Advertising startups are entering a pivotal window. Despite tighter late-stage funding, early-stage investing in AI-native AdTech/MarTech, retail media, and privacy-centric infrastructure remains active, driven by shifting consumer behavior, the rise of new channels, and the urgent need for better measurement. Global ad spend continues to hit new highs, and brands are reallocating budgets toward performance and commerce media—opening clear opportunities for startups that can prove outcomes and scale responsibly.

What’s different now is the mix of tailwinds and constraints founders must navigate. The deprecation of third-party cookies, signal loss on major platforms, and evolving privacy regimes are forcing a re-architecture of the ad stack. At the same time, breakthroughs in generative AI and automation are compressing creative and operations cycles, while retail media networks and connected TV (CTV) create fresh inventory and first-party data access. Investors are backing founders who can turn these structural shifts into durable advantages with defensible data, interoperable integrations, and provable incrementality.

Three forces define the opportunity in 2025. First, budgets are following channels with measurable ROI: retail media and commerce-driven advertising are among the fastest-growing categories, supported by closed-loop sales data. Second, AI is moving beyond copy and images into targeting, bid optimization, and media planning—making full-stack automation and creative-performance feedback loops a core differentiator rather than a nice-to-have. Third, privacy-by-design is now table stakes for enterprise sales; startups that can operate with consented first-party data, clean rooms, and modern identity frameworks unlock global brand and retailer partnerships.

For founders raising capital, the bar is higher but clearer. Investors want crisp unit economics (gross vs. net revenue recognition, payback, retention), a credible go-to-market motion that fits brands, agencies, and retail media partners, and a moat grounded in proprietary data or workflow lock-in. Platform dependency risk must be addressed head-on with multi-channel strategies that include open web, CTV/streaming, and retail media. Compliance and security posture need to be part of your pitch, not an afterthought, to accelerate enterprise diligence and shorten sales cycles.

In this guide you’ll find an up-to-date list of top global VCs actively investing in advertising-focused startups. We’ll cover the trends shaping the market, the technology shifts that matter, and the investor criteria that win term sheets. You’ll get a practical playbook on GTM, measurement, clean rooms, and compliance, plus cross-border fundraising tips, key accelerators and events, and exit pathways. With this information you can sharpen your narrative, strengthen your data room, and target the right investors with confidence.

Top Global VCs Investing in Advertising Startups

Aperiam

About: Driving the Future of Advertising and Marketing Technology. Aperiam is the leading adtech and martech venture capital firm. In addition to venture capital, we offer advisory and technology orchestration services to drive outcomes for both our portfolio companies and their customers: brands, agencies, media owners, and other tech companies. Aperiam is led and backed by the adtech and martech entrepreneurs and operators who built the industry.

North Base Media

About: An investment firm focused on journalistic enterprise and digital-driven opportunities in emerging markets.

Sweetspot check size: $ 750K

Thesis: Digital media in global growth markets; engagement and monetization software

NDRC

About: NDRC is a business that transforms entrepreneurial teams and ideas into startups with early investment and research help. We're an Accelerator providing €100k SAFE to ~10 companies per cohort.

Traction metrics requirements: Pre-seed. Team and Opportunity

Thesis: Digital B2B Mature founders with deep domain knowledge

Circadian Ventures

About: Venture capital firm investing in early-stage tech and tech-enabled businesses. We actively partner with exceptional entrepreneurs to build enduring businesses. Circadian Ventures has investments in various sectors across the United States.

Ground Up Ventures

About: Our relationship with our founders is one in which we intend to grow together, learn from each other, and hold each other accountable. We check our egos at the door and jump into the trenches with you as you build your business.

Sweetspot check size: $ 500K

Thesis: We partner with extraordinary founders building transformational companies from the ground up.

Expert DOJO

About: Expert DOJO is a startup accelerator based in Santa Monica.

Sweetspot check size: $ 100K

Traction metrics requirements: MVP

Thesis: Our mission is to help entrepreneurs at the early stages of your startup’s development to achieve your goals and more.

Ridge Ventures

About: Ridge Ventures is a fast, flexible, and founder-focused early stage venture capital fund.

Sweetspot check size: $ 5M

Watkins Bay

About: Watkins Bay assist Founders and Entrepreneurs realise their dreams by providing all the help they need too succeed, specialising in Go To Market for Hypergrowth .

Sweetspot check size: $ 500K

Traction metrics requirements: 20% CGMR

digitalundivided

About: At digitalundivided, we use original, proprietary research to develop a data-driven ecosystem that expands the current body of knowledge about entrepreneurship in emerging communities.

