Are you a founder building a Health & Wellness, digital health, medtech, or healthcare services startup? If you're actively seeking venture capital, this comprehensive guide is your essential resource. We understand the unique challenges and immense opportunities within this sector, and we're here to equip you with the knowledge and connections you need to succeed.

In this article, you'll discover an up-to-date list of the top venture capital firms actively investing in Health & Wellness globally. Beyond the list, we'll dive deep into actionable, sector-specific fundraising insights, including current global trends, the unique challenges and opportunities within Health & Wellness, and practical tips for crafting a compelling pitch that resonates with VCs. We'll also cover key networking opportunities, accelerators, and resources available to Health & Wellness founders around the world, with a focus on international ecosystem trends, cross-border funding considerations, and major industry events.

Top VCs Investing in Health and Wellness Startups

Altitude Ventures

About: Altitude Ventures aims to maximize value creation through value-added partnerships. AV provides early-stage venture capital financing to healthcare services and technology startups that improve healthcare.

Sweet Spot Check Size: $2M

Asset Management Ventures

About: Asset Management Company made history as one of the first Silicon Valley venture capital firms. Founded and led by Franklin "Pitch" Johnson, the company has been instrumental in the birth and evolution of more than 100 outstanding companies. Asset Management focuses its primary capital investment on the emerging sector of digital health, in addition to the biotechnology and information technology sectors.

Breakout Ventures

About: Breakout Ventures is an early stage fund that backs bold scientist entrepreneurs.

Thesis: Breakout Ventures backs bold companies working at the intersections of technology, biology, materials, and energy.

Civilization Ventures

About: Civilization Ventures is a venture capital firm focused on cutting edge innovations in exponential health tech and biology.

Emmeline Ventures

About: Emmeline Ventures is a female-founded early-stage fund investing in ambitious female founders building businesses that are helping women, in particular, manage their health, build their wealth, and live in a cleaner, safer world.

Sweetspot check size: $ 2.50M

Traction metrics requirements: Pre-seed - Prototype built with initial beta feedback underway; Seed- Early revenues in hand and insight for pivots and PMF emerging.

Thesis: We invest across women's health, financial services, and sustainability specifically where breakout technology and innovaton is helping women live & thrive.

HealthQuest Capital

About: HealthQuest Capital is a growth equity, private equity firm investing in commercial-stage companies across the healthcare industry

LionBird

About: Investing in resetting healthcare's relationship with technology

We provide pre-scale capital and assistance to teams on a mission to fix healthcare

Thesis: We aspire to be the best pre-scale digital health investors out there. That means our focus is on helping founders lay the best foundations for their companies to scale and succeed.

Lotux

Sweetspot check size: $ 50K

Traction metrics requirements: We would like to see some early validation but can invest in pre-revenue stage if we are bullish on the team and the opportunity.

Thesis: Lotux focuses on partnering with mission-driven founders building software-based companies in the pre-seed stage that will improve the lives of the 99% in Latin America.

RH Capital

About: RH Capital a Rhia Ventures fund, is an impact-first venture capital firm that invests in early-stage startups with the potential to transform women's health and increase health equity.

Thesis: We invest across all healthcare segments, including the life sciences (diagnostics, devices, therapeutics), digital health, services, and consumer health, with a focus on contraception, maternal health and a broad range of other high-impact and underserved areas in women's health. entrepreneurs who share a common vision—to improve the health of all women in the US. Underlying all of our work is a continued commitment to gender and racial equity.

SteelSky Ventures

About: SteelSky Ventures is an early stage VC fund investing in Women’s Health.

Sweetspot check size: $ 2.50M

Thesis: SteelSky Ventures invests in companies that improve access, care, and outcomes in women's health. Our innovative approach allows investment across the spectrum of women’s health indications and in technology infrastructure that supports new and innovative care delivery models.

TEAMFund Health Ventures

Sweetspot check size: $ 2M

Thesis: Medtech, Digital health, impact (India and SSA) with global/leapfrog potential

Town Hall Ventures

Sweetspot check size: $ 7M

Thesis: Town Hall Ventures ("THV") is a healthcare-focused investment firm dedicated to partnering with technology and services businesses that address critical patient needs. THV partners with entrepreneurs and teams passionate about changing the United States health care system, focusing on solutions that use innovation to address health inequities.

