Blog

Visible Blog

Resources to support ambitious founders and the investors who back them.

All

Fundraising Metrics and data Product Updates Operations Hiring & Talent Reporting Customer Stories

founders

Product Updates

Xero Integration 2.0 – Chart of Accounts

Introducing Xero Chart of Accounts

We originally launched our Xero integration into the Add-On marketplace just over a year ago and it has quickly become one of our most popular accounting integrations. Xero is a cloud accounting platform that has gained in popularity and is beloved by their power-user accountants.

Our initial integration was great. We pulled in your high level financial metrics from your Income Statement, Balance Sheet and Cash Flow Statement. We started to hear more and more that our customers wanted to get granular reporting on their Chart of Accounts — after all, being able to compare your Online Ad Spend to Budget has become increasingly popular as “unit economics“ has become the in vogue term of 2016.

We’re excited to release our Xero 2.0 integration to all that not only pulls in financial metrics but will query and pull in any account from your own chart of accounts.

By pulling in your unique chart of accounts you’ll get to fine tune how you present and tell the story of your most important data.

Protip: Use your actuals from your Xero chart of accounts and compare them against a budget or forecast by utilizing our Google Sheet integration.

We’re excited to be improving the initial set of integrations we used when we launched Visible. Should you have any requests for future integrations or current ones, send us a note to hi at visible dot vc.

Up & to the right,

Mike & The Visible Team

founders

Metrics and data

How to Avoid Revenue Growth Distortion

Last week in a post about hitting revenue milestones to prepare for a Series A, I mentioned the importance of achieving true growth rates and avoiding false indicators of success. The problem for many founders comes when they try too hard to show exciting growth numbers at the expense of a clearer picture of the company’s performance.

Avoid Misleading Metrics

You don’t want to look like an idiot in front of your investors. At the same time, you want to excite your backers with some of the new accomplishments that are adding to the bottom line. So how do you avoid misleading numbers? Be honest with the size of monthly recurring revenue (MRR) numbers and your month over month growth (MoM) percentage. Your investors are likely assessing revenue figures from a number of portfolio companies, which means they know where to find weak spots. Don’t look unprepared. Here are some of the most popular mistakes–according to Amplitude–that founders make when outlining revenue growth figures:

Don’t pass off big growth rates on small numbers

If you’re still gaining traction as a startup, your month over month numbers may be tiny. So boasting mega percentages in MoM growth will be laughable to seasoned investors if you’re passing the rate off as sustainable growth at scale.

January February March April May June July August September MRR 1000 1300 1800 2500 3300 4100 5000 6200 7300 MoM Growth Rate 30.00% 38.46% 38.89% 32.00% 24.24% 21.95% 24.00% 17.74%

Don’t hide MoM fluctuation It isn’t sustainable unless you can show a detailed strategy for sales and market growth. An early stage startup with 30 percent growth MoM may not wow new investors, but it is a sign that you’re moving at a strong pace. That’s only a problem if you’re passing off your big digit percentage as a large MMR number.

Your numbers can fluctuate. That’s perfectly normal. Especially over the course of quarter, a SaaS company can often begin their first two months hitting only 50 percent of its mark, but rally for more than 50 percent in the final month on the back of the groundwork down in the beginning. Make sure your founders now how your numbers may fluctuate from month-to-month. Showing the chart below and claiming a steady 15 percent growth rate over the course of nine months is inaccurate, even though the company hits that average over time.

January February March April May June July August September MRR 10000 13000 14000 18000 20000 22000 26000 31000 32000 MoM Growth Rate 30.00% 7.69% 28.57% 11.11% 10.00% 18.18% 19.23% 3.23%

Instead, show your investors a list of your monthly numbers and explain the factors that cause the fluctuations. If you’d like to calculate your compound monthly growth rate to have the metric on hand, use the following formula:

Compound Monthly Growth Rate = (Last month/First month)^(1/Number of months difference) – 1

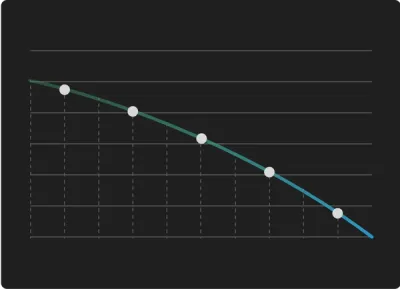

Don’t disguise declining growth rates

Using the compound growth rate (CMGR), the following chart shows a 15 percent average over the course of nine months:

January February March April May June July August September MRR 10000 13000 16000 19000 21500 24000 26500 28500 30500 MoM Growth Rate 30.00% 23.08% 18.75% 13.16% 11.63% 10.42% 7.55% 7.02%

But as you can also see, as this startups numbers continue to climb, the growth rate is slipping. That’s not always a red flag. Sometimes scaling your MRR is going to come at the cost of maintaining your growth rate. However, you don’t want to lead with your CMRG during the period without discussing the difficulty of holding that percentage moving forward.

In the long run, it’s only going to benefit you to share any bad news with investors, invite their help and be as transparent as possible to get everyone on board for the future. As Archana Madhavan said, distorting your company’s revenue picture can really damage your reputation moving forward. “When you fudge your growth models, you’re not just deluding yourself and your team,” he wrote. “You’re not just giving potential investors the signal that you don’t know what you’re doing.”

Be clear about your MoM goals and how they impact your company’s long-term success strategy. Your month-to-month performance isn’t going to be the only indicator of your company’s growth, especially if you’re sacrificing in the short-term to improve product or reformat with your team. Nevertheless, discuss these numbers with regular updates to investors in order to allow for the necessary information to be shared and everyone to feel confident in the future direction of the business.

founders

Metrics and data

Customer Segmentation Brings Focus to Startups Ready to Scale

Using Customer Segmentation to Your Advantage

Customer segmentation is a fantasy for startups struggling to gain customers. If your company hasn’t reached the product-market-fit stage, it’s hard to justify spending time segmenting your small client base.

But once your startup begins to grow at a strong pace, it’s no longer responsible for your startup to continue grabbing at any potential clients without a clear understanding of how it potentially impacts your business. Customer segmentation applies mostly objective differentiation around your varying client types and helps you build a strategy to scale each. Additionally, understanding the value of scaling each will drive decisions to dedicate resources and future planning.

Your investors aren’t going to be encouraged by your company’s direction if you’re not employing customer segmentation. “At the expansion stage, executing a marketing strategy without any knowledge of how your target market is segmented is akin to firing shots at a target 100 feet away — while blindfolded,” Tien Anh Nguyen writes for Openview. Bottom line: you might be wasting your time aiming for customers that aren’t worth the effort, while more valuable fish swim away.

Types of Segmentation

To get started on segmenting, Openview has developed a helpful guide for best practices for B2B companies. In this guide, Nguyen also outlines the three different types of segmenting strategies that are usually employed.

