This guide is your essential playbook if you're a founder building consumer products and brands anywhere in the world and looking to raise venture capital in 2025. We'll equip you with the latest investor landscape, global ecosystem resources, and a vetted list of 15 top consumer-focused VC firms (with a link to their profile on our Connect Investor Database).

When we talk about "consumer" startups in this guide, we're casting a wide net. This includes digitally native brands (D2C/CPG), dynamic consumer marketplaces, engaging social and creator platforms, innovative consumer fintech solutions, consumer health and wellness brands, subscription services, and cutting-edge consumer-facing AI applications.

Consumer investors are increasingly prioritizing businesses with durable unit economics, strong brand moats, community-driven growth strategies, and truly differentiated AI-native consumer experiences. The days of relying solely on paid acquisition for growth are largely behind us. This guide will provide macro context, drawing on recent industry roundups and rankings, alongside a curated consumer VC list to pinpoint active investors. For each firm, you'll find their current focus, typical check size/stage, and notable consumer investments.

Top 15 Venture Capital Firms Actively Investing in Consumer Startups

Maveron

About: Maveron funds seed and Series A companies that empower consumers to live on their terms. Based in SF and Seattle and invest coast-to-coast.

Thesis: Maveron funds seed and Series A companies that empower consumers to live on their terms. Based in SF and Seattle and invest coast-to-coast.

Left Lane Capital

About: Left Lane is a venture capital and early growth equity firm based in New York City. Left Lane’s four partners all previously worked at Insight Partners, where they led investments into consumer subscription, software, marketplace, and platform businesses.

Sweetspot check size: $ 12.50M

Traction metrics requirements: >1M in run rate revenue, gross margin positive, efficient unit economics, high growth

Thesis: We invest in high-growth internet and consumer technology businesses that are fundamental to the human condition and spirit – where customers maintain a long-term relationship with the product, platform or service.

Forerunner Ventures

About: VC firm investing in transformative B2C & B2B companies defining a new generation of business, with an eye on the consumer.

Interlace Ventures

About: Early Stage fund investing in the Future of Commerce

Sweetspot check size: $ 250K

Thesis: Theme: Technology for the commerce world

JamJar Investments

Thesis: JamJar Investments is the innocent drinks founders' venture capital fund. They invest in high growth, digital consumer brands.

L Catterton

About: Catterton Partners is the leading private equity firm with an exclusive focus on providing equity capital to growing middle market consumer companies in North America. Their combination of investment capital, strategic and operating skills, and industry network has enabled them to become the most sought after private equity firm in the consumer sector.

Shrug Capital

About: Shrug Capital is a Venture capital firm investing in consumer startups.

Shasta Ventures

About: At Shasta, we are deeply committed to passionate entrepreneurs that are building businesses that will change the world. We believe strongly in supporting those entrepreneurs and helping them to figure out how to iterate through the challenges of being an early-stage company and to build and grow and scale.

Thesis: We now invest in innovative early-stage startups in sectors like SaaS, cybersecurity, infrastructure, data intelligence, and consumer subscription. By focusing on early-stage, we can dive deeper to partner with our portfolio and give them the resources they need to reach new milestones, faster.

No Brand

About: No Brand is a private investment company focussed on opportunities empowered by technology. Our focus is on backing mission driven leaders, who are building for a long term horizon and benefit from online platforms, community or network effects.

Sweetspot check size: $ 500K

XFund

About: Xfund is the early-stage venture capital firm built to back entrepreneurs who think laterally and experiment across disciplines.

Sweetspot check size: $ 2M

Thesis: You can be a hacker and a historian. You can be a techno-utopian and an aesthete. We want to back minds that stretch laterally and not just linearly. We want to back the coder who not only knows what she’s doing, but why. Maybe that’s you.

TSG Consumer Partners

About: TSG is a global leader in consumer-focused investing with approximately $14 billion in assets under management and a 35+ year track record of building iconic brands. Since its founding in 1986, TSG has been an active investor in the food, beverage, restaurant, beauty, personal care, household and apparel & accessories, and e-commerce sectors.

General Catalyst

About: General Catalyst backs exceptional entrepreneurs who are building innovative technology companies and market leading businesses, including Airbnb, BigCommerce, ClassPass, Datalogix, Datto, Demandware, Gusto (fka ZenPayroll), The Honest Company, HubSpot, KAYAK, Oscar, Snap, Stripe, and Warby Parker. The General Catalyst team leverages its broad experience to help founders build extraordinary companies. General Catalyst has offices in Cambridge, MA, Palo Alto, CA and New York City.

Sweetspot check size: $ 30M

Thesis: General Catalyst is a venture capital firm that makes early-stage and growth equity investments.

Night Ventures

Sweetspot check size: $ 375K

Thesis: Our LPs are 50+ of the top creators in the world across YouTube, TikTok, Twitch and elsewhere. Together, we specialize in influence - understanding what's popular, what's trending and how to acquire more customers/fans of your product.

Ascend

About: Ascend is the most active pre-seed venture capital fund in the Pacific Northwest.

Thesis: Pre-seed investor in marketplace, consumer brands, ecommerce, and B2B software.

