Blog

Visible Blog

Resources to support ambitious founders and the investors who back them.

All

Fundraising Metrics and data Product Updates Operations Hiring & Talent Reporting Customer Stories

founders

Reporting

How to Deliver Bad News to Investors

Even the best companies will eventually face one of the unfortunate inevitabilities of startup life—the investor update that’s littered with bad news. But delivering dissatisfactory results doesn’t make you unique. How you handle adversity, on the other hand, can make you stand out and serve as a test that separates the strongest founders from those that crumble under the pressure.

Related Reading: How To Write the Perfect Investor Update (Tips and Templates)

The irony of investor updates

Entrepreneurs on a hot streak tend to be better at keeping investors up-to-date than those struggling to hit KPI goals. Makes sense. We’re happiest to show our work when we’re assured accolades for our hard work. But it’s the entrepreneurs missing their goals that need to be the most transparent with investors—even if the next report resembles an S.O.S. message.

You can’t lose sight of the fact that investors are bought into the company’s future as well and willing to assist. Let them help. Shielding a group of experienced mentors from chipping in with their expertise on issues they’ve likely faced before is a lose-lose scenario for investors and founders. So regardless of company performance, keep investor updated early and often. “Transparency is the foundation of all great companies,” Entrepreneurial coach CJ McClanahan says. “Everyone is going to figure out what’s going on eventually—your team, investors, the marketplace, everyone. So live by this adage: tell the truth fast.”

How to avoid the big blow up

Hit your investors with some unpleasant news after months of radio silence could be seen as a sign of disrespect. Thus, an unnecessary blowup could ensue, taking everyone’s eye of the ball of what’s really important: turning the company around.

Regularly send your investor reports. There’s no reason a bad quarter has to turn into a company crisis, but slumping numbers will shock investors if they haven’t been able to track the company’s progress in months. This approach is also a great strategy for securing future funding. Early stage VCs tell me they are twice as likely to invest again in later rounds with companies that kept them up-to-date on performance.

When it comes to the bad news, don’t be afraid to get specific. If there’s been a plan or decision that you’ve executed that didn’t work, walk your investors through your process. Explain why it didn’t work. And always justify. Even if you’ve made the wrong choice, backup your decision making with what you knew at that time and what you expected as a result. You don’t want your investors thinking you’re acting careless with company strategy. A Columbia study showed people are much more likely to empathize with poor results if they understand the process. By doing this, you’ll also preemptively answer many of the questions your investors will want to know about the company and use the moment as an opportunity to showcase your preparedness.

Plus, the extra level of detail will help investors identify where you may be able to improve or how they may be able to help. After you explain your process for previous decisions, let your investors share how they would’ve done it different. If you allow the room to debate the merits of a decision, investors will feel more confident that their voice will be considered in the future.

Finally, as Joshua Margolis, a professor of business administration at Harvard Business School, explained to HBR.org admitting that you’ve made a strategic mistake can help you maintain credibility as a founder and provide a rallying point for everyone to work harder on making the business a success.

But your message won’t motivate unless it’s delivered well. It’s essential to walk into a meeting ready to deliver bad news without ambiguity. Don’t make investors guess which metrics underperformed or what efforts didn’t work. Outline the problem right away. Make sure you’ve prepared your remarks before you give them and practice, practice, practice. Go over your updates with a co-founder or a friend and double-check that you’re clearly conveying the information you want to get across. Even if you’re not a natural presenter, rehearse enough to allow yourself to stand in front of room full of investors and speak with confidence. You don’t want your body language to say something more negative than your underperforming numbers.

How to turn the ship around

Now it’s time to move on to the future. Like Don Draper said, “If you don’t like what’s being said, change the conversation.” That’s not always easy when you’re looking at hard numbers, but a shifting the conversation to a strategic focus on the future can get all investors onboard. Don’t just beg for help, get into specifics. Assign tasks to individual investors (based on their strengths) and share with the group what you expect in return.

Then show what you and your team are going to do to solve your biggest problems. Much like walking through the process that lead you to poor results, show the specifics of what you plan to do to jumpstart your KPIs. Open the floor to questions and feedback after. Allow your investors to tweak the process. Strong collaboration will create additional buy-in and get everyone excited for what’s coming next.

You’re in a great position to turn this situation into a big win for you and your company. Never forget that adversity is a necessary ingredient in all great startups.

founders

Fundraising

Product, Market, or Team

It’s an endless debate: product, market or team.

Which matters most? That depends on whom you ask. The beauty of this startup conundrum is often in the eye of the beholder VC. Even the most prominent firms rooted on Sand Hill Road can’t agree on what matters most in funding decisions. “The difference between venture firms in a lot of ways is how they rank the importance of market, product and team,” Marc Andreessen said.

To better understand why, we took a look at the reasons given from a few notable groups.

Product

There may be no better advocate for the creation of the undeniable, unbeatable product than the “Competition is For Losers” spouting investor Peter Thiel. The Paypal co-founder and famed Silicon Valley contrarian even developed a seven-part test to determine if a founder’s new technology meets his criteria to make a bet on its success. Is your team good enough? They’ll pass the test. Is your market big enough? Who cares—create a new one if it isn’t. Thiel argues good innovation sells itself. “If your product requires advertising or salespeople to sell it, it’s not good enough.” He wrote in Zero to One. “Technology is primarily about product development, not distribution.”

The Founder’s Fund, which Thiel co-founded, has a longer manifesto here that explains in greater detail their investment philosophy on startups.

Market

Don Valentine keeps his philosophy simple: “great markets make great companies.” Dubbed the “Grandfather of Silicon Valley,” Valentine, who founded Sequoia Capital, famously fired Sandy Learner and Leonard Bosack, the co-founders of Cisco Systems, from the company they started and the technology they built. Without its founders, Cisco continued to succeed under the leadership of professional CEO John Morgridge. “I like opportunities that are addressing markets so big that even the management team can’t get in its way,” Valentine said.

People can be hard. Benefitting from a rapidly growing market can be easier.

In a remarkable talk (below) with the Stanford Graduate School of Business (unsubtlety titled “Target Big Markets”), Valentine explains how Sequoia Capital is most often interested in markets already populated by a few products. “We were not interested in creating markets. It’s too expensive. We were interested in exploiting markets early.”

Team

Marc Andreessen is acutely aware of the inherent absurdity in startup investing, where having 15 of 30 investments succeed —a batting average that would sicken hedge fund managers—can make for a dynamite portfolio. No matter what’s prioritized: market, product or team, Andreessen is under no illusion that growing a company is easy. “The default setting of every startup is dying in obscurity.”

But if someone is going to solve big problems, Andreessen wants invest in the person doing it. On a recent podcast, Andreessen explains that team is makes the most sense of the three to back: “We struggle from a distance to evaluate market, he said. “And we also actually struggle to evaluate product. But if you can get yourself in business with really good people, I think number one: if it works it’s great, because those are really good people to be in business with and they, with you, can build something great. But even if it doesn’t work—if it’s the wrong market or the wrong product—you’ll still learn so much working with the right people and you’ll build such a valuable network for what you do next.”

It’s wise to do reconnaissance on the investors you’re going to pitch to find out which matters most to them. The answer may not jive with what makes your company is great, but even in the worst of circumstances, you’ll understand why you’re getting told “no.”

founders

Fundraising

Pitch Deck Success: Drip Campaign for Term Sheets

Drip Campaigns for Investor Relations

One of the most difficult parts of fundraising is getting your foot in the door with an investor. Grasping their attention is key and receiving an invite for a meeting has an extremely low success rate.