A priori segmentation

In this type of segmenting, classify potential customers based on publicly available information –like company or industry size. The biggest issue in this approach will surface when you find companies of a similar size or industry that have very different needs. Nevertheless, a priori segmentation can be one of the quickest and easiest ways to objectively differentiate customers if you’re just begin to use customer segmentation in your business.

Needs-based segmentation

What are the different needs your company serves? This segment separates out the different clients with different needs. You can verify these needs through primary market research. The needs approach is one of the most popular forms of segmenting, hitting on the “jobs to be done” mentality that can prevent customer segmentation from being too rigid or narrowly focused.

Value-based segmentation

This type of segmentation separates potential customers by their economic value to your business. Not all clients are going to be able to offer the same initial contract value nor will all clients be able to make your customer service efforts as worthwhile as others.

Depending on your company’s needs and product, your segmenting efforts might stray from the traditional forms of differentiation. By focusing one (or many) of the above strategies first, you’ll likely get into the pattern of recognizing the value of customer segmentation, which can help as you begin to make your model more custom.

Part of growing up as a company is focusing in on the customers that offer the most value—no longer feeling around for the right fit, but knowing your target client that is mostly likely to convert. Here’s how segmentation can help each area of your business focus:

How it improves marketing

One aspect that customer segmentation improves is the focus of your marketing message. By understanding the needs of your most valuable customers, you can tailor your communication strategy to address these pain points and offer solutions. Segmenting also identifies the value of creating different messages for different segments. If your customers are segmented by industry or company size, they may be more active on different platforms as well—providing yet another layer of marketing specificity that can improve messaging performance.

How it improves sales

Customer segmentation can focus a sales team quickly. If the segmentation process properly identifies the traits that make a potential client less valuable, your SDRs can avoid scheduling meetings and your AEs won’t have to worry about conducting demos or drawing up paper work. Instead, they’ll be digging in deeper to find out how to close the clients that really count and make more meaningful progress towards the quarterly goal. Then, the new information gleaned from the successes and failures can be poured back into the segmentation process to further parse out customer traits.

How it improves customer success

Understanding how each segment engages with your product and renews will also help you determine the cost of serving these clients. You might be able to identify how likely you are to upsell a client based on their current needs and the success of upselling similar customers in the past. On the other end, you’ll be able to better predict which customers might cancel quickly and add to your churn rate if the needs your servicing aren’t leading to renewals or if the company size tends to be in a low performing segment. While initial revenue might entice your sales team for the potential value of a customer, renewal segmenting might help you better identify the lifetime value of the customer you’re going after.

How it improves product

Trying to develop and improve a product that appeals to an unnecessarily large customer population can be overwhelming. By segmenting your potential client base, you can zero in on the specific needs that require attention first. As later iterations of your product are release, your priority structure and product road map could largely be dependent on how your customers are segmented.

So much of your success as a SaaS startup relies on execution. Share your updated customer segmentation profile with investors to help increase confidence that your company is taking additional steps to make the necessary improvements to scale.

founders

Fundraising

How to Avoid the Series A Crunch

By now, it’s obvious to most experts: the Series A crunch is a reality and a burden on many founders in need of a capital boost. The boom in seed funding and the stagnation in Series A funding has created greater competition when founders return for the next round. Quick and easy results can set false expectations—especially for first-time founders—for just how hard it might be to succeed in future fundraising efforts. Couple this distorted view with the false belief that startups are getting cheaper and a cash-strapped business could be cooking up a recipe for disaster. Is it any wonder then that about two-thirds of startups fail to raise a Series A round?

To best prepare for your future round, consider the following tips to stand out from the competition:

Prepare strong unit economics early

If seed rounds are more about inspiration, Series A rounds are closer to an interrogation. You’re no longer able to coast on an ambitious vision and a smart team to get a deal done. As a founder, it’s essential to provide proof that your unit economics are working and the model will work at scale once the business receives its next capital infusion.

Being able to share your current customer acquisition costs and lifetime value and demonstrate how those numbers have tracked over time will earn you an advantage over many of your Series A startup competitors. You’re placed with the burden of proving your model is solid, so start financial planning early so you’re not surprised when you’re hit with questions about metrics when it’s time to raise.

Get investors interested before you raise

If you’re ready to raise a Series A but you haven’t established any relationships with VCs that can make it happen, it could be too late. You may have outlined a strong path for scaling your business, but it’ll tough to earn attention quickly unless you’re already on an investor’s radar. Take informal meetings regularly when you’re not fundraising. Share your story with investors before you ever start looking for Series A cash.

Partners and associates at VC firms are hunting for their next deal. Don’t hesitate to reach out to them directly if you feel your business isn’t getting the attention it deserves after its seed round. By familiarizing VCs with your offering, you could be lining up potential suitors if the time is right. Just make sure to preface each meeting as an informal “informational” session, so they know you’re not looking to raise already.

Call on your angels

Your current crop of angel investors should be able to connect you to eager VC firms if you have trouble drumming up interest on your own. Rely on their network as much as yours.

Founders who don't update investors on their progress & problems never engage their biggest supporters — & fail 95% of the time. #realtalk

— jason ? ?? ❤️ (@Jason) October 30, 2016

But don’t just keep your investor’s Series A responsibilities to introductions. Make sure your regular updates provide an opportunity for investor to challenge your company’s metrics and help you reach important milestones that will make your business an attractive target when it comes to the Series A round. Your monthly and quarterly updates can serve as a vetting exercise that prepares you for the investors you don’t have yet. As Jason Calacanis tweeted recently, “Founders who don’t update investors on their progress & problems never engage their biggest supporters — & fail 95% of the time.”

Maintain proper expectations

Many investors caution against aiming your sights too high early. This could set you up for failure in the future. “A simple piece of advice: It’s much easier to increase a round size than to decrease it,” Josh Kopelman wrote.

Setting a fundraising amount at $10 million and subsequently reducing the round to $5 million will send a signal to investors that something isn’t right with your company and could quickly cool their interest. Unfortunately, too many founders worry about what other companies are raising instead of focusing on what their business truly needs and determining with their investors’ advice the right number to go after. Losing ideal terms on improper expectations is an unforced error.

Set a timeline and stick to it

Attracting interest from investors doesn’t mean raising money on their timeline. It’s their job to spot the next great startup and get in on deals early in the process to wedge out their own competitors. As a result, investors will often pressure founders (with their kindness, of course) to meet before they start an official fundraising process. Not only can that decrease their competition, but it likely puts them in a position for the most VC-friendly deal. Don’t let it happen. Talking terms before you need the cash can compromise your business, as your company may not have earned enough traction to receive the offer you’ll ultimately deserve when the time is right to raise.