Cathay Innovation

About: Cathay Innovation is an international early growth venture capital firm that partners with entrepreneurs by bridging USA, Europe and China.

Sweetspot check size: $ 10M

Actionable Fundraising Insights and Pitch Tactics for Consumer Founders

What Consumer VCs Are Prioritizing

Investors are looking for evidence of organic demand (community, referrals, creator flywheels, UGC) and a credible path to attractive contribution margins. They want a distinct moat—brand, distribution, product, or supply—and authentic ways AI improves the user experience, personalization, discovery, or support. Firms consistently emphasize fundamentals, brand defensibility, and platform effects over top-line growth alone.

Model-Specific Metrics VCs Will Diligence

For D2C/CPG, expect deep dives into order frequency, cohort retention, contribution margin after fully-loaded logistics and returns, inventory turns, and cash conversion cycle.

For marketplaces, focus on liquidity (time-to-transaction, search-to-fill), take rate, buyer and seller retention, CAC by side, and evidence of network effects.

For consumer apps and subscriptions, highlight activation, WAU/MAU, session frequency, conversion to paid, churn, net revenue retention, CAC payback, and LTV drivers.

In consumer fintech and health, be prepared on compliance, trust and safety metrics, claims or chargeback rates, and margin structure.

A Pitch Narrative That Lands

Lead with the consumer problem and your proprietary wedge—brand, data, distribution, or technology—that lets you win in a crowded category. Show proof of pull with waitlists, organic channel growth, community engagement, creator advocacy, and efficient referral loops. Map a credible path to margin and defensibility, starting with gross margin today and the levers to expand contribution margin as you scale. Be concrete about AI’s role where it’s real, such as measurable lift from personalization, customer support automation, merchandising improvements, or fraud reduction. Close with traction that compounds—cohort curves, unit economics, and a near-term roadmap tied directly to capital use.

Materials Checklist for Consumer Rounds

Investors will expect clean monthly cohort retention, CAC by channel, a transparent LTV methodology, and a contribution margin waterfall. For CPG, include inventory and cash cycle visibility, returns, and discounting effects. Add funnel analytics, pricing experiments, and your attribution model, alongside references from customers, creators, partners, and prior investors where applicable. Screenshots and short demos of merchandising improvements, community metrics (Discord, socials, UGC), and before/after tests help validate claims.

CAC, LTV, and Payback: What “Good” Looks Like Contextually

Early-stage rounds tolerate noisy CAC, but you should demonstrate repeatable channels, the difference between blended and incremental CAC, and a payback window appropriate for your category and gross margins. LTV must be cohort-grounded, not a top-down guess: anchor assumptions in observed repeat rate, AOV, contribution margin, and a sensible discount rate. Demonstrate your understanding of channel concentration risk and outline a plan to diversify into community, partnerships, and, when appropriate, retail or wholesale, to enhance trust and blended CAC.

Pricing, Merchandising, and Growth Loops

Demonstrate a systematic approach to pricing, including anchoring, premium SKUs, bundling, subscriptions, and regional strategies, with experiment design and results. Show how merchandising drives conversion and AOV—PDP improvements, cross-sell and upsell logic, and content-to-commerce. Detail your growth loops: UGC that feeds discovery, creator amplification, referral mechanics, and community content that reduces CAC and compounds retention over time.

Building Defensibility as a Consumer Brand

The strongest moats sit beyond performance marketing. Highlight supply or formulation advantages, exclusive distribution or partnerships, proprietary data and personalization, community/IP, and omnichannel strategies that reinforce trust. Adding retail or wholesale at the right time can decrease blended CAC and increase credibility, but be explicit about the margins and operational tradeoffs. These are consistent themes among consumer brand specialists noted in 2025 investor roundups and leadership lists Forbes Midas 2025.

Running a Tight Fundraise Process

- Start with a tiered target list mapped by stage, geography, and sub-vertical fit using our connect investor database.

- Prioritize warm introductions through portfolio founders, creators, operator-angels, and ecosystem partners.

- Time-box the process, define the round size and high-level terms, and tie use of funds to measurable milestones such as margin expansion, channel diversification, or SKU/feature roadmap delivery.

- Keep engaged firms updated weekly with KPI momentum and experiment results.

Common Red Flags and How to Preempt Them

Overreliance on paid acquisition without improvement in blended CAC or retention, inflated LTV assumptions that ignore returns and logistics, inventory bloat and long cash cycles without a financing strategy, and shallow differentiation versus entrenched incumbents are all red flags. Preempt them by showing channel mix evolution, cohort-grounded LTV, clear inventory and working capital plans, and crisp positioning backed by proof from customers and creators.

When You Don’t Have “Perfect” Metrics Yet

If you’re early, lead with the velocity of learning: a tight experiment cadence, rapid iteration, and clear KPI deltas over short cycles. Showcase early love—qualitative user feedback, creator endorsements, community engagement—and small but improving cohorts. Present a 90–120 day plan post-raise that de-risks CAC, retention, and margin, with specific experiments, targets, and decision gates. This signals operating rigor even before scale.