Anyone who has ever raised capital knows that it is not something you complete as a weekly sprint, and that it can take months from start, to term sheet, to finally spending that money on some well deserved office beers.

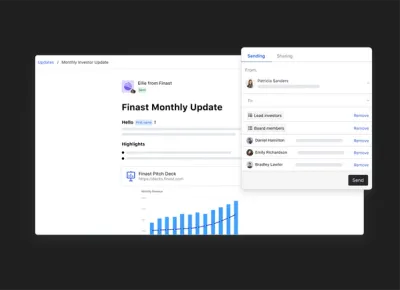

At Visible, our initial success has been with stakeholder and investor reporting; all the details and data after you received funding. As we continued to grow and build new features and tools, we built Visible to be used throughout the entire process of investor backed companies; from sending out initial pitches, full on pitch decks, and investor reporting after investment.

I want to share a few things that we have learned, both from Visible, founders, and investors about pitch decks and fundraising. We put this into an eBook so that you can always keep it with you and easily share with others. Here are a couple excerpts…

Pitch Decks Are Resumes: Make Yours Targeted

If your metrics are akin to a resume then what is your cover letter? How are you and your company effectively telling your story in a succinct way that matters?

Drip Your Way to Success

Every conversation you have with a stakeholder is your chance to plot a dot in time. Have enough dots, create a trend. Have a trend (ideally a good one) and your fundraising process will be tight, clean and efficient.

Interested in checking out the entire eBook? Click below to get your own copy of how to easily and effectively start your next fundraise.

Get access to your copy of Visible’s Solution to Pitch Decks here (no email required)!

Raise capital, update investors and engage your team from a single platform. Try Visible free for 14 days.

founders

Reporting

5 Ways to Make Investor Communication Better

Yes, bad blood between a startup CEO and one of the company’s financiers may be a plague on both houses, but the responsibility largely falls on the founder to prevent the affliction.

Maybe you’re one of the lucky ones. Maybe you have managed to preserve the sacred union between founder and investor. Good. But your work is not complete! Like all relationships it’s bound to fall apart without strong trust and communication. It’s not good enough to simply declare an open door policy for emails, calls or visits. Set a schedule and stick to it. Provide regular updates that outline vital metrics and allot time for investors to have the opportunity to ask you anything. The cycle of updates and willingness to be transparent mitigates one-off asks and actually helps you stay focused on the most important aspects of the business.

Follow These 5 Steps to Improve Investor Relations

Go one-on-one—Set up individual investor calls. Allowing time for long-form discussions, brainstorming, individual inquiries and just shooting the breeze or sweet talking to help make every investor feel important. This is essential for those unable to attend in-person meetings. Do your best to schedule interactions outside of the office, too. If you and your investors are able to make time for lunch or drinks, you can better understand your investors on a social level as well.

Regular conference calls— Follow up on written reports by setting up a call to field questions or any other particulars that pique an investor’s interest. Share a conversation and you and your investors will remember why you fell for each other in the first place.

Write monthly reports: Keep it simple. Investors want updates in five key areas: how much cash is in the bank, how many months until $0, how the team is functioning, how are the KPIs and how they can help you. Having a hard copy provides your investors with a reference sheet when they need quick answers about your company.

In-person meetings— Get everyone in a room and let investors pepper you with questions like you’re facing a firing squad. The physical meeting simply can’t be replaced, even if out-of-town investors can’t make it. Investors will appreciate the chance to meet face-to-face.

Ask what you’re doing wrong –Vulnerability is a great thing if it strengthens relationships. Open yourself up to criticism from your investors. Let them take you to task, you’ll be better off for it. And to improve your communication strategy, ask each investor what else you could do to keep them properly up-to-date on the company’s health.

Investor communication is no less important than communication with your employees. Everyone involved in the business needs to stay on top of what’s going on. And investors will have a much tougher time staying in the loop while managing a portfolio of other companies and spending most days not interacting with your business at all. So don’t let communication gaps form and relationships fizzle. Keep the feedback loop going and let harmony reign. Now say it together: ‘til liquidation do we part.

Related Resource: Liquidation Preference: Types of Liquidation Events & How it Works

Search through thousands of VCs with Visible Connect:

founders

Product Updates

Recurring Updates – Building Better Habits

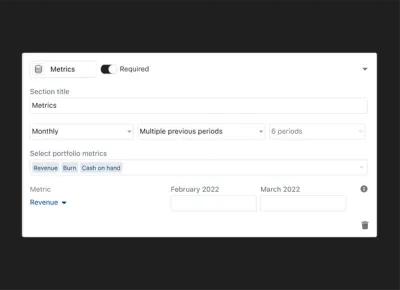

We always strive to reduce the friction for letting companies tell the right story to the right stakeholder at the right time. Recurring Updates is our latest step in that direction.

Recurring Updates simply let you choose a time period on which you would like your Updates to be prompted to send (think of them as recurring calendar invites but for your data and reports). You can have your investor updates recur every month, team updates every week and board reports every quarter. We’ll automatically grab your new data for the respective period and all you have to do is provide the context.

Create a Cadence

Utilizing Recurring Updates will get you into a cadence and form a great behavior over time. Your stakeholders will know that they will hear from you in a timely, professional and visual way. You’ll be able to leverage your stakeholders and spend valuable time diving into major issues in your business by saving time on your stakeholder updates.

Build a Rapport

Your stakeholders will be more engaged in the business than ever. The secret to all great relationships is communication. Your stakeholder relationships are no different. Recurring Updates make it easy to invest in your stakeholder relationships without having to invest too much of your time.

Utilize our Contact Lists functionality to segment various groups of stakeholders and use them in your various Recurring Updates.

Business Intelligence for your Stakeholders

With any Update sent on Visible we close the loop providing the sender with detailed analytics of who is engaging with the content you’ve crafted. Quickly understanding who is engaged and disengaged. You’ll know exactly where to start a conversation with any stakeholder.

FAQs

Q: How do I create a Recurring Update?

A: Easy. When you are sending an Update we’ll ask you if you would like to make it recurring. You can also create one from the templates section in your Visible account. Find step by step instructions in our knowledge base.

Q: Do Recurring Updates automatically send?

A: No. They are put in a draft in your Visible account. Only those with edit access to Updates can see the drafts. You still have to hit send and are able to make any changes (or delete it completely). Someday we may let you automatically publish Updates but that would be an explicit action and setting.

Q: Is there a limit to how many Recurring Updates I can have?

A: No! You can have as many Recurring Updates as you like!

Q: Why should I be using Recurring Updates?

A: They’ll save hours of time but more importantly they will help you create a great behavior that will let you attract more talent and more investment dollars.

Q: Am I reminded when I have a Recurring Update?

A: Yes! We’ll send you an email reminding you that the Update is in draft and link directly to it so you can make any changes and send!

We hope you enjoy. As always, let us know if you have any questions or feedback. You can directly schedule a quick 15 minute consultation by clicking this link.

Up & To the Right!

-The Visible Team

founders

Metrics and data

Why Revenue Per Lead is Really Important to Track

Are you tracking revenue per lead?

Sales can fix a lot of problems. As company growing pains continue as a business scales, it’s easier to focus on marketing initiatives or nip product bugs in the bud if your Monthly Recurring Revenue (MRR) regularly surpasses its goal. Drilling down to the core metrics that drive sales performance is one of the best ways to expose how well a startup scales after reaching initial traction.

As we’ve discussed before, Lead Velocity Rate (LVR) is the favorite metric many VCs want to see to evaluate a company’s sales. Jason Lemkin unabashedly loves LVR, calling it the #1 metric to determine the trajectory of SaaS company’s sales. But Lemkin is also an advocate of measuring Revenue Per Lead (RPL), noting it as the second crucial sales stat to track.

