Blog

Visible Blog

Resources to support ambitious founders and the investors who back them.

Product Updates

Product Update: Turn Emails Into Insights With Visible AI Inbox

Structured data. The holy grail of business intelligence.

Structured data unlocks a realm of possibilities, from setting benchmarks to enhancing decision-making processes. Yet, in the venture capital landscape, accessing reliable, structured data remains a formidable challenge. This is precisely why we created the Visible AI Inbox.

With unique features like automated metric detection and file parsing, the Visible AI Inbox stands out as a pioneering solution for portfolio monitoring. Discover how it can transform your data strategy by meeting with our team.

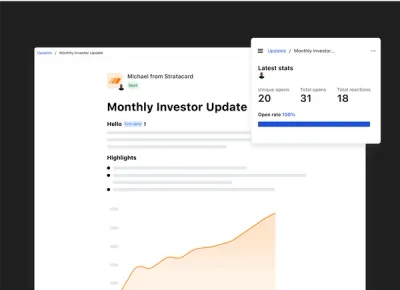

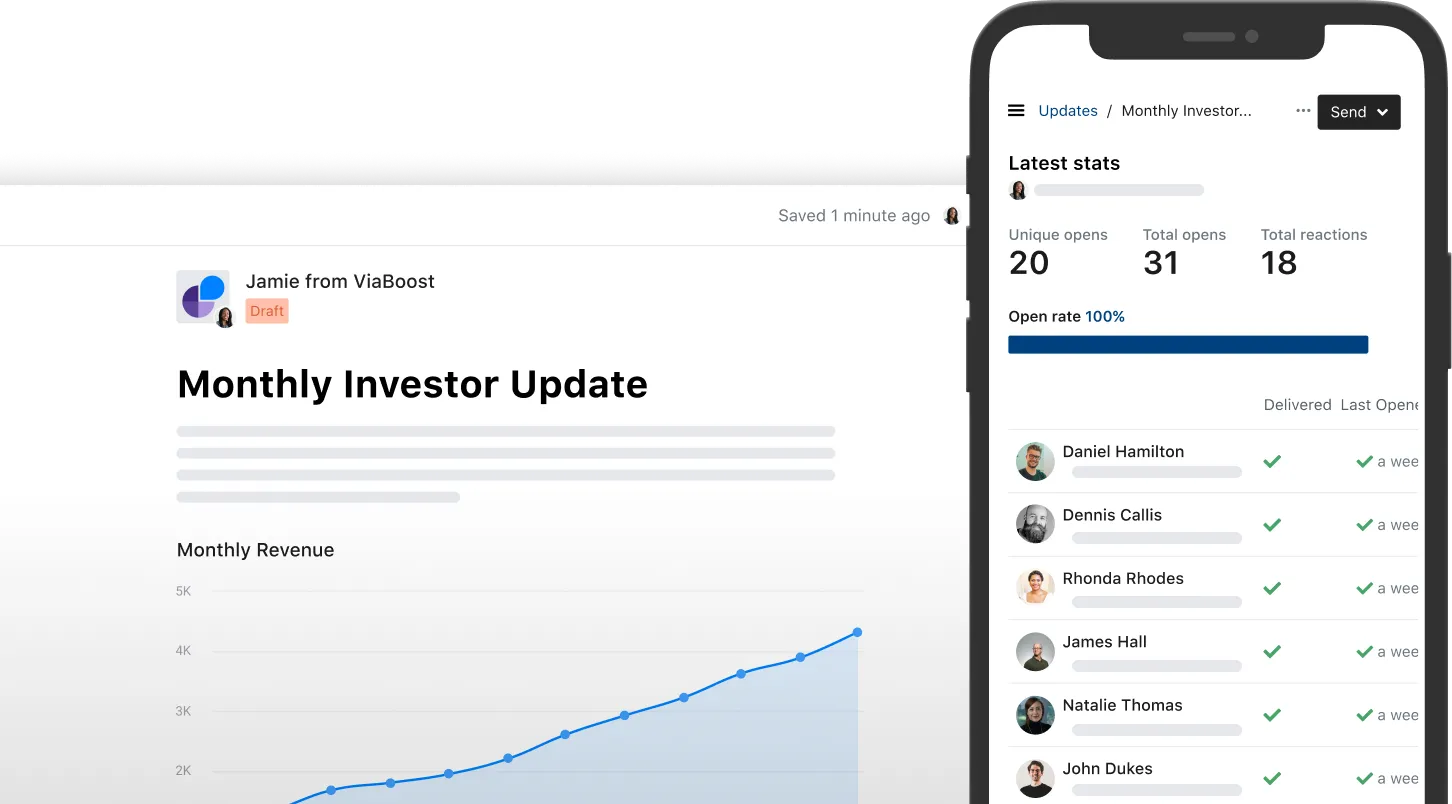

Turning email into insights

We believe that investors should spend time sourcing new deals and helping founders, not manually copying and pasting data from email 🙂.

