Current Investment Landscape in 2024

The investment landscape for e-commerce startups in 2024 remains robust, albeit more competitive than in previous years. VCs continue to invest heavily in the sector, but the selection criteria have become more stringent due to evolving market dynamics and economic conditions.

Key Trends and Changes

1. Economic Factors

- The global venture capital market saw a significant downturn in 2023, with a 35% year-over-year investment decrease. Although the market is gradually recovering, the total venture funding for Q1 2024 reached $66 billion, a 6% increase from the previous quarter but still a 20% decrease from the same period last year.

- Economic uncertainties, including geopolitical tensions and inflation, continue to impact investor confidence, leading to a more cautious investment approach.

2. Selectivity and Profitability

- With the maturing of the e-commerce market, easy growth opportunities have diminished. Startups need a clear path to profitability to attract VC attention. Investors increasingly favor startups that demonstrate strong financial health and sustainable business models.

3. Market Concentration

- Major players like Amazon and Alibaba continue to dominate the global e-commerce landscape. This concentration makes it challenging for new startups to compete unless they offer unique value propositions or operate in niche markets.

4. Emerging Opportunities

- Despite these challenges, significant opportunities remain, especially in emerging areas such as social commerce, live commerce, and B2B e-commerce. These segments are drawing considerable interest due to their potential for growth and innovation.

5. Patterns Guiding VC Investments

- Omnichannel Retail: Integrating online and offline shopping experiences remains a strong focus. VCs are investing in startups that enhance customer experiences through seamless omnichannel strategies.

- International Expansion: Startups with plans to expand into emerging markets like Asia and Latin America are attractive to VCs. These regions offer substantial growth potential due to increasing internet penetration and digital adoption.

- Direct-to-consumer (D2C) Brands: D2C brands that leverage social media and direct marketing channels continue to be prime candidates for funding. The ability to build direct customer relationships and generate data-driven insights makes these startups particularly appealing.

- Subscription Models: The stability of recurring revenue models remains attractive. Companies that successfully implement subscription services, offering consistent value to consumers, are likely to draw VC interest.

6. What Investors Want

- Consistent Growth: Investors seek startups with well-defined strategies that show clear scalability and robust revenue pathways.

- Powerful Teams: The focus is not just on the ideas but on the execution. Startups with solid and experienced teams are more likely to secure funding.

- Market Analysis: It is crucial to have a deep understanding of the market, competitors, and a unique selling point. To attract investors, startups must demonstrate thorough market research and a clear competitive advantage.

Evolving E-commerce

The future of e-commerce is set to combine the spontaneity and excitement of offline shopping with the convenience and personalization of online platforms. By leveraging AI, AR, and blockchain technologies, retailers aim to create more engaging, efficient, and sustainable shopping experiences.

Offline Discovery and Online Options

Recent advancements in AI and technology are significantly enhancing the offline-to-online shopping experience. Retailers are now leveraging AI to create personalized shopping experiences that mimic the serendipity of in-store discovery. AI algorithms analyze past purchases and browsing behaviors to offer tailored product recommendations, making online shopping more intuitive and engaging.

One notable development is the use of augmented reality (AR) to bridge the gap between offline and online shopping. For instance, AR apps allow customers to visualize how products like furniture or clothing will look in their homes or on their bodies before making a purchase. This technology enhances the shopping experience and reduces the likelihood of returns.

Future of E-commerce (Three Phases)

the future of e-commerce is set to combine the spontaneity and excitement of offline shopping with the convenience and personalization of online platforms. By leveraging AI, AR, and blockchain technologies, retailers aim to create more engaging, efficient, and sustainable shopping experiences.

1. Discovery

In 2024, new platforms and methods are revolutionizing product discovery. Social media channels like TikTok and Instagram are at the forefront, utilizing short-form videos and influencer marketing to introduce products to consumers. These platforms are essential for brands to reach new audiences and drive engagement through entertaining and informative content.

Additionally, AI-driven recommendation engines are becoming more sophisticated. E-commerce sites like Amazon and Alibaba use AI to suggest products based on real-time data, such as trending items and customer preferences, enhancing the discovery phase.