How do you measure RPL? The equation is simple division:

Revenue Generated/Number of Leads = RPL

On the other hand, the benefits of RPL can be widespread for your sales force. Take individual sales rep performance. Once you’ve established your company’s current RPL and track its growth, you’ve created an evolving benchmark that can help measure the effectiveness of everyone on the team. RPL will showcase which reps are able to convert leads into customers at the highest rate. It can also determine how many leads one rep can handle before the workload becomes counterproductive and RPL starts to slump.

More than Monthly Recurring Revenue (MRR), RPL can reveal whether or not your funnel is actually filled with Sales-Qualified Leads (SQL). It will also outline how well your team is converting SQLs and able to achieve additional revenue on each sale as the business scales. As Lemkin told InsightSquared:

“Leads are precious for a long time in startups, and if you can get 20 percent more out of each lead, that’s magic. But if you don’t measure it down to the individual rep level and you just look at MRR, you’re missing an opportunity to improve things.”

So for founders and investors, noting RPL in regular updates provides an easy top-line metric to communicate a startup’s health. It also a powerful indicator within a company of whether or not the business is steady as it scales.

Related resource: Lead Velocity Rate: A Key Metric in the Startup Landscape

founders

Metrics and data

When & How to Calculate Market Share (With Formulas)

What is Market Share?

One of the first steps to building a business is understanding the market and understanding the viability of a successful business. Regardless if the goal is to be a multi-billion dollar company or a local joint that can sustain a few employees — understanding the market, and your share of the market is vital.

As Investopedia puts it, “Market share is the percent of total sales in an industry generated by a particular company. Market share is calculated by taking the company’s sales over the period and dividing it by the total sales of the industry over the same period. This metric is used to give a general idea of the size of a company in relation to its market and its competitors. The market leader in an industry is the company with the largest market share.”

Why is Market Share Important to Understand?

Understanding the market share is vital to determining the viability, and success of a company. In the earliest days, market share will help understand if a business is worth pursuing. Later in a business’s life, it can help stakeholders understand how they are performing compared to their competitors and can help shape roadmaps for future markets and products.

When building out financial models and projections, market share can certainly play a role. Market share has the opportunity to help shape and impact your future go-to-market strategy and product development. \

On the flip side, understanding your market share can oftentimes help shape your financing options. Your ability to capture a % of a market, large or small, will help funders and lenders understand the likelihood of receiving a return at a later date. For example, if you’re pursuing venture capital you need to demonstrate you can build a large business that will generate returns for them.

How to Calculate Market Share

Revenue vs. Units/Customer Count

Market share can be broken down a few different ways. Generally, the 2 most common ways to break down market share is by revenue or by # of units/customer count. Calculating either follows the same general steps as below (but you will sub out units for revenue and vice versa).

1. Determine what you’re calculating

Like any startup metric, you have to first determine how and why you are calculating something. A couple of questions to ask yourself when calculating market share:

What period of time am I analyzing?

What specific market am I evaluating?

Am I calculating our share of revenue or units/customers?

For example, let’s say we have a store, Visible Bread Co, and sell artisan bread in Chicago. We want to calculate our % of the artisan bread market sales over the last year in Chicago.

2. Calculate company data

First things first, you need to calculate your revenue (or units/customers) for the specified period of time. For companies that have multiple products that span different markets, make sure you are focused solely on the product and market you are evaluating.

Continuing on our example, let’s say Visible Bread Co. did $100,000 in artisan bread sales over the last year. (Keep in mind, if we were calculating our share based on units that might translate to something like 30,000 units/loaves of bread)

3. Calculate market data

Now that you understand your company’s performance in a specific market, you need to understand how the market is performing as a whole. Calculating the market data is a mix of art and science. Depending on the market, there may be publicly available reports and data you can leverage. On the flip side, if there is no publicly available data you may need to piece together your data and assumptions to estimate the market.

To help, you can check out our total addressable market template here.

For Visible Bread Co., we found sales from a local association that shows there has been $1,000,000 in total artisan bread sales in Chicago over the past year.

4. Calculate your market share

Now that we have our data in place, it is time to do a simple calculation. Simply take your sales or units and divide it by the sales or units for the market as a whole. Times by 100 and that is your market share.

For Visible Bread Co., that looks like this $100,000/$1,000,000 = .10 x 100 = 10% of Chicago artisan bread sales over the last year.

5 Things to Consider When Evaluating Market Share

There are few better ways to measure your business against competitors than by calculating market share. Knowing how big your slice of the pie is helping keep founders and investors on the same page when it comes to tracking a product or services’ participation in the market. So how do you do it the right way?

1. Is now the right time for market share?

Depending on company size, investors may disregard market share as a progress indicator. Especially in the early days, this metric doesn’t matter if your company doesn’t have already own a significant percentage to track. Sizing your company up against the market leaders may be a fruitless exercise if you’re still in the process of rolling out a product. For founders and investors talking about a startup in its first few rounds of financing, now is likely not the time to worry about your share of the market.

2. Understand your Total Addressable Market (TAM)

You can’t measure your market share without first knowing the Total Addressable Market (TAM) you’re pursuing. It’s essential to conduct a thorough assessment of long and short-term market factors, as determining TAM can be a tricky exercise. But make the best estimate of the number of customers in your market, the different types of customers you’re targeting, how much they’ll pay, how you expect the market to grow, and project revenue for 100% market penetration.

3. Measure market penetration

Now you’ve got a reasonable idea of how many total customers are there for the taking. How many are currently under contract? Treat the total number of customers like units and simply calculate your current client base percentage from the total number. For instance, if your SaaS company has an installed customer base of 200 in a TAM of 200,000, your market penetration is 1 percent.

4. Determine market share

How much are customers actually paying under each contract? In your TAM exercise, you’ve assessed your client’s propensity to pay, now determine how well that’s translated into contract value. Again, it’s a simple equation: if you currently own $1,500,000 of a total sales volume of $150,000,000, 150,000/150,000,000 = 1 percent market share.

Now, your market share and market percentages won’t align if your contract value underperforms or exceeds projections. However, both data points will help underscore your evolving market share and provide insight.

5. Track over time

Growth or decline in market share or market penetration can be powerful communication tools for your business narrative. A sagging market share may expose a surge in competition, whether that’s revealed to be a battle over price or new challengers to the game. On the other hand, it’s hard to argue with a founder that’s showing steady growth when it comes to the company’s fight for market dominance. Keeping market share in your regular investor communication will be greatly useful once you’ve determined that your company has reached a significant percentage threshold.

How to Expand Market Share

Most businesses are constantly looking to expand and grow (some are not, which is great too!) their share of the market. At the end of the day, this requires finding new customers and/or expanding your existing customer base. A few ways companies generally find success when looking to grow their customer base and capture more of a market:

1. Lower prices.

Lower prices can be a quick way to convert more customers (be aware of underpricing your product or service!). Note, lower prices can have an impact on your overall revenue, especially for SaaS businesses.

2. Innovate new products and features.

One way to grow your share of a market is by introducing new features and products. Using existing research and customer feedback, you can make an informed decision about the development of new products and features.

3. Appeal to new demographics.

Going hand-in-hand with building new products and features, is finding a new demographic. You may dominate one small segment of an overall market but have the opportunity to pursue new personas.

4. Delight your customers.

Word-of-mouth and happy customers can take your business to a new level. Having customers that are eager to spread the word about your business can be an incredible, and organic, way to grow your share of the market.

Download our Template!