The AI Inbox helps aggregate insights that exist siloed in data, files, and updates across a venture firm. Updates from founders often stay stuck in one team member's inbox because it's too time-consuming to extract and enter the data and files into a more centralized repository. Visible AI Inbox makes this possible within seconds.

Requests + AI Inbox = A Complete Picture

The addition of the AI Inbox continues to advance our market-leading portfolio monitoring solution. The pairing of Requests + the AI Inbox will give investors a holistic view of portfolio company performance across a fund.

Visible continues to be the most founder-friendly tool on the market. We’ll continue to build tools in existing workflows where both founders and investors live every day.

How Does it Work?

Visible AI Inbox works in three simple steps.

Forward emails to a custom AI inbox email address

Visible AI automatically maps data and files to portfolio companies

Investors can review and approve content before it is saved

From there, dashboards, tear sheets, and reports are all automatically updated on Visible.

Learn more about how Visible AI Inbox can streamline workflows at your firm by meeting with our team.

FAQ

Will this be available on all plans?

Visible AI Inbox is only available on certain plans. Get in touch with your dedicated Investor Success Manager if you want to explore adding this to your account.

How is Visible addressing privacy and security with Visible AI Inbox?

No data submitted through the OpenAI API is used to train OpenAI models or improve OpenAI’s service offering.

Visible AI Inbox leverages OpenAI GPT 4 and proprietary prompts to extract data in a structured way and import it into Visible.

If you’re uncomfortable with utilizing OpenAI to optimize your account, you can choose not to utilize this feature. Please feel free to reach out to our team with any further questions.

These processes adhere to the guidelines outlined in Visible’s privacy policy and SOC 2 certification.

Metrics and data

[Webinar] VC Portfolio Data Collection Best Practices

Customer Stories

Case Study: How Moxxie Ventures uses Visible to increase operational efficiency at their VC firm

Operations

How to Start and Operate a Successful SaaS Company

Fundraising

View all

founders

Investor Agreement Template for Startup Founders

Navigating the complexities of investor agreements is crucial for startup founders aiming to secure crucial funding while protecting their interests. This article will guide you through the essentials of crafting a solid investor agreement, highlighting key components like investment terms, company valuation, and exit strategies. You'll learn not only what makes up an investor agreement but also how to tailor one to fit your startup's unique needs, ensuring a clear path to successful investor relationships.

What Is an Investor Agreement?

An investor agreement is a legal contract between an investor and a company that outlines the terms of the investment. It specifies the roles, expectations, and obligations of both parties, ensuring that the investor's financial contributions are protected and that the company uses the funds as agreed upon. There are several types of investor agreements commonly used in business, each tailored to different investment scenarios:

Stock Purchase Agreement: This type of agreement is used when investors purchase shares directly from the company, giving them ownership according to the percentage of stock acquired.

Convertible Note Agreement: Often used in early-stage startups, this agreement allows the investment to initially be a loan that converts into equity, usually after a subsequent financing round or under certain conditions outlined in the agreement.

Simple Agreement for Future Equity (SAFE): Popular among startups for its simplicity and flexibility, a SAFE grants investors the right to convert their investment into equity at a later date, typically during a future funding round.

Restricted Stock Agreement: This agreement governs the issuance of shares that are subject to certain restrictions, typically vesting over time and providing that shares must be sold back to the company under certain conditions.

Debt Agreement: When startups prefer not to give up equity, they might opt for debt agreements where the investor lends money to the business, to be repaid with interest by a specified date.

Each type of agreement has its nuances and must be chosen carefully based on the company’s specific needs and the investor's expectations. It’s crucial for founders to understand these distinctions to choose the most appropriate form of agreement for their circumstances.

