Blog

Visible Blog

Resources to support ambitious founders and the investors who back them.

All

Fundraising Metrics and data Product Updates Operations Hiring & Talent Reporting Customer Stories

founders

Metrics and data

7 Startup Growth Strategies

Raise capital, update investors and engage your team from a single platform. Try Visible free for 14 days.

Whether a venture-backed startup looking to attack a massive market or a bootstrapped business, startups are generally in pursuit of growth. One of the main competitive advantages of a startup is the ability to test new growth strategies and move quickly compared to its predecessors.

Related Resource: The Understandable Guide to Startup Funding Stages

Finding a growth strategy or channel can make or break a company. In order to best help you find and develop the growth channels that work best for your business, we’ve laid out a few key strategies below:

1. Develop a strong value proposition

First things first, you need to develop a strong value proposition. As put by the team at Investopedia, “A value proposition refers to the value a company promises to deliver to customers should they choose to buy their product. A value proposition is part of a company’s overall marketing strategy. The value proposition provides a declaration of intent or a statement that introduces a company’s brand to consumers by telling them what the company stands for, how it operates, and why it deserves their business.”

This should be used at the backbone of your growth strategies and can be used to define your channels, messaging, and overall growth strategy. It is important to be thoughtful when laying out your value proposition — talk to customers, potential customers, and other stakeholders to help construct your value proposition.

Related Resource: How to Easily Achieve Product-Market Fit

2. Understand and embrace your target audience

After you’ve laid out your value proposition, you need to define the market and audience you would like to target. This is similar to creating your ideal customer profile.

As put by the team at Gartner, “The ideal customer profile (ICP) defines the firmographic, environmental and behavioral attributes of accounts that are expected to become a company’s most valuable customers. It is developed through both qualitative and quantitative analyses, and may optionally be informed by predictive analytics software.”

Related Resource: How to Write a Business Plan For Your Startup

Identify why a customer wants your product or service

If you’ve properly laid out your value proposition, this should be fairly easy. If you understand the value you are offering your customer, it should be straightforward why they would want to purchase your product or service.

Segment your overall market

For modeling purposes, you will likely start with your market as a whole. From here, it is important to narrow down your target and hone in on your specific segment in a market.

For example, if you are selling snowboards your total addressable market might be every outdoors person but you’d likely want to hone in your market to just anyone that has snowboarded in the last X years.

Related Resource: Total Addressable Market vs Serviceable Addressable Market

Research the market

Once you’ve honed in on your market, you need to make sure you are an expert in all things related to the market. When reaching out to potential customers, chances are they will turn to you for best practices on the market and space. To go above and beyond, come equipped with the right knowledge.

Choose the segmented market

After researching and analyzing the different markets, make the choice. Pick your segmented market and make sure you have the messaging and product in place to win the market.

3. Research and analyze your top competitors

Inevitably, when speaking and targeting potential customers you will be compared to your competitors. In order to best combat any pushback, you need to come prepared. In order to best grow you need to understand how your product or service compares to competitors.

If you can understand your strong points (and weak points) in comparison to competitors you’ll be able to better tailor your messaging and campaigns.

4. Establish smart key performance indicators

As the old adage goes, “you can’t improve what you don’t measure.” When testing and finding growth strategies, it is important to have the right KPIs in place to track your performance.

Related Resource: Startup Metrics You Need to Monitor

Depending on the growth strategy or campaign will dictate what metric you should track. Check out a few examples below:

Return on investment (ROI)

One of the most common KPIs to track in relation to a growth strategy is return on investment. In order to continue investing in a growth strategy, you need to make sure it is generating returns.

As put by the team at Investopedia, “Return on investment (ROI) is a performance measure used to evaluate the efficiency or profitability of an investment or compare the efficiency of a number of different investments. ROI tries to directly measure the amount of return on a particular investment, relative to the investment’s cost.”

Churn rate

On the flip side, growth can be fueled by improving your churn rate. If you’d like to grow your current customer base, focusing on churn rate is a surefire way. Learn more about tracking and improving your churn rate below:

Related Resource: Our Ultimate Guide to SaaS Metrics

Customer acquisition cost

As we wrote in our post, “Customer Acquisition Cost: A Critical Metrics for Founders,” customer acquisition cost is “The sum of the amount that it takes your business to acquire a customer, including time from your sales representatives and marketing and advertising expenses.”

By monitoring your customer acquisition costs, you’ll be able to determine what channels make the most sense for your business. A surefire way to fuel growth is by improving your CAC. For example, if you are running ads at a high cost that do not convert to customers, chances are you’d be better suited to reallocate those costs to a better converting channel with lower acquisition costs.

Customer lifetime value

As put by the team at NetSuite, “Customer lifetime value (CLV) is a measure of the total income a business can expect to bring in from a typical customer for as long as that person or account remains a client.”

By monitoring your customer lifetime value, you’ll be able to boost margins and warrant spending more on acquisition costs. Learn more about customer lifetime value below:

Related Resource: Defining Customer Lifetime Value for Startups: A Critical Metric

5. Scale wisely and effectively

In the early days of building a business, the old adage goes, “do things that don’t scale.” However, as you find your rhythm and have a valuable product with growth strategies that work, it is time to scale. During uncertain times, it is especially important to scale efficiently to work towards profitability.

Scaling involves taking your existing channels and growing them at scale (and ideally improving margins). This means making smart hires that will take certain areas of your business to the next level.

Related Resource: Scaling != Growth

6. Continuously review your business model

As you find the growth strategies and channels that work best, it is important to be consistently evaluating your business model. Markets and customer needs change quickly so it is important to make sure you are staying ahead of them.

This means that you are likely evaluating your different acquisition channels, your product, and your hiring plans. If you find your business is most capable of executing in a certain area (for example, product-led growth), you might want to consider hiring and building your product around product-led growth.

Related Resource: How to Write a Business Plan For Your Startup

7. Engage your investors to build relationships

Once you have found the growth strategies that work best for your business, you’ll need to make sure you have the resources in place to grow and scale. This is capital and talent.

One of the most common ways to source capital for a startup growth strategy is by raising venture capital. You’ll want to make sure that you are engaging with current and potential investors along the way to improve your odds of raising venture capital.

Related Resource: How To Write the Perfect Investor Update (Tips and Templates)

Related Resource: Top VCs Investing in the $100 Billion Creator Economy

Grow your startup with Visible

Finding the right growth strategies for your business is only half the battle. Having the resources in place to track your key growth metrics will help you make informed decisions along the way.

Raise capital, update investors and engage your team from a single platform. Try Visible free for 14 days.

founders

Reporting

Build Stronger Investor Relationships with Video Updates

The following is a guest post from the team at Sendspark. Use Sendspark to connect with customers, investors, team members, and other stakeholders. Learn more here.

Communicating with investors is a skill all founders should hone. Regular and predictable communication is a surefire way to build trust and improve your odds of unlocking an investor’s capital, network, experience, and more. Learn how you can leverage video + email updates to communicate with your investors below:

Why Send Videos in Investor Updates

Whether you’re pitching new investors or updating existing ones, sending videos to investors can help you build investor relationships.

Here are some ways it can help you:

Stand out from the crowd

Build a personal relationship

Show, rather than tell

Save time

Have great communication skills

Let’s dive into the best use cases and strategies that are going to help you close your next round!

When to Send Videos to Investors

1. Investor Outreach

A strong video in your investor pitch can help you get that first conversation.

One question that comes up a lot is should you make a personalized video when pitching investors?

And the answer is a bit nuanced. The world seems to be changing, but right now, I’d still recommend getting a warm introduction to an investor (even if that means cold emailing one of their portfolio founders), and using a video as a supplemental material in your “forwardable email”.