2. Conversion

Live shopping has emerged as a powerful tool for converting interest into sales. Platforms like Facebook, Instagram, and dedicated live shopping apps enable real-time interactions between sellers and buyers. This format allows customers to ask questions, see products in action, and make purchases instantly, creating a sense of urgency and trust.

Innovations in virtual fitting rooms and chatbots also play a crucial role in the conversion phase. Virtual fitting rooms use AR to help customers see how clothes fit without trying them on physically. AI-powered chatbots provide instant customer support, guiding shoppers through their purchasing journey and promptly addressing any concerns.

3. Returns & Resale

Improving return management and promoting sustainable shopping are critical in 2024. AI is now used to predict return patterns and optimize inventory management, ensuring returned products are restocked efficiently. Some companies are integrating blockchain technology to enhance transparency in the returns process, providing customers real-time updates on their return status.

The resale market is also gaining traction, with major brands like Target and Gucci entering the space. These companies use tech-powered platforms to facilitate the sale of secondhand goods, appealing to environmentally conscious consumers and promoting a circular economy. AI-driven platforms assess the condition of returned items and determine their resale value, making the process seamless and efficient.

VCs Investing in E-commerce and Marketplaces

FJ Labs

As put by the team at FJ Labs, “Marketplaces are the tool by which we achieve our purpose, the means to our end. We believe in entrepreneurs as solutionists to the world’s greatest challenges and VCs as the means to enabling all the amazing founders addressing the challenges of our time.

At FJ Labs, we believe in human ingenuity and back it with the full weight of our resources and knowhow. This is our ultimate mission and the reason we invest in so many companies.

- Location: New York, United States

- About: FJ Labs is a stage-agnostic New York-based investment firm with a global focus. FJ Labs focuses on marketplaces and consumer-facing startups.

- Thesis: FJ Labs is a stage-agnostic New York-based investment firm with global focus. FJ Labs focuses on marketplaces and consumer facing startups.

- Investment Stages: Seed, Series A, Series B, Series C, Growth

DN Capital

About: DN Capital is a global early-stage venture firm, founded in 2000 and based in London, Berlin and San Francisco. We focus on Seed, Series A and select Series B opportunities in Europe and North America. We believe great tech companies can emerge across any vertical, but we focus our attention on four: Software, Fintech, Marketplaces and Consumer Internet. We have consistently backed category leaders in these verticals such as Shazam, Auto1, HomeToGo, Purplebricks, Endeca and Remitly. We use our extensive global network and financial expertise to give portfolio companies the best possible platform for growth. We are always excited to receive business plans from entrepreneurs seeking capital. So, if you have a business we need to know about, then send us your materials here.

Thesis: We invest in Seed, Series A and growth-stage businesses and can support companies with up to €20m of capital.

- Location: Menlo Park, California

- Investment Stages: Pre-Seed, Seed, Series A

Commerce Ventures

About: E-commerce Ventures is a venture capital firm focusing on investments in the e-commerce, retail, FinTech and Insurance sectors.

Thesis: We invest across a range of sub-sectors that we refer to collectively as the Commerce Continuum. These sub-sectors include retail technology, payment technology, banking technology, and insurance technology.

- Location: San Francisco, California

- Investment Stages: Seed, Series A, Series B, Growth

Greenoaks

About: Greenoaks is a global internet investment firm that operates in the commercial services, health tech, and B2B sectors.

- Location: San Francisco, California

- Investment Stages: Seed, Series A, Series B, Series C, Growth

Adevinta Ventures

About: Adevinta Ventures is the corporate VC leg within Adevinta (formerly Schibsted Marketplaces)

Thesis: At Adevinta, we believe everything and everyone has a purpose in life. Our portfolio of digital brands unlock the full value in every person, place and thing by creating perfect matches on the world’s most trusted marketplaces.

- Location: Barcelona, Spain

- Investment Stages: Seed, Series A, Series B

Cabra VC

About: Adevinta Ventures is the corporate VC leg within Adevinta (formerly Schibsted Marketplaces)

Thesis: At Adevinta, we believe everything and everyone has a purpose in life. Our portfolio of digital brands unlock the full value in every person, place and thing by creating perfect matches on the world’s most trusted marketplaces.

