Mexico’s startup ecosystem is experiencing unprecedented growth, drawing attention from both local and international investors. In recent years, the country has emerged as a leading innovation hub in Latin America, fueled by a young, tech-savvy population, increasing digital adoption, and a wave of successful startup exits. As a result, venture capital activity in Mexico has surged, with more funds being deployed and a growing number of global VCs establishing a presence in the region.

For founders actively fundraising in Mexico, understanding the local VC landscape is crucial. The right investment partner can provide not only capital but also strategic guidance, access to networks, and deep market expertise. However, navigating this dynamic environment requires up-to-date knowledge of who the top players are, what they’re looking for, and how to position your startup for success.

This guide is designed to be your go-to resource for fundraising in Mexico. We’ll introduce you to the top venture capital firms currently funding startups in the country, give actionable insights on current ecosystem trends, fundraising strategies, key networking opportunities, and essential local resources—everything you need to build and scale your startup in Mexico.

Top VCs in Mexico

Dalus Capital

About: Investing in the best entrepreneurs developing scalable solutions for significant problems in LATAM.

Sweetspot check size: $ 4M

Traction metrics requirements: We are focused on early-stage financing rounds, in startups that have a validated product and client traction.

Thesis: Dalus Capital invests in tech companies with scalable solutions to address significant problems in Latin America, in four investment themes: Inclusion (Fintech, Edtech, Healthtech, HRtech), Climate Innovation, Business Productivity (SaaS, etc.) and Digital Consumer (D2C, marketplaces).

Redwood Ventures

About: Mexican venture capital fund, industry agnostic, investing in technology-based startups.

Sweetspot check size: $ 200K

Traction metrics requirements: Not a static number but products or services that already have product/market fit defined as a growing user base and revenues

Thesis: Founded in 2017, Redwood Ventures is a venture capital fund, based in Mexico. The firm focuses primarily in seed, early-stage, and Series A investments in high-impact tech companies. The firm seeks to invest in companies that are based in North America.

Lotux

Thesis: Lotux focuses on partnering with mission-driven founders building software-based companies in the pre-seed stage that will improve the lives of the 99% in Latin America.

Sweetspot check size: $ 50K

Traction metrics requirements: We would like to see some early validation but can invest in pre-revenue stage if we are bullish on the team and the opportunity.

Poligono Capital

About: We invest in early-stage startups to develop possibilities for success through technology. Non-bank financial organization that believes in exponential capital growth through portfolio diversification and innovative vision.

Sweetspot check size: $ 100K

Hi Ventures

About: Hi Ventures invests in Latin American founders and is an early-stage venture capital fund based in Mexico.

Thesis: Hi’s investment thesis participates deeply and actively in the Fintech, Future of Commerce, Human Capital and Smart Cities sectors, which are all experiencing a strong acceleration shift at a regional level.Across four portfolios, the fund has invested in 40+ innovative and successful companies led by founders who share our vision to democratize access to services and fix large inefficient industries throughout the region.

Jaguar Ventures

About: Jaguar Ventures is a venture capital firm that seeks to invest in firms operating in the technology sector.

Traction metrics requirements: Companies should have at least US$50k in monthly revenues, growing at more than 10% per month.

Thesis: Focused on early stage ventures in Latin America.

Bridge Latam

About: Bridge Latam is a Seed stage fund based in Mexico investing in Latam-based companies.

COMETA

About: COMETA is a venture capital firm that invests in early-stage technology companies targeting Spanish speaking markets.

Thesis: The first fund, VARIV I, which started making investments in 2013, was focused on e-commerce and its enablers, namely, payments and logistics. Over 10 investments were made in those categories expanding the geographic scope from Latin America to Spain. In 2015, the Firm raised a second fund, VARIV II, to capture the emerging opportunities in fintech, marketplaces, and first-generation enterprise businesses founded by local entrepreneurs. Pepe Bolaños, who joined the Firm as Principal in 2014, became Partner in 2017. Throughout the four-year investment period, sixteen companies were added to the firm’s portfolio and the scope broadened to include the US.

COLABORATIVOx

About: We invest in seed and early stage Impact Tech startups that solve complex problems that lead to sustainable development in emerging markets, developing economies and underserved communities.

Fundraising and Operating a Startup in Mexico: Key Trends, Opportunities, and Challenges

Current Ecosystem Trends

Mexico has emerged as a leading innovation hub in Latin America, attracting record levels of venture capital investment. Sectors such as fintech, e-commerce, healthtech, and logistics have seen the most activity, with Mexican startups like Clip and Konfío achieving unicorn status and drawing international attention. The rise of corporate venture arms and increased cross-border investment from U.S. and European funds have further energized the ecosystem. Additionally, government-backed initiatives and accelerators, such as Startup Mexico and Endeavor, continue to support early-stage founders.

Regulatory and Legal Considerations

Mexico’s regulatory environment is generally supportive of startups, but there are important nuances. Company formation is straightforward, with the Sociedad Anónima Promotora de Inversión (SAPI) structure being popular among startups seeking VC investment. Foreign investment is welcomed, though founders should be aware of sector-specific restrictions and reporting requirements. Tax incentives are available for certain industries, and recent reforms have made it easier to access government grants and support programs. It’s advisable to work with local legal counsel to navigate compliance, intellectual property, and labor laws.