In order to help calculate your market share and your potential to build a large business, it helps to calculate and understand the total addressable market and sensitivity analysis. Check out our free total addressable market template below:

founders

Product Updates

Shameless Plug: The 97 Second Update

Send an Investor Update in Under 2 Minutes

We recently rolled out our Google Sheets integration in Beta and are stoked on the possibilities this presents for telling the story around your data. With the addition of our Google Sheets integration we have taken what used to hours of work into a few minutes of your time… Seriously, check it out:

In addition to sending out Updates you can do the following with our Google Sheets integration:

Automatically grab data from Google Sheets and bring into Visible.

Create beautiful visualizations and dashboards for your stakeholders.

Combine Google Sheets data with other data source integrations or custom metrics.

If you’re ready to start telling your company’s story using Google Sheets and Updates you can check out a quick article here or shoot us a message at hi@visible.vc

founders

Reporting

Investor Letters: One Ford

Ford was Founded in 1903 and has been a staple of American culture since. No company has created the stories and memories like those of Ford; the Model T, the assembly line, the Mustang, the Pinto, and most recently “their 2008 comeback”.

We are all too familiar with the financial crisis in 2008. The automotive industry was hit particularly hard and faced challenging questions all while on the brink of collapsing. Alan Mulally, Ford’s newly appointed CEO at the time, stuck to his guns and pulled out a historical comeback. Mulally’s plan, ONE Ford, is prevalent while the company fought to stay afloat in one of the most uneasy times in recent history. Although Alan stepped down in 2014, ONE Ford is still largely influential at Ford and crucial to their company history.

All of the charts, images, quotes, and emphasis below were added by us.

If you like what you see and want to share Visible Investor Letters with friends or colleagues, send them here to sign up.

Ford’s 2008 Letter to Shareholders

A Message from the President and CEO,

In 2008 the automotive industry faced a deep recession in the United States and Europe, the worst worldwide financial crisis in decades and a dramatic slowdown in all major global markets. Like all automakers, Ford Motor Company was adversely impacted by these extraordinarily difficult economic conditions.

However, the plan Ford is operating under – what we call ONE Ford – is helping us endure these current conditions and position ourselves for future success. Our plan has been consistent for the past two years:

Aggressively restructure to operate profitability at the current lower demand and changing model mix.

Accelerate the development of safe, fuel-efficient, high-quality new products that customers want and value.

Finance our plan and improve our balance sheet.

Work together as one team, leverage our global assets.

ONE Ford has transformed us into a different auto company: different than others today and from ourselves a few years ago. However, the worldwide economic slowdown – driven by tight credit markets and weak consumer confidence – has shaken the foundation of even the strongest companies, in the automotive sector and in every other industry.

A plan so simple it can fit on a business card – yet so influential it overhauled the culture at Ford. ONE Ford was the first step Alan Mulally took when he took over the reigns as Ford’s CEO in 2006. The plan, simply enough, revolved around creating one vision for everyone on the team – not just executives and managers. The fruits of the plan have paid off greatly as Ford has generated record profits while staying lean and innovative.

Certainly, the severe economic challenges of 2008 had a significant impact on our results for the year, both in terms of our operating losses and cash flow. After earning a profit in the first quarter of 2008, we had an overall net loss of $14.7 billion for the year, with $6 billion of that coming in the fourth quarter. That compares with an overall net loss of $2.7 billion in 2007. Our worldwide Automotive revenue was $129.2 billion in 2008, compared with $154.4 billion in 2007. At yearend 2008, our total Automotive liquidity was $24 billion, including gross cash of $13.4 billion.

Fortunately, we began aggressive restructuring efforts under ONE Ford before the current crisis began. We eliminated excess manufacturing capacity, closing plants and reducing our workforce. We negotiated a new contract with the UAW to improve our competitiveness. We shifted to a balanced product lineup offering high quality, proven safety, excellent fuel economy and good value.

As part of our ONE Ford plan we also secured credit in advance of the financial market meltdown. As a result of all of these actions and based on our current planning assumptions, we have sufficient liquidity to make it through this global downturn while maintaining our product plans, without the need for government bridge loans. However, as we told Congress in our business plan submission in December 2008, in this environment a number of scenarios could put severe pressure on our Automotive liquidity, causing us to require such a loan – including most importantly a significantly deeper economic downturn, or a significant industry event such as the uncontrolled bankruptcy of a major competitor or major suppliers that caused a major disruption to our supply base or dealers.

When Mulally took over as CEO, in 2006, Ford mortgaged all of their assets to finance the loans spoken of above. At the time, Ford was in desperate need to restructure their company as whole and saw the need for “a cushion to protect for a recession or other unexpected event”, as Mulally put it in a separate interview. As an added bonus, staying away from a bailout was solid for marketing and created a positive image of Ford for many consumers.

Staying aligned with their plan, Ford sold off most of their marques in order to stay agile and focus on their most important brand; their own. In the year or so leading up to this annual report Ford sold off their interest in Aston Martin, Jaguar, Land Rover, and Mazda. A few years after the report they would continue the trend and sell off their share in Volvo as well as discontinuing the Mercury line.

We continue to take the decisive actions necessary to lower production to match lower worldwide demand and reduce costs. We expect this will contribute to significantly reduced negative Automotive operating-related cash flow in 2009 as compared with 2008, and position Ford for growth when the economy rebounds. Based on our current planning assumptions, we believe we are on track for total Company and North American Automotive pre-tax results and Automotive operating-related cash flow to be at or above breakeven in 2011, excluding special items. Our ultimate goal remains unchanged: to create a viable Ford Motor Company and a lean global enterprise delivering profitable growth for all.

Looking ahead, we anticipate very weak global industry sales volumes during 2009, with a full-year decline in the range of about 15% from 2008 levels. Significant government policy stimulus is being implemented in most markets and is expected to improve the environment for sales later this year. Financial markets remain under significant stress, however, and further government and central bank actions are needed to provide liquidity and stabilize banks.

For Ford, the year ahead will be marked by an unprecedented number of new product introductions. Consistent with our ONE Ford plan, we are introducing more products that customers want and value.

As other automotive companies were solely focused on gathering capital, Ford’s previously mentioned loans allowed them to continue to invest in the introduction of new products and technologies. This has included the innovation of their hybrid/electric vehicles and renewed success of their staple models, such as the Focus.

Ford also is on track with its plan to invest in new, smaller, fuel-efficient vehicles and achieve a more balanced global product portfolio. Within the next five years, all Ford vehicles competing in global segments will be common in North America, Europe and Asia, fulfilling a key element of our ONE Ford plan. This includes Ford Fiesta- and Focus-sized small cars, Fusion- and Mondeo-sized midsize cars and utilities, as well as commercial vans. Importantly, every new product will be the best or among the best in its segment for fuel economy, while providing top quality, safety, smart technologies and value.

In another instance of ONE Ford, Mulally touches on the importance of consolidating their platforms and becoming a global company. In the above graphic, pulled from a 2015 Ford corporate update, you can see the continuance of consolidating their platforms. Currently all of Ford models share just 9 platforms and roughly 80% of the same parts; by doing so Ford has been able to create massive economies of scale.

We also are launching the most aggressive vehicle electrification program in the industry. By 2012, we plan to produce at least four high-mileage vehicles that will use the most advanced forms of battery technology in a family of hybrids, plug-in hybrids and battery-powered vehicles.

In addition to producing these vehicles, we are employing a comprehensive approach to electrification that will tackle commercial issues such as batteries, standards and infrastructure. We are working with Southern California Edison, the Electric Power Research Institute and six additional electric utility companies from New York, Atlanta, Detroit and Raleigh to develop plug-in hybrid vehicles and infrastructure.

