Blog

Visible Blog

Resources to support ambitious founders and the investors who back them.

All

Fundraising Metrics and data Product Updates Operations Hiring & Talent Reporting Customer Stories

founders

Hiring & Talent

Operations

Operations

The (Remote) Water Cooler

As many companies are transitioning to remote work for the first time it is normal to feel overwhelmed. Getting used to the social norms of working from home can be odd for some individuals: no group lunches, desk visits, mid-day games, and “water cooler talk.”

Remote Work at Visible

Being remote for the last 5 years, we’ve missed the serendipitous moments and random conversations that take place at an office. We have done our best to fill the void with different Slack channels, games, Zoom calls, and offsites (more on that in a different post). Being able to have personal conversation outside of work is vital to any startup culture. Being able to translate that conversation when working from home is just as important.

Out of the different strategies and ideas we have tried to mimic office communication, the one that has stood the test of time is the #watercooler Slack channel. Our #watercooler Slack channel is exactly what it sounds like — a chance to take a break from work-related tasks to discuss hobbies, interest, food, and current events.

Our Favorite Slack Channels

We all like to see our respective Slack channels light up, but there is an added excitement when the #watercooler channel lights up (especially later in the day). We do not have hard set guidelines for what should be posted in the #watercooler channel but it generally consists of the following:

Food/what we ate — Pictures or recipes for what we are cooking at home/eating at restaurants. We all love to eat at Visible so this is big for us.

Random videos/pictures/stories from our day to day lives — For example, a current event or something big that may be happening in someone’s respective city/neighborhood/etc.

Travel and Hobbies — Being a remote company, a lot of us spend a good amount of time in different locations. We love to share pictures and stories from our time in new places.

Work Inspiration — This is also where we share examples and inspiration of something cool we see a different company doing. Anything from a new product feature to an intriguing marketing email.

Fun Stories — If someone runs into a fun story, stat, or fact they run into online, we tend to share it in #watercooler.

While there is no substitute for in person conversation, being able to take a break and have casual conversation with co-workers is a must when working from home. Being fully remote ourselves, it has allowed us to get to know each other as if we were working in an office. For those working from home for the first time, give the #watercooler a try and let us know what you think!

founders

Operations

Mike’s Note — Acting in Bad Faith

Have you ever dealt with someone acting in bad faith? How did you handle it?

This week I believe a partner of Visible’s is acting in bad faith. Nothing illegal but what I would consider bad business. I’ve sent them an email outlining my concerns and have yet to hear back. I could…

Put them on blast online. This might feel good for a minute but will likely not solve the problem. I could also be seen as acting in bad faith.

Go the legal route. That sounds expensive and likely will not solve my problem.

Ignore it.

I’d love to hear any of your experiences and outcomes that you feel comfortable sharing. I will definitely follow up when I feel more comfortable doing so as well.

founders

Reporting

Operations

Operations

Do You Have a Stakeholder Management Strategy?

All eyes are on leaders in a time of uncertainty. How a leader acts, presents themselves, and communicates echoes throughout the organization (and any outside stakeholders).

Having a stakeholder management strategy in place is a surefire way to give a sense of unity and direction to all of your stakeholders; especially in a time of turmoil. A stakeholder management strategy generally relates to individual projects or campaigns. However, a founder can use a stakeholder management plan to oversee their communication.

As the team at MindTools writes, “Stakeholder management is the process of maintaining good relationships with the people who have the most impact on your work. Communicating with each one in the right way can play a vital part in keeping them on board.”

The goal of your startup stakeholder communication plan should be to give everyone the information they need to understand direction, goals, and to feel a sense of cohesiveness. For a startup, we can boil down a stakeholder management strategy into 5 unique groups: team, investors, board of directors, advisors/mentors, and customers.

As a CEO or Founder it is your job to set the tone for communication and delegate or own different stakeholder groups as needed. Here are a couple of things to keep in mind when setting a stakeholder management and communication strategy:

Keep it Predictable

When it comes to setting up a stakeholder management strategy one of the key components is to keep it as predictable as possible. Set a specific cadence with each stakeholder group so they can expect when they’ll be receiving an email update, phone call, report, etc.

Not only will a predictable cadence help your stakeholders, it will help you as a founder as well. We have found that by committing to a schedule it will help hold you accountable and build good habits. If you’re looking for an easy way to get started with a team communication strategy, check out our “Friday Note” template.

Apples to Apples

We often preach that it is vital to keep things consistent from update to update, especially when communicating with your investors. The same can be said when developing your stakeholder management strategy. If you commit to sharing a certain metric or context, be sure to keep it consistent throughout.

If you are sharing a certain metric, lay out how it is calculated in your first correspondence and stick to it. Questions and a lack of trust will start to form if the calculations or metrics you are sharing begin to change on a regular basis.