In fact, not only should you delay serious fundraising conversations until you’re ready for term sheets, you should be thinking of creating greater time restrictions as well. When you’re ready to raise your Series A, set a firm deadline for the process so investors know how long they have to secure a deal and that you’re serious about getting it done quickly. Meet with all interested parties (if possible with your schedule) over a two-to-three week period and schedule second meetings quickly after. It’s not an unreasonable ask, nor will your deadline be arbitrary. The business got where it is today because you worked on the business instead of spending unnecessary amounts of time on fundraising. You don’t need to have flexible timeline. Plus, if you’ve driven enough interest in your company, adding a time restraint will increase the competitive atmosphere in the round and provide you better leverage in the process. Get them to agree the timeline if they are interested in moving forward in the process.

Prove that now is the time

If you can demonstrate strong unit economics, have the right amount of interest and a solid timeline, now it’s back to the basics: painting a picture of future success. Fundraising will always mix a little art into the science. In order to demonstrate that your startup is at an inflection point and ready for major scale, share your vision for how your startup will continue to grow in the market over time. Share examples of how your software has become an invaluable tool that’s saved your clients 10x what they paid. Lay out a plan that gets investors excited that you’re well on your way to hitting future milestones.

In a Series A round, these intangibles won’t be worth more than hard metrics, but don’t forget that you’re adding members to your team when attracting investors. Part of closing any deal will always rely on convincing them that they should bet on you.

founders

Fundraising

Unit Economics for Startups: Why It Matters and How To Calculate It

By now, most startup founders are exhausted by the seemingly endless talk of a tech bubble and the inevitable wave of destruction that never seems to arrive. It may not be time to hit the panic button, but the ever-present buzz around bubbles provides a reminder that any business built without a strong foundation will be (and has always been) vulnerable as the favorable tides turn.

What Is Unit Economics for Startups? A Crash Course

Eventually, all the delusions of grandeur you may have developed around your startup must be tested with a real financial model that’s easy to communicate to your investors. Sure, in the early days, you can attract capital by telling ambitious, untested stories of rapid growth and high margins. But when the rubber meets the road, the success of your business can’t be dependent on a series of hypothetical. Instead, you need to satisfy investors with an easy-to-explain model that demonstrates a formula for growth. That starts with a grasp on your company’s unit economics.

Unit economics are the foundation that sustains your business as it scales. If you understand your unit economics, you understand what needs to happen and what needs attention in your business in order to hit your goals. This is essential when it becomes necessary to determine how much you can invest in the business to get an expected return. With positive unit economics, you’ll develop your projected return on investment and also make forecasting easier in the future. No matter what stage your business is in, you need the following basics:

How much direct revenue is coming in?

What are the costs associated with the business?

What’s our unit of measurement? (one customer per unit for SaaS companies)

Then you can begin to paint a picture for your investors of your company’s customer acquisition efforts and lifetime value projections that hopefully provide a high margin return on their investment. Triple-digit revenue growth is meaningless if you’re not providing a path to earn real margins on the customers you are acquiring. As Sam Altman notes, many of the poorly constructed startups he sees today rely on wild assumptions untied from traditional unit economics considerations: infinite customer retention projections, an implausible reduction in labor costs or a highly doubtful steep drop in the cost to acquire users. “Most great companies historically have had good unit economics soon after they began monetizing, even if the company as a whole lost money for a long period of time,” Altman said.

Related Resource: Our Ultimate Guide to SaaS Metrics

What are the Components of the Unit Economics?

To best track and understand your unit economics you need to understand the individual components. Learn more about the components that are used to calculate and influence your unit economics below:

The Unit

Depending on your business model, how you classify a “unit” might differ. For a software company, this could be one customer. For a company selling a physical product, this could be one product.

Customer Lifetime Value (LTV)

A crucial aspect of your unit economics is understanding the value of a single customer. LTV is simply the lifetime value of one customer (or average order value (AOV) for an ecommerce store). This not only helps inform your unit economics but can help teams develop go-to-market strategies and product decisions.

As an example for a startup company, let’s say their customer’s lifetime is on average 22 months and they pay $100 a month. That would be a lifetime value of $2,200.

Customer Acquisition Cost (CAC)

As we wrote in our guide, Customer Acquisition Cost (CAC): A Critical Metrics for Founders, “CAC is the sum total of the amount that it takes your business to acquire a customer, including time from your sales representatives and marketing and advertising expenses.”

Customer acquisition is important when calculating your unit economics because you need to understand what it to takes to acquire a customer.

Related Resource: Customer Acquisition Cost: A Critical Metrics for Founders

Lifetime Value (LTV) vs. Customer Acquisition Cost (CAC)

In order to better understand your acquisition efforts, you can calculate your LTV:CAC ratio. As we put in our guide on LTV:CAC ratio, “to make your cost to acquire is worth the lifetime value of the customer, it’s helpful to check the ratio between both. LTV:CAC ratio measures the cost of acquiring a customer to the lifetime value. An ideal LTV:CAC ratio is 3 (your customer’s lifetime value should be 3x the cost to acquire them). “

Customer Payback

Customer payback period is exactly what it sounds like – the amount of time it takes to payback the acquisition of a new customer.

For example, let’s say it costs a company $500 on average to acquire a new customer and they pay $100 a month on average. That would be a payback period of 5 months ($500 CAC/$100 MRR). Note: This is the simplest form of calculating a payback period — there are formulas that take into account gross margins.

Churn Rate

According to Investopedia, “churn rate is the annual percentage rate at which customers stop subscribing to a service or employees leave a job.” Churn rate influences your lifetime value which in turn influences your unit economics. If you can improve churn, you’ll be able to improve your unit economics.

Retention Rate

Going hand in hand with churn rate is retention rate. Being able to retain and grow your existing customer base is a surefire way to improve every aspect of the economics around your business.

What is the Most Important Aspect of Unit Economics?

Your business model will dictate the different components and aspects of your unit economics. However, the most important aspects will boil down to how your business and acquisition model scales. Unit economics for certain business models may make sense from day 1 — for example, if you are going after large contract sizes and building a custom solution. On the flip side, there are models that will take years to make sense — for example, if you have a smaller margin business that requires massive scale and customers.

No matter how you slice it and dice it, investors want to understand that your business has the ability to turn to profitability and grow efficiently with the product and acquisition efforts you have in place.

How To Calculate Unit Economics for Your Business

Now that we understand what unit economics are and why they matter to your business. We need to find a way to calculate and track them specific to your business.

Method 1: Defining the Unit as One Item Sold

Calculating your unit economics based on a single item is sold is very straightforward. You simply take the revenue per unit and subtract the costs to sell 1 unit.

Method 2: Defining the Unit as One Customer

When calculating the unit economics for one customer (or one software user). You use the customer acquisition cost and lifetime value metrics we mentioned above. You can use the LTV:CAC ratio to understand this relationship or subtract your CAC from LTV to understand the profitability of a single customer.