Despite an extremely difficult year we continue to see many positive developments. These ongoing improvements make us more confident than ever that we have the right plan and are taking the right actions to survive the downturn and emerge as a lean, globally integrated company poised for long-term profitable growth.

As always, we thank you for your support of our efforts.

Alan R. Mulally

founders

Reporting

Investor Letters: The Etsy Economy

In the world of business, moving first can be difficult and dangerous. Etsy, the Brooklyn-based marketplace connecting sellers and buyers of handmade and vintage goods, who IPO’d in 2015 is finding this out the hard way.

When it went public, Etsy was the largest (and one of the first) B Corporations ever to do so at a market cap of over $3B. Since, Etsy’s value has slipped to under $1B and it is yet to convince investors of its long term viability in light of widening losses and competition from Amazon (“your margin is my opportunity”).

In this week’s Investor Letter, which was included as part of the company’s S-1 filing, CEO Chad Dickerson makes the case for Etsy as a public company and tries to push Wall Street analysts to see past simple profits and also evaluate the company on the community it has built and the economic impact it has had…good luck with that.

The Etsy Economy

Since inception, Etsy has challenged conventional ways of thinking about commerce, business, individuals and communities. I intend to keep our unconventional operating philosophy as we become a public company, and I welcome new investors into our community.

When I joined Etsy almost seven years ago, Etsy was an online marketplace for handmade goods, vintage items and craft supplies that connected sellers and buyers. Even in my early days at Etsy, it was clear to me that the vision for Etsy could extend far beyond the founding idea of the company and have even more potential to impact the world for good.

Vision is just the starting point. I believe Etsy can truly change the world when our vision is met with strong culture, a powerful team and disciplined execution. In my time at Etsy, I’ve put my heart and soul into nurturing a culture and building a team and company that match the ambition of our mission. Today our mission is much more expansive than when Etsy began: to reimagine commerce in ways that build a more fulfilling and lasting world.

The reimagination of commerce means transforming every aspect of how goods are made, bought and sold. We believe that Etsy has the long-term potential to transform the world economy into one that is more people-centered and community-focused—one that values and honors designers and makers and one that creates stronger connections among people who make, sell and buy goods. We see an economy that is more sustainable and transparent—and one that is more joyful. We believe in an economy that transcends price and convenience, one that emphasizes relationships over transactions and optimizes for authorship and provenance. We call this the Etsy Economy.

Building the Etsy Economy matters more than ever. For decades now, the conventional and dominant retail model has relentlessly focused on delivering goods at the lowest price, valuing products and profits over community, short-changing the future with the instant gratification of today. I do not believe that this race to the bottom is a sustainable, successful model. Our growing community has made it clear that they desire thoughtful alternatives to mass commerce and impersonal retail and products that better reflect their personal style and values. Person by person, sale by sale, we are building a new model to replace the old. With GMS of $1.93 billion in 2014, I see the Etsy Economy emerging.

Etsy’s Values

If you want to understand Etsy, you’ll have to understand our values.

We are a mindful, transparent and humane business.

We plan and build for the long term.

We value craftsmanship in all we make.

We believe fun should be part of everything we do.

We keep it real, always.

Fundamentally, we believe that companies can and should use the power of business to create social good, which is reflected in our status as a Certified B Corporation.

As we noted in the intro, Etsy was the largest (and one of the first) B Corporation ever to do so at a market cap of over $3B. Rally Software, out of Denver, was the first of the group to go public (at a market cap of just over $300MM). It has since been acquired by CA Technologies for $480MM. Natura Brazil (Market Cap: $12.4B) is the world’s largest publicly traded B Corp but it received certification after it was already public

Other well known B Corporations include Ben & Jerry’s, Warby Parker, which could overtake Etsy as the largest B Corp IPO should it choose to take that route.

Our commitment to using business as a force of good manifests itself in the way we run our business.

People often ask me how I choose between the success of our community and the success of our business. My answer is that I don’t have to choose; we have built a business that does well when our community is successful. Making money matters to Etsy because our financial success creates long-term sustainability for our community. The more we invest in our platform, the more we enable Etsy sellers to pursue their craft and grow their businesses and the easier we make it for Etsy buyers to find unique goods. We call this Etsy’s Empowerment Loop.

Community

At Etsy, we believe that our strength and business success rest in the interdependence among Etsy sellers, Etsy buyers, responsible manufacturers and our employees—in other words, our community.

Etsy sellers represent a diverse mosaic of needs and aspirations. Some sellers are first-time small business owners and benefit greatly from our seller support and education programs. The vast majority of sellers on Etsy are one-person shops, and we continue to embrace and develop new ways to support them. Other sellers have grown and need help scaling with the assistance of responsible manufacturers, creating opportunity for other participants in the Etsy Economy. In all cases, we empower each Etsy seller to succeed on her own terms.

I have heard concerns that by allowing our sellers to partner with responsible manufacturers, we are diluting our handmade ethos. I share our community’s desire to preserve what is special about Etsy. After all, Etsy has always served as an antidote to mass manufacturing. We still do. With our vision of responsible manufacturing, we are promoting a new, people-centered model in which artisans can preserve the spirit of craftsmanship and grow responsibly by collaborating with people at small-batch manufacturers to make their goods. This brings more hands together to build both products and more diverse local, living economies. These local, living economies band together into a larger Etsy Economy made up of individuals with diverse roles but all sharing a collective vision of an economy based on community.

When individuals share a collective vision, the power and possibility of community manifest in profound ways. Etsy is, by design, a collection of many small things. As we grow, Etsy becomes a larger collection of individuals and communities, with compounding benefits when they connect with each other. Etsy sellers have self-organized into more than 10,000 groups around the world, known as “Etsy Teams.” They provide local support to each other and collaborate with Etsy on initiatives, such as teaching entrepreneurship to economically disadvantaged people in their communities, lobbying the government on issues important to Etsy sellers, running local craft fairs and translating Etsy’s site into other languages.

In 2012, Mayor Larry Morrissey reached out to me on Twitter asking how to build an Etsy Economy in his community of Rockford, Illinois. Rockford is a city that has faced challenges familiar to many cities in America and around the world: loss of manufacturing jobs, high unemployment and a struggling economy. We worked with Mayor Morrissey, members of the local Rockford Etsy Team, the public education system, local arts organizations and the public housing authority to launch the Etsy Craft Entrepreneurship Program. This program teaches people with a craft skill that entrepreneurship and economic opportunity are within reach on our platform. We have extended this program to 10 cities around the world and see it as an inspirational model for even deeper community involvement in the coming years.

Our concept of community includes the cities where we live and work, and we run Etsy in a way that supports our own local economy and ecosystem. At our headquarters in Brooklyn, twice a week we serve a meal that we call “Eatsy.” Our approach is to foster community and productivity through a meal, designed for employees to eat together on picnic-style benches. This meal allows employees to engage with each other, within and across teams, and increases team-building and work relationships throughout the company. Eatsy also serves as an end point for company-wide meetings, so that employees can continue the conversation on important workplace topics.

In 2014, we sourced food from over 40 local businesses with an emphasis on our health and ecological impact. We eat on compostable plates, and employees sign up to deliver our compost by bike to a local farm in Red Hook, Brooklyn, where it is turned back into the soil that produces the food we enjoy together. In this way, Eatsy goes into the very soil we live and work on. Eatsy is a metaphor for how I think about many aspects of our business and our relationship to the world around us: regenerative, mindful, interdependent, community-based and fun.