Set the Tone

As we mentioned earlier, a stakeholder management strategy is intended to help your different stakeholder groups understand direction, goals, and feel a sense of cohesiveness. In turn, this should also increase productivity and allow employees and stakeholders to build trust with their leaders.

When a founder or leader takes an action, it often reverberates throughout the organization. Keep this in mind when setting up a management and communication strategy for different stakeholder groups. If you want to establish a certain value or action in your company, your stakeholder management strategy is a great place to start.

A Note on Remote Work

In the wake of recent turmoil, more companies are transitioning to remote work. When working remote for the first time, having a sound stakeholder management and communication strategy is more important than ever. There is not such thing as too much communication, especially when all of your stakeholders are feeling the stress and anxiety of our current situation. To learn more about remote work, check out our 9 favorite posts here.

If you think you’re ready to implement a stakeholder communication and management strategy, head over to our Update Template Library to see examples for how to best communicate with your investors, team, board members, and more.

founders

Metrics and data

Our Guide to E-Commerce Metrics (with Google Sheet Template)

A few years back Dave Ambrose, Managing Partner at Steadfast Ventures, shared a template full of KPIs for ecommerce startups and founders. Since Dave’s original template, we’ve surveyed a few of our customers and friends to make some tweaks and add in new metrics. Special thanks to Dave and the team at Italic for allowing us to share their key KPIs. Italic is an ecommerce company that sells “unbranded luxury goods straight from the source.” With $13M in venture funding and customers across the globe it is vital for Italic to keep a tab on their metrics across the funnel.

Related Resource: 10+ VCs Investing in E-commerce and Consumer Products

Using the E-commerce Metric Template

Related Resource: Key Metrics to Track and Measure In the eCommerce World

The setup of the template should be simple and ready to use and customize to your own liking out of the box. We’ve set the data to monthly but feel free to change to weekly, quarterly, etc. From here the template is broken down into 4 major metric categories — Customer Breakdown, Acquisition, Behavioral, and Operational.

Customer Breakdown Metrics

This is a simple breakdown of where your new customers are coming from. For the template, we’ve included the following channels:These channels can vary from business to business to make any changes to the names/sources.

Acquisition Metrics

Acquisition metrics are particularly important when it comes to monitoring an ecommerce business. Our friends over at Italic like to break down their acquisition costs by paid and blended. This allows them to analyze how their paid channels are performing to the rest of the business. To learn more about customer acquisition costs, check out our guide here.

Jeremy Cai, CEO of Italic, explains LTV tracking and benchmarking:

“Typically it’s the amount of spend a customer has by a certain point (i.e. 6 month LTV, 12 month LTV, 2 yr LTV, etc) and people hope to see growth in this over time. For most higher ticket items, frequency will be close to 1 so they don’t expect LTV to grow very much but for subscription (toothpaste, razors) or higher replenishment items (consumables, beauty) then LTV growth is critical.”

Behavioral Metrics

These are the metrics that can help measure how customers are behaving and moving through the funnel once they have started the purchasing process. Put simply, Jeremy explains it as, “Basically it’s Add to Cart > Checkout Started > Checkout Completed, with a general 50% falloff between each step.”

Operational Metrics

These are the financial and operational metrics that make sure your business is healthy and running as expected. These metrics show how efficient your marketing and go-to-market efforts have been. Dave Ambrose keeps an eye on these metrics as an indicator to what ecommerce companies “are taking off.”

Use Template Now

Connecting the E-commerce Metric Template with Visible

Naturally, the template connects to Visible in a few quick steps. Once you have the template added to your Google account head over to Visible. From here, you’ll want to make your way to the “Metrics” section and select “Add a new data source” –> “Google Sheet.”

After you’ve authenticated your Google account you’ll see the ecommerce template. Select the sheet and the correct tab from the sheet. As the sheet is setup with the date in row 1 and metrics in column A there is no need to make any further changes.

Click “save” and your new metrics will be brought into Visible. You can easily chart and share these metrics using Dashboards and Updates.

Raise capital, update investors and engage your team from a single platform. Try Visible free for 14 days.

founders

Fundraising

Checking Out Venture Capital Funding Alternatives

Over the last few years there has been an explosion of alternative financing options to venture capital. There are a number of interesting alternatives to venture capital that each have their own pros and cons. Today, these alternative options are becoming more widely available to companies at every stage.

In an effort to help founders sort through different funding options, we’ve shared a few of our favorites below.

Pipe

Pipe is one of the newer and most interesting options. Pipe is a non-dilutive financing option for SaaS startups. As their website puts it, “Pipe turns MRR into ARR.” So how does it work? Pipe looks at your monthly contracts and offers a cash advance on the annual value of those contracts. In turn, they will take a small % of that contract for offering the cash advance.

For example, if you have a customer paying $1000/mo then the annual value would be $12,000. Let’s assume they are taking 10% (purely a guess, we are not sure what the actual terms are) that would result in $10,800 in cash ($12k*90%).