Key Components of an Investor Agreement Template

When structuring an investor agreement, it's essential to include comprehensive and detailed sections that address every aspect of the investment relationship. This clarity not only safeguards both parties' interests but also ensures smooth cooperation throughout the duration of the agreement. Below, we delve into the key components that should be part of any investor agreement template, each playing a crucial role in fostering a transparent and effective partnership.

Related resource: A Complete Guide on Founders Agreements

1. Preliminary Information

The foundation of any investor agreement begins with the preliminary information, which includes all the basic and identifying details such as the names, addresses, and legal statuses of the parties involved, as well as the date of the agreement. This section sets the legal context for the agreement and acts as a reference point for all parties involved, ensuring there is no ambiguity about who is bound by the terms of the document.

2. Investment Details

Specifying the investment details is critical. This includes the amount of investment, the form it will take (whether cash, assets, or services), and any conditions or milestones that must be met before the investment is realized. Clear articulation of these details prevents misunderstandings and sets clear expectations for the deployment of the investment, which is vital for both parties’ financial planning and accountability.

3. Company Valuation and Capital Structure

It's important to clearly outline how the company is valued and how its capital structure will be affected post-investment. This information sets the stage for determining ownership percentages and the distribution of equity. Transparency in this area reassures investors about the basis of their investment valuation and aligns all parties’ expectations regarding their stakes.

4. Roles and Responsibilities

Defining the specific roles and responsibilities of both the investor and the startup is crucial for maintaining clear expectations and accountability. This section should detail the commitments of each party, including any operational roles the investor might assume, and their involvement in decision-making processes. Clarity here ensures smooth day-to-day operations and helps prevent conflicts.

5. Terms of Investment

The terms of investment outline the specifics of the financial relationship, such as the rights to dividends, conversion rights, and voting rights. This section is fundamental as it delineates how profits and losses are distributed, how and when investments might be converted into equity, and how investors can influence company decisions through their votes.

6. Governance and Voting Rights

Governance structures and voting rights are essential for outlining how decisions are made within the company, who gets to vote, and what issues require a vote. This framework is key to maintaining order and clarity in the company's decision-making processes, particularly in scenarios involving multiple investors with varying stakes.

7. Exit Strategies

Planning for future changes in ownership or the potential exit from the company is crucial. This part of the agreement might include buyback rights, rights of first refusal in case of sale, and other mechanisms that allow for a smooth transition or exit. Having these strategies predefined helps manage expectations and reduces potential conflicts during critical transitions.

8. Confidentiality and Non-Disclosure

To protect the sensitive information of both the startup and the investor, confidentiality and non-disclosure clauses are critical. These provisions help build trust, protect trade secrets, and ensure that strategic information does not fall into competitors' hands.

9. Dispute Resolution

Finally, having a predetermined method for resolving disputes is crucial for handling disagreements efficiently and fairly. This section should specify whether disputes will be handled through mediation, arbitration, or court proceedings, and outline the steps each party should follow in the event of a disagreement.

Related resource: What Should be in a Startup’s Data Room?

How Do You Write an Investor Agreement?

Drafting an investor agreement is a critical step for any startup engaging with investors. This document not only formalizes the relationship between a company and its investors but also ensures that both parties are clear on the terms of the investment. Below, we detail the essential steps involved in creating a robust investor agreement that secures interests and fosters a positive business relationship.

Gathering Information and Structuring the Agreement

The first step in drafting an investor agreement is to collect all necessary information about the investment and the parties involved. This includes details about the investment amount, the structure of the investment (e.g., equity, debt), and the specific roles and obligations of each party. Accurate and comprehensive information is crucial as it forms the basis of the agreement, ensuring that all terms are based on a clear understanding of the investment and the expectations of both parties. This foundational step prevents future misunderstandings and lays the groundwork for a solid legal agreement.

Involving the Right Parties

It is essential to identify and involve all relevant parties in the agreement process. This includes not only the investors and company founders but also may include lawyers, accountants, and other stakeholders who have a vested interest in the transaction. Ensuring that all parties are appropriately represented and that their roles and expectations are clearly defined from the outset is crucial. This clarity helps in avoiding conflicts later and ensures that the agreement reflects the interests and responsibilities of everyone involved.