- Location: Barcelona, Spain

- Investment Stages: Seed, Series A, Series B

Piton Capital

About: Founded in 2010, Piton Capital is a venture capital and growth equity firm headquartered in London and investing in businesses with network effects. We make investments ranging from €200k to €20m and since inception have invested in over 50 businesses, primarily in Europe. Piton focuses exclusively on network effects businesses as this provide one of the few moats or forms of defensibility to achieve dominance.

Thesis: Investing in companies with network effects.

- Location: London, England, United Kingdom

- Investment Stages: Series A, Series B, Early Stage

Dutch Founders Fund

About: The Dutch Founders Fund (DFF) is an early-stage VC that primarily invests in marketplaces and network effects across Europe. Our fund is founded by founders, for founders. We look beyond spreadsheets and resolve early-stage growth-pains with lightning speed. Ready to scale together? Submit your pitch deck to basrieter@dutchfoundersfund.com

- Location: Amsterdam, Netherlands

- Investment Stages: Early Stage, Pre-Seed, Seed

GGV Capital

As put by their team, “GGV Capital is a global venture capital firm focused on multi-stage, sector-focused investments. Recognizing that the talent to build great companies can come from anywhere, the firm invests in founders building category-leading companies around the world.”

- Location: Menlo Park, California, United States

- About: GGV Capital is a multi-stage venture capital firm based in Silicon Valley, Shanghai, and Beijing. We have been partnering with leading technology entrepreneurs for the last 18 years from seed to pre-IPO. With $3.8 billion in capital under management across eight funds, GGV invests in globally minded entrepreneurs in social/internet, commerce/new retail, frontier tech, and enterprise/SaaS. GGV has invested in over 280 companies with more than 30 companies valued at more than $1 billion.

- Investment Stages: Series A, Series B

Kleiner Perkins

As put by the team at Kleiner Perkins, “For five decades we have partnered with intrepid founders to build iconic companies that made history. Today, Kleiner Perkins continues that legacy, investing in founders with bold ideas that span industries and continents, partnering with them from inception to IPO and beyond to maximize the potential of their ideas… and make history.”

- Location: Menlo Park, California, United States

- About: Kleiner Perkins is a venture capital firm specializing in investing in early-stage, incubation, and growth companies.

- Thesis: To be the first call for founders who want to make history and to partner with them as company builders in pursuit of that goal.

- Investment Stages: Series A, Series B, Growth

Lyra Ventures

As put by the team at Lyra Ventures, “We are venture capitalists investing in companies that use innovative technology to reinvent the business of fashion and retail. Our team and network of advisors have deep domain expertise in our industries of focus. We channel this knowledge into each of our investments, working alongside our founders, particularly early on in their company’s lifecycle.”

- Location: Singapore, SG

- About: We are venture capitalists investing in companies that use innovative technology to reinvent the business of fashion and retail. Our team and network of advisors have deep domain expertise in our industries of focus. We channel this knowledge into each of our investments, working alongside our founders, particularly early on in their company’s lifecycle.

- Thesis: We support visionary and disciplined entrepreneurs who are transforming the industries of fashion and retail via the creation of high growth and resilient businesses.

- Investment Stages: Seed, Series A

14W

As put by the 14W Team, “Founded in 2010, 14W is a global venture capital firm with offices located in New York, London, and Madrid. The firm seeks to invest in the consumer internet, e-commerce, consumer packaged goods, marketplace, and media sectors.”

- Location: New York, New York, United States

- About: 14W is a venture capital firm specializing in consumer internet, marketplace, ecommerce, CPG, and media.

- Investment Stages: Seed

PayU

- Location: Poznań, Wielkopolskie, Poland

- About: PayU is a leading financial services provider in global growth markets. We enable billions of people to buy and sell online.

- Thesis: One of the leading fintech investors globally, combining the expertise of high growth companies with our own unique local knowledge and technology to ensure that our customers have access to the best financial services.