This helps you play it cool, while still getting valuable information across in your blurb and video.

Personalized videos become significantly more important after the first meeting, on your way to closing the deal.

2. Investor Follow Up

Sending a video recap after an investor conversation is a great way to lock in key points. Investors might have had 10 other conversations with strong founders that day, so this short video can remind them what they liked most about you. It can also help you stand out among the competition.

A video recap will give investors a shareable clip to pass around to other partners or decision makers at the firm who didn’t get to speak to you directly. This way, the wonderful aspects that make your pitch unique won’t get lost in translation.

For this video, I’d 100% recommend making it truly personalized to the investor you spoke with. Don’t try to include everything about your business, just the key points that you found best resonated with them during the call.

3. Diligence

When it comes to diligence, video messages can help you speed up the process. Here are some ways you can use video to get to a “yes” faster:

Record over your usage dashboards or product metrics

Request video testimonials from customers who can advocate for your product

Respond to any objections or concerns thoroughly

4. Investor Updates

An investor investing is the first step in a long partnership. Great investor communication over time will help you build a strong partnership, help investors help you, and lead to subsequent checks in future rounds.

Just like in B2B Sales, it’s easier to get your existing customers to pay more than to close new customers. Never take your investors for granted, and continue to keep them informed and excited about what you’re building.

Here are some ways you can strengthen your investor updates with video:

Record yourself discussing your current initiatives

Show off a new feature or product launch

Introduce a new team member or advisor

Request a video from a customer to share why this matters to them

How to Send Videos in Investor Updates

You can send videos in investor updates using Sendspark and Visible together. First, create a free account with Sendspark to easily record videos of yourself or your product.

Sendspark is great for this because…

It’s super fast to record a video of yourself or your product — no editing needed!

Videos will automatically look polished and professional with your own branding and logo

You can add calls-to-action for investors to schedule a meeting, reply with video, or take another next step

You get insight into who’s watching your video, how far they watched, and what actions they’re taking

After creating your video, just paste your video URL into your investor update on Visible. You’ll see the video preview automatically appear in your email, giving you a super polished and professional-looking update. Check out an example below:

Give Visible a free try for 14 days here. Send investor updates, manage your fundraise, and keep tabs on your most important metrics — all from one platform.

Tips for Making Great Investor Videos

Be clear and concise. When it comes to pitching investors, Aaron Blumenthal, Director of Global Accelerator Programs at 500 Startups, says, “every 10 seconds buys you your next 10 seconds.” You need to keep your viewer engaged for the entire length of your video — so make it easy for yourself and keep your video to 20-30 seconds.

Give the gift of information. Whether it’s a pitch, a recap, or an update, reward your viewer with a nugget of information that makes them feel great that they watched the video. That being said, remember rule #1 and don’t try to put everything in the video. Just discuss 1-2 points that are better said or shown than written.

Be conversational. Even if you are recording a video for multiple investors at once, each one is viewing alone, so use singular words like “you” instead of “y’all” to make the experience more intimate and personable. Imagine you are speaking 1×1 to an investor via Zoom — not pitching a room full of people at Demo Day.

Know your video will be shared. This has two implications: (1) don’t put confidential information in your video that you don’t want floating around, and (2) use this knowledge to your advantage with soundbites that you want shared – your vision, your asks, your unique spark, etc. Don’t include content that you wouldn’t want shared among different audiences.

Don’t overthink it. Remember: we are our own harshest critics (especially us founders ????). Investors — especially those who have already invested — love getting these more personal updates. They are not judging you nearly as hard as you are judging yourself (especially if your numbers are up and to the right).

Final Thoughts

When fundraising, and running a business in general, you see a lot of “shoulds.” You should do this, you shouldn’t do that. All great founders do this, and if you don’t, you’ll never succeed. However, that’s not the point of this post. You don’t HAVE to use video when emailing investors. Rather, it’s a great option to have in your arsenal.

My belief is that the founders who win lean into their strengths and indisynchronies. What makes you special? What makes you unique? Video can help you tap into that – and easily communicate who you are, what you’re doing, and why it’s important – in far less time than text. I hope Sendspark helps you have fun and enjoy the ride.

investors

Reporting

[Webinar Recording] ESG Best Practices for VCs

Environmental, Social, and Governance (ESG) principles are becoming a topic of increasing interest in Venture Capital — and for a good reason. Beyond the benefits of long-term, multistakeholder value, the data is clear that environmentally-and-socially responsible companies will outperform in years to come.

On October 4th we discussed ESG best practices for Venture Capital investors with Tracy Barba from 500 Startups and ESG4VC.

Tracy Barba has been working in Venture Capital for the past 25+ years and at the forefront of implementing ESG practices in Venture Capital since 2012. Most recently she joined 500 Startups as their Head of ESG and Global Stakeholder Engagement where she leads the design and implementation of their ESG policy and practices.

We’re grateful she could join us and discuss the following topics:

What is ESG and why is it becoming mainstream now

Best practices for incorporating ESG into your fund processes

Tips for monitoring ESG across your portfolio

Q&A

founders

Fundraising

Pitch Deck 101: How Many Slides Should My Pitch Deck Have?

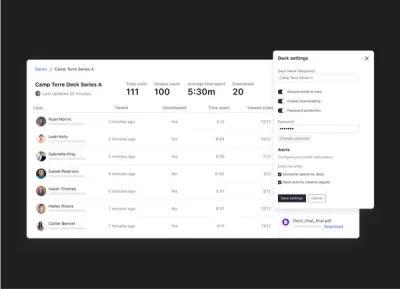

At Visible, we are on a mission to help more founders connect with investors — one of our key tools to help do this is “Decks.” This helps founders share any PDF document with potential investors and colleagues. It enables founders to share documents with security and peace of mind, they know who is viewing their document and the amount of time spent.

We are regularly asked how to construct a pitch deck by startup founders. While there is no silver bullet when it comes to building a pitch deck, we can share the data and best practices we have seen from other founders. We’ve collected thousands of data points related to pitch deck sharing. Learn more about best practices for crafting and sharing your pitch deck below.

The Ideal Startup Pitch Deck Length

The biggest theme we identified is that less is more. The ideal deck size for a stakeholder to view your entire slide deck is 12 slides or less.

We took a look at all decks that had a 100% completion rate. We found across the data set the average length was 12.2 pages/slides.

The average # of slides of a deck uploaded to Visible is 18 slides with a median of 16.

Learn more about how the specific slides and content you should be creating in our pitch deck guides below:

Tips for Creating an Investor Pitch Deck

18 Pitch Deck Examples for Any Startup

How to Pitch a Series A Round (With Template)

Sharing Your Pitch Deck

A pitch deck can be a powerful tool to help founders tell their story during a fundraise. Check out a few of our tips for sharing your pitch deck below:

When to Share a Pitch Deck?

There is a popular debate about whether or not to share your pitch deck prior to a meeting with an investor. Generally, we find it best to share your entire pitch deck until after a meeting. This will enable the pitch deck to be a tool for you. It will be 10-13 slides, that can be a refresher for the investors as to what your company is about. The market you are looking to penetrate. Investors can then click through your slides after your meeting as they discuss and weigh the investment opportunity.