Drafting Key Clauses

The heart of the investor agreement lies in its clauses, which detail the terms of the investment, rights, and obligations of the involved parties. Key clauses include those related to the amount and structure of the investment, conditions for funding, management and use of the investment, investor rights, and any specific covenants related to company governance. Each clause must be drafted with clarity and precision to avoid ambiguity and ensure that the terms are enforceable. Legal expertise is often required in this phase to ensure that the clauses are legally sound and adequately reflect the agreed-upon terms.

Negotiation and Finalization

Once a draft of the investor agreement is prepared, the negotiation phase begins. During this stage, both parties review the draft, suggest modifications, and discuss any concerns they might have with the proposed terms. This phase is crucial as it allows both sides to refine the agreement to better meet their needs and to ensure mutual understanding and satisfaction with the terms. After negotiations are completed, the final agreement is prepared for signing. It is advisable for both parties to have legal counsel review the final document to ensure that it is comprehensive and legally binding.

Related resource: The Startup's Handbook to SAFE: Simplifying Future Equity Agreements

Build Strong Investor Connections with Visible

Crafting a solid investor agreement is key to protecting the interests of both the startup and its investors. Establishing clear terms and open lines of communication from the outset can significantly enhance these critical business relationships.

To manage and enhance investor relations with ease and efficiency, try Visible. By using Visible, you can streamline investor communications, track important metrics, and report progress efficiently, keeping your investors engaged and informed. Ready to take your investor relations to the next level?

Try Visible free for 14 days and start strengthening your investor connections.

founders

Understanding The 4 Types of Crowdfunding

Crowdfunding has revolutionized the way startups and social initiatives gather the necessary funds to bring their ideas to life. This article will explore the intricacies of crowdfunding, delving into its various types and the unique benefits and challenges they present. Whether you're a founder looking to kickstart your project or simply curious about how crowdfunding could play a role in your financial strategy, read on to discover the ins and outs of this dynamic funding mechanism.

What Is Crowdfunding, and Why Is It Important?

Crowdfunding is a method of raising capital through the collective effort of friends, family, customers, and individual investors. This approach taps into the collective efforts of a large pool of individuals—primarily online via social media and crowdfunding platforms—and leverages their networks for greater reach and exposure. Crowdfunding is vital not only as a tool for gathering financial resources but also for validating a product or service in the market, engaging with customers, and building community support.

Three of the most popular crowdfunding platforms include:

Kickstarter- The platform operates on an all-or-nothing funding model, which means that project creators only receive funds if their campaign reaches its predetermined funding goal. This model encourages creators and founders to set realistic goals and actively promote their projects to ensure success.

Indiegogo- Known for its flexibility, it supports a wide range of campaigns from tech innovations to artistic endeavors. The platform is distinct for allowing both fixed and flexible funding goals, making it a versatile choice for project creators who may still benefit from partial funding if they do not meet their full target.

Patreon- Patreon stands out among crowdfunding platforms because it caters to creators seeking continuous funding rather than one-time project support. This makes it particularly popular with individuals involved in ongoing creative endeavors such as musicians, YouTubers, podcasters, and filmmakers.

Related resource: How to Raise Crowdfunding with Cheryl Campos of Republic

The Pros and Cons of Crowdfunding

Crowdfunding offers unique opportunities and benefits for startups and projects, but it also comes with its set of challenges. In the next section, we will delve into the pros and cons of crowdfunding, providing a balanced perspective that will help founders understand what to expect and how to prepare for a successful campaign.

Pros of Crowdfunding

Pre-Launch Interest and Momentum: Crowdfunding allows founders to generate buzz and interest in a product or service before it officially launches. This pre-launch momentum can be crucial in establishing a brand and ensuring a successful market entry.

Market Validation: Crowdfunding campaigns allow investors to gauge customer interest and validate the market demand for a product or service before it fully hits the market. This can reduce the financial risks associated with launching new and untested products.

Risk Reduction through Pre-Sales: By using crowdfunding platforms to pre-sell products, founders can reduce financial risks associated with production and inventory. This approach ensures that there is a market demand before significant investments are made.

Marketing and Publicity: Crowdfunding campaigns can serve as powerful marketing tools, providing significant media exposure and public attention that can continue to benefit the project long after the campaign has ended.

Direct Customer Feedback: Crowdfunding offers a unique opportunity for founders to receive direct feedback from early adopters. This feedback can be invaluable for making adjustments to the product or service before it hits the broader market.