Example Unit Economics Table

Here’s a sample model we developed that helps you demonstrate your company’s financials. Below, you can see the secondary performance indicators to include to develop a wider look at your company’s unit economics:

Scenario A Average Contract Value (ACV) $5,000 $5,000 $5,000 $5,000 $5,000 $5,000 $5,000 Gross Margin 85% 85% 85% 85% 85% 85% 85% Gross Profit $4,250 $4,250 $4,250 $4,250 $4,250 $4,250 $4,250 Customer Acquisition Cost (CAC) $14,286 $14,286 $14,286 $14,286 $14,286 $14,286 $14,286 Sum of all Sales & Marketing Expenses $500,000 $500,000 $500,000 $500,000 $500,000 $500,000 $500,000 Number of New Customer Added 35 35 35 35 35 35 35 Churn Rate 8% 8% 8% 8% 8% 8% 8% Expansion Rate 0% 0% 0% 0% 0% 0% 0% Lifetime Value (LTV) $53,125 $53,125 $53,125 $53,125 $53,125 $53,125 $53,12

It’s wise to have this level of detail available to investors in your regular updates. With a model like this you can help answer some of the most pressing questions facing your startup: Are you maximizing retention rates to justify the cost to acquire? Are you delivering the expected conversion rate on the money you’re spending to attract new leads? Is the revenue per user outpacing the cost to serve? As your business scales, are you seeing an expected decline in churn rate?

Why Should Startups Use Unit Economics?

Having a clear vision and path to profitability is a must for any startup. At the end of the day, if a startup fails to be able to pull a lever to generate profit, it will cease to exist. Learn more about why you should track and monitor your unit economics below:

Identify Obstacles to Profitability Early?

As we previously mentioned, solid unit economics is the path to profitability. By modeling your unit economics in the early days you’ll be able to paint a picture of your potential for profitability. If your model and plans aren’t demonstrating what you’d like to see down the road you’ll be able to identify obstacles and focus on those in order to achieve profitability.

Evaluate Potential Strategies

As we mentioned in our previous point if your unit economics are not demonstrating a clear path to profitability it might be time to tweak your strategy. By identifying the weak components of your unit economics you’ll be able to inform strategy for the coming months, quarters, years, etc. For example, if you find that you are spending too much to acquire new customers, you’ll want to focus on bringing that number down.

Analyze and Update Financial Model

As we wrote in our blog, Building A Startup Financial Model That Works, “No matter who you are talking to – team members, investors, potential investors – company storytelling doesn’t stop, it simply changes contexts and mediums. A financial model is one of those mediums through which your company can tell its story, even without the operational history one might assume would be necessary to persuade investors or make smart decisions about the direction of the business.” Unit economics will certainly play a role in this direction. By manipulating your unit economics, your financial story will need to be changed and updated as you seek capital from potential investors.

The Importance of Good Unit Economics for Startups

Unit economics are the lifeblood of a business. Without a scalable and profitable way to acquire customers, a business will cease to exist. In order to improve your unit economics, you need to keep an eye on and track your efforts. Check out a few examples below:

Raising Venture Capital

The strength of your unit economics will be one of the key competitive advantages in a venture capital market that many predict will toughen considerably as the cost of that will toughen considerably for founders over the next 5-10 years. “The question that will immediately follow, ‘What is your annual growth rate?’ will be ‘What are your unit economics?’” Tomasz Tunguz predicted. “This change in investor mentality is catalyzed by the increasing cost of startup capital.”

It’s not going to get any cheaper to run your startup or raise serious capital to keep things going. And if you’re earning low-margins, face a high-level of competition and are looking out on a short runway, your financials won’t inspire confidence in your investors. On the other hand, if you have racking up short-term loses on customer acquisition, but can clearly demonstrate your customer payback period and lifetime value, you’ll be an attractive target for investment. Learn more about raising capital in our guide, The Understandable Guide to Startup Funding Stages.

Acquisition Improvements

Tracking your unit economics forces you to keep an eye on your acquisition efforts and go-to-market strategies. If you launch a new acquisition campaign and begin to see your CAC is on the rise — it might be time to evaluate and tweak your new acquisition model. Keeping tabs on your acquisition efforts is a surefire way to grow your business.

Growing & Scaling

As we mentioned above, tracking your acquisition efforts is a great way to grow your business. By doing so, you’ll be able to understand what channels work best. You’ll be able to invest in the channels that work best so you can grow your company in an efficient manner.

Track Your Key Metrics with Visible

Markets fluctuate and conditions will better and worsen as your time goes on. But with a strong approach to unit economics, you are making responsible choices and setting yourself up to easily handle investor communication. It might not be the sexiest approach to drawing interest from top venture capitalists, but it’s a solid foundation that helps you build any kind of business.

Raise capital, send updates and engage your team from a single platform. Try Visible free for 14 days.

founders

Product Updates

Zapier & Product Updates

We quietly launched some awesome updates to Visible last week that we wanted to make sure got the attention they deserve. The two updates below focus on automation of your KPIs and enhancing the storytelling of your data.

Zapier Integration

Our integration with Zapier is now live! It is in beta so you’ll have to use this link to accept the invite to Zapier.

Link any trigger apps and assign values to your Metrics in Visible. E.g. Every time a new trial of our “Pro” account is started in Stripe I have that add +1 to our Pro Trials Created metric within Visible.

You can find more info in our knowledge base. Feel free to reach out with any questions or recipes that you love!

Update Enhancements

You can now do two commonly requested actions within an Update. 1) Include bold number visualize types and 2) Include 2 charts side by side in an Update similar to a dashboard.

In an Update simply hover over a chart component and click the grid icon to add a secondary chart. You can click the arrow to re-arrange the position as well.

We hope you enjoy these updates! Stay tuned for more exciting announcements in the near future!

Up & to the right,

-The Visible Team

founders

Metrics and data

Your Startup Needs Financial Planning Now

Your Startup Financial Planning

Financial planning for your startup is a real buzzkill. It’s a long, potentially arduous process that can feel like a gigantic distraction from the actual work needed to make your company grow. Not to mention the plans that founders create that end up closer to WAGs – wild assed guesses –than accurate plans.

But overlooking the importance of financial planning will cause major damage to your company. And if you’re only working on your plan once a year, you’re already doing it wrong. Your annual plan needs to be reviewed every month and possibly readjusted after every quarter. By reevaluating your financials every three months and checking in regularly, you’re performing maintenance on your startup—finding the weak parts of your business and testing your assumptions from the previous year. This is good discipline for any startup CEO.