This allows SaaS companies to get cash up front and hold in their bank account or use for customer acquisition. Presumably, their % take is less than what most SaaS companies offer for an annual discount as well. Learn more about Pipe here.

Earnest Capital

Earnest Capital provides early-stage funding, resources and a network of experienced advisors to founders building sustainable profitable businesses. Earnest Capital uses their own financing instrument called a Shared Earnings Agreement (SEAL). Essentially, SEALs are geared towards bootstrapped companies who are profitable or approaching profitability.

The SEAL is a form of profit sharing where Earnest receives a share of “Founder Earnings.” This is essentially leftover profit after founders receive modest salaries, dividends, and retained earnings. Earnest also takes an equity percentage but it is reduced as more profit is shared.

David Cummings, Founder of Atlanta Tech Village, summed it up nicely by saying, “This model is better for using cash flow to grow in the near-term (payments are only required if profit is distributed) but more expensive in the long term if everything works out.”

We highly encourage checking out the SEAL document and the Earnest Capital investment Memo (it is a long read but well worth it). We also recorded a webinar with Tyler Tringas, Founder of Earnest Capital, that you can watch here.

Corl

Rather than explaining it ourselves we’ll let the Corl website explain what they do. “Corl uses machine learning to analyze your business and expedite the funding process. No need to wait 3-9 months for approval. Find out if you qualify in 10 minutes.

Corl can finance up to 5x your monthly revenue to a maximum of $1,000,000. Payments are equal to 1-10% of your monthly revenue, and stop if the business buys out the investment for 1-3x the investment amount.”

Learn more about Corl and how to apply here.

Clearbanc

“Clearbanc offers funding from $5,000 to $10 million in exchange for a steady revenue share of their earnings until it’s paid back plus a 6 percent fee.” ClearBanc is known for their ability to make an investment in just minutes via their “20 minute term sheet.”

Clearbanc is a great option for companies already generating money and are looking to ramp up growth (especially direct-to-consumer companies). Currently, ClearBanc only invests in eCommerce and consumer SaaS companies that meet these minimum requirements:

“Average monthly revenue of $10,000”

“6 months of consistent revenue history”

“Business must be incorporated

Learn more about Clearbanc and their requirements/process here.

These all have the ability to help different companies in different ways. As more alternative funding options come to market, more founders and companies will succeed. Hopefully this will lead to more entrepreneurs starting companies and raising some form of capital.

If you have an experience with a venture capital alternative or can vouch for another option to add to our list send us a message to marketing@visible.vc

founders

Reporting

Sending Your First Investor Update Using Visible

Why Send Investor Updates

Investor updates can help in a number of ways. We’ve laid out some of the top reasons for sending investor Updates below. To learn more about why you should send investor updates, head here or visit the Visible Blog.

Communication saves companies

If your investors don’t know what’s going on in your business, they don’t know how to help. Investors provide more than capital. They offer advice, expertise, introductions, and more.

Accountability and trust

Proactive communication builds trust. When investors are kept in the loop they are more likely to help. You’ll always be top of mind for introductions, customer referrals and potential hires.

Follow-on funding

Follow on funding is imperative for success. Current investors provide signal, can lead rounds or can step in to bridge a financing. Make sure your current investors are allocating future capital by demonstrating your commitment to transparent communication and good governance.

Below are the steps for getting successfully set up on Visible to send your first Investor Update. Have a question or need a hand with anything? You can reach out by using the Intercom chat messenger located in the bottom right of you screen.

Starting with Metrics

Sharing metrics allows investors to understand how your business is performing. If a certain metric or KPI is down, don’t be afraid to share this — it happens. In fact, investors can likely offer help to turn things around.

In general, we suggest keeping the metrics you share consistent. You know your business best, so what financials and KPIs to share will vary. If you’re looking for more on what metrics to share check out the Founders Forward Blog here.

To get started with metrics and charts in Visible, click the “Metrics” tab towards the bottom of the left hand side navigation. If you do not use any of our data sources, we suggest getting started with a Google Sheet or User Provided metrics.

For this example, we’ll walk you through getting a Google Sheet connected. The video below will walk you through connecting Google Sheets.

We are using this Google Sheet in our example. Feel free to make a copy (using this link) to follow along at home! We suggest keeping the date + metric format and swapping out metric names where you would like.

You can find a more involved article for getting started with Google Sheets here and articles for connecting other integrations here.

Charting Your Data

Once you have your metrics and data in Visible, it is time to start creating charts. We suggest creating charts in a dashboard to start. You’ll be able to select any of your dashboard charts when you craft your Updates.

From a dashboard, click “+” button followed by “Chart” as shown below:

Screen Recording 2020-03-17 at 02.01 PM.mov

Once you’ve opened the chart builder. Select what metrics you’d like to pull into the chart. You can select as many metrics as you’d like from any data source! For this example, we’ll be creating a chart with Revenue and Total Expenses.