Building a Loyal Community: Crowdfunding not only raises funds but also helps in building a community of supporters who are emotionally and financially invested in the success of the project. This community can become a vital asset for future promotions and continued business growth.

Access to Capital: Crowdfunding provides a platform to raise significant amounts of money without the need for traditional financial intermediaries such as banks or venture capital firms. This can be especially useful for startups and small businesses that may not have access to traditional funding sources.

Cons of Crowdfunding

High Competition: The popularity of crowdfunding platforms means that numerous projects are vying for the same pool of potential backers. Standing out among the crowd requires a compelling story and effective marketing strategies, which can be challenging and resource-intensive.

Fulfillment Pressures: Successfully funded projects face the pressure of fulfilling backers' rewards and expectations. This can be particularly challenging if the campaign goes viral and the number of backers exceeds initial forecasts, complicating logistics and potentially increasing costs.

All-or-nothing Funding Models: Many crowdfunding platforms operate on an all-or-nothing funding model, where you must reach your funding goal to receive any money. Falling short means no funding at all, which can be a significant risk if you've already invested in campaign marketing and product development.

Public Exposure of Ideas: When you pitch a project on a crowdfunding platform, you expose your business idea or concept to the public, which includes potential competitors. This can lead to issues if the intellectual property is not fully protected or if the concept is easily replicable.

The 4 Different Types of Crowdfunding

As you explore the world of crowdfunding, it's essential to understand the different types that are available. Each type offers unique advantages and fits different kinds of projects and goals. Below, we delve into the four primary types of crowdfunding: donation-based, equity-based, rewards-based, and debt-based. Choosing the right one can be critical to your campaign’s success.

Related resource: 6 Types of Investors Startup Founders Need to Know About

1) Donation-Based Crowdfunding

Donation-based crowdfunding is exactly what it sounds like – backers donate money without expecting anything in return. This model is primarily used for charitable causes or community projects where the reward is the satisfaction of contributing to a good cause.

When to Use This Method of Crowdfunding

This method is ideal for non-profit organizations, social causes, or community projects where monetary return isn't an expectation. It's particularly effective when the audience is motivated by philanthropy rather than a tangible return.

2) Equity-Based Crowdfunding

Equity-based crowdfunding involves offering a stake in your company in exchange for capital. This means investors receive shares of your business and become partial owners. It’s a way to raise significant funds while distributing the financial risk among a group of investors.

When to Use This Method of Crowdfunding

Use equity-based crowdfunding when you need substantial capital and are comfortable sharing ownership of your company with investors. It is suitable for startups that expect to grow and generate significant revenue, making the equity stake potentially valuable.

3) Rewards-Based Crowdfunding

Rewards-based crowdfunding allows backers to contribute in exchange for tangible rewards, which can vary from the product itself to other unique perks. This type is popular among creative projects and startups that wish to offer their product as a pre-sale.

When to Use This Method of Crowdfunding

This method works best for consumer-focused projects where you can offer your product as a reward to backers. It's suitable for validating product demand before mass production and engaging with your customers directly.

4) Debt-Based Crowdfunding

Also known as peer-to-peer (P2P) lending, debt-based crowdfunding allows individuals to lend money to a project or business with the expectation of getting their money back with interest. It mirrors traditional loans but from multiple lenders at potentially more favorable terms.

When to Use This Method of Crowdfunding

Debt-based crowdfunding is appropriate for founders who need traditional loan conditions but prefer a broader base of lenders to minimize risk. It is also beneficial when founders can ensure a steady revenue stream to manage repayments.

Crowdfunding vs Traditional Fundraising: What are the Differences?

Crowdfunding and traditional fundraising serve the same primary purpose—raising money—but differ significantly in their approach and execution. Traditional fundraising typically involves seeking substantial sums from a few donors, such as angel investors, venture capitalists, or banks, and often requires a detailed business plan, credit checks, or proven business history. It can be a lengthy process with a lot of personal interaction and persuasion.

In contrast, crowdfunding is usually conducted online and aims to gather smaller amounts of money from a large number of people. This method leverages the power of social networks and is accessible to anyone with an internet connection. Crowdfunding campaigns provide immediate feedback and market validation, as they allow the entrepreneur to gauge interest in a product or concept before fully committing to production or scaling. Moreover, crowdfunding can offer more than just financial benefits; it can also provide publicity, community engagement, and customer feedback.