Sweetspot check size: $ 5K

Thesis: Founded in 2012, digitalundivided is the leading non-profit leveraging our data, programs, and advocacy to catalyze economic growth for Latina and Black women entrepreneurs and innovators. Our goal is to create a greater world in which all women of color own their work and worth. Our mission moves the entrepreneurial ecosystem forward, to increase funding, access, and opportunities for women of color in business and innovation.

Key Element Capital

About: At Key Element Capital, we’re dedicated to fueling the future of gaming, casino, and sportsbook innovations. As seasoned investors and industry enthusiasts, we’re passionate about discovering and supporting the next generation of gaming disruptors.

Unit Economics & Revenue Quality Investors Expect

Why Revenue Quality Matters in Ad/MarTech

Advertising startups often blend software, data, and media. Investors differentiate between high-margin, repeatable platform revenue and pass-through media dollars. Clear disclosure of what’s true platform/technology revenue versus media spend is essential for comparability, margin analysis, and valuatio.

Gross vs. Net Revenue Recognition

Be explicit about when you recognize revenue on a gross versus net basis. If you control the media buy and set pricing, you may record gross; if you’re acting as an agent or facilitating spend, you typically record net (platform fee/take rate). Disclose take rates, rebates, and usage components so investors can normalize your P&L and metrics package.

Media-In vs. Media-Out Models

Media-in models (you purchase and resell media) can inflate top-line but compress gross margin and increase working-capital needs. Media-out models (SaaS, usage-based API, or take rate) generally yield higher gross margins and simpler recognition. Many ad startups run hybrids; if so, break out revenue and margin by line of business so investors can assess LTV, valuation multiple fit, and risk profile.

CAC, LTV, and Payback the Way VCs Calculate Them

Standardize CAC by channel and segment. Include sales cycle length, win rates, ACV by segment, and fully loaded sales/marketing costs. For LTV, anchor on gross margin dollars, realistic expansion assumptions, and observed churn, not aspirational. Early-stage investors often look for sub-12–18 month payback; growth investors favor <12 months with line of sight to single-digit months in core segments. Show how pilots/POCs convert to production and expand ACV to validate your payback logic.

Cohort Quality, NRR, and Retention

Present monthly or quarterly cohorts by vertical and product module. Separate expansion from new ARR to illuminate land-and-expand. Strong B2B adtech/martech signals include expanding cohorts after initial pilots and NRR above 110–120% in core ICPs; if seasonality depresses certain cohorts, explain why and how you counterbalance with multi-vertical mix.

Customer Concentration and Seasonality

Flag if any single brand, agency holding company, or retailer exceeds 10–15% of revenue and outline diversification plans. Normalize seasonality by showing TTM metrics, Q/Q bridges, and usage-adjusted gross margin. Clarify campaign-driven spikes and retention through non-cancelable terms or always-on contracts.

Pricing Architecture and Margins

Choose a model that aligns value with outcomes and supports margin expansion over time: platform subscription plus usage, take rate on spend, seats for workflow tools, or outcome-based fees tied to verified conversions/incrementality. Disclose discounts, credits, and rebates to avoid surprises in diligence. Track gross margin by product line and show how automation, AI-driven ops, and cloud efficiency will lift margins as you scale.

The Metrics Pack for Your Data Room

Include a GAAP P&L with gross/net reconciliation, revenue by product line and model (SaaS, usage, media), cohort tables with retention/expansion, CAC/LTV and payback by segment and channel, NRR/logo retention, gross margin by line of business, pipeline coverage and win rates by stage, channel mix with platform dependency exposure, and verified outcomes/incrementality studies to substantiate renewals. These artifacts let investors underwrite revenue durability and path to profitability (IAB/PwC measurement and revenue trends.

Global Trends in Advertising Startup Fundraising (2025 and Beyond)

AI Moves From Experimentation to Production

Generative and predictive AI are now embedded in creative workflows, media planning, and bid optimization, with brands prioritizing tools that prove incrementality and compress time-to-value. Startups that pair proprietary data with measurable ROI and tight workflow integrations are attracting early-stage interest.

Retail Media and CTV Outpace Overall Ad Growth

Retail media remains the fastest-growing channel globally thanks to first-party shopper data and closed-loop attribution, while CTV/streaming expands with more addressable inventory and shoppable formats. These dynamics create openings for retail media infrastructure, off-site activation, commerce creative automation, CTV verification, and cross-device identity.

Privacy and Identity Reshape Product Roadmaps

Third-party cookie deprecation and tighter data protection enforcement are accelerating first-party data strategies, privacy-enhancing technologies, and clean room adoption. Enterprise buyers now expect privacy-by-design, interoperable identity, and consented activation as table stakes.

Cross-Border Capital Is Selective but Active

US and European investors are backing non-domestic teams with strong traction, particularly in Europe, India, and Southeast Asia, where digital ad growth outpaces mature markets. To win cross-border capital, founders must show localization readiness.