Establish rigorous financial planning in your business and you’ll better understand how your unit economics are trending, whether headcount projections have created the expected outcome and what’s needed in the next few quarters to stay on track. In the early days it may be exhausting to reassess every quarter, but in the long-run you’ll be building a stronger business.

Tomasz Tunguz recommends creating and sharing two different financial plans every quarter with both the board and your company. The board plan includes the projections that you have 90 percent confidence in executing. With your board plan, you’re making a predictable commitment so you’re not over promising results, but still getting everyone on board in the room that the company is producing real growth. It’s the management team that will bear the responsibility if this plan goes awry, so setting responsible projections is essential.

Tunguz also advocates for a company plan that includes the goals you have 70 percent confidence in achieving. This should be broader, more ambitious and include the individual goals of each team. Your company plan is your reach plan, which helps fire up your troops to do more without applying too much pressure if you fall short. Every company plan should also help you measure department performance and reveal any under performing parts of the team.

The plan should be as detailed as possible so you understand the underlying factors of your business model. If your plan is just a sales number, that won’t show you where you need to improve or where your assumptions may be wildly off. Break out the plan into your different channels and show the key metrics for each. Whether it’s your cost per acquisition, number of marketing leads or customer lifetime value, it’s essential to have everything regularly measured to know if something is going wrong.

It’s not necessary to share all this information with your investors unless requested. Your investors are likely too busy to dig into the weeds. Stick to KPIs and telling the story of your company with your developed board plan. By creating two plans you are speaking to two audiences and maximizing the impact of your message. You’re setting up both ambitious goals and proper expectations. That’s financial planning without unnecessary stress.

Once you’ve hit the end of the quarter, if you feel like your business has only slightly over performed or underachieved on its performance, it’s best to stick to the plan for the next few quarters and not overreact to a potentially short-term trend. Especially if things are going well, the natural inclination of someone building a business is to think that positive performance will continue uninterrupted. Adjusting plan too quickly could cause you to overshoot your company’s ability in the next few quarters. As for under performing, even a one-time loss may provide a reason to add to headcount to help cover the gaps created so you can get back on track to hit your end of year goals.

Falling short of your quarterly goal could be a sign of bad planning on your end as well. Maybe you assumed all your reps would hit 100 percent of their quota instead of the more realistic 80 percent. If you’ve missed consecutive quarters or if your numbers are wildly off, readjust your plan for the next quarter. There may be external factors that are causing the plan to be disrupted as well, like unforeseen market forces or key employee loses that you didn’t expect. Either provides a reason to adjust your quarterly and annual figures. However, make sure these changes are being communicated to your board.

You wouldn’t avoid making constant improvements in any part of your business. A financial plan is no different. These exercises will keep you in constant communication with all parts of your business and allow you a better grasp on different aspects. This will be especially helpful when you face specific questions from investors. It will make you a better founder and executive.

Related Resources: How to Write a Business Plan For Your Startup

founders

Metrics and data

Are You Qualifying Leads the Right Way?

Qualifying leads properly is one of the most effective ways to ensure a healthy sales funnel. In order to do it right, your sales team has to examine whether or not a company qualifies on three different levels. As Bob Apollo argues, a good prospect will exhibit behaviors that earn a sales qualification in three separate categories: “organization-level,” “opportunity-level,” and “stakeholder-level.”

Let’s take a look at the kinds of questions Hubspot uses to determine what your team needs to ask and what they should understand about potential leads to find the right fit for your company.

Organization level

Is this company the right size? Do you sell to their industry? Is this a company that fits the buyer persona you’ve outlined?

Opportunity level

Can you actually fill a specific need for this potential client? Do they have the budget to make it happen?

Stakeholder level

Is this the person that can actually make the deal happen? Will the money come out of their budget? Who decides the criteria for making a purchasing decision?

If the client is way off from your buyer persona, you can cross them off the list immediately. They don’t qualify on an organizational level. If they aren’t feeling the specific pain your company serves, you’ll be wasting their time. You should know how to solve their problem better than the potential client. If they aren’t ready for the solution, you risk on-boarding someone doomed for a bad experience and a quick cancellation.

Remember the most important lesson: you don’t need to grow unnecessary leads. It’s one of the hardest lessons any sales staffs will learn (especially as sales development teams aim for lead quotas), but stuffing your pipeline with unqualified prospects will only clog your path to closing real customers. Reinvest your time into researching and listening to your best qualified prospects instead. Even if you close an unqualified lead, you’re setting yourself up to take a likely loss on lifetime value and won’t enjoy the negative churn opportunities with account expansion. Find incentives for your sales development teams to reign in only the best potential clients.

You might consider developing a qualification framework to deliver to your sales staff. Many deals your team will close will share similar behavior and commonalities. Providing a specific framework can help reinforce that message and methodology across the organization.

Ever since IBM popularized the method in the early days of software sales, BANT (Budget, Authority, Need, Timeline) has been the go-to framework for determining a client’s qualification. To make adjustments for the realities of SaaS sales, SalesHacker argues for an updated version of BANT. As Jacco Van der Kooij outlined, the prioritization of BANT doesn’t jive with the needs of most potential SaaS customers. “When SDRs are given BANT to qualify a deal, it backfires as they essentially are starting to sell while a client is still in ‘education’ mode,” he said. “When AEs are executing BANT to qualify a deal, they are getting affirmative answers yet the deal is still not qualified.”

For instance, budget will play less of a role for your SaaS sales efforts than it would for traditional software companies. Almost all your qualified SaaS leads won’t have to worry about clearing the necessary budget for the monthly or annual subscription fee. Your prospects will be more concerned about whether the problem you’re proposing to solve is worth prioritizing. Knowing that allows your account executives (AEs) or sales development reps (SDRs) to get more specific in qualifying. Let them ask “is what we’re offering something your company needs right now?” once a prospect has been properly educated on the product. Here’s how Van der Kooij would rework BANT to NTBA:

N = Need = Impact on the customer business

T = Time-line = Critical event for the customer

B = Budget = Priority for the customer

A = Authority = Decision Process the customer goes through

Finally, if your company uses lead scoring—a quantitative scoring sheet to analyze potential leads—makes sure to take a thorough qualitative assessment as well. There are almost an endless amount of behaviors that any client could display that might tip you off on their qualifications, but they may not rise to the surface immediately. Plus, it may months to score all the characteristics you require to qualify, which could lead to the decay of the initial behaviors. Instead of waiting on the client to take the actions you need, spend more time evaluating their potential need for the tools you’re offering and identifying the person in the organization who can make that happen.

Further reading

http://www.saleshacker.com/bant-sales-qualification-new-era/

https://mattermark.com/effective-lead-scoring-includes-company-data/

http://blog.hubspot.com/sales/ultimate-guide-to-sales-qualification#qualifying

http://www.inflexion-point.com/Blog/bid/95959/The-3-levels-of-sales-qualification-account-opportunity-sponsor

What’s an Acceptable Churn Rate?

founders

Product Updates

Q3 Product Updates

With Q3 in the books, we put together a wrap up of all the improvements that have been introduced on Visible over the past 3 months.