The Teaser Pitch Deck

However, we suggest sharing a short (or teaser) pitch deck with investors before a meeting. This should be around 5 slides and give investors the context they need about your company to have a material discussion about your business in the first meeting. Brett Brohl of Bread & Butter Ventures shares what he likes to see in a teaser pitch deck below:

Related Resource: Our Teaser Pitch Deck Template

No matter how you decide to share your pitch deck, remember to keep it at a reasonable length for investors to easily digest. As our data points out, early-stage startups should try to keep their pitch deck to 14-15 slides at most. Keep things simple. Be brief. Be clear with your value proposition. The average minutes spent viewing a deck is 19.4 minutes. Make that 20 minutes count. As always, it is important to create the pitch deck that is right for your business. Some may require more or fewer slides than others!

Share Your Pitch Deck with Visible

Fundraising oftentimes mirrors a traditional B2B sales process. You are adding investors to the top of your fundraising funnel, nurturing them throughout with meetings, email, and updates in the middle, and ideally closing them as new investors at the bottom.

Just as sales & marketing teams have tools to understand how leads are engaging with their emails and content, the same should be true for a fundraise. By having a tool in place to understand how investors are engaging with your pitch deck, you’ll be able to spend time with the investors that are most interested in your business.

Upload your pitch deck, track the progress of your fundraise with our Fundraising CRM, and share Updates along the way with potential investors using Visible. Give it a free try for 14 days here.

investors

Operations

VC Fund Marketing 101 for Today’s Emerging Manager

By: Kayla Liederbach, Strut Consulting

For today’s emerging manager, attracting the best founders and LPs to join on your quest is a critical piece of your fund journey. In order to do this successfully over the long-term, you must address the one thing so many others run from: Marketing. Yes, good old-fashioned getting the word out! While at the end of the day, word-of-mouth referrals will be the most valuable source of quality deal flow, there are some fundamental bases to be covered when it comes to raising your visibility in the venture capital ecosystem, whether through social media, creating blog content, or hosting events. Below is a quick crash course every emerging manager should take when thinking through their fund’s marketing strategy.

1. Codify your main goal(s)

The first thing to ask yourself is: What are the fund’s primary goals? Every GP has a limited amount of bandwidth, and countless marketing efforts can be made. So before you race out to start recording a podcast, it’s important to think about tying your efforts to activities that are in line with your main business goal(s). These goals can (and probably will) change every year, sometimes even every quarter, and that’s why it’s important to stop and think through them carefully first.

Examples of goals are: Closing your first fund, increasing the number of founder applications by 25%, helping your founders become visible to other investors, cultivating your founder community, and raising another fund.

2. Know your audience

For the most part, your audience is going to be founders and LPs, both current and prospective. Secondary audiences include your community-at-large, the media, and the general public. You want to keep this in mind when deciding what types of content and resources to create and where to share them. LPs and founders are already bombarded with emails and cold outreaches, so GPs need to be thoughtful and intentional about their touch points.

3. Build your audience on social media

I’m going to give away one of my biggest tips: Follow all of your portfolio companies on social media and set up news alerts for each, which will give you an endless stream of ideas to curate meaningful content. After all, isn’t it really all about the founders and highlighting their success? I recommend using Google Alerts, Feedly, Mention, or any other services that work best for you. You can find creative and thoughtful ways to connect yourself to their success story without being braggy. Also, be sure to make a Twitter list of your portfolio companies to see what they’re sharing that’s newsworthy and/or worth re-sharing.

Here’s another tip: Share a mix of your own news and content as well as top-level industry content from others. Think of social media as a cocktail party rather than a sales pitch. No one wants to hang out with that person who only talks about themselves all night. Elevating others almost certainly guarantees positive reverberations.

Some other quick social media tips:

Share a variety of media when you can, including photos and videos, in the main part of your post to increase engagement on the algorithm.

Links are certainly interesting and relevant, but contained media posts on platforms like LinkedIn actually perform better because they increase dwell time (meaning, LinkedIn wants people to stay on LinkedIn).

Create public Twitter lists to engage with your portfolio companies and private Twitter lists to engage with writers and other influencers.

4. Start posting thoughtful blog content

If you’re investing in early-stage companies, one way to help boost their visibility is to write a blog post when you invest in them or when they have a newsworthy moment. This not only elevates the founder(s) and the company in a meaningful way but also serves as a topic of interest to share on your social media! As a general rule, you should be sharing your blog posts at least two to three times on both Twitter and LinkedIn. Aim to say something unique or different each time you share, such as (1) using the title of the article in the first post, (2) highlighting a great quote from the article in the second post, and (3) sharing a quick but thoughtful summary or insight in the third post.

Some solid ideas for blog posts are:

Company profiles (this can be written by anyone on the team).

A post about why you invested that’s written by you (obviously!).

A founder’s background story, which requires an interview with the founder or founding team.

5. Keep people engaged

Now that you’re churning out awesome content and tracking portfolio news to share on social media, you can start recapping highlights from the past month or quarter and curating it into a quality newsletter.

Creating a newsletter is also the perfect way to let your community-at-large know what types of startups you’re looking to invest in, which in turn helps to drive referrals. If you’re able to segment your newsletter into one that’s founder-focused, one that’s LP-focused, and one for a more general audience and customize content accordingly, that’s even better! Doing so allows you to create a current and clear call to action for each segment to increase engagement.

Events are a tested and true way to further engage your community. Especially after enduring the last two years, meeting in person for things like intimate founder dinners to larger summits is more compelling than ever before. However, you can also leverage the virtual power of webinars as a way to connect with founders throughout the year. Bringing in experts who can teach about topics that matter to founders most—like fundraising, PR, sales, marketing, and people ops—is a powerful way to capture their attention while allowing them to learn and also engage with their peers.

Final note: Don’t forget about the power of internal comms.

I know I’ve talked a lot about external-facing marketing initiatives that can raise your fund’s visibility to the outside world. But keeping your own community of founders, LPs, and your employees informed and engaged through internal comms is what’s going to help your firm’s brand stand the test of time.

Never forget that helping your founders as much as possible—especially while their budget for in-house marketing talent might be tight to nonexistent—is what’s going to lead to future (valuable) referrals to other founders. And, if your founders love you and are grateful for your support, they might just mention you to the media when they have major news of their own. We all love a good shoutout, am I right? 🙂

Kayla Liederbach is the Communications & Marketing Manager at Strut, a venture capital consulting firm providing operations, marketing, and people ops expertise to funds of all shapes and sizes. If you would like help with your firm’s marketing and communications strategy, get in touch at ops@strutconsulting.com.

Three ways Visible can help VCs with their Fund Marketing:

Create a custom branded Investor Update Template for our Template Library. Get in touch with us at Matt@Visible.vc if you’re interested

Create or update your Fund profile on our Connect Investor Database. This is an investor database used by 3,000+ founders.

Get featured in one of our Investor Spotlight List Articles. Get in touch with us at Angelina@visible.vc if you’re interested.

founders

Metrics and data

How to Calculate Runway & Burn Rate

Building a venture-backed startup is difficult. On top of building a useful product, hiring a great team, and attracting qualified customers, founders need to be a 1 person finance team (in the early days).

When just starting and scaling a business, founders likely have no dedicated finance team in-house to lean on for insights. Founders need to rely on their own financial savviness (hopefully with the help of an accounting firm) to keep finances in check.

In order to efficiently grow your business, you need to have an understanding of your cash position. Learn more about calculating and tracking your startup runway below.

Related resource: How to Reduce Burn Rate: 8 Cost-Saving Strategies for Startups

What is Startup Runway?

A startup runway is exactly what it sounds like — it is the amount of time (generally in months) a startup can operate before it runs out of money. For a profitable business, this metric likely means little. However, an early-stage startup that has yet to monetize its product or service will need to pay close attention to its runway.

Related Resource: The Understandable Guide to Startup Funding Stages

Your startup runway will inform how you hire, develop products, and finance your business in the coming months and years.