Screen Recording 2020-03-17 at 02.11 PM.mov

A couple of tools/tips when using the chart builder:

Enhance Individual Metrics — If you click on a metric from the chart builder, you’ll be able to enhance your metrics with our business intelligence layer, chart colors, aggregation, and chart the metric on the Y-axis.

Options Tab — From the options tab of the chart editor, you can edit the visualization and settings of the chart. From the top half you can change the chart title and chart type. Moving down you can pick the metric name or date to show on the x-axis, show data labels, show data markers for line charts, and set a y-axis scale.

In the bottom half of the options tab, you can change the display frequency, pick a time period to display the data, and add in goal lines.

Add Annotations — To add text annotations directly to a chart, click on any data point and select “Add Annotation” when you have the chart builder open. You can add up to 100 characters.

Creating Your First Update & Using the Editor

Now that you’ve got a hang for creating charts, it is time to create your first Update! To get started, click the “+” sign next to Updates in the left hand side navigation. You will have the option to use a blank Update or start with one of our Update Templates.

Screen Recording 2020-03-17 at 02.14 PM.mov

For this example, we’ll walk through our basic investor update template.

This a rough guideline of what we have found to be best practices for sharing investor Updates. Feel free to make any changes to the Update Template that you would like.

With Updates you can include and combine any of the following components:

Text with rich formatting

Images

Charts

Side-by-side charts

Tables

Files

Line breaks

Check out the video below for a quick breakdown of our Update Editor:

Rich text — Simply highlight text to expose our editor. Create bulleted and numbered lists, create merge tags, and hyperlink text from here as well.

Build and include charts — Connect data and build charts. To include a chart in an Update, hit enter on your keyboard and you will see an option to add a component to the right side. Select an existing chart or build a new one directly in an Update. You can include as many charts as you’d like as well as tables and side-by-side charts.

Files and Images — To include a file or image, click enter and you will see an option to add a component to the right side (same as a chart). Select the image or file icon to embed either directly in your Updates.

Sharing Your Qualitative Data

You’ll notice in our standard investor Update template it is broken into a few key qualitative sections:

Highlights — Always start with the good news! Briefly recap your company highlights, including things like goals hit or exceeded, new key hires, product updates, etc. Anything that made the previous month great.

Lowlights — Next, include some areas where you struggled or could use some help. Noting the steps you’re taking in response is even better, as investors will see you reacting to tough situations and moving forward. Transparency is key!

Asks — Potentially the most important part of your update! Here is where you can leverage your investors and get the help you need. Make specific asks that investors can easily respond to by drawing on their networks, experience and advice.

Thanks — Giving credit where credit is due is important. This is where you can call out team members who went above and beyond in the previous month. Also, specifically call out any investor who responded to your previous month’s asks, or helped you in another way. Nothing wrong with creating a little peer pressure for your other investors!

Customer Story — Investors love to see customer reactions to your product or company. Include customer feedback, social media mentions or anything that highlights how you’re impacting your buyers.

Monthly Metrics — Finally, include the key data your investors want to see. This will vary from company to company, but we recommend all companies track Revenue, Burn, Cash in Bank. Include everything you think investors will want to see, but don’t go overboard with unimportant numbers. If you aren’t sure what charts/metrics to include, just ask!

Sending Your Update

Once you’ve got your charts and qualitative sections dialed in it is time to share your Update with your investors.

There are 3 main ways to share an Update; email, link, and Slack. To get started with all 3, click the “Send” button in the top right corner. From here, you’ll be able to share via email in the “Sending” tab and/or setup a link/Slack share in the “Sharing” tab.

Screen Recording 2020-03-17 at 02.26 PM.mov

A couple of things to note when sending Updates:

Create Contact Lists — By clicking “Contacts” in the left side navigation, you’ll be able to create segmented lists. For example, you could create a list of “Investors” that has all of your investors. Instead of adding individual contacts, you can add a list. Learn more here.

Stats — After you send an Update, we’ll display engagement stats. View clicks, opens, and “reactions” to your Updates. Learn more here.

Reactions — Reactions are a simple thumbs up icon at the bottom of your Update that investors can click to acknowledge they’ve read your Update. Think something similar to a like on Facebook or Twitter. Lear more here.

We hope this guide was helpful! If you have any questions or need a hand with anything don’t hesitate to reach out via email or by sending a message using the Intercom chat in the bottom right corner.

If you’re ready to take your reporting to the next level be sure to check out our Founders Forward Blog and Update Template Library.

founders

Hiring & Talent

How We Work: Zoom Calls

Remote work is here. Even if it is only for the next couple of weeks/months, companies are transitioning to remote work. The obvious distractions combined with companies transitioning to remote work who do not have a system in place will lead to many companies’ productivity and growth taking a hit.

At Visible, we believe in remote work. We have been fully remote for 5 years and have learned a lot along the way. We’ve tested just about everything — especially when it comes to weekly communication. Slack and Zoom are essentially our office. We’ve been using Zoom to power our meetings since day 1 (we love Zoom but love them even more after offering their product for free to educators and students).