UNIQA Ventures

About: We invest in outstanding founder teams in InsurTech, FinTech und Digital Health

Sweetspot check size: $ 2M

Fundraising Landscape

Snapshot: Where Capital Is Flowing Now

After the post-2021 cool-down, digital health and Health & Wellness funding has reset and stabilized. Deal volume is healthy, but average check sizes are lower; earlier-stage rounds dominate; AI-enabled companies attract an outsized share; and investors and buyers are prioritizing evidence of outcomes and real ROI over “growth at all costs.”

In Q1 2024, U.S. digital health raised $2.7B across 133 deals, with AI-enabled startups capturing 40% of funding; creative financing structures remained common as founders bridged to milestones. By the end of 2024, total U.S. digital health venture funding reached $10.1B across 497 deals, with late-stage median check sizes stepping down and mega-rounds becoming rarer.

Momentum continued into 2025. In Q1 2025, U.S. digital health startups raised roughly $3.0B across 122 deals, lifting the average deal size to $24.4M versus $15.5M in Q4 2024, with signs of a late‑stage rebound alongside continued early‑stage dominance.

Globally, investors deployed $12.1 billion across 616 deals, with late-stage median rounds climbing to $49 million—the highest since 2021. Europe, led by the UK, saw the fastest growth, and therapeutic areas like oncology, mental health, and cardiovascular care drew the most investment.

AI-driven innovation and evidence-backed outcomes are commanding investor attention, larger checks, and a bigger share of the market.

Outcomes Evidence Is the New Moat

Buyers and investors increasingly require evidence that solutions work in the real world. Rock Health highlights that outcomes data has become central to fundraising and enterprise sales, especially in crowded spaces. Founders should build a lean but rigorous evidence program early: well-structured pilots tied to buyer KPIs, real-world evidence and claims analyses, peer-reviewed posters and papers, and credible reference customers. Align endpoints to your primary buyer—e.g., utilization and total cost of care for payers, throughput and quality metrics for providers, productivity and benefits ROI for employers.

Tip: Include an “evidence pack” in your data room with study design summaries, endpoints, statistical methods, outcomes, and external validation where possible.

Exit and Liquidity Outlook

After a long drought, public exits showed tentative momentum in mid-2024 with listings like Tempus and Waystar, plus a SPAC for Nuvo. Although selectivity is high, a thaw suggests more optionality for top performers with strong margins and visibility.

M&A is expected to tick up in 2025 as late-stage companies face valuation pressure and seek strategic fits; private equity remains an active acquirer for assets with clear operational improvement levers.

What “Great” Looks Like for 2025 Raises

Investors are backing efficient growers with evidence and clear paths to durable margins. Expect scrutiny on CAC payback, net retention, cohort-level gross margins, and disciplined burn. Best-in-class teams show regulatory and security readiness, interoperability, and AI governance. Commercially, they demonstrate repeatable sales motions, multi-year enterprise agreements, and evidence-backed expansions and renewals—all tied to quantified buyer ROI. For AI-native products, come prepared with model risk management practices, safety documentation, and a defensible data advantage.

Global Networking: Accelerators, Communities, and Events

Why Ecosystem Access Matters

The fastest Health & Wellness startups don’t just raise capital; they plug into the right ecosystems to win clinical pilots, validate outcomes, and unlock distribution. Accelerators, operator communities, and events compress learning cycles, surface the right buyers, and generate qualified investor intros. If you have a clear ICP, early evidence, and a defined regulatory path, you’re ready to leverage global networks.

Choosing the Right Accelerator or Venture Studio

Calibrate for fit on sector depth (digital health, medtech, wellness), pilot access and clinical partners, investor exposure, economics (equity/fees), and quality of post-program support. For North America, look for programs that can broker health system pilots or payer access; in Europe/UK, prioritize those with MDR/IVDR and NHS procurement expertise; across APAC, Middle East, and LatAm, seek partners with hospital group relationships and localization support.