What is Startup Burn Rate?

The first component of your startup runway is your burn rate. According to Investopedia, “The burn rate is typically used to describe the rate at which a new company is spending its venture capital to finance overhead before generating positive cash flow from operations. It is a measure of negative cash flow.”

Related Resource: Startup Metrics You Need to Monitor

Simply put, the burn rate is the amount of money your business is “burning” every month. For example, if your business is spending $5,000 a month on salary, $1,000 on software, and $500 on office space but has yet to bring in any revenue your burn rate would be $6,500. Your burn rate is generally the input that you can dictate the most when it comes to extending your cash runway.

Related resource: Burn Rate: What It Is and How to Calculate It

Formula for Startup Runway

Calculating your runway is simple and something that every startup founder should hone, especially in the early days. To calculate your runway, simply take your beginning cash balance and divide it by your monthly net burn rate as shown below:

Related Resource: 6 Metrics Every Startup Founder Should Track

Real-Life Example of Startup Runway

For a real-life example of calculating a startup’s runway — let’s take an early-stage venture-backed company that raised a few million dollars in VC money and has been at it developing its product. At the beginning of the most recent period, their cash balance is $320,000 and their monthly burn rate is $20,000. You’d simply divide $320,000 by $20,000 to get a runway of 16 months.

How Much Startup Runway Should You Have?

There is no right or wrong answer when it comes to determining how long your cash runway should be. Your company’s stage, current market, and business model might impact how long your runway should be. As a general rule of thumb, it is suggested that seed and series A companies have a runway of 12-18 months

Formula for Burn Rate

Like startup runway, burn rate is a straightforward formula — especially for founders who have their cash statements and metrics in place. To calculate your burn rate, simply take your beginning cash balance, subtract your ending cash balance and divide that by the # of months over the given period. Typically it is better to calculate your burn rate over a longer period of time as a single month could be lumpy as expenses vary from month to month.

Related Resource: What is a Startup’s Annual Run Rate? (Definition + Formula)

Real-Life Example of Startup Burn Rate

For a real-life example of calculating a startup, let’s take a startup that raised $3M and already had $200k in the bank bringing its cash balance to $3.2M. Fast forward 6 months and their cash balance is now $2.6M. Using the burn rate formula that would mean their monthly burn rate is $100K ($3.2M – $2.6M = $600K / 6 months = $100K) as shown below:

Ways to Extend Startup Runway and Reduce Burn Rate

As we mentioned earlier, the easiest way to manipulate your runway and extend your runway is by controlling your monthly burn rate. Learn more about how to extend your runway below:

Drive More Sales

First and foremost, the best way to extend your runway is by driving more sales. Of course, this is likely already a goal of your business (unless your business is not ready to monetize your product or service). By driving more sales you’ll be able to increase your cash balance and in turn, extend your startup’s runway.

Cut Non-Essential Expenses

The most straightforward way to extend your startup’s runway is by cutting non-essential expenses. This can feel difficult as it can impact your team’s day-to-day operations — however, this can be done in a thoughtful manner that extends your runway. For example, consolidating software or removing marketing channels that might not be performing well is a good way to extend the runway.

Related resource: The Only Financial Ratios Cheat Sheet You’ll Ever Need

Utilize Corporate Credit Cards and other Funding Sources

You can also get creative with the financing options that your business leverages. While venture financing might take months to get cash into your bank account, new funding options could be of interest. Learn more about alternative ways to fund your business below:

Related Resource: Checking Out Venture Capital Funding Alternatives

Track Runway With Visible

Runway is a vital metric for early-stage startups. Every startup founder should be in tune with their runway and use it to inform spending decisions and strategy for the coming months and years.

Tools and software are a great way to keep tabs on your finances. Track key metrics, send investor Updates, and track the status of your next fundraise with Visible. Give it a free try for 14 days here.

Related resource: What is Internal Rate of Return (IRR) in Venture Capital

founders

Fundraising

Bootstrapping 101: Pros & Cons of Bootstrapping Your Startup

Founding and growing a startup is difficult. On top of developing a great product or experience, founders need to hone all aspects of their business — financing, hiring, etc.

Founders are faced with countless funding decisions – none of which come easy. On the Visible Blog, we oftentimes talk about venture capital. However, there are other options that are better suited for some companies. One of which is bootstrapping.

Related Resource: Alternatives to Venture Capital

Learn more about bootstrapping and what it means for startup founders below.

Defining Bootstrapping in the Startup World

As defined by the team at Investopedia, “Bootstrapping describes a situation in which an entrepreneur starts a company with little capital, relying on money other than outside investments. An individual is said to be bootstrapping when they attempt to found and build a company from personal finances or the operating revenues of the new company.”

Related Resource: Bootstrapping a Beauty Brand with Aishetu Dozie, CEO of Bossy

On the VIsible Blog, we generally write about how founders can leverage outside financing (like venture capital and angel investors), to fund their business. Bootstrapping foregoes outside funding and requires a founder to leverage their personal savings, credit, time, and customer revenue.

The Pros and Cons of Bootstrapping

Bootstrapping can be extremely beneficial for founders. However, the benefits come with real risks. Learn more about the pros and cons of bootstrapping below.

Related Resource: Building a Calm Company with Tyler Tringas

Pros of Bootstrapping

Bootstrapping is a huge bet for a founder to place on themself. By steering clear of outside funding, founders will need to leverage their own time and resources to build their business. However, a founder placing their own resources on the line does not come with the opportunities to benefit. Learn about the pros of bootstrapping below:

It Allows Owners to Retain Full Ownership of Their Company

One of the downsides of taking on venture funding is the loss of ownership and equity. One of the major upsides of choosing to bootstrap a business is the exact opposite. When choosing to bootstrap a business, founders retain full ownership of the business and will experience all of the upsides in the event of a successful exit or deal.

It Makes Owners Create a Model That Works

When bootstrapping a business there are no “safety nets.” While most founders do not need a forcing function to help them prove a model, bootstrapping heightens the stakes. Bootstrapped founders are risking their own resources so it is vital that they build a successful business.

Path to Profitability

A venture capitalist’s job is to create outsized returns for their limited partners. This means that VCs are in search of companies that can grow into huge companies to create returns. Chances are that outside investors will push for quick growth.

When bootstrapping, founders will likely have a strict budget and need to grow within their own means. While it can possibly limit the possibility of hypergrowth, it can be a great way to grow sustainability and build a long-term company.

Cons of Bootstrapping

Just like any funding option, there are cons of bootstrapping as well. Weighing the pros and cons is a great way to help a founder determine what funding option is right for their business. Learn more about the cons of bootstrapping a business below:

It Can Be Riskier

As we laid out above, one of the biggest perks of bootstrapping a business is maintaining ownership and equity. On the flip side, this means there is no one else to share risk with a founder.

When bootstrapping a business, a founder will put their own resources on the line. If something goes south, it not only impacts the business but has the ability to impact a bootstrapped founder’s personal finance as well.

Bootstrapping Only Offers Limited Support

Being a founder is difficult. There are very few individuals who understand what it takes to find and grow a business. Because of this, it is important for founders to learn from their peers, investors, and leaders in the space. This comes naturally with some funding options. For example, venture-backed companies can lean on investors for help and future capital. For bootstrapped founders, chances are they will have fewer natural networking opportunities with investors and other founders.

It Requires Many Strengths

When building a company, leaders need to have strengths across the board – they might be a technical founder or great marketer, etc. Many founders, they can lean on co-founders and their investors to help balance their weaknesses. For a solo founder or bootstrapped founder, they will need to rely on themselves across the board.