- Investment Stages: Seed, Series A, Series B

Act Venture Capital

As put by the team at Act, “We believe great companies are built by great founders, not investors. We have never been the loudest venture firm. We don’t want to add to the noise of VCs making it about them – it is about the founders and the problems they are trying to solve.”

- Location: Dublin, Ireland

- About: ACT is Ireland’s leading independent venture capital company and they have a very experienced and successful investment team. They provide capital to growth-oriented private companies in the range of €750K to €15M. Larger sums can be provided in syndication with their institutional investors. In December 2002, ACT closed its third fund at €170 million. ACT now manages €350 million through a number of venture capital funds.

- Thesis: Investing in people, markets and technology.

- Investment Stages: Seed, Series A, Series B, Series C, Growth

Activant Capital

As put by their team, “We typically invest when two things come together. First, the company has the potential to achieve escape velocity and transform an entire industry. Second, we believe the founders can lead the company through hyper growth, and our support can significantly increase the probability of this success.”

- Location: Connecticut, United States

- About: Act VC is an early-stage venture capital firm that partners with founders starting out, and established teams scaling their growth. We have raised €487m across multiple funds to support this goal. We look for innovative, category-defining companies in large markets. We help founders build and scale these leveraging the experience of backing over 200 founders before. We work closely with them in this process. Over the past 25 years, we have invested in over 120 companies and built a broad global network.

- Investment Stages: Series A, Series B, Series C

Ascend

- Location: Washington, United States

- About: Pre-seed investor in marketplace, e-commerce/D2C, and B2B software startups in the Pacific Northwest.

- Investment Stages: Pre-Seed

A.Capital

As put by their team, “Unlike traditional VCs, we do not have ownership thresholds. We work with entrepreneurs to determine how much to invest, and at what valuation, based on what their company needs, not based on historical VC financial models. This reduces overall dilution while still leaving room for value-added partners.”

- Location: Menlo Park, California, United States

- About: a_capital provides resources and counsel to the creators, inventors and entrepreneurs who are building a new future.

- Thesis: Investing in consumer and enterprise technology companies.

- Investment Stages: Seed, Series A, Series B, Series C, Growth

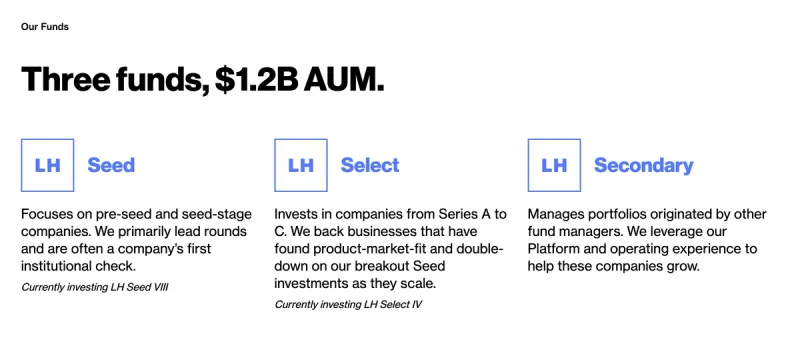

Lerer Hippeau

As put by their team, “Lerer Hippeau is an early-stage venture capital fund founded and operated in New York City. We invest in good people with great ideas who redefine categories — and create new ones entirely.”

- Location: New York

- About: Lerer Hippeau is a seed and early-stage venture capital fund based in New York City.

- Investment Stages: Lerer Hippeau invests in companies from seed to Series C

Tandem Capital

About: Tandem Capital is a seed-stage venture fund and studio helping drive go-to-market innovation. Our studio helps companies craft business strategies, build brands, acquire customers and extend distribution channels. Our dedicated studio team engages deeply with a company’s business, to help find product-market fit and accelerate early growth. The studio provides support primarily to businesses selling products and services directly to individuals, including: connected devices, consumer packaged goods and subscription services.

Thesis: Our fund backs stellar teams whose innovation extends beyond their products into how they acquire their customers, develop their distribution channels and build their overall brands. Tandem leads and co-leads rounds with up to $500K in pre-seed and up to $2M in seed funding. We reserve a significant amount of capital in order to support our founder long-term through follow-on funding.