Investor and Operator Communities

Engage communities that consistently convene founders with payers, providers, and top investors. Examples include the Health Tech 50 community and Health Tech Forward network (global investor/operator mix), the RockHealth network and Rock Health Summit (U.S.-centric investors, enterprise buyers, and policy voices), and specialist groups in your subcategory. These are valuable for warm intros, evidence design support, and regional “landing pads.”

Be explicit about your asks (pilot design partner in X specialty, payer advisory, co-investor intros), contribute your data (benchmarks, lessons learned), and reciprocate with references and content—this raises your visibility for curated introductions.

Conference and Event Calendar (By Region)

United States

- J.P. Morgan Healthcare Conference (JPM Week): The largest healthcare investor gathering; anchors many high-density side events for partnering and BD.

- BIO Partnering at JPM Week: Structured, double–opt-in 1:1 partnering alongside JPM; strong for scheduled investor and buyer meetings.

- Fierce JPM Week: Editorially led sessions and networking running in tandem with JPM; strong cross‑industry attendance.

- RESI JPM: One-day partnering forum focused on early-stage biotech, medtech, diagnostics, digital health, and AI; dense schedule of investor meetings.

- Rock Health Summit: High-signal investor, operator, and enterprise convening with curated conversations and strong U.S. buyer/investor density.

- Digital Health CEO Summit (invite-only): Intimate, candid roundtables for CEOs; strong peer learning and investor/operator access.

Europe/UK

- Health Tech Forward (Barcelona): Flagship for healthtech innovation and investment; curated 1:1 meetings, Tech Meets Capital, and high buyer density.

- Health Tech Challengers (co-located): Epic startup pitch competition drawing investors and enterprise buyers across key healthtech tracks.

Middle East

- WHX Dubai(World Health Expo): Arab Health transitioned to WHX Dubai (World Health Expo). The region’s largest healthcare exhibition and congress; strong buyer density across hospital groups, distributors, and government, plus extensive side programming for partnerships.

- Global Health Exhibition (Riyadh): Saudi Arabia’s flagship healthcare expo and conference; brings together providers, government, and investors with dedicated content and networking zones.

- Global Health Exhibition — Investor Program: Curated track connecting government officials, VCs/PE, healthtech/biotech startups, and healthcare executives; useful for capital and partnership discussions.

- Global Health Exhibition — NextGen Pitch Competition: Startup pitching platform to meet investors and buyers and showcase innovations aligned to KSA’s health transformation agenda.

How to Pitch a Health & Wellness Startup to VCs

Pitch Strategy: Narrative, Positioning, and Thesis–Market Fit

- Clarify the problem, who pays, and why now; align your story to macro trends VCs are actively backing (AI enablement, outcomes proof, efficiency). Tie your narrative to specific buyer pain points and the measurable outcomes you improve.

- Define your wedge and expansion: start with a focused ICP and use cases, then show how you land, expand, and compound value across adjacencies.

Evidence Plan: Clinical, Real-World, and Economic Proof

- Map your evidence to the buyer (payer, provider, employer, consumer); specify endpoints, study designs, and timelines. Include early RWE, pilot KPIs, and health-economic modeling.

- Prepare an “evidence pack” for diligence: protocols, endpoints, statistical methods, outcomes to date, and references or publications. Leverage outcomes as a moat, per current investor expectations.

Regulatory and Compliance Readiness

- Summarize applicable frameworks (e.g., HIPAA, GDPR, UK DPA, MDR/IVDR, FDA/CE pathways) and where you are on the path. Clarify whether you are a medical device/DTx or wellness product and implications for labeling and claims.

- Outline your security program: data architecture, PHI handling, SOC 2/ISO 27001 roadmap, AI model risk management, and vendor oversight.

Go-To-Market by Channel: Payer, Provider, Employer, Consumer

- Payer: show total cost-of-care impact, utilization shifts, and contractable outcomes; highlight pilots, LOIs, or MA benefits integration.

- Provider/Health System: emphasize throughput, clinician time saved, quality metrics, revenue cycle impact, and EHR interoperability (FHIR/HL7).