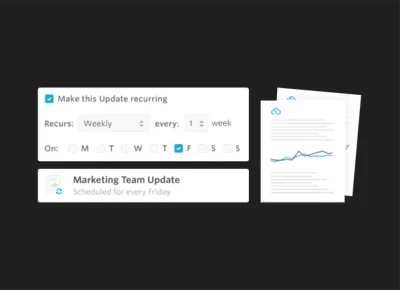

Recurring Updates

We launched recurring updates so companies can focus on telling their story to their stakeholders without having to worry about the cadence or creation of the Update.

Recurring Updates help build a rapport with the most influential people in your business. They are great for frequent team updates, investor updates and for fundraising. Read more about them on our blog: https://visible.vc/blog/recurring-updates/

Business Intelligence Layer

With our new BI layer, we are automatically calculating 5 additional metrics for each metric provided.

Easily show growth changes, rolling averages and more. We also improved charting so you can add as many axes as you wish! Read more about the BI layer on our knowledge base.

Shareable Dashboards

With Shareable Dashboards you can have tight control over who can see what. You may want certain data available to your board which could be different than your team or potential investors.

Shareable dashboards are part of a much larger push towards what we are calling Visible 3.0 which you can read more about on our blog: https://visible.vc/blog/visible-3-0-note-ceo/

Other Improvements

In addition to some major features above we also launched the following:

Ability to search Updates & pagination to increase speed.

New color palette options to give your data a unique twist.

Charting frequency improvements to customize when charts start/end.

Exporting Metrics, great for pivot table analysis.

Coming Soon…

We have some exciting integrations lined up with Zapier, appFigures and Mixpanel. Should you wish to get on any of the beta programs and provide feedback email us at beta@visible.vc

founders

Product Updates

A Note From our Design Team

Our New Chart Builder Colors

We recently added 3 new color palettes to our color picker in the chart builder. The first row of colors (which have always been in place) are from the original Visible color palette. They’re what you would currently see in any Visible charts presuming you haven’t changed the default colors (and let’s be honest – nobody changes the defaults!).

But in case you’ve been looking for an easier way to brighten up your charts, we’ve added 3 new color palettes. The 2nd row is inspired by Visible 2.0 and reflects the more modern colors we use throughout our app. The 3rd color palette is inspired by the simple and smart colors of Google’s Material design. The 4th is inspired by the bright colors of Apple’s iOS. It’s best to coordinate on one color palette for a Dashboard. So if you’re going for the blue in Material, it’s best to use the green in material for your next chart. We plan to make it easier to ‘Choose a theme’ so you can easily stick to the color palette of your choice in the future but in the meantime this should help!

founders

Metrics and data

What’s an Acceptable Churn Rate?

Calculating Your Customer Churn Rate

How do you know how many customers you can lose? Of course, you want to lose as few customers as possible and save as much revenue as you can. However, the reality is any startup is going to shed some clients no matter how well they perform. But both churn rates can help answer two vital questions facing your company: are you targeting the right customers? Is your company big enough?

Customer churn isn’t the same as revenue churn. The first refers to the number of customers that cancel their subscriptions. Revenue churn is simply the amount annual money lost in a month or year.

In the early days, you should have a higher churn rate than what your company will average over its lifespan. In your first few years, you can expect as high as a double-digit churn rate and not need to hit the panic button. But if you’re not seeing a steady drop year over year, you may have the wrong client base or need to invest more money in your client success team.

Talk to your clients that renew. Why did they continue the service? If they love what you offer, they may be the key to unlocking the best set of customers you can target. You don’t want your startup to waste time worrying over cancelled subscriptions if these clients are a natural mismatch and your current set of renewals can help find signal for your product and its go-to-market fit. Sometimes the best strategy for reducing churn rate happens at the acquisition stage.

When it comes to determining an acceptable churn rate, it’s every bit as important to understand the size of your customers’ business as it is your own company. You can accept about three to five percent of your small to medium sized businesses portfolio every month or less than 10 percent annually. As enterprise level businesses go, aim for a churn rate less than one percent. Your churn rate should continue to decline in subsequent years until you reach negative churn.

Reaching negative churn—monthly or annually—is going to be one of the most attractive metrics your company can showcase to its investors. It’s good to have a portfolio of customers “that are like high-yield savings accounts.” Negative churn, also known as account expansion, occurs when the new revenue you are earning from current customers (whether it comes from upsells or cross-sells) exceed the revenue you are losing from customers that cancel their subscriptions. As Lincoln Murphy writes: “Remember, it’s a lot easier to get more money from a customer who’s happy and already paying you than it is to get money for the first time from non-customers.”

Negative churn can also serve as one of the key metrics to judge your client success efforts, as expanding your account revenue beyond your subscription loss will help determine if your team is moving in the right direction. Tomasz Tunguz has even advocated for startups to aim for negative churn when deciding their pricing model and developing a customer success strategy. You’ll want to keep your eye on your minimizing your churn rate and show a sharp decline as years go on, but make sure to set forth on a path that will reach negative churn as your holy grail.

Related Reading: How To Calculate and Interpret Your SaaS Magic Number

founders

Hiring & Talent

When & Why it’s Critical to Hire A Customer Success Manager

When to make the first client success hire

Is there a simple revenue mark you need to hit to justify your first client success manager? Not really. Most large SaaS companies add one client success manager for about every $2 million in annual recurring revenue, but you can’t wait until you reach $2 million to make a client success hire. As Jason Lemkin wrote, “hire your first CSM as early as you can afford to, as soon as you have even 1 large customer, or even a handful of medium-sized customers.”

Lemkin believes once SaaS companies gain initial traction they can plan to spend anticipate about 10% of existing revenue base on the client success efforts. “At $2m in ARR, budget $200k in headcount for the CSM positions + support. At $4m, $400k, and so on,” Lemkin wrote. “You may be able to pare this back a bit later, but probably not too much.” Using that benchmark is an easy way to keep your company from putting too much pressure on your client success team and keeping you accountable to growing the team. It’s also a simple way to justify your hiring plan.

As a SaaS company, so much of your success will not only rely on your ability to get clients to renew, but also upgrade and provide additional revenue to the deal. A good client success team could be responsible for handling as much as 75% of revenue. Don’t wait too long to make that first hire or risk losing quite a bit of that.

What is a customer success manager?

A client success manager centralizes communication efforts. In the early days, everyone from the head of IT or CEO might field questions, which sets up a potentially confusing system for solving client problems. Once a client success manager is in place, not only does it organize the customer service process but it also provides clients a regular contact. That adds a personal touch to the feedback loop and it will make your customers more comfortable using the product and reaching out when they have issues.