Why Etsy Should be a Public Company

I believe the principles and resources of being a public company align well with the model of shared success that is fundamental to Etsy’s way of doing business, namely that we make money when our sellers make money. Investing in the growth of our business and increasing Etsy’s visibility will help elevate Etsy sellers and attract more buyers, which creates more opportunities for everyone.

This section is perhaps the most interesting since it attempts to answer a question that, to this day, the public markets feel has not been put to rest.

To date, the public markets have shown an unwillingness to accept a company like Etsy where profit seems to take a back seat to impact — unless, of course, that company is Amazon whose scorched earth brand of market expansion appeals a great deal to Wall Street in spite of minimal profits.

Accountability / transparency

Etsy has a long history of providing data to the community, everything from key financial metrics, to our gross happiness index, to our carbon footprint data, to our workplace diversity stats. As a public company, we will be able to provide a higher level of transparency and accountability to a broader number of people.

Community participation

Being a private company means that most people don’t have an opportunity to invest in Etsy. When Etsy is a public company, anyone will be able to own a piece of Etsy, including our sellers, our buyers and anyone else who shares Etsy’s values and mission. These shareholders will be valued members of our community.

Long-term sustainability

We want to be a company that spans generations. Eighty-six of the original companies in the S&P 500 index are still publicly traded after 58 years. I view going public as an important step towards providing Etsy with the capital and long-term corporate structure to achieve similar longevity.

In light of Amazon’s foray into the handmade goods market and Etsy’s struggles as a public company (likely related), there has been some chatter about a buyout. As we noted above, Amazon has a history of scoffing at traditional Wall Street desires and with its acquisition of Zappos in 2009 proved it is willing to take bets on company whose culture seems to be at odds with their own.

Making the world more like Etsy

I believe that Etsy can be a public company that holistically integrates the concerns of people and the planet, the present and the future, profitability and accountability. If we succeed, then other companies might replicate our model. We think the world will be a better place for it.

As a public company, we will continue to concentrate on the long term. Our mission to reimagine commerce is a big goal and it will take time to achieve it; success will be based on strategies that evolve over years and decades, not just quarters. We are more focused on creating long-term results for us and our community than short-term results that lack that promise. I believe this approach will deliver the most sustainable long-term returns to investors.

When we’re public, we do not plan to give quarterly or annual earnings guidance. I think providing quantitative earnings guidance is misaligned with Etsy’s mission. For example, the pressure to hit a quarterly financial target could incent us too heavily to seek near-term gains, which could diminish our ability to fulfill our larger mission over the long-term.

We will continue to be transparent with our investors. Instead of providing guidance in the traditional sense, I plan to talk frequently with our investors about our progress, challenges and opportunities. I welcome investors who share our long-term, community-oriented philosophy.

What’s Ahead

I am intensely grateful to all of the people who have given so much of themselves to build Etsy, and I am excited to welcome new like-minded shareholders to our community.

We are entering a new era. I believe that successful businesses will be those that combine vision, execution and discipline with values, heart and conviction. That is how I plan to lead Etsy and work with our community to build a more fulfilling and lasting world through commerce. Etsy will be entering its second decade this year, and we look forward to many more in our new form as a public company.

founders

Operations

6 More Great Startup Newsletters

Last year, we put together a list of 17 startup newsletters that people here on the Visible team read and love. In one way or another, each of those newsletters helps to inform our decision-making around strategy and product or features content that we find generally entertaining and insightful.

Related Resources:

Our 15 Favorite Newsletters for Startup Founders

The 16 Best Startup Newsletters

In the months since, we have come across a few more newsletters that have quickly become can’t miss material for us each week.

Snippets from Social Capital

As a firm, Social Capital focuses on backing companies solving big problems. Snippets, their weekly newsletter surfaces content to help readers learn more about those big areas – like healthcare, education, and technology’s impact on society.

The Ringer

While the newsletter from Bill Simmons’ new venture, The Ringer, doesn’t even remotely focus on product or business – like his old site, Grantland, it focuses on the intersection of sports and pop culture – it does allow the reader to follow along with how one of the media world’s more interesting thinkers is going about building something from the ground up (albeit with an existing audience of millions).

UX Design Weekly

Kenny Chen’s newsletter is pretty simple — which any good UX designer knows is important. The best UX focused content from around the web sent out weekly. The list includes articles, tools, resources, and even portfolios to help readers advance their understanding of how to build usable products.

L2 News – The Daily & The Week, Winners & Losers

If you follow our blog, you know we love the stuff produced by L2 Digital and include videos and images from their reports in a lot of our posts. The firm focuses on benchmarking the performance of firms in the digital space — for example, how effective are Nike’s Ecommerce efforts vs. competitors — and their newsletters deliver all of that great content right to your inbox.

Farnam Street Brain Food

The Farnam Street Blog is difficult to describe succinctly. Basically, founder Shane Parrish has tried to build a site that pulls together great resources to make readers smarter and better. Decision-making, mental models, leadership, innovation…these are all topics that the blog touches on. The newsletter distills the best stuff from the site each week.

Paul Singh’s Weekly Newsletter

Over the years, Singh has worked on both sides of the table – founding multiple companies and working as a partner at 500 Startups. Since selling his most recent company, Disruption Corp., to 1776, Singh has built a community around his newsletter, where he shares 10 or so links that he and his community loved in the last week.

And since you made it all the way to the end…we’d love to have you check out our little newsletter, The Visible Foreword. We generally send stuff twice per week. On Wednesdays, we share a new investor letter and over the weekend we provide some commentary on what we launched, learned, wrote, and thought about during the week.

founders

Reporting

Investor Letters: Howard Marks on Liquidity

Like Warren Buffett, Howard Marks is a master craftsman of memos on the state of the market, investment psychology, and investment philosophy. In January of 2016 as capital seemed to be pouring out of public and private equity markets – at the time of his post, the S&P was down almost 9% from where it ended 2015 – and liquidity was on the minds of many investors and operators.

For people building companies (as opposed to investment firms), his notes on liquidity provide ample learning opportunities to help effectively navigate periods of exuberance and tightening that inevitably occur.

Marks framed his thoughts on liquidity well at the beginning of this Bloomberg interview where he states: “The best defense against liquidity is not needing it. It is buying things you can hold for a long period of time.”

We have pulled out our favorite sections and added our thoughts below. The full investor letter (pdf) can be found at the bottom of this post. All of the charts, images, quotes, and emphasis below were added by us.

If you like what you see and want to share Visible Investor Letters with friends or colleagues, send them here to sign up.

Oaktree’s Howard Marks on Liquidity

Liquidity Defined

Sometimes people think of liquidity as the quality of something being readily saleable or marketable. For this, the key question is whether it’s registered, publicly listed and legal for sale to the public.

“Marketable securities” are liquid in this sense; you can buy or sell them in the public markets. “Nonmarketable” securities include things like private placements and interests in private partnerships, whose salability is restricted and can require the qualification of buyers, documentation, and perhaps a time delay.

But the more important definition of liquidity is this one from Investopedia: “The degree to which an asset or security can be bought or sold in the market without affecting the asset’s price.” Thus the key criterion isn’t “can you sell it?” It’s “can you sell it at a price equal or close to the last price?” Most liquid assets are registered and/or listed; that can be a necessary but not sufficient condition. For them to be truly liquid in this latter sense, one has to be able to move them promptly and without the imposition of a material discount.

Much ink has been spilled in recent periods about the lack of liquidity – using the definition Marks’ favors – in the private markets. Companies of all stages are struggling to raise fresh capital without taking a haircut (selling an asset below the last price) and the IPO window is firmly closed.