In order to (hopefully) help more companies increase productivity while working from home, we’ve shared weekly meeting examples and guidelines for Zoom calls below.

Zoom Meeting Guidelines

As a remote team, meetings are a crucial medium for our team to connect, share & collaborate. Here are some general guidelines for all meetings.

Video should always be on by default (unless you have some serious connection issues).

Your microphone should always be on and not muted. We want to feel like we are next to each other in a meeting. Visual and verbal queues & feedback are important ways we communicate.

Try to find a quiet place with limited background noise.

When applicable, send out an agenda, documents, etc prior to the meeting for the attendees to review.

Below are a few examples of different meeting formats we have found to be most valuable:

Weekly kickoff and standups

Collaboration and brainstorming

One on Ones

Show & Tell

Monday Kickoff & Standup

This gets us warmed up for the week. We’ll see how everyone’s weekend went and dig into the week ahead.

Mike (our CEO) will start by giving a quick recap of our company-wide metrics, goals, news from the previous week and priorities for the coming week.

We will then review our current product & marketing boards to see if there are any obstacles, outstanding questions, etc. This is not a time to go in-depth but rather schedule a follow up time to pair with your colleagues.

Collaboration Calls

Collaboration calls are a time for us to get together as a team and work on a larger project or idea. Generally we will decide on our Monday kickoff call what we will discuss on a team collaboration call. Some ideas:

Review a product cycle item — What is the status of a current product cycle item? What is needed from others here? Is there a mockup that someone would like to present? Etc.

Play a game — Use this as a time to play a collaborative game as a team.

Brainstorm — Working on a bigger product or marketing idea that you need input from others? Use this as a time to present and collaborate on bigger ideas that involve the entire company. Be prepared with activities to guide the brainstorm session!

Other talking points:

Give a shout out to a team member and thank them. Tell them why!

Tell us a story about something Visible related! Could be a customer story, a bug you found, something you designed, etc

What did you learn last week? (Doesn’t have to be Visible related!)

What is something you are proud about from last week?

One on One Meetings

One on one calls are to make sure we are identifying opportunities to serve one another better, a chance to deepen our relationship as well as uncover any challenges before they grow into something larger.

The time should also be spent talking about near terms goals & priorities but also long term development as well.

Every one on one is the employees time and the time can be used for whatever they deem most valuable (90% of time for the employee). To make sure the time is used in a mutually beneficial way we want to make sure the employee is providing a quick update (before the call) with how everything is going, how they are feeling, and what challenges they are facing.

A couple of blog posts we used as inspiration for our meetings:

Managers, Take Your 1:1s to the Next Level with These 6 Must Reads

28 Questions For Insightful One-On-One Meetings

Show & Tells

Every Thursday a team member presents a show and tell. The topic does not have to be work related. It can range from your favorite tacos to how venture capital works to budgeting apps for personal finance!

Every week a team member presents a show & tell — @VisibleVC related or can be anything you are passionate about…

This week we learned about mechanical keyboards. I had no idea the massive community that exists! pic.twitter.com/mhFyS7m3C0

— Mike Preuss (@MikePreuss) December 18, 2019

We hope this helps with how your team can use Zoom as you navigate remote work. If you have your own tips and tricks, we’d love to hear them! Or if you’d like to learn more about how we successfully work from anywhere, feel free to reach out.

founders

Hiring & Talent

Our 9 Favorite Posts on Remote Work

At this point, it is expected that most companies and corporations will be exploring working from home/remote work for the coming weeks. There has been an explosion of “work from home” blog posts, resources, tweets, etc. over the past couple of weeks. In order to help cut through the noise, we have shared our 9 favorite blog posts on remote work below.

The post are largely curated from our weekly Founders Forward Newsletter. We search the web for the best tips to attract, engage and close investors, then deliver them to thousands of inboxes every week. Want in? Subscribe here.

The Remote Work Report by GitLab

The team from GitLab surveyed 3000+ remote employees to explore the future of remote working.

Work From Home

Seth Godin, business author, offers a framework to help employees determine when and how to work from home.

REMOTE: Office Not Required

Jason Fried, CEO of Basecamp, is temporarily offering full refunds to anyone who buys the Basecamp book, “REMOTE: Office Not Required.”

The State of Remote Work 2020

The team at Buffer share insights and data from surveying over 3500 remote workers.

Upside.fm Podcast: Powering Communication for Founders and Investors

Our founder, Mike Preuss, had the opportunity to join the Upside.fm podcast to discuss all things remote work, investor communication, and portfolio management.

Best Practices for Managing Remote Teams: A Psychological Perspective

Steph Smith of Toptal discusses how remote work can deeply influence the dynamics of workplaces and individual teams.

How to Create a Remote Work Routine That Works

Marcus Wermuth of Buffer shares his remote work tips to help form a routine that maximizes creativity and productivity.