Later-Stage Selectivity Favors Durable Economics

Growth rounds prioritize efficient payback, healthy NRR, and diversified channel mix with limited platform concentration risk. Startups that demonstrate profitable unit economics by channel or vertical, plus margin expansion via automation and data moats, clear diligence more consistently.

Defensibility & Moats in Advertising Tech

What to Show Investors

Investors look for proof, not promises. In your deck and data room, include: a description of your proprietary datasets and how they’re ethically sourced; an integration map showing depth across DSPs/retail media/CDPs/clouds; third-party-verified performance lift and incrementality; a compliance and security roadmap with milestones (e.g., SOC 2); case studies demonstrating retention and resistance to switching; and evidence of channel diversification beyond any single walled garden.

Proprietary Data and Data Network Effects

Defensibility starts with unique, consented datasets that competitors can’t easily replicate. High-value sources include first-party behavioral data, commerce and SKU-level signals, contextual and creative performance metadata, and privacy-safe retail media and CTV exposure logs. Pair data assets with a clear value exchange and robust consent management so data volume and quality improve as usage scales, creating a compounding model advantage.

Workflow Lock-In Through Deep Integrations

Embedding into the daily stack increases switching costs. Integrate natively with ad servers, DSPs/SSPs, retail media platforms, CDPs, cloud data warehouses, and BI tools, and expose activation via APIs and connectors so your product becomes a system of record rather than a point solution. Align with industry specs—OpenRTB, Prebid, transparency and supply chain standards—to reduce friction and win enterprise procurement.

Model Performance Advantages and Continuous Learning

A sustainable moat requires measurable lift versus baselines and incumbents. Build continuous learning loops—online learning, multi-armed bandits, and constrained optimization—that adapt to noisy, privacy-limited environments. Validate model advantage with incrementality tests, geo-experiments, and MMM triangulation, and report outcome metrics that withstand scrutiny in diligence and enterprise MSA renewals.

Compliance, Trust, and Security as a Competitive Moat

Enterprise buyers reward vendors who reduce risk. Make privacy-by-design, consent frameworks (GDPR/CCPA/CPRA), and clear data processing agreements part of your core product story. Maintain a SOC 2 roadmap and readiness to answer IT security questionnaires. Implement brand safety, fraud/IVT mitigation, and supply chain transparency to unlock larger-brand budgets and premium inventory access.

Marketplace Liquidity and Two-Sided Network Effects

If you operate a platform connecting advertisers with creators, retailers, or publishers, liquidity and quality control are your moat. Focus early on governance (verification, rating systems, SLAs), incentive design that rewards high-quality participation, and tooling that reduces cold-start friction. As both sides scale, matching efficiency and data richness improve, increasing defensibility and margin.

Interoperability and Ecosystem Standards

Winning vendors “play nice” with the ecosystem. Support major identity frameworks used in the market (such as UID2/SCID where applicable), leading clean rooms, and cloud/CDP connectors so customers can deploy you across multiple regions and partners without re-architecting. Interoperability is becoming a buying criterion in RFPs, especially for multinational brands and retailers.

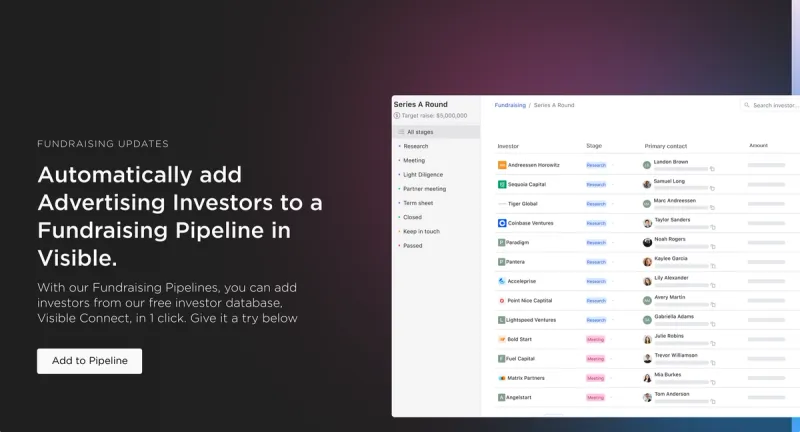

Find VCs Investing in Advertising Companies with Visible

Visible helps founders connect with investors using our connect investor database, find VCs specifically investing in Advertising here.

For Advertising startups, securing the right investors is critical as it goes beyond mere funding. These investors bring specialized expertise and strategic insights specific to the Advertising sector, and their guidance is invaluable in navigating the unique challenges and opportunities within the space.

Use Visible to manage every part of your fundraising funnel with investor updates, fundraising pipelines, pitch deck sharing, and data rooms.

Raise capital, update investors, and engage your team from a single platform. Try Visible free for 14 days.