Challenges Unique to Mexico

While the opportunities are significant, founders should be prepared for challenges such as market fragmentation, complex regulatory processes in some sectors, and competition for top tech talent. Macroeconomic volatility and currency fluctuations can also impact fundraising and operations. Building strong local partnerships, leveraging government and accelerator resources, and maintaining operational flexibility are key strategies for overcoming these hurdles.

Opportunities for Growth

Mexico offers unique advantages for startups, including access to a large and youthful domestic market, proximity to the U.S., and a growing digital infrastructure. The country serves as a gateway to the broader Latin American region, making it an attractive launchpad for regional expansion. Government programs, such as Instituto Nacional del Emprendedor INADEM and ProMéxico, as well as private initiatives like 500 Startups LatAm and MassChallenge Mexico, provide valuable support, mentorship, and funding opportunities for founders.

Essential Networking Opportunities and Local Resources for Mexican Startup Founders

Building a successful startup in Mexico goes beyond securing funding—it’s about tapping into the right networks, communities, and support systems. The Mexican startup ecosystem is rich with opportunities for founders to connect, learn, and grow. Here’s how you can make the most of what’s available:

Key Startup Events and Conferences

Attending major events is one of the best ways to meet investors, mentors, and fellow founders. Notable annual gatherings include:

- INCmty (Monterrey): One of Latin America’s largest innovation festivals, attracting thousands of entrepreneurs and investors each year.

- Startup Grind Mexico City: Regular meetups and an annual conference featuring top VCs, founders, and ecosystem leaders.

- Cumbre AMEXCAP Venture Capital & Private Equity Summit: A premier event for connecting with leading VCs and institutional investors in Mexico.

Accelerators and Incubators

Mexico boasts a robust network of accelerators and incubators that provide funding, mentorship, and access to investor networks:

- 500 Startups LatAm: Offers a highly regarded accelerator program in Mexico City, with a strong track record of helping startups scale.

- MassChallenge Mexico: A zero-equity accelerator supporting high-impact startups with mentorship, office space, and investor connections.

- Startupbootcamp FinTech Mexico City: Focused on fintech innovation, this program connects startups with industry leaders and investors.

- Endeavor Mexico: Selects high-potential entrepreneurs and provides them with access to a global network of mentors, investors, and peers.

Co-Working Spaces and Innovation Hubs

Collaborative workspaces are central to Mexico’s startup culture, offering not just desks but also community and events:

- WeWork Mexico City: Multiple locations with a vibrant community of startups and regular networking events.

- Centraal: A well-known hub in Mexico City for entrepreneurs, offering events, workshops, and a collaborative environment.

- IOS Offices: With locations in major cities like Monterrey and Guadalajara, IOS Offices provides flexible workspaces and networking opportunities.

Government and Nonprofit Support

Several public and nonprofit organizations offer resources, grants, and business development support:

- INADEM (Instituto Nacional del Emprendedor): Provides funding, training, and support programs for startups.

- ProMéxico: Offers assistance for startups looking to expand internationally.

- NAFIN (Nacional Financiera): Government-backed financial institution offering loans and advisory services to entrepreneurs.

Connect With Investors in Mexico Using Visible

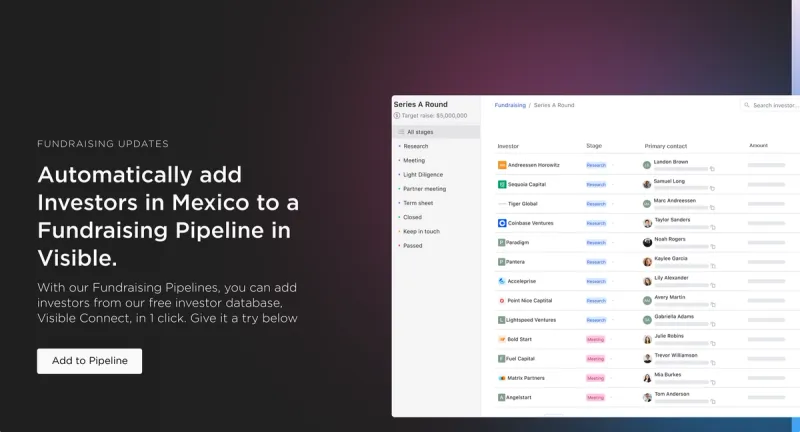

At Visible, we often times compare a fundraise to a B2B sales and marketing funnel. At the top of your funnel, you are finding new investors. In the middle, you are nurturing and pitching potential investors. At the bottom of the funnel, you are working through diligence and ideally closing new investors.

With the introduction of data rooms, you can now manage every aspect of your fundraising funnel with Visible.

- Find investors at the top of your funnel with our free investor database, Visible Connect and find a filtered list of Mexico's investors here.

- Track your conversations and move them through your funnel with our Fundraising CRM

- Share your pitch deck and monthly updates with potential investors

- Organize and share your most vital fundraising documents with data rooms

Manage your fundraise from start to finish with Visible. Give it a free try for 14 days here.