Stages a Bootstrapped Company Goes Through

Companies go through different stages and lifecycles. At their core, most startups follow a similar journey. For venture-backed and bootstrapped companies, this journey might look slightly different but is similar at their core. Learn about the basic stages a bootstrapped company goes through below:

1) Starting Stage

When starting a bootstrapped business, it likely looks no different than starting any other business. The founder or founding team likely has an idea or big problem they’d like to solve. From here, there are the formalities of setting up a business.

However, a bootstrapped founder will have the ability to pursue their new business on the side (or dedicate they full day-to-day). Because there are no outside stakeholders, the pace at which a bootstrapped founder launches is solely up to them.

2) Customer-Funded Stage

Once a bootstrapped founder has built a product and determined channels for distributing their product, they can begin to bring in revenue from customers. While bootstrapped founders can work at their own pace, bringing in customer revenue is vital as it is the likely source of financing and future growth.

3) Profitability & Growth

If a bootstrapped founder can build a product and find their first customers, the next step is profitability and growth. Because bootstrapped companies use their customer revenue to fuel their growth, it is incredibly important they are wise with their spending decisions as customers grow – they likely won’t have the cash cushion and safety net in the early days.

Find Out More Information on Bootstrapping

Bootstrapping can be a great way to fund and build a startup for many startup founders. At the end of the day, founders need to evaluate their funding options and determine what is right for their business. To learn more about bootstrapping and funding a business, subscribe to the Visible Weekly. We curate the best resources to help founders hire top talent, raise capital, and build great products. Sign up here.

founders

Fundraising

6 Helpful Networking Tips for Connecting With Investors

Fundraising is a challenge. We find that the most successful founders treat a fundraise like a traditional B2B sales process. It is a game of relationships and is important that you are connecting with and finding the most qualified investors for your business — just as a sales and marketing team finds the best leads for their product.

Related Resource: 9 Tips for Effective Investor Networking

In order to help you better connect and find the right investors for your business, we’ve put together a quick guide below:

Understanding the Different Types of Investors

First things first, you need to understand who you are talking to. At the highest level, there are different types of investors that are willing to fund privately held companies. From here, you’ll be able to take things a level deeper and identify the specific investor and firms that are best suited for your business.

Related Resource: How To Find Private Investors For Startups

Check out some of our tips for connecting with different types of investors below:

Angel Investors

A common type of startup investor is the angel investor. As we put in our post, How to Effectively Find + Secure Angel Investors for Your Startup, “An angel investor is generally a wealthy individual who is looking to invest spare cash in an alternative investment.” A few tips when it comes to connecting with angel investors:

Warm introductions — find if anyone in your network can make an introduction

Social media — some angel investors might have an online presence. Check out Twitter, LinkedIn, etc. to see if there are any in your network

VC Firms

The most common type of startup investor is a venture capital firm. As defined by Investopedia, “A venture capitalist (VC) is a private equity investor that provides capital to companies with high growth potential in exchange for an equity stake.” VCs are professional investors so it is important to have a strategy when finding and pitching them. A few tips below:

Warm introductions — like angel investors, use your immediate network to find introductions to VCs in your network. Existing investors, other founders, and customers can be great sources of warm introductions

Cold outreach — If you do not have any connections to a VC fund, you can use cold outreach. To learn more, 3 Tips for Cold Emailing Potential Investors + Outreach Email Template.

Events — Many VC funds host events dedicated to founders, or attend larger startup events. Leverage these as an opportunity to meet and connect with targeted funds.

Related Resource: Investor Relationship Management 101: How to Manage Your Startups Interactions with Investors

Banks

Traditionally, banks are a source of capital for businesses. With early-stage startups, bank loans have become less common as they are not able to take the risk on early-stage companies. However, for later-stage and proven startups, bank loans can be a strong funding option. A few things to keep in mind:

Strong performance — your business needs to demonstrate a strong track record and predictability that you can pay back the bank

Collateral & cash — having high-value collateral and a strong cash position will increase the likelihood that a bank approves your leone.

Alternative Investors

New funding options have taken the startup world by storm over the last few years. Depending on your business and model, some of the newer funding options can be an option. Check out a few of the common options below (from our post, Checking Out Venture Capital Funding Alternatives)

Pipe — As their website puts it, “Pipe turns MRR into ARR.” So how does it work? Pipe looks at your monthly contracts and offers a cash advance on the annual value of those contracts. In turn, they will take a small % of that contract for offering the cash advance.

Calm Company Fund — Calm Fund uses their own financing instrument called a Shared Earnings Agreement (SEAL). Essentially, SEALs are geared towards bootstrapped companies that are profitable or approaching profitability.

Corl — Rather than explaining it ourselves we’ll let the Corl website explain what they do. “Corl uses machine learning to analyze your business and expedite the funding process. No need to wait 3-9 months for approval. Find out if you qualify in 10 minutes.”

6 Helpful Tips for Connecting with Investors

No matter the type of investor, there are common tips and strategies that you can use to connect with investors. Making warm introductions, or connections through people in your network, is typically the best way to get an introduction to an investor. However, attending events, networking with peers, cold outreach, and your current investors are great opportunities. Check out some tips below.

Related resource: How to Get Into Venture Capital: A Beginner’s Guide

1) Use the Right Tools or Platform

Just as sales and marketing teams have dedicated tools for their process, so do founders that are fundraising. By using a tool to find and connect with qualified investors, you’ll set yourself up for success and smoother fundraise.

At Visible, we offer a free investor database, Visible Connect, that allows you to filter by the fields and properties that are most relevant to your business. For example, you can search by their investment geography, stage, market, and more. Give it a try here.

From here, you can add your investors directly to a Fundraising Pipeline in Visible. This is the headquarters of your fundraise and allows you to keep tabs on the status of conversations and pitches throughout your fundraise. Give it a free try for 14 days here.

Related Resource: A Step-By-Step Guide for Building Your Investor Pipeline

2) Target the Right Investors

Spending time on the right investors is a vital part of a successful fundraise. Just as a sales team would only spend time on the most qualified leads, the same is true of a fundraise. By building out a profile of what your ideal investor looks like, you’ll be able to focus on the investors that truly matter to your business.

Learn more about determining your ideal investor profile in our post, Building Your Ideal Investor Persona.

3) Build a List

Once you’ve determined who the right investors are for your business, you need to build a list. Over the course of a fundraise, you will hear countless “Nos” so it is important to have a list of investors to speak with. For an early-stage company, we generally suggest having somewhere around 50 investors to speak with. Brett Brohl of Bread & Butter Ventures recommends talking with at least 60:

4) Tell a Data-Backed Story

At the end of the day, investors want to fund companies that have the ability to turn into huge exits and create returns for them and their LPs. In order to help paint the picture of your potential for growth, you need to use data that helps supplement the story.

When discussing with potential investors, you do not need to go overboard with the data you are sharing. Stick to a metric or 2 from your own business that demonstrates traction. You can even share compelling data from the market that shows why you are set up for success.

Related Resource: How to Model Total Addressable Market (Template Included)

5) Reach Out

Having your assets in place is only half the battle. Having a concise plan and tone for reaching out to potential investors is a must. Generally, finding warm introductions to your ideal investors should be the first line of defense. If you are unable to find warm introductions, don’t be afraid to use cold outreach.

Related Resource: 3 Tips for Cold Emailing Potential Investors + Outreach Email Template

Learn about what Ezra Galston of Starting Line Ventures likes to see in cold outreach below:

As we previously mentioned, chances are you will be talking to 50+ investors over the course of a fundraise. It is important to have a game plan and process in place to track conversations and the status of your raise. With Visible, you can find investors, add them to your pipeline, and track the status of your fundraise all from 1 tool. Give it a free try for 14 days here.