Liquidity Characterized

I often say many of the important things in investing are counter-intuitive. Liquidity is one of them. In particular, it’s probably more wrong than right to say without qualification that something is or isn’t “liquid.”

If when people ask whether a given asset is liquid they mean “marketable” (in the sense of “listed” or “registered”), then that’s an entirely appropriate question, and answering it is straightforward. Either something can be sold freely to the public or it can’t.

But if what they want to know is how hard it will be to get rid of it if they change their mind or want to take a profit or avoid a possible loss – how long it will take to sell it, or how much of a markdown they’ll have to take from the last price – that’s probably not an entirely legitimate question.

It’s often a mistake to say a particular asset is either liquid or illiquid. Usually an asset isn’t “liquid” or “illiquid” by its nature. Liquidity is ephemeral: it can come and go. An asset’s liquidity can increase or decrease with what’s going on in the market. One day it can be easy to sell, and the next day hard. Or one day it can be easy to sell but hard to buy, and the next day easy to buy but hard to sell.

In other words, the liquidity of an asset often depends on which way you want to go . . . and which way everyone else wants to go. If you want to sell when everyone else wants to buy, you’re likely to find your position is highly liquid: you can sell it quickly, and at a price equal to or above the last transaction. But if you want to sell when everyone else wants to sell, you may find your position is totally illiquid: selling may take a long time, or require accepting a big discount, or both. If that’s the case – and I’m sure it is – then the asset can’t be described as being either liquid or illiquid. It’s entirely situational.

There’s usually plenty of liquidity for those who want to sell things that are rising in price or buy things that are falling. That’s great news, since much of the time those are the right actions to take. But why is the liquidity plentiful? For the simple reason that most investors want to do just the opposite. The crowd takes great pleasure from buying things whose prices are rising, and they often become highly motivated to sell things that are falling . . . notwithstanding that those may be exactly the wrong things to do.

Select Passages

Specific investor actions can have a dramatic impact in illiquid markets For example, the price of an illiquid asset can rise simply because one buyer is buying, in which case selling the asset becomes very easy. When that buyer stops buying, however, the market can quickly reset to much lower levels in terms of both price and the liquidity enjoyed by sellers (and it can overshoot in the other direction if the buyer decides to sell what he bought.

People have pointed out that the slowdown in VC funding (to whatever extent it has or will happen) has been largely a VC conspiracy and it is tough to write this off entirely — although I am sure that in this imagined world of VC “conspiracies” a yoga studio or vest-shopping excursion replaces the dark, smoke-filled rooms of old-timey conspiracy theories.

The reality is that the venture market is small and quite illiquid, so when a few major firms decide to focus more on their existing portfolios or non-traditional players like mutual funds decide to slow down, liquidity begins to trickle out of the market.

And in an already illiquid market, change can happen fast. In describing current market conditions, Mark Suster of Upfront Ventures noted the following:

If you want to see what was on my mind – I started foreshadowing change publicly in October 2015 with a forecast of what I expected in 2016 VC funding markets at a presentation I gave at the annual Cendana VC/LP conference hosted by Michael Kim. Word travels at light speed amongst this small network of people who all know each other and even though they’re rivals they also sit on boards together and many probably went to business school together.

So when something in changing those at ground zero, in my word, “get the memo.” Of course it’s not literally a memo but that’s a metaphor for knowing that things have dramatically changed. If you’re not in this closed group of VCs you will eventually figure out the new game but the memo arrives more slowly. Many of the industry’s top thinkers were at Cendana’s annual meeting and panel after panel privately debated what they were seeing.

On the other hand, at the right time, investors can make tremendous amounts of money simply by being willing to supply liquidity (are accept illiquidity). When everyone else is selling in panic or sitting frozen on the sideline, refusing to buy, cash can be king. Often when a crash follows a bubble driven run-up, most people are short of cash (and/or the willingness to spend it).

A few paragraphs before this passage, Marks touches on the need to think about liquidity levels carrying over from one asset or market to another. This was the case in 2008 and 2009, when it seemed people in all markets were content to sit on the sidelines and reserve cash. During that time, investors who were unwilling to spend their cash (supplying liquidity) in the early stage private markets would have missed out on investing in generation-defining companies like Uber, Slack, and Airbnb.

The bottom line is unambiguous. Liquidity can be transient and paradoxical. It’s plentiful when you don’t care about it and scarce when you need it most. Given the way it waxes and wanes, it’s dangerous to assume the liquidity that’s available in good times will be there when the tide goes out.

What can an investor do about this unreliability? The best preparation for bouts of illiquidity is:

Buying assets, hopefully at prices below durable intrinsic values, that can be held for a long time – in the case of debt, to its maturity – even if prices fall or price discovery ceases to take place, and

Making sure that investment vehicle structures, leverage arrangements (if any), manager/client relationships and performance expectations will permit a long-term approach to investing.

These are the things we try to do.

In the section above, Marks is talking about the Oaktree approach to building their firm and later notes two benefits to their approach:

We aren’t highly reliant on liquidity for success, and

Rather than be weakened in times of illiquidity, we can profit from crises by investing more – at lower prices – when liquidity is scarce.

Rephrased for someone building a company and not an investment firm, the benefits to this type of strategy would be:

1. We aren’t highly reliant on another round of funding for success

2. Rather than be weakened when the funding market pendulum swings, we can profit from downturns by investing more – at lower prices – in things like talent and customer acquisition

This mirrors the approach of Slack’s Stewart Butterfield who has tried to take advantage of a period of high liquidity to protect his company (financially and psychologically) from a market downturn.

“And really the thing we get out of having the cash in the bank at this point is options. We’re in a really good position where when opportunities arise that we want to take advantage of, we can just do them. Whether that’s acquisitions, international expansion, advertising — whatever it is that comes up that feels like the best move for the business, we will take advantage of. Having the freedom to pursue opportunities without the constraint of capital enables all kinds of things which otherwise wouldn’t have been possible.” – Stewart Butterfield, Business Insider Interview

founders

Reporting

This YouTube Investment Memo Shows You the Path to the Perfect Pitch

Every company going out to try to raise capital from angel investors or VCs seems to have some derivative of the same question – “What should we include in our pitch deck?”

While the outsize clout people give a simple slide deck may seem silly, it speaks the importance of being able to weave a compelling narrative about your business.

Roelof Botha of Sequoia Capital is one of the most successful venture capitalists of all time. He sits on the board of companies like Square and Jawbone and led investments in Youtube and Meebo before they were acquired by Google. Recently, he checked in at #18 on CB Insights list of the top 100 venture capitalists.

Basically, he knows what it takes to build great companies and how those companies should think about raising capital.

Thanks to court records from the 2010 Viacom-YouTube lawsuit, we can take a first hand look at how the Youtube founders pitched Botha (exhibit 1) and how Botha pitched Youtube internally to his Sequoia partners (exhibit 2). From there, we can better understand how companies should think about structuring their own pitches to investors as well as the major hurdles companies need to get over to turn a potential investor into an advocate who makes sure to push their deal forward.

Exhibit 1 – Youtube’s Pitch

Here is the rundown of the order in which the Youtube founders presented their business opportunity and our interpretation of the reasoning. As you will see, the way this is presented does a great job of continually answering questions and pushback that would be brought up in the preceding section.

Purpose – Why should I care?

Problem – What point of friction are you attacking? Money is made at points of friction.

Solution – How are you removing (extracting value from) that friction point?

Market Size – How much value can you conceivably capture from this new offering?

Competition – If the market is so big there must be others after it, right? While some argue that competition is not a good thing, a Blue Ocean approach to entering the market shows you have thoughtfully evaluated where others have failed and understand how to attack those areas.