How to Build Social Connections in a Remote Team

Claire Lew, Founder of Know Your Team, offers 7 tips to help remote employees and managers build a social connection.

At Visible, we have been fully remote for the last 5 year. Next week, we will share more specifics and advice form our time as a remote company.

founders

Hiring & Talent

Mike’s Note — Flamin’ Hot Cheetos

When I started drafting the note earlier this week I was going to ask you about Covid-19 and how it will impact your business in the short, medium and long term.

Well… a lot has changed in 72 hours and you would think we are going through GDPR again with how many emails I’ve received from vendors that I haven’t heard from in years. I don’t want to make light of the situation, it is serious, but figured you might be tired of the constant reminder. (*some extra notes at the end)

Instead, I want to share the story of Richard Montañez. If you haven’t read his story yet — please do. It made the rounds a couple years ago but want to re-share as it is one of my favorites. In short, Montańez was a janitor at a Frito-Lay plant but became the inventor of the Flamin’ Hot Cheeto and is now a VP at Frito Lay.

Two of my favorite quotes from the article:

“There’s no such thing as ‘just a janitor”

“Act like an owner”

Great ideas, innovations and processes can bubble up from anywhere in an organization. It took guts for Montańez to call Roger Enrico (CEO at the time) to pitch the idea. It took equal guts from Enrico to be open and receptive to fielding a call from someone at the Cucamonga plant.

Last Week’s Note – The Press

“Whenever that happens, I’ve called it “the floodgates have opened” and I do the exact same thing. Love it”

“To me, skills are highly influenced by your state of mind, mind and body fitness, your relationship with your loved ones, what you ate 2 hours ago… And much more. In some days, you’ll be able to overcome some challenges much more easily than in some others.”

“I just wanted to say thanks for the email below; coming during the cancellation of a major event, it was a calming and encouraging read”

founders

Fundraising

Reporting

Y Combinator Investment Memo Template

Raise capital, update investors and engage your team from Visible. Use the YC Investment Memo Template to get started.

Memos are a clear and concise document to lay out strategic vision, rationale, and expectations (in case you missed it, we wrote about the importance of memos earlier this week). We found the Y Combinator Investment Memo to be particularly interesting.

The YC Investment Memo

Memos have been something that most of us likely associate with VC funds writing for a prospective investment. The YC memo flips this idea on its head. In the YC Series A Guide, they share an investment memo template aimed towards founders. YC suggests sending your memo to investors in advance of a meeting to set the tone for the conversation. The idea is that by articulating your own memo, you can:

“Clarify your own company’s pitch and story”

“Incept your vision of the memo into their (potential VCs) brains.”

To give you an idea of what a memo may look like, we turned it into a Visible Update Template.

Pitch Deck vs. Memo

Using a memo to power a fundraise is an interesting idea. As YC suggests, founders that are strong writers may benefit from using a memo. The pitch deck has always been the go-to form for sharing data but Billy Gallagher of Rippling makes the case for using a memo in tandem.

Billy Gallagher shares a few key advantages to a memo that we’ve summarized below:

It is standalone — By sending a memo in advance you do not have to worry about the investors missing any context. Investors will be able to read and digest the memo on their own. Opposed to a pitch deck that may require a pitch and narrative around different components.

Less time — A memo will allow investors to quickly pass or take the next meeting. This way you can spend time on the firms that are truly interested.

Helps GP Pitch — At the end of a process a GP will have to pitch their other partners on why their fund should make an investment. By writing your own memo, it will make sure that the GP is properly presenting your company and idea to their peers.

We are not suggesting that every company suddenly start sending memos to kickoff an investor meeting. However, there are clear advantages and an interesting tool that more founders should study. If a memo sounds like a good fit for you and your company, give it a shot!

If you’re interested in learning more fundraising tips, be sure to subscribe to our weekly Founders Forward Newsletter.

founders

Fundraising

What is Pre-Seed?

If you’ve been following along at home it may feel like seed rounds are exploding in size. However, this is not just a feeling but a fact. Not long ago, it felt like $500k to $1M was getting up there in size for a seed deal. Fast forward to today and we are seeing seed deals pop up well in excess of $5M.

As Elizabeth Yin, Founder of Hustle Fund, put it, “I’m seeing massive party rounds here in San Francisco — $3 million – $5 million seed rounds. Sometimes $10 million rounds right out of the gates! My friend, a fantastic serial entrepreneur with an exit, raised $8 million recently at $30 million+ post-money valuation with only a very early version of a product. Investors literally threw money at her and her round was oversubscribed.”

Defining exactly what a seed round is today has become more subjective. You’ll often see companies raise a pre-seed, a seed plus, or seed extension, etc. The explosion of the traditional seed round size has cemented the rise of the pre-seed round. No doubt the pre-seed round has been around for years but is becoming more prevalent.