- Location: San Mateo, California

- Investment Stages: Pre-Seed, Seed

Launch

- Location: San Francisco, California, United States

- About: We are on a mission here at LAUNCH to support founders and inspire innovation. Our small team of rebels put on the largest startup conference in the world, the LAUNCH festival, the podcast This Week In Startups and we run the LAUNCH Incubator. We invest millions of dollars into 40 promising founders a year, some of which go on to change the world. Most of these founders spend 12 weeks in our very intense -- but fabulously fun -- accelerator.

- Investment Stage: Accelerator

Imag/nary Ventures

- Location: New York, United States

- About: Founded by Natalie Massenet and Nick Brown, Imaginary Ventures is venture capital firm that invests in early–stage opportunities at the intersection of retail and technology in Europe and the US.

- Investment Stage: Seed, Series A, Series B

Act One Ventures

- Location: Seattle, Washington, United States

- About: Seed stage fund focused on enterprise software and research from LA Universities. We believe in community, diversity, and Los Angeles.

- Thesis: Investing in capital-efficient companies with excellent founder-market fit

- Investment Stage: Pre-Seed, Seed

Acequia Capital

- Location: Seattle, Washington, United States

- About: Acequia Capital is focused on advising early stage founders and teams that have passion and conviction about the power of software.

- Investment Stage: Pre-Seed, Seed

Arbor Ventures

- Location: Singapore

- About: Founded in 2013, Arbor Ventures is a global investment firm focused on companies that leverage advanced technologies such as artificial intelligence, cloud computing, composable service offerings and blockchain applications to facilitate, broaden or fundamentally change the way financial services are served, consumed, and managed. Arbor uses its global vantage point, extensive network and deep sector knowledge to identify key trends and partner closely with leading entrepreneurs to build transformational companies.

- Investment Stage: Seed, Series A, Series B, Series C

BECO Capital

- Location: Dubai, United Arab Emirates

- About: BECO Capital provides growth capital and hands-on operational support for early-stage technology companies.

- Investment Stage: Seed, Series A, Series B

Additional Resources

- 4 trends that will define e-commerce in 2022

- Personalization and zero-party data become critical.

- E-commerce embraces web3 and NFTs, but what will that look like?

- Live shopping goes mainstream.

- Slow but gradual improvement to the supply chain.

- Jungle Scout is an eCommerce platform that helps entrepreneurs leverage Amazon to sell products. Their platform offers customers solutions to manage inventory, conduct product research, find suppliers, and more. Though the company is mainly Amazon-centric now, they are eyeing expansion to cover solutions for other online retail platforms, such as Walmart.com.

- Consumer Trends Report | Q1 2022

- The State of the Amazon Seller

- Society Brands– Society Brands embraces the entrepreneur and provides them with a network of support and a rich pool of industry-leading resources to help them take their brands to the next level and create real value for a great exit.

- Elevate Brands– A New York- and Austin-based startup that acquires and runs third-party Amazon merchants.

- Berlin Brands Group (BBG)- One of the new wave of e-commerce startups hoping to build lucrative economies of scale around buying up smaller brands that sell on marketplaces like Amazon and using technology to run and scale them more efficiently.

- 20 Fast-Growing Ecommerce Startups (2022)

- Our Guide to E-Commerce Metrics (with Google Sheet Template)

- Key Metrics to Track and Measure In the eCommerce World

- Video: Shopify Ecommerce Dashboard

Start Your Next Round with Visible

We believe great outcomes happen when founders forge relationships with investors and potential investors. We created our Connect Investor Database to help you in the first step of this journey.

Instead of wasting time trying to figure out investor fit and profile for their given stage and industry, we created filters allowing you to find VC’s and accelerators who are looking to invest in companies like you. Check out all our investors here and filter as needed.

After learning more about them with the profile information and resources given you can reach out to them with a tailored email. To help craft that first email check out 5 Strategies for Cold Emailing Potential Investors.

After finding the right Investor you can create a personalized investor database with Visible. Combine qualified investors from Visible Connect with your own investor lists to share targeted Updates, decks, and dashboards. Start your free trial here.

Related resource: 14 FinTech Startups Shaping the Future of Finance