Related Resource: How To Write the Perfect Investor Update (Tips and Templates)

Visible Can Help You Connect With The Right Investors

Fundraising is comparable to a traditional B2B sales and marketing process. Just as any sales process starts by finding the right leads, so should a fundraise. Use Visible Connect, our free investor database, to find the right investors for your business. Give it a try and start searching for investors for your business here.

founders

Fundraising

Emerging Fund Managers You Want on Your Cap Table

“Rolling funds, the rise of solo capitalists, crowd syndicates and team-based seed funds all scream one thing in unison: venture capital is growing and getting unbundled at the same time.” TechCrunch

Emerging Managers are Venture Capital Fund Managers whose assets under management (AUM) range from $25 – $100M and have typically raised less than three funds. These types of managers are playing an important role in the ‘growing and unbundling’ of the Venture Capital landscape as they oftentimes focus on previously overlooked founders and markets. Emerging managers bring unique perspectives and experiences to the world of Venture Capital which is why startups should have a solid understanding of this type of investor as they start their fundraising journey.

How are Emerging Managers Different Than More Established VCs

If we compare established fund managers to emerging fund managers, a known investment claimer holds very true, “past results are not an indicator of future success,”– According to Pitchbook research “Nearly 18% of first-time funds nab an internal rate of return (IRR) of 25% while later funds only exceed that number about 12% of the time”.

Many respected LPs have also reported that emerging managers tend to outperform more established funds that are larger scale.

Other distinguishing attributes of Emerging Managers include:

They generally write smaller checks

They’re more hands-on with their fewer number of investments

They’re focused on brand building

They’re agile and less organizationally bureaucratic

There has historically been a high-risk bias on emerging managers because of some constraints that they faced in the past with regards to limited partners, but as they “consistently outperform industry benchmarks” you can see that isn’t holding Emerging Managers back from growing rapidly year over year.

Why Would You Want Emerging Managers On Your Cap Table Instead

Emerging Managers usually come with years of experience from larger funds where they had the chance to learn and work with the big players. Since the IRR of their new funds are the key indicator of success for LPs, they are highly motivated to make their investments successful.

As they are also more agile, they are able to bring more innovation and ideas to the table which allows them to recognize and jump on new trends which takes more time for established VCs to react to.

The number of Micro VCs, which are also considered emerging managers, jumped 9x from 2012 to 2019, “The underpinning insight was that the “generalist” approach by legacy VC created an opportunity for bespoke firms that could better support founders at the early stage in their respective markets and that this would lead to improved outcomes.” Kaufman Fellows

Other benefits of emerging managers include:

They have more real-life experience that’s recent and relevant

They’re more engaged investors and are more motivated to help you out as they’re establishing their brand

“At the end of the day, LPs look for evidence that an emerging manager can, and will, identify the best companies in their area of focus, and be able to win those deals based on their approach, skills, and expertise. The best early-stage VCs bring tremendous value to their portfolio, creating a flywheel of entrepreneur referrals which in turn, fosters that GPs’ success, so they can build the next industry-leading franchise.” Crunchbase Ventures

They have more specialized knowledge pertaining to the focus of your startup.

“LPs typically look to avoid overfished ponds and overplayed deal channels, so you should make a compelling case for why they should follow you off the beaten path. The best EMs have a unique perspective within their area of focus. The prospective LPs you’re targeting need to agree that the approach and space you’re betting on is an exciting place to spend time.” Crunchbase Ventures

They serve as a pathway that enables more diversity in venture.

Emerging Managers include more women and racial minorities than in established VCs, which operate with “predominantly homogenous teams” that have been proven to yield poorer outcomes than in diverse teams.

“Emerging managers are grinders, hungry for success the way a young underdog is against a perennial winner in the sports world. This tightly aligns their goals with LPs – a strong return means both the manager and their partners win.” Gridline

How to Find Emerging Managers

Filter investors by AUM that are less than $100M and (pre) seed and Series A funding stage on our Connect Investor database

Emerging manager training programs (Recast Capital, Strut Consulting, Kauffman Fellows, and the VCI Fellowship for BIPOC First-Time Fund Managers)

Networking Events

Emerging manager communities (Transact Global, Raise Global)

VC Guide’s List of Emerging Managers

Emerging Managers to Check-out

Base Case Capital

Location: San Francisco, California, United States

About: base case capital is an early-stage venture capital firm focused on the next generation of enterprise software.

Investment Stages: Pre-Seed, Seed, Series A, Series B

Recent Investments:

Ashby

Supergrain

Fiberplane

Conscience

Location: Miami, Florida, United States

About: Conscience VC invests into early-stage, science-led consumer companies.

Investment Stages: Pre-Seed, Seed

Recent Investments:

Aqua Cultured Foods

Last Gameboard

Wayfinder Biosciences

Atman

Location: New York, United States

About: We partner with inevitable people. We provide leverage, access, and acumen through aligned principles. We partner with founders at the pre-seed and seed stages. At Atman Capital, every founder in our egregore is a partner of the fund.

Investment Stages: Pre-Seed, Seed

Recent Investments:

Chico.ai

Bamboo

Pipefy

NP-Hard Ventures

Location: Amsterdam, Netherlands

About: We support early teams in Europe and the US to build the infrastructure, tools, and decentralized platforms that simplify the way we work, by making technology more accessible and unlock creativity.

Investment Stages: Pre-Seed, Seed

Recent Investments:

tldraw

Universe Energy

eDRV

Empath Ventures

Location: Los Angeles, California, United States

About: Empath Ventures is a venture capital firm that mainly invests in psychedelic medicine companies.

Investment Stages: Pre-Seed, Seed

Recent Investments:

Freedom Biosciences

MAPS Public Benefit Corporation

Pangea Botanica

Garuda Ventures

Location: San Francisco, Bay Area, California, United States

About: Garuda is an angel fund run by full-time operators Rishi Taparia and James Richards. We spend every day on the founder side of the table.

Investment Stages: Pre-Seed, Seed

Recent Investments:

Paragon

ConductorOne

Arena

Lorimer Ventures

Location: Brooklyn, New York, United States

About: We’re a Brooklyn-based investment firm made up of founders, operators, and financial professionals with experience building and operating businesses from pre-revenue to post-IPO. We bring a founder-first perspective to each startup we back, and strive to be on a speed-dial basis with the founding teams we back.

Investment Stages: Pre-Seed, Seed, Series A

Recent Investments:

Tyba

Circuit Mind

OatFi

m]x[v

Location: New York, United States

About: m]x[v Capital is an up and coming early-stage venture fund building momentum for the next generation of cloud disruptors. We bring a founder and operator perspective to the cap table, helping our founders build their vision, product, and teams.

Investment Stages: Pre-Seed, Seed

Recent Investments:

Epoch

Mailmodo

Postscript

Brickyard

Location: United States

About: Brickyard is an early-stage capital and founder outpost backing builders.

Investment Stages: Pre-Seed, Seed

Recent Investments:

Krepling

Joon App

IRON

Acquired Wisdom Fund

About: Acquired Wisdom Fund helps seasoned professionals create scalable technology products. We invest in early stage tech startups.

Investment Stages: Pre-Seed, Seed

Recent Investments:

Achievable

NOCAP Sports

Angler AI

True Wealth Ventures

Location: Austin, Texas, United States

About: We see value in the impact of women. True Wealth Ventures invests in smart female entrepreneurs, from health innovators to sustainable solution pioneers. Women-led companies have proven they deliver higher returns. It’s time to invest in new perspectives.