These fundamental differences make each method suitable for different types of projects and funding needs, with crowdfunding often being more accessible and engaging, while traditional fundraising can offer more significant amounts of capital and potentially fewer stakeholders to manage.

Related resource: How to Secure Financing With a Bulletproof Startup Fundraising Strategy

Fundraise the Right Way With the Help of Visible

Crowdfunding not only helps raise the necessary funds for your venture but also connects you with a community that can offer support and feedback.

If you are also interested in finding traditional investors and accelerators check out our Connect Investor Database. Instead of wasting time trying to figure out investor fit and profile for their given stage and industry, we created filters allowing you to find VCs and accelerators who are looking to invest in companies like you. Check out all our investors here and filter as needed.

As you embark on your fundraising journey, consider leveraging platforms like Visible to streamline your efforts.

After finding the right Investor you can create a personalized investor database with Visible. Combine qualified investors from Visible Connect with your own investor lists to share targeted Updates, decks, and dashboards. Start your free trial here.

founders

Miami’s Venture Capital Scene: The 10 Best Firms in 2024

At Visible, we often compare a venture capital fundraise to a traditional B2B sales and marketing funnel.

At the top of your funnel, you add qualified investors to your pipeline (via cold and warm outreach). In the middle of the funnel, you nurture and pitch potential investors with emails, updates, pitches, meetings, etc. At the bottom of the funnel, you are hopefully closing your new investors.

Related Resource: How to Find Venture Capital to Fund Your Startup: 5 Methods

In order to best help you fill the top of your “fundraising funnel,” we’ve put together a list of a few popular VC firms located in Miami. Check them out below:

1. Ocean Azul Partners

As the team at Ocean Azul Partners put on their website, “We are an early-stage venture capital firm passionate about helping entrepreneurs bring innovative technology solutions to market. We’re operators who are determined to use our successes and lessons learned to provide significant value to the teams with which we work. We are proud to support entrepreneurs building unique solutions that will shape the futures of their industries.”

Investment Range

As put on their website, “We write initial checks of size $200K-$2M, with a portion of our fund reserved for follow-on. We play an active role in all of our investments and have board seats on most of them.”

Industries

The team at Ocean Azul primarily focuses on B2B software.

Learn more about Ocean Azul Partners by checking out their Visible Connect Profile.

Related Resources: The 12 Best VC Funds You Should Know About

2. Guild Capital

As the team put on their website, “Guild Capital is an early-stage venture capital firm. Founded in 2009, we have been dedicated to venture further than conventional Silicon Valley-based VC patterns to look for growth-stage teams who can evolve into great companies.”

Investment Range

The team at Guild does not publicly state their investment range but does look to companies that have “generated early revenue” or those that have not generated revenue that shows signs of momentum.

Industries

The team at Guild does not have a specific industry but shares their thesis for industries and markets by stating, “We believe in businesses bringing industry-contrarian solutions to large addressable markets. In general, we prefer markets that are not ‘winner-takes-all.”

Learn more about Guild Capital by checking out their Visible Connect Profile →

3. Starlight Ventures

As put on their website, “We are an early stage venture firm designed to address humanity’s biggest challenges and opportunities through breakthrough technology. We aim to enable long-term human flourishing: a prosperous civilization that responds effectively to large-scale opportunities and existential threats alike.”

Investment Range

The team at Starlight does not publicly state their investment range.

Industries

The team at Starlight does not publicly state-specific industries but rather invest in companies that impact long-term human flourishing.

Learn more about Starlight Ventures by checking out their Visible Connect Profile →

4. Fuel Venture Capital

As put by their team, “Fuel Venture Capital has brilliantly executed against this mission and has become known and trusted as leaders who are founder-focused and investor-driven. Our world-class venture executives have deployed over $400MM of capital from our global LP base following a disciplined “Phased Investment Thesis” managing risk while driving return on investment.”

Investment Range

The team at Fuel invests across multiple stages as put below:

Industries

The team at Fuel invests across many industries but ultimately look to, ‘disruptive global, tech-driven companies.”

5. LAB Miami Ventures

As put by their team, “LAB Ventures is a VC Fund and Startup Studio dedicated to accelerating early-stage real estate and construction technology companies… We invest in early-stage real estate and construction technology companies. We invite investors with an interest in these sectors to join our growing network and stay on the leading edge of tech trends.”