Why hiring a customer success manager is important

Especially in the early days—when you’re scrapping for revenue and closing last minute deals to hit quarterly goals—it’s easy for SaaS startups to overlook client success. Making a hire on the client success side doesn’t provide the immediate returns like a sales or marketing addition. It won’t improve your product like an engineering addition. But a strong client success strategy offers enormous value and is every bit as important as sales, marketing and product. It’s a long-term investment in growth and also an indicator your company will grow faster than your competitors and do it with less capital.

Delight Your Customers

One of the biggest benefits of making your first customer success hire is that they are someone that will be able to delight and expand your existing customer base. Having someone solely dedicated to delighting your customers will help ensure any potential problems, cancellations, or churn are picked up before it is a problem.

Grow Your Business Efficiently

In order to best grow your business it is vital that your existing customers stick around. No matter how fast your sales team is bringing on new customers if they are cancelling or churning shortly after. A customer success manager will be essential in growing your business as your customer acquisition continues to expand.

Free Up Time of Other Team Members

Generally in the early days of a business everyone kind of owns customer success but no one truly owns it. By having someone dedicated to owning customer success you’ll allow the rest of your team to focus on their day-to-day to grow the business in their respective areas.

How much does a customer success manager make

According to PayScale the average customer success manager makes around $68,000/year with the range being anywhere from $49,000 to $120,000. Generally speaking a customer success manager’s salary is largely their base pay with the occasional incentive or bonus plan.

However, the location of the employee can also make an impact on their compensation. For example, a manager in New York City will make more than one in Denver.

Do customer success managers get commission?

According to data from PayScale and BuiltIn, customer success managers generally do receive a small form of commission. PayScale shows that the range floats from $2k to $31k whereas the average from BuiltIn floats around $10k. Generally, commission is not widely expected for the customer success role but including incentives and commissions can be a valuable tool to hire top talent.

What responsibilities does a customer success manager have

As the old adage goes, “it is cheaper to keep an existing customer than to find a new one.” Customer success managers are responsible for engaging, upselling, and building relationships with current customers to make sure they are getting the most out of your product or service. A few of their key responsibilities:

Build Relationships

Arguably the biggest responsibility of a customer success manager is to build and maintain relationships with existing customers. They should have a good understanding of the customer base and should not hesitate to reach out when needed.

Educating the Customers

A customer success manager has the ability to educate your customers and get them deeply engaged with the product.

Upselling & Renewing

Another key role of a customer success manager is the ability to upsell and call on existing customers to upgrade their plan. This is generally done at the end of a period (month, quarter, year, etc.) so strong task management and a follow up cadence is a good trait to mave. If they’ve properly educated a customer an upsell should be an easier accomplishment.

Onboarding

Depending on how the business is structured a customer success manager might own customer onboarding as well. This goes hand-in-hand with educating the customer but this is essential in getting them setup and ready to dive into the product or service.

Understanding Customer Needs

A customer success manager also has the opportunity to impact the product roadmap and help with decision making on where to invest the time of the team. As they are the voice of the customer they should advocate when they notice a trend or gap in the product or service.

How many accounts should a customer success manager have?

There are many varying takes on what a customer success manager’s workload should look like. Some argue it should be a set number of accounts while others say it should be counted by a revenue number.

Managing Accounts

Having a set number of accounts can be tough to translate across different businesses. For example, if the maintenance and contract value are higher they will likely have less time to manage accounts. As the team at ClientSuccess put it, “I prefer to keep the number of accounts in the 25-35 range, but many CSMs can manage up to 50 accounts and still build meaningful relationships, pick up the phone, respond to emails, and eliminate customer challenges in a reasonable amount of time. Any more than 50, though, and a CSM’s ability to proactively engage starts to diminish and the CSM will need to use additional technology and automation to improve his ability to manage the larger number of customers.”

Managing Revenue

On the flipside a more relatable metric might be managing revenue. While this certainly holds true for SaaS businesses it can also make sense for other businesses. When speaking to SaaS companies the contract and customer type impacts the $ of revenue a customer success manager can handle but generally speaking it is anywhere from $2-$5M. As Tomasz Tunguz puts it, “The truth is most CSMs manage between $2-5M in ARR and somewhere between 10-500 accounts. But it varies by segment.” Tomasz Tunguz charted the data by segment in his chart below as well:

What skills should a customer success manager have?

There is no one size fits all when it comes to a customer success manager but there are a few traits that you can keep an eye out for:

Empathetic

Generally speaking a customer success manager needs to be able to step into the shoes of the customers and understand how they are feeling. Not everything goes smoothly so they need to be able to help during down moments and show empathy to the customer base.

Transparent

Being able to have an open and transparent relationship with customers will only strengthen the trust and improve likelihood of an upsell or renewal in the future. If the core responsibility of a customer success manager is relationship building it all starts with building trust.

Proactive

Customer success managers need to be incredibly proactive. They need to sense problems before they happen and not be afraid to reach out before it becomes a real problem. Proactive outreach and communication will keep they ahead of the curve and will help strengthen their relationship.

Customer success manager vs account manager

As a SaaS company, every renewal is a referendum on client success. Each time clients get a bill they have to decide if your software is worth the money. So your client success manager cannot adopt the onboard and release approach, where an account manager typically spends 90 days getting a customer comfortable and then fade away. Instead, your client success manager needs to commit to a multi-year process that involves getting your customers acclimated to your company, developing a rapport and quickly tending to any issues they encounter. That’s what helps keep the renewals coming and increase your customer’s lifetime value.

And your customers will be doing you a service as well. Through solving client’s problems and answering their questions, you’ll be acquiring essential product feedback that will help inform the next wave of iterative improvements.

To learn more about hiring and building culture in the early days of a startup, check out our guide to startup company culture here.

founders

Metrics and data

Sales Development Rep (SDR) – KPIs Template

A Google Sheet Template for SDRs

Last week, we talked about the importance of SDRs. Sales Development Representatives (SDRs) have become an increasingly popular position to hire the past 10 years. Just check out this Google Trend from 2010 to now:

If you want to learn a little more about the history and progress of the role, PersistIQ has a great post here. When it comes to SDR teams, the process and metrics always vary depending on multiple factors like company stage, contact sizes, sales cycles and more. There may be no one size fits all playbook and the strategies and processes to get there could vary by a wide amount.

But in our research we found one important commonality in success SDR teams: handing off qualified leads to Account Executives (AE) is an essential goal.

Some teams consider a qualified lead a company that schedules a demo. Other teams wait for the AE to officially qualify the lead after a demo. Either way, you must allow AE’s to work on the most relevant deals to maximize their time and increase their likelihood to close.