Global Networking, Accelerators, and Events

Where Consumer Founders Network Globally (and How to Get Warm Intros)

High-signal relationships come from places where operators, creators, and investors already collaborate. Start with portfolio founders of the firms in your target list, operator-angel syndicates with consumer track records, curated Slack/Discord communities for D2C/CPG and marketplace builders, and regional founder groups tied to key hubs (SF/NY/LA; London/Berlin/Paris; Bangalore/Singapore; São Paulo/Mexico City).

Engineer warm intros by asking your network which investors they follow, cross-referencing with our connect investor database, and arming referrers with a one-paragraph forwardable blurb, three bullets of traction, and a data room that is neat and professional — it should inspire confidence.

Top Accelerators and Venture Studios for Consumer Startups

Generalist accelerators with strong consumer alumni networks can open doors to downstream VCs and retailers, while specialist programs and venture studios provide category expertise.

Look for programs with hands-on merchandising, supply chain, and growth support (for CPG/commerce) or mobile product and creator distribution depth (for consumer apps).

Evaluate by mentor quality and operator density, demo day reach in your target regions, check size and equity cost, follow-on rates, and post-program support.

Global Consumer/CPG/Retail Events That Convert to Meetings

Large tentpole gatherings concentrate consumer investors and partners. General tech and founder events like CES, Web Summit, Slush, and SXSW offer broad exposure.

Retail and commerce conferences such as NRF, Shoptalk, Groceryshop, and the eTail series bring merchants, platforms, and commerce VCs.

CPG and food/wellness shows like Natural Products Expo West/ East and Fancy Food Show enable retail buyer and distributor meetings; beauty and fashion convene at Cosmoprof and selected fashion-tech forums.

Creator economy and media investors cluster around events like VidCon.

Global Trends in Consumer Fundraising

Resurgence of Consumer VC Interest

After years of waning attention, consumer startups are experiencing a notable revival in VC interest—funding in the sector increased by 25% last year.

New York City is emerging as a hotbed for consumer tech startups, drawing founders with its vibrant, creative, and collaborative ecosystem. Founding teams of Gen Z–focused startups like Fizz, Posh, and Partiful are gravitating toward the East Coast city’s unique energy. As Derek Chu, a partner at FirstMark Capital, puts it—a “consumer renaissance” is igniting in NYC.

Profitability and Sustainable Growth Take Center Stage

Gone are the days of “growth at all costs.” In 2025, VCs are laser-focused on unit economics—prioritizing startups that demonstrate customer retention, repeat purchase behavior, and clear paths to profitability. Particularly in sectors like beauty, investors favor brands with strong fundamentals, genuine founder narratives, and defensible positioning.

Social Commerce Accelerates, Fueled by Influencer Power

As regulatory pressure mounts on platforms like TikTok, investor attention is shifting toward social-shopping platforms. Startups like Whatnot (livestream sales leader with $265M raised) and ShopMy (profitable, secured $77.5M) are thriving by tapping influencer-driven commerce. This highlights the growing effectiveness of creator-led marketing in the consumer VC landscape.

Niche Personalization, AI, and New Social Frontiers

The consumer tech landscape is being reshaped by emerging platforms that harness AI, Gen Z trends, and niche social experiences. Investors are eyeing AI-powered apps, boutique dating tools, and hyper-personalized social networks built around identity, culture, and shared interests. Though caution remains—especially given competition from Big Tech—the appetite for these disruptive formats is rising.

Find VCs Investing in Consumer Companies with Visible

Visible helps founders connect with investors using our connect investor database, find VCs specifically investing in Consumer here.

For Consumer startups, securing the right investors is critical as it goes beyond mere funding. These investors bring specialized expertise and strategic insights specific to the Consumer sector, and their guidance is invaluable in navigating the unique challenges and opportunities within the space.

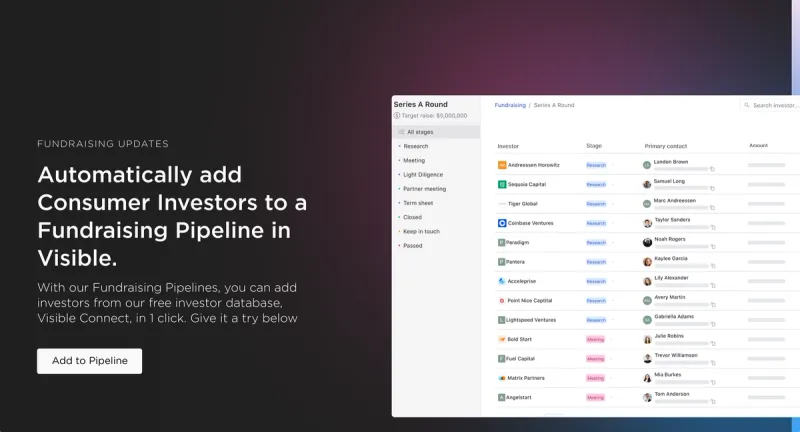

Use Visible to manage every part of your fundraising funnel with investor updates, fundraising pipelines, pitch deck sharing, and data rooms.

Raise capital, update investors, and engage your team from a single platform. Try Visible free for 14 days.