Investment Range

The team at LAB does not publicly state their investment range but typically invests in pre-seed, seed, and series A rounds.

Industries

As put by their team, “Our focus is on early-stage technology businesses that serve the Real Estate and Construction industries – Property Technology, or “PropTech” for short. We take a very broad view of what is included in PropTech, but have a preference for software over hardware, recurring revenue, and enterprise over the consumer.”

6. Krillion Ventures

As put by their team, “Krillion Ventures is a Miami-based venture capital fund that actively invests in early-stage technology companies solving problems in healthcare, financial services, and real estate.”

Investment Range

The team at Krillion Ventures does not publicly list their investment range but gives the following information, “We invest in companies that can demonstrate proof of concept and are seeking capital to accelerate their growth. We make follow-on investments in our portfolio companies on a deal-by-deal basis.”

Industries

The team at Krillion is focused on companies in the health tech space.

Learn more about Krillion Ventures by checking out their Visible Connect Profile →

7. Miami Angels

As put by the team at Miami Angels, “We bring together exceptional entrepreneurs and accomplished accredited investors to fuel success.

Our group is comprised of over 150 angel investors, many of whom have been entrepreneurs themselves. Beyond providing capital, we collaborate with our founders to ensure they have access to talent and future funding.”

Investment Range

The team at Miami Angels does not publicly state what their investment range is. You can learn more about their investment criteria below:

Industries

As put on their website, “Because of our diverse investor base, we are able to leverage that expertise and invest in many industries.

However, we do NOT invest in hardware, lifestyle brands, consumer goods, biotech, development shops, or financial derivatives.”

Learn more about Miami Angels by checking out their Visible Connect Profile →

8. Secocha Ventures

As put by their team, “Secocha Ventures is an Investment Firm focused on early stage Consumer Products & Services, Fintech & Healthcare Technology companies.”

Investment Range

The team at Secocha Ventures does not publicly disclose their investment range. They do mention, “We invest in startups raising their Pre-Seed, Seed, or Series-A rounds.”

Learn more about the Secocha Ventures investment criteria below:

Industries

As shown above, the team at Secocha Ventures states, “We invest in FinTech, HealthTech, and Consumer Products & Services.”

Related Resources: Private Equity vs Venture Capital: Critical Differences

9. Third Sphere

As put by the team at Third Sphere, “We use early stage capital to upgrade systems. That starts with finding the sectors currently not working with consideration for people, businesses, or general public responsibility – everything from infrastructure to supply chains. Because ensuring our future takes more than reducing carbon emissions.”

Investment Range

The team at Third Sphere has multiple funds. For their venture fund, they explain their range and criteria as, “A real investment is about more than capital. We invest at the earliest stages (pre-seed & seed), stay close to our founders, and work with them from the onset of our relationship to build relationships with other founders, investors, and customers. From crafting a clear, eye-catching subject line to navigating a pitch, our emphasis on coaching leads to productive, inventive, and valuable relationships that bring ideas to life. Our community is more than just a nice idea – it’s a system designed to work for you.”

Industries

Third Sphere breaks down their industries and markets into the following:

10. TheVentureCity

As put by their team, “TheVentureCity is a global, early-stage venture fund that refuses to follow the conventional crowd. We offer promising founders investment with bespoke data insights and operating expertise – designed for product-led growth.”

Investment Range

According to their Visible Connect Profile, the team at TheVentureCity typically writes checks between $1M and $4M.

Industries

As put on their website, “We are generalists, but index high on Fintech, HealthTech, AI/ML/Data and B2B SaaS. We like businesses that are “needed” and are not just “nice to haves”.”

Learn more about TheVentureCity by checking out their Visible Connect Profile →

Find out How Visible Can Help Your Startup Today

At Visible, we oftentimes compare a fundraise to a B2B sales and marketing funnel. At the top of your funnel, you are finding new investors. In the middle, you are nurturing and pitching potential investors. At the bottom of the funnel, you are working through diligence and ideally closing new investors.

Related Resource:A Quick Overview on VC Fund Structure

With the introduction of data rooms, you can now manage every aspect of your fundraising funnel with Visible.

Find investors at the top of your funnel with our free investor database,Visible Connect

Track your conversations and move them through your funnel with ourFundraising CRM

Share yourpitch deck andmonthly updates with potential investors

Organize and share your most vital fundraising documents with data rooms

Manage your fundraise from start to finish with Visible.Give it a free try for 14 days here.