What is Pre-Seed

Put simply, “a Pre-Seed round is a pre-institutional seed round that either has no institutional investors or is a very low amount, often below $150k.” The pre-seed round gives a startup the opportunity to continue developing a product and create a plan to generate significant revenue.

How to Raise a Pre-Seed Round

If you set out to raise a pre-seed round a few things must be true:

You have some proof of concept or early product

The market has desired some form of need for a product/solution

One of the interesting aspects of raising a pre-seed round is the lack of traction and metrics you will likely have. A later stage fundraise will likely revolve around metrics, financials, and data (on top of your product, market, and team) but a pre-seed round will revolve around concepts and vision.

The lack of traction will also add an extra focus on the founding team. If you have no traction but a proven track record it will ease the decision making process for a pre-seed investor. If you have no traction and no track record, raising a pre-seed round will be even more difficult. Your ability to pitch and demonstrate your ability to build a product and model your total addressable market are a must.

Successfully closing a pre-seed round is just the start of your startup journey. Being able to deploy the capital to build a product, sell to customers, and attract top talent will be vital to raising future rounds (seed, series a, etc.).

If you’re just getting started with your pre-seed pitch, be sure to check out our other fundraising content. Good luck!

founders

Fundraising

Reporting

Founders — are you sharing memos?

This won’t be the first or last time we write this: being a startup founder is hard. On top of your day-to-day tasks you have to worry about your customers, employees, and investors. You can often feel like you’re buried when balancing the communication and relationships with all of your stakeholder groups. Concisely sharing strategy with your stakeholder groups is an effective way to set expectations and build relationships.

One tool we’ve seen pop up more frequently in the last few weeks are strategic memos. Memos are a clear and concise document to lay out strategic vision, rationale, and expectations. We’ve shared 3 different “memos” below that can be used for your investors, team, and executives.

Y Combinator Fundraising Memo

In case you missed it, YC recently published a Series A Fundraising Guide. The guide is full of useful information covering every aspect of a fundraise. One of the areas we found to be most interesting was the idea of writing and sharing an investment memo.

YC makes the case that founders should write an investment memo is two-fold. First, it can set up a meeting with a potential investor nicely when sent in advance. Secondly, it helps you as a founder clarify your pitch, thoughts, and rationale. As the team at YC writes, “A memo is particularly effective if you can write well. It stands better on its own as the deck (sent ahead of time) can miss context provided by your voiceover. Founders tell us that memos sent before meetings in place of a deck provided the necessary to set up an engaged conversation from the outset.”

They go on to share a template of a memo that you can find here. We’ve turned it into an Update Template so you can share it out via email or link!

Executive Team Strategic Memo

Andy Johns is a seasoned startup professional and currently a partner at Unusual Ventures. Andy recently published a blog post, A Simple Tool for Managing an Executive Staff as a First-Time CEO, to help first time founders deal with their first executive hires. As Andy points out, managing an executive can be quite different than managing team individuals.

“An executive’s job is to focus primarily on taking strategic risks. Each year, they should identify 2–3 major initiatives, large enough in impact to shape the direction of the company and enforce great execution against those initiatives. This is in contrast to non-executives, who you want to be focused primarily on tactical execution.”

So how does a founder enforce execution against those initiatives? Andy suggests having your executives fill out a quick memo template for your executives to share with you. As Andy puts it, “Ideally, what they come back with is a strategy that has 2–3 major initiatives that they find are important, along with a list of success metrics and resources they need to get it done.”

Once a founder gets a strategic memo from each executive it makes forming strategy and roadmap for the company as a whole easier. These memos can be used to fuel your strategic and financial plan for the year, create performance plans with executives and individuals, and the kickoff discussion points for annual planning.

Check out the strategic memo template from the team at Unusual Ventures here.

The EVERGOODS Product Brief

The last memo is slightly different than the first two. EVERGOODS is a small equipment and apparel company based out of Bozeman, MT. EVERGOODS has a strong focus on building an incredible product and puts a great deal into R&D and perfecting every minor detail of their products (a couple of gear junkies on the Visible team can attest to this).

As the founders, Jack and Kevin, put it, “Our experience lies in product design, development, R/D, and manufacturing for the likes of GORUCK and Patagonia. We believe in product and the processes of doing the work ourselves. Each project is an exploration, and ultimately a discovery, aided by our triumphs and our failures. This evolution inspires us and is at the heart of EVERGOODS.”

Being gear junkies and product focused ourselves, we found their product brief to be interesting and useful to more than equipment and apparel companies. While it may not translate directly to every industry, their brief is a great tool to help product-focused founders understand why and how they are building certain products and features.

Check out the product brief memo from EVERGOODS here.

Each template above serves a different purpose. While each template may be entirely different they all have one thing in common: clear and concise communication. Setting up a system to properly share strategy and rationale in a concise way will not only strengthen relationships but keep all of your key stakeholders aligned.

