitch is straightforward. A simple slide that shares an overview of your business. Use this slide to set the stage for your pitch deck design. The most important thing to remember when making your cover slide is this is often your first impression with the investors you’re pitching. These are investors who have seen a lot of pitches, so getting their interest and attention quickly is important. Your cover slide is your best shot at doing that.

Related resource: Our Guide to Building a Seed Round Pitch Deck: Tips & Templates

So what makes a great cover slide? Just a few important elements:

Sharp design. If there’s a slide to fuss over, design-wise, it’s this one. Remember, you’re making a first impression here. Good design is key. Related Reading: Pitch Deck Designs That Will Win Your Investors Over

Your logo. Obviously.

What you do (or tagline). This is the element that is most often omitted, but it’s critical. You want to provide context right away, orienting the listener to what your business is all about. Don’t get cute here—the more straightforward, the better.

Contact info. This is especially important when you’re sending the deck via email before or after the pitch. You want the names of the people who are pitching, some direct contact info (probably email) and a place online where the investor can learn more about you, whether that’s your home page or a social media profile.

As I mentioned, a lot of startups get this slide wrong. A good example is the cover slide from SteadyBudget, which is now Shape.io.

Pitch Deck Slide 2: Problem Solving

The second pitch deck slide consists of what problem you are solving. This can take form in what the opportunity is or what the pain your potential customers are feeling. Use social proof or a story to clearly demonstrate how potential customers are evaluating and solving the problem with current solutions vs. your solution.

The problem slide from Airbnb’s original pitch deck is a great example.

Related Reading: How to Write a Problem Statement [Startup Edition]

Pitch Deck Slide 3: Value Proposition

The third pitch deck slide should explain the value proposition that you are offering. This explains the direct value that your customers receive when choosing your product or solution. This is where your business pitch template will come in handy as you describe your value. Statistics, stories, and first hand data can be a valuable tool for the third slide.

Pitch Deck Slide 4: Your Differentiator

The fourth pitch deck slide explains what differentiates your solution than others in the market. Guy Kawasaki suggests using a visual pitch deck design here by using images, charts, and diagrams of your “secret sauce.” Instead of using text to explain the differentiator use visuals. If your secret is in the product, use this as an opportunity to show product screenshots or a demo video.

Pitch Deck Slide 5: TAM & Opportunity Breakdown

The fifth pitch deck slide should contain your business model. This shows how you are, or plan, to make money. The goal of this slide is to demonstrate the addressable market and portraying why your company has the ability to generate huge amounts of revenue to attract a large payout for the investors. Check out our Total Addressable Market Template to help get started with your TAM model.

Mathilde Collins, CEO of Front, has a great example of an opportunity in her Series C pitch deck. The slide clearly shows how the large the opportunity is (and later details how the Front product can win the market).

Pitch Deck Slide 6: Customer Acquisition and Go-to-Market

Being able to show a repeatable and efficient process for acquiring new customers is a must. Investors want to make sure that they will not be throwing their money down the drain. Going into a pitch with potential investors you need to understand your revenue model and go-to-market strategy like the back of your hand.

Make sure your GTM strategy slide is easily digestible and can be easily understood without added context.

One of the key metrics that investors will want to understand is your costs to acquire a new customer. (Learn more about CAC here).

It is important to demonstrate to your investors that your customer acquisition costs are less than your customer lifetime value. This will help showcase your path to profitability.

Ablorde Ashigbi is the Founder and CEO of 4Degrees. Earlier this year, Ablorde wrapped up a round of financing for 4Degrees. We went ahead and asked Ablorde what tips he has for founders looking to showcase their CAC in a pitch deck. His response:

Don’t present CAC without a corresponding view of LTV

Don’t present a blended CAC (including both organic and paid – only include conversions that came from paid channels)

For earlier stage companies, payback period equally (maybe more) important than pure LTV / CAC

When it comes to presenting your GTM strategy and customer acquisition costs it all comes down to simplicity. An investor should be able to take a look at your slide and know exactly how your business functions.