- Employer: quantify absenteeism/presenteeism improvements, benefits integration, and claims ROI; showcase broker/TPA partnerships.

- Consumer: demonstrate retention cohorts, LTV/CAC, and engagement drivers; show compliance with claims and marketing standards.

Metrics That Matter: Traction and Efficiency

- Present a metric dashboard tailored to your model: CAC, payback period, gross margin by cohort, net revenue retention, unit economics, and contribution margin trends. Include pipeline coverage and sales velocity.

- For AI-enabled products: add productivity lift, accuracy/precision metrics, error-rate reduction, and governance KPIs.

Product and Data Advantage

- Show why you win technically: proprietary data, integrations, workflow embedding, and model differentiation. Explain your defensibility (data network effects, switching costs, regulatory barriers).

- Interoperability: detail integrations, standards supported, and proof of seamless deployment in target environments.

Team, Advisors, and Clinical Credibility

- Highlight domain-experienced leadership, clinical advisors, and operator talent. Make explicit how expertise reduces risk in regulatory, evidence generation, and commercialization.

The Deck: Structure and Flow

- Problem and urgency; solution and product demo; who buys and why; evidence and ROI; business model and pricing; traction and metrics; GTM and pipeline; regulatory and security; roadmap and milestones; team; fundraise ask and use of funds.

The Fundraise: Round Dynamics and Use of Proceeds

- Calibrate round size to milestones that unlock next-stage proof (e.g., evidence readout, payer contract, system deployment). Articulate a crisp use-of-funds tied to de-risking.

Fit the Investor: Targeting and Personalization

- Map investor theses, stage, and portfolio to your category; tailor outreach to highlight alignment and avoid conflicts. Balance mega-funds for distribution with specialists for domain help.

Diligence Readiness: Data Room and References

- Data room index: corporate docs, cap table, info sec, regulatory, clinical/evidence, product/architecture, GTM, financial model, KPI definitions, and customer references.

- Prepare a diligence FAQ: regulatory classification, claims you can make, evidence plan and timelines, security posture, and unit economics assumptions.

Common Pitfalls and How to Avoid Them

- Over-claiming clinical impact without evidence, unclear regulatory classification, weak ROI story, and misaligned buyer/channel strategies. Provide concrete fixes and examples.

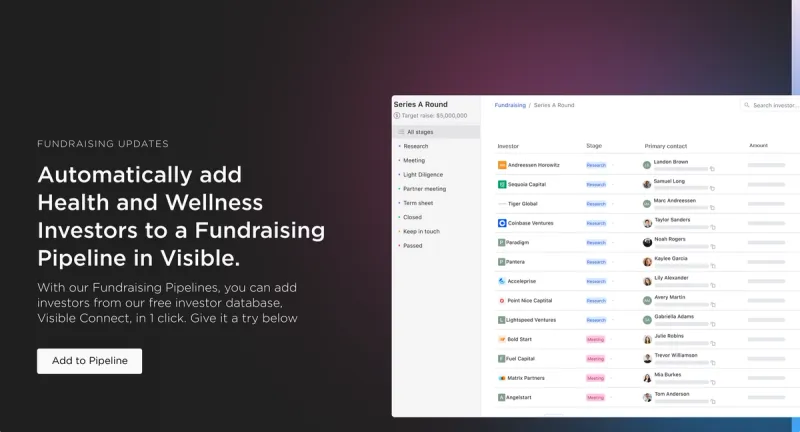

Find VCs Investing in Health and Wellness Companies with Visible

Visible helps founders connect with investors using our connect investor database, find VCs specifically investing in Health and Wellness here.

For Health and Wellness startups, securing the right investors is critical as it goes beyond mere funding. These investors bring specialized expertise and strategic insights specific to the Health and Wellness sector, and their guidance is invaluable in navigating the unique challenges and opportunities within the space.

Use Visible to manage every part of your fundraising funnel with investor updates, fundraising pipelines, pitch deck sharing, and data rooms.

Raise capital, update investors, and engage your team from a single platform. Try Visible free for 14 days.