Thesis: Women-led companies improving either human health or environmental health

Investment Stages: Pre-Seed, Seed

Recent Investments:

De Oro Devices

Reharvest Provisions

Aeromutable

CapitalX

Location: San Francisco, California, United States

About: CapitalX.vc – enterprise focused generalist with $100k – $500k initial checks in preseed/seed.

Thesis: Women-led companies improving either human health or environmental health

Investment Stages: Seed, Pre-Seed, Series A

Recent Investments:

Simplifyber

Impossible Mining

Front Finance

Overlooked Ventures

About: We support founders who operate early-stage technology companies that are historically overlooked and provide them capital, resources, and connections to scale their business. We’ve been in your shoes. We’re tech founders with 10+ years of experience running companies and making deals. Now we’re authentically supporting entrepreneurs with capital and a founder-friendly focus.

Recent Investments:

Pipe

Stagger

West Tenth

Chingona Ventures

Location: Chicago, Illinois, United States

About: Chingona Ventures invests in founders from backgrounds and industries that are not well understood by the traditional investor.

Thesis: Focus on industries that are massively changing and founders whose backgrounds uniquely position them to create businesses in growth markets that are often overlooked. Focus areas are in financial technology, female technology, food technology, health/wellness, and future of learning.

Investment Stages: Pre-Seed, Seed

Recent Investments:

Cartwheel

Sigo Seguros

Encantos

Forum Ventures

Location: New York City, San Francisco, and Toronto, United States

Thesis: B2B SaaS; Future of Work, E-commerce enablement, Supply Chain & Logistics, Marketplace, Fintech, Healthcare

Investment Stages: Pre-Seed, Seed

Recent Investments:

Sandbox Banking

Tusk Logistics

Vergo

Check out Forum Ventures profile on our Connect Investor Database

Dream Machine

Location: Palo Alto, California, United States

About: Dream Machine is an opportunistic seed fund interested in consumer and frontier tech. It is founded by Alexia Bonatsos, the former co-editor-in-chief of Techcrunch and one of the earliest reporters to write about WhatsApp, Uber, Instagram, Airbnb and Pinterest. With Dream Machine, she hopes to help exceptional founders make science fiction non-fiction.

Investment Stages: Pre-Seed, Seed

Recent Investments:

TTYL

BlockParty

Powder

VamosVentures

Location: Los Angeles, California, United States

Investment Stages: Pre-Seed, Seed, Series A

Recent Investments:

Miga Health

Form Energy

Zócalo Health

Revent

Location: Berlin, Germany

Investment Stages: Series A, Series B, Series C

Recent Investments:

Resourcify

Noscendo GmbH

Sylvera

Spark Growth Ventures

Location: San Diego, California, United States

About: Spark Growth Ventures is a community driven, early & mid stage, vertical-agnostic, technology venture capital firm. Our mission is to support gritty and exceptional founders in their missions by bringing forth the combined value of our strong community. We are fortunate to have a global network of entrepreneurs, C-level relationships, subject matter experts, world-class talent, institutional investors, high net worth individuals and family offices, many of who are investors in our platform. Our team has several decades of global experience in venture capital, entrepreneurship, innovation, executive & board management, functional leadership and advisory work.

Thesis: Capital efficient and scalable business model rooted in tech enabled products and services solving real and large problems. Mission oriented and gritty founders are a must.

Investment Stages: Series A, Series B, Series C

Recent Investments:

Redcliffe Labs

Tab32

Placer.ai

Nomad Ventures

Location: Los Angeles, California, United States

About: Nomad Ventures is an LA-based Venture Fund focused on Early-Stage Marketplace businesses. The GPs (Chris Taylor and James Mumma) are entrepreneurs who have helped build some of the fastest growing startups in recent history (Uber, Uber Eats, Opendoor) and they support founders by providing both expertise and capital to build the next big tech businesses. ???? ???? ????

Investment Stages: Pre-Seed, Seed

Recent Investments:

Intro

Minoan

Lunch

Climentum Capital

About: Climentum Capital is a Venture Capital firm based out of Copenhagen, Berlin and Stockholm. We invest in European startups that can cut down megatons of CO2 emissions in a concrete and measurable way. The fund targets late Seed and Series A investments into the six sectors that demonstrate the largest CO2 reduction potential: – Industry & Manufacturing – NextGen Renewables – Food & Agriculture – Buildings & Architecture – Transportation & Mobility – Waste & Materials As one of the first Venture Capital funds with a double carry structure (with both financial and impact targets), Climentum is dedicated from day one to evaluate and only invest in companies that hold true carbon reduction potential.

Investment Stages: Seed, Series A

Recent Investments:

Entocycle

Qvantum

Continuum

Seed Club Ventures

About: Seed Club Ventures is a Venture DAO backing early-stage founders building at the intersection of web3 and community. With a membership of 60+ leading innovators and investors in crypto, we are diverse in our ability to support projects throughout their life cycle. Launched in partnership with Seed Club, the leading network for DAO builders, our mission is to build a community-owned internet.

Investment Stages: Pre-Seed, Seed

Recent Investments:

Guild

Stability AI

Molecule

Capchase

Location: New York, New York, United States

About:Capchase is the growth partner for ambitious software-as-a-service (SaaS) and comparable recurring-revenue companies. They help founders and CFOs grow their businesses faster through non-dilutive capital, market insights, and community support. Founded in 2020 and headquartered in New York City, Capchase provides financing by bringing future expected cash flows to the present day – thereby securing funding that is fast, flexible, and doesn’t dilute their ownership.

Investment Stages: Series B

Recent Investments:

Fondo

Enerex

BlogTec

Gold House Ventures

About: Gold House Ventures is the definitive fund investing in Asian/Pacific Islander-founded companies. We back founders building industry-changing, culturally-compelling businesses by providing a singular suite of services that includes our accelerator, Gold Rush (whose alumni have collectively raised $500 million+); our talent placement vehicle, the Multicultural Leadership Coalition, which partners with leading multicultural funds to increase diversity in Board and Advisory pipelines; media marketing with every major film studio and streaming platform, and access to Gold House’s network of top Asian Pacific leaders across venture capital, media, entertainment, and tech.

Investment Stages: Pre-Seed, Seed, Series A, Series B

Recent Investments:

CreatorDAO

Xiao Chi Jie

Blossom.team

The Fintech Fund

About: An early-stage venture fund supporting the best fintech and defi teams.

Thesis: The Fintech Fund is a $25M venture fund investing in the top 1% of fintech and decentralized finance startups globally. Our focus is split between more established fintech markets in the US and Europe – for which picks-and-shovels SaaS and infrastructure builders will sell into a growing market of buyers – and emerging markets, where opportunities exist for consumer fintechs to dominate winner-take-all markets.

Investment Stages: Pre-Seed, Seed

Recent Investments:

TrueBiz

GuruHotel

Yave

Vibe Capital

About: Vibe Capital is a $10m Fund that invests in the Web3, AI, and Deep Science sectors at the Pre-Seed and Seed stage. We seek venture-scale returns by leaning in to the volatility caused by the exponential growth of the Web3, AI, and Deep Science sectors intertwining with demographic shifts and climate change.

Thesis: Vibe Capital is a $10m Fund that invests in the Web3, AI, and Deep Science sectors at the Pre-Seed and Seed stage. We seek venture-scale returns by leaning in to the volatility caused by the exponential growth of the Web3, AI, and Deep Science sectors intertwining with demographic shifts and climate change.