Do you have a memo or strategic doc that you share with your stakeholders? We’d love to check it out. Shoot us a message to marketing at visible dot com.

investors

Product Updates

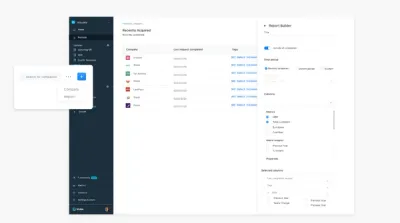

Investor Platform Updates – Reports, Advisor Roles and Custom Properties

The Visible team has been hard at work on our investor platform. Check out the updates below.

Over the next 6 weeks we will be rapidly rolling out new functionality — stay tuned! Our team is happy to jump on a quick call or demo to walk you through the latest changes and answer any questions. Schedule your demo today!

Reports

Our new report builder allows you to create and save reports for your portfolio. Reports will provide instant insights into company performance and custom views — great for weekly meetings!

In our initial release, reports can include:

Metrics

Metric Insights for changes between periods — % and actual (WoW, MoM, QoQ and YoY)

Custom Properties

Request Metadata

Sorting

Advisor Roles

Want to share specific portfolio companies with advisors, mentors or individuals that work closely with your portfolio companies but don’t want them to get full access? Advisor Roles are a perfect fit for you!

Custom Properties

Custom properties are now live in the UI. In your portfolio click the secondary dropdown and create custom properties for your portfolio.

Properties can include:

Numbers

Percentages

Currencies (Full currency support)

Dates

Short/Long Text

Dropdowns

URLs

Revamped Portfolio Company Metrics

We re-architected how company metrics are created and handled. Metrics can be assigned to all companies or on a per-portfolio company basis giving you ultimate control and customization.

Want to learn more? Schedule your demo today!

founders

Operations

Operations

Mike’s Note — The Press

Ever have one of those days where everything is clicking? Customers are signing up, the team is excited and your vision is being executed.

I had a day like this not too long ago. I was sharing the feeling with one of my mentors. He gave me some great advice, “Those are the days to work late… Call up leads that went cold. Write up a product spec. Do some strategic planning.” I call this the press. Doubling down when the going is good.

What if it is the opposite? Customers are leaving. Partnership agreements are falling apart. You missed an important deadline. Call it a day early. Spend time with some loved ones, work out or get some sleep.

Just last week I had a day when I was pressed. We had an awesome day and then saw a potential customer signed up last minute for a demo late in the evening (we love all of our Australia, New Zealand & Singapore customers :). If I was having a crap day I would have asked to rescheduled. I pressed, took the call, and fortunately converted a customer right there.

What do you do when everything is clicking? Seems like it is falling apart?

Have a great weekend all!

-Mike

founders

Hiring & Talent

Operations

Building Your Personal Board of Directors

When times are tough (which they will be) being a founder can often feel like you are alone on an island. Having people to open up to and work your way through the troughs is key not only for your mental health, but your company’s health as well. Establishing a trusted circle of mentors, advisors, and peers, your personal board of directors, from day one is a great way to prepare for what lies ahead in your company building journey.

What is a personal board of directors?

A traditional board of directors is “ a group of people who jointly supervise the activities of an organization.” A personal board of directors is a group of individuals that can offer advice and direction for both personal and life decisions. Your personal board should be a trusted group you can lean on when making difficult decisions. Just as a board of directors holds an organization accountable, the same could be said for your personal board of directors.

Who should be in my personal board of directors?

Finding the right mix of individuals for your personal board of directors can be tricky. They should be a collection of individuals that are willing to give honest and candid feedback. Generally speaking, this means leaving family and close friends off of your board of directors. The team at Harvard Business Review suggests including a mixture of the following people:

“First, you need fans — people who support you and will deliver tough feedback with kindness and good intent.”

“Second, recruit potential sponsors — senior leaders who can advocate for you when it’s time for a promotion.”

“Third, include at least one critic. These people may be the toughest to approach, but they can be the most valuable.”

No one wants to face criticism; but it is an important aspect of personal and company growth. This mixture of individuals will be able to help with professional development, company strategy, and major life decisions.

Assembling your personal board of directors

Asking people to be on your personal board of directors can be an intimidating tasks. We suggest building a list of people you would find to be a good fit (using the criteria from above). Start with your top choices and make your way down the list. If you get no response or a simple “no,” don’t fret. Simply move on to the next person on your list. If you’ve done your research and built a proper list most of the people should be eager to help you.

As we wrote in our post, “Startup Leaders Should Have Mentors. Here’s How to Find One,” we suggest when reaching out, “you should make sure to 1) explain why you’re reaching out to them specifically and 2) ask to meet with them once instead of asking them to commit right away. Those two things will make them much more likely to say yes.”

Well a personal board of directors can’t guarantee success it can certainly help as you struggle through the inevitable tough times of building a startup. If you’re interested in learning more about approach mentors and advisors, be sure to check out our mentors post here.

Unlock Your Investor Relationships. Try Visible for Free for 14 Days.

Start Your Free Trial