Every company should also know the progress of their SDR team, the goals they need to hit and make sure management understands the return. Don’t forget about the intangibles either. Conner Burt, Chief Operating Officer at Lesson.ly, said the long-term prospects for SDRs can often be about more than just filling a funnel.

“Your building a bench that you can use to promote SDRs to quota bearing sales people. That’s an intangible benefit.”

With this in mind, we built a simple SDR KPIs template for sales teams in Google Sheets. It is flexible so you can remove any irrelevant info, manipulate it or add anything missing that fits your process. The template will also easily plug into your Visible account! Get it below!

Click here to get the Free SDR metrics template!

Feel free to copy the sheet and drop in your own goals, metrics and KPIs. Hopefully this is a great reference to get you started! Send any any all feedback our way to marketing at visible dot vc. If you want to integrate with your Salesforce account schedule a demo!

founders

Hiring & Talent

Roundup: The Importance of SDRs

The Call for Sales Development Reps

Sales development reps (SDR) are an extraordinary tool to help you efficiently scale your startup sales staff. Reallocating some of the early work to SDRs can help experienced account executives focus on closing deals. But despite the value of specialization, a recent survey by Bridge Group revealed that just over half (51%) the companies asked segment inbound qualification and outbound prospecting into separate roles. What are they missing? The Bridge Group listed out four key advantages to specializations:

A more focused, accountable sales force

A well-aligned process to match prospect behavior

Clearly defined career paths in your organization

Role-specific innovations

Of course, not every company will have enough employees to segment its sales staff. In the article, David Skok provided two provided criteria to know when you’re ready to hire a SDR:

There is enough lead flow to make qualifying potential customer a full-time job for SDRs

There is enough budget to hire two SDRs–hiring only one SDR might give you inaccurate view of how effective the role can be for your company

Related Reading: Breaking Down the Nuances of Annual Contract Value (ACV)

When adding SDRs, your return on investment may take an initial dip as the added staff may not be remarkably efficient out of the gate. But even if metrics slide, Conner Burt, Chief Operating Officer at Lesson.ly, said the long-term prospects for SDRs can often be bright for your business. “Your building a bench that you can use to promote SDRs to quota bearing sales people. That’s an intangible benefit.”

Since 2010, there’s been a steady rise in the number of SDRs hired, which has resulted in a drop in the level of experience for the position. The average experience now is 1.3 years. The number of companies that hire SDRs with less than one year of sales experience has quadrupled since 2010.

So ready to hire? While not all organizations are equal, Tomasz Tunguz does recommend having an average contract value (ACV) over $3,000 to justify building out your sales pipeline. Once you’re ready and looking for SDRs, Hubspot has a list of 19 questions for you to ask candidates. Here are some examples of the kind of questions they recommend:

Pretend I’m a potential customer: how would you describe our product?

Why do you want to sell this product?

What would you ask potential leads to determine if they’re qualified?

How would you research a potential customer? What resources would you use?

What do you think will be the most common objections you’ll hear from potential clients?

Lastly, while we’re on the subject of scaling your sales staff, be sure to check out this post from SalesHacker on the topic for further reading.

founders

Product Updates

Visible 3.0 – A Note From our CEO

Today’s feature announcement is relatively minor (yet awesome) but its meaning is much greater. If you just want to read about Shareable Dashboards head to the bottom. If you want to hear what we are up to, keep reading. I’m really excited to share Visible’s focused vision for our product and business.

When we on-boarded our first customer almost three years ago (thanks Iron Yard!) our goal was to solve the pain that came with monitoring and managing a privately held portfolio. We constantly heard the same thing from investors over and over again,

“I never get investor updates or know what is going on with my portfolio!”

We set out with a grand vision to build a product used by companies to provide KPIs, updates and cap tables to their investors in addition to a product that would roll all of this information up to the investors and for their own reporting to their investors (LPs).

We learned two valuable lessons from this initial product and go-to-market strategy:

Companies have to want to communicate with their stakeholders and respect their relationship with them. (Btw – we’ve also found that the best ones do and are 200% more likely to get funded)

We were trying to solve too many problems for too many people. We built very average features for all of the end-users which were not 10x better than current workflows in the market.

Despite the issues above we were able to prove that there is a big problem in the space and that we could execute. We raised some funding and started to build a world-class team. We went to the drawing board and launched Visible 2.0 last summer (if you want to check out the technical considerations read Karel’s post).

With Visible 2.0 launched and in market we saw many interesting use cases develop (including but not limited to):

A distillery in NYC sharing depletion and market data with their sales team.

A team at a 900 person travel company providing Updates internally

Marketing and branding agencies sharing campaign and other KPIs with their clients

Innovative CFO & Accounting firms like Xcelerate Financial, Scalability, and LiveCA integrating their clients into the Visible ecosystem.

A church in New Zealand providing updates to the congregation.

And of course our original use case where Unbounce is providing monthly investor updates about their $12,000,000 a year business!

With our learnings and and evolving use cases we started to greatly hone in our product focus and strategy. We removed the cap table, improved our Updates editor, invested in creating great content like our ebook on data distribution and model for total addressable market. Our goal was (and is) to create a frictionless product while helping educate the market.

So what does this all mean? In short, we want to empower companies to share the story of their data with their stakeholders. It doesn’t mean that we are getting out of the investor reporting or portfolio game…quite the opposite. We are doubling down but also building a platform to elegantly handle all the uses cases mentioned above.

What about the product? Starting with this launch we are merging the idea of “companies” and “funds” in our product architecture. Our current customers and users wont know the difference; however, it opens up to handle more use cases & complexities for the future. The first step in this endeavor is sharing dashboards:

Sharing Dashboards

Starting today you’ll be able to share specific dashboards with individuals directly or with one of your Contact Lists. We’ve received a lot of feedback that companies want to only share certain dashboards with certain team members, investors or clients giving them more control over who can see what.

Those with access to shared dashboards will have a feed at the user level of all of the dashboards they have access to along side Updates they have received.

So what is next? Over the coming weeks and months you can expect the following from the Visible team:

Improved data integrations – If you are using our Quickbooks, Xero or Google Analytics integrations give me a shout.

More advanced charting, Updates and ways to present data outside of Visible.

The ability for an individual assign Dashboards or Updates to an entity. E.g. if you are a VP of Sales and getting an Update from a sales manager, you can assign it to your sales entity in Visible or if you are a GP of a VC fund and get a dashboard from a company, you can assign it to the proper fund in Visible.

“Data Pipes”. That is what we are calling them internally for now. Sometimes you need to get raw data from one entity to another for analysis. We will be enabling (on a per metric level) to share a metric with an individual or list similar to Dashboards.

I’m truly excited for what is ahead and to share the journey with our customers and community.

Up & to the right,

-Mike

Unlock Your Investor Relationships. Try Visible for Free for 14 Days.

Start Your Free Trial