More here -> https://vibecap.co/thesis/

Investment Stages: Pre-Seed

Recent Investments:

Pipedream Labs

Circle Labs

Fauna Bio

Origins

About: We’re a new type of VC firm backing legendary consumer founders with an unfair advantage from pre-seed to seriesA. We invest $100k to $500k in consumer tech startups and also come with the power of influence of our LP’s and their 160,000,000 followers. You can reach us at hello@origins.fund

Investment Stages: Pre-Seed, Seed, Series A

Recent Investments:

Matchday

Stadium Live

Upway

Portfolio Ventures

About: The PV Angel Fund is backed by a great mix of investors leading UK angels, successful founders, C-level execs, and corporate NEDs who co-invest alongside the fund and provide strategic support to our portfolio companies.

Thesis: Co-investing tax-efficient capital in the best UK tech startups alongside lead investors.

Investment Stages: Pre-Seed, Seed, Series A

Punch Capital

About: Punch Capital backs early-stage founders who break new ground.

Thesis: Punch Capital backs courageous immigrants at the earliest stages. We are honored to be among Weekend Fund’s Emerging 50: signatureblock.co/emerging-50.

Investment Stages: Angel, Pre-Seed, Seed

Start Your Next Round with Visible

We believe great outcomes happen when founders forge relationships with investors and potential investors. We created our Connect Investor Database to help you in the first step of this journey.

Instead of wasting time trying to figure out investor fit and profile for their given stage and industry, we created filters allowing you to find VCs and accelerators who are looking to invest in companies like you. Check out all our investors here and filter as needed.

After learning more about them with the profile information and resources given you can reach out to them with a tailored email. To help craft that first email check out 5 Strategies for Cold Emailing Potential Investors.

After finding the right Investor you can create a personalized investor database with Visible. Combine qualified investors from Visible Connect with your own investor lists to share targeted Updates, decks, and dashboards. Start your free trial here.

investors

Hiring & Talent

Five Ways to Help your Portfolio Companies Find Talent

In Visible’s 2022 Portfolio Support Survey (full report here), VC Operators reported that the number one support request they receive from portfolio companies is help with sourcing and hiring talent. This makes complete sense considering funds are investing in companies they hope will scale quickly, and in order to do so, companies need to recruit top talent quickly.

This post outlines 5 ways VC Funds can better support their portfolio companies with hiring and talent.

1. Develop recruiting expertise internally at your VC fund.

For funds just thinking about making their first platform hire, consider hiring someone with a recruiting or talent background and making that your defined approach to your VC platform. Alternatively, if your fund has the resources, consider bringing on a Head of Talent either full-time or on a contract basis to lead your portfolio talent initiatives.

2. Bring in external expertise to educate founders.

Invite relevant talent service providers to deliver content to your portfolio companies on the topic of sourcing and recruiting talent. Your companies will benefit by learning best practices from an expert and also by being introduced to a vetted service provider if a company decides to outsource recruiting for a role.

Tip: Record the content and host it in a place where other portfolio companies can access the content in the future. (We like using Notion at Visible).

3. Create a curated list of vetted recruiting service providers.

If you’re not sure where to start, you can begin by asking other founders and VCs where they’ve found talent. Which service providers, job boards, and networks did they use? Document and host this information in a place that can be easily accessed in the future.

Here’s a VC & Startup specific recruiting firm to check out –> SCGC Executive Search

4. Host job-matching networking events.

Hosting events for portfolio companies is a great way to build community and expand networks. Consider hosting an event or session specifically focused on bringing together your portfolio companies and talented candidates for intentional networking.

5. Add recruiting tech to your VC Tech Stack.

If you’ve decided talent is going to be your VC Platform’s area of focus, it may be time to invest in recruiting technology to support your efforts. Here are three recruiting tech platforms to check out —

Bolster – Bolster is an on-demand executive talent marketplace that helps accelerate companies’ growth by connecting them with experienced, highly vetted executives for interim, fractional, advisory, project-based, full-time or board roles. Bolster also provides startup and scaleup CEOs with software, programming, and content to help them assess, benchmark, and diversify their leadership teams and boards. Sign up for a free partner account here to unlock a $2,000 credit for your portfolio companies.

Getro – This is an automated job board that updates as your portfolio companies add or remove job openings from their career pages. It takes the manual work out of connecting people and companies in your network.

Pallet – This is a community-led job matching platform. You can host all your portfolio job opens in a single place to host on your website and promote on social media. For an example of a VC Fund’s pallet board check out K50 Ventures Portfolio’s pallet board.

Visible for Investors is a founders-first portfolio monitoring and reporting platform.

Learn More

investors

Operations

A Guide to Onboarding New Companies into Your VC Portfolio

We can all agree that first impressions are important. Whether we like it or not, our first interactions with someone, often set the tone for the duration of the relationship. This holds true when it comes to welcoming a new company into your fund’s portfolio as well.

This is why it’s important for Venture Capital Platforms to provide new portfolio companies with an organized, well-thought-out, first impression to their post-investment support resources. This will help with company <> Platform engagement and is an opportunity to live up to your fund’s brand promise.

If you’re looking to improve your onboarding experience for new companies, check out the resources and templates in this guide to get started.

This guide covers the following:

1) Sending your initial welcome email

2) Setting up your first introductory meeting

3) Sending out thoughtful swag

4) Integrating founders into your community

5) Scheduling a follow-up meeting

Related Resources:

How to Hire Your First VC Platform Role

Portfolio Data Collection Tips

Visible for Investors is a founder-friendly portfolio monitoring and reporting platform. Schedule time with our team to learn more.

founders

Fundraising

Operations

Business Startup Advice: 15 Helpful Tips for Startup Growth

Raise capital, update investors and engage your team from a single platform. Try Visible free for 14 days.

Building a startup is difficult. Being a founder can almost feel impossible. There are very few people that have been in the shoes of a startup founder. This means that there are very few people that know the difficulties that come along with building and leading a startup.

As a startup founder, you are responsible for hiring and retaining employees, securing capital, developing a product, building culture, and more. Chances are you haven’t lead all of those things in the past. Because of this it is important for you to look to the founders and leaders that have been there before to uncover advice.

Related Resource: 7 Essential Business Startup Resources

Check out our 15 helpful tips for startup success below:

1) Be Persistent

Leading a startup is full of ups and downs. Inevitably, things will not go as planned and will feel like everything is headed in the wrong direction. Paul Graham, Founder of YC, coined the term “trough of sorrow” to explain when your startup loses momentum and feels like things are all headed in the wrong direction.

In order to navigate troughs of sorrow and down periods, startup founders need to stay persistent. You’ll need to focus on what truly matters to your business and stay the course.

Related Resource: The 23 Best Books for Startup Founders at Any Stage

2) Always Be Solution Focused

As we’ve alluded to earlier, founders are pulled in a hundred different directions. — whether it be with hiring, fundraising, or developing a product. It is easy to get distracted and spend your time (and your team’s time) working on projects or initiatives that are not core to your business.

As a startup founder, it is important to stay focused on your solution and the problem you are solving. As Kyle Wong, the CEO of Pixlee, puts it,

“Having a product that does a lot of things but doesn’t do anything well is useless. Your goal should be to definitively say that your product is the best at doing X for market Y. You should ask yourself, “Which customers do I care most about, and what can I do to make their experience better?”

Determine what your company is uniquely good at and stay focused on that solution.

3) Invest in Yourself

When managing a team, it can be difficult to put yourself aside and continue to invest in the team members around you. As a startup founder, it is important that you take the time and resources necessary to invest in yourself. This will differ from founder to founder depending on they do this. For some it might be setting time off from work to hone other skills, attending leadership conferences, etc.

4) Execution, Execution, Execution