Product Development – What is the actual product that will serve as the conduit for this better customer experience?

Sales & Distribution – How will you make the market care about this cool product?

Metrics – Have any of your previous predictions been tested and evaluated by your target market? How has it gone?

Team – Are you the people that are going to connect all of these dots?

Exhibit 2 – Botha’s Pitch to His Sequoia Partners

Raising a seed round is like making a sale to a SMB customer — smaller amount of money in play, usually one decision-maker, and a relatively short sales cycle.

Raising institutional money is more like conducting an Enterprise sale. The check size is bigger, the timeline is longer, and you need to find an advocate on the inside that is going to continually work to push the deal forward and get buy-in from other decisionmakers.

This latter process is the one we see at play here in Exhibit 2, where Botha takes us the Youtube cause internally at Sequoia and present the case for investment to his partners. Here, we get a rare glimpse into how an investment decision is made at a VC firm.

As a founder, reading through this section is instructive in that it can help you anticipate some of the questions an investor will face from partners so you can be sure to address those in your own presentation.

Intro – What is the thesis and (like in the previous section) why should we care?

Deal – How do the terms and structure of the deal (valuation, our ownership, etc.) fit in overall with the portfolio we are building?

Competition – How does this company fit into the marketplace of both large and small competitors? An outline of the competition quickly helps investors build a framework for what your go-to-market strategy may look like.

Hiring Plan – Does this company have a plan and the ability to attract talented executives and key employees to bring the business from where it sits today to where the founders have said it will be in the future?

Key Risks – What factors will cause the statements that have been made around market, product, distribution, and team to not come true? What is the likelihood and scale of those risks?

Recommendation – As Thrive’s Miles Grimshaw put it in his blog post on the document, how does management, market, and monetization all tie together?

founders

Reporting

Investor Letters: Overstock’s Super-de-Duper Year

Overstock has long been a bit player in the world of Ecommerce. Founded in Utah in 1999 (at the height of the Dot-Com boom), the company grew rapidly and IPO’d in 2002 (a week after Netflix and almost right at the bottom of the Dot-Com bust) on annual revenue of $40mm and at a market cap of just under $350MM dollars.

Despite being one of the few companies to come out of the Dot-Com crash alive, its long term growth has disappointed and the value of the company today sits just a few million dollars north of where they IPO’d 14 years ago.

Still, the company and its CEO, Patrick Byrne have a way of keeping themselves in the news. There was the battle with naked shortsellers, its rebrand to O.co, and its early adoption of cryptocurrency.

There has also been his ongoing embrace of transparency, which started with the following letter to shareholders recapping the company’s 2003 performance. The general tone and openness of this letter is uncommon for a public company and calls to mind the way Warren Buffett approaches his shareholder communication. So while the performance of the company hasn’t quite kept up with its peers, Byrne’s approach to stakeholder management is as relevant as ever.

All of the charts, images, quotes, and emphasis below were added by us.

If you like what you see and want to share Visible Investor Letters with friends or colleagues, send them here to sign up.

Overstock’s “Super-de-duper” Sales Numbers

The rhythm of the Dao is like the drawing of a bow. – Lao-zi

Dear Owners:

My colleagues executed well this quarter. Were 2003’s four quarters a boxing match, I’d say we were dropped to our knees in the first, cleared our head in the second, got on our toes again in the third, and won the fourth on a decision.

In this letter I will describe how my colleagues accomplished this, and detail some mistakes your chairman made that prevented victory by a knockout.

First, I will explain why I am appending this letter to our earnings release. Simply put, I want owners to understand their business: they entrust capital to me and I owe them no less.

I am warned that a letter such as this has risks. A lawyer told me that my use of this more colloquial style may be misconstrued, saying: everything you write will be Exhibit A in a lawsuit against you, (but lawyers say that about most things). Bill Mann of The Motley Fool says that we live in a time when, if things go passably well, CEOs say, Everything is super-de-duper, and when they go poorly they say, Everything is just super-duper. In such a climate, if I write, X went pretty well, but I could do better on Y and Z, the former is read as an admission of mediocrity, and the latter, calamity.

This fits in with what many founders in the early stage world worry about. Everyone else is “killing it”, why aren’t we? Stakeholders – as Byrne touches on above – deserve to hear from management in an honest and open fashion that lays out what has worked, what hasn’t, and what is coming next.

Lastly, cynics claim that my candor is but an attempt to pump my stock by drawing investors looking for someone who does not pump his stock: I am flattered to have attributed to me such Machiavellian subtlety! (And I suggest they look up Popper’s Falsification Principle.)

Saved you a click…

For six quarters I have struggled to reconcile my desire to report in this fashion to Overstocks owners with the more traditional approach used by most companies. Trying to mold a murky reality into a few lines of happy quotes has always been difficult. I have thus decided (when able and time permitting) to write lengthier and more informative letters to owners, filtering out points that concern individuals, details, or strategies that might bore readers or advantage competitors. Note, then, shareholder, that when I write, X is going pretty well, just because I did not say, X is super-de-duper it does not mean, X is a disaster. Sometimes a cigar is just a cigar. The journalists, lawyers, and cynics will find their own way.

Ed Note – The entirety of the 2003 letter from Overstock is about 10 pages long…we’ve pulled out a few of our favorite passages here. You can read the entire letter here.

Sales

To begin with, sales were super-de-duper. They truly were. We returned almost to the hyper-growth curve (94% year-on-year growth).

Just to give you a sense of the size of the business at the time of this writing, Overstock brought in just under $300mm in revenue during the preceding year and was, as Byrne notes, growing rapidly.

As you would expect, this growth has since slowed significantly due to a number of factors – increased competition and the buyer behavior shift to mobile being a couple. Still, the company has returned to double digit revenue growth in the last three years.

Expense Discipline

I believe I can do much better here. At the risk of giving an excuse I’d note that it is difficult to get expenses precisely right when one starts a quarter with a range of expected GMS from $80 million to $120 million: optionality costs money. Still, in retrospect, I believe I could have saved $1-2 million if I had addressed some issues earlier.

Something that teams at any high growth company can likely relate to.

Capital Needs

Funds call me regularly offering to do PIPE’s (private investment in public equity) at X% discounts with Y% warrant coverage struck up Z%, etc. etc. I am a bear of little brain, and my reaction to such invitations is roughly the same as being asked to join a game of Three Card Monte in Times Square. Yet their enquiries do keep me thinking about the issue of capital.

Build a model of our business at break-even and growing 100%. Do we need capital? If we were a brick factory the answer would be, “yes”, but for the float reason given above the answer is, hard as it may be to imagine, maybe not. Yet my answer would continue, That is, if we are comfortable skimming along at times with a weeks worth of cash in the bank, as we did at one point this Q4 when we bulked up for Christmas.

Are we at break-even? Not yet: our GAAP loss in Q4 2003 was 2.6% of revenue. Should we strive to be at break-even? What if, by continuing to lose two-and-a-half pennies on every dollar of sales, we could grow at our current rate for three more years (and thus turn into a >$2 billion GAAP revenue business): should we? What if we could lose four pennies but grow at 200%: should we? It depends, I suppose, on what our net margin would be when we throttled back growth.

In sum, then: it is not clear that Overstock needs more capital; if we do, it is not clear we need it now; if we do need it now we are not going to raise it through a warrant-warted PIPE. That said, we will continue to look at our capital needs and try to position ourselves so that we will be able to raise capital conveniently if the right time arrives. For example, we are in the process of obtaining an inventory line of credit. Please know that I have the benefit of an excellent board, well-versed in capital and which views advising me on this issue as one of its main duties.