Metrics and data

View all

investors

Dry Powder: What is it, Types of Dry Powder, Impact it has in Trading

In the ever-evolving world of finance, "dry powder" serves as a pivotal concept for investors, encapsulating the essence of liquidity and strategic investment readiness.

The term "dry powder" echoes through the corridors of finance, signifying a reservoir of liquid assets poised for deployment. Originating from the military use of gunpowder, the contemporary financial landscape repurposes this term to signify cash reserves and highly liquid securities, ready to be ignited for investment opportunities or to navigate economic tumults.

In this article, we’ll delve into the nuances of dry powder, shedding light on its types, strategic uses, and indispensable value in venture capital – aiming to arm investors with insights to optimize their investment strategies.

What is Dry Powder?

Dry powder in finance refers to readily available cash or liquid assets held by investors, companies, or funds, earmarked for immediate investment opportunities or emergency use. This concept spans across personal finance, corporate reserves, and notably, in private equity and venture capital, where it underscores the readiness to capitalize on opportune moments or cushion against unforeseen financial downturns.

Types of Dry Powder

There are three primary types of dry powder, each serving distinct purposes and embodying different levels of liquidity and deployment readiness. Each type of dry powder plays a unique role in an investor's arsenal, offering different degrees of liquidity, potential for appreciation, and strategic flexibility. Understanding and managing these forms of financial reserves enable investors to navigate the complexities of the market, seize emerging opportunities, and safeguard against economic volatility.

Cash Reserves

Cash reserves constitute the most liquid form of dry powder. They are immediately available funds that do not require conversion or sale to be utilized. This immediacy makes cash reserves an invaluable asset for investors looking to act swiftly on investment opportunities or cover urgent financial needs without the delay of liquidating other assets. Cash reserves are kept in accounts where they can be quickly accessed, often without significant transaction costs or losses, offering unmatched liquidity and readiness.

Marketable Securities

Marketable securities, including stocks, bonds, and treasury bills, represent another key form of dry powder. While not as liquid as pure cash reserves, these assets can be sold relatively quickly in the financial markets, often with minimal impact on their value. This category of dry powder allows investors to hold assets that can appreciate over time but can still be converted into cash on short notice. The ability to sell these securities rapidly makes them a crucial component of an investor's dry powder, balancing potential growth with liquidity.

Unallocated Capital

Unallocated capital refers to funds that have been raised or set aside for investment but have not yet been deployed. In the context of venture capital and private equity, it includes committed capital from investors that is waiting to be invested in portfolio companies. This type of dry powder offers strategic flexibility, allowing funds to seize new investment opportunities as they arise or to support existing investments with additional capital. Unallocated capital must be managed carefully to balance the readiness for new investments with the risk of having excessive unused capital, which could otherwise be earning returns.

How do Investors Use Dry Powder?

As we delve deeper into the strategic application of dry powder, it's crucial to recognize its multifaceted role in bolstering investment portfolios, safeguarding against market downturns, and capitalizing on unique investment opportunities.

This section explores some pivotal strategies investors employ to leverage their dry powder, illustrating how these reserves enhance both the resilience and growth potential of investment endeavors.

1. Dry Powder as a Tool for Growing Portfolio Companies

Dry powder represents a critical resource for investors, particularly those in venture capital or private equity, aiming to accelerate the growth of their portfolio companies. By keeping a reserve of liquid assets, investors can swiftly inject capital into these companies when opportunities for expansion, product development, or market entry arise. This proactive use of dry powder can significantly enhance a company's competitive edge, drive innovation, and facilitate scale-up operations, ultimately contributing to its long-term value creation. The strategic allocation of dry powder for growth initiatives enables investors to optimize the trajectory of their investments, ensuring they are well-positioned to capitalize on emerging trends and opportunities.

2. Acting as a Safety Net in Case of Economic Downturn

In the unpredictable landscape of financial markets, economic downturns pose a significant risk to investment portfolios. Dry powder serves as a critical safety net in these scenarios, providing investors with the liquidity necessary to navigate through periods of market volatility without being forced to liquidate assets at a loss. This reserve of liquid assets allows investors to maintain their investment positions, cover operational costs, and even seize counter-cyclical investment opportunities that may arise during downturns. The presence of dry powder enhances financial stability and resilience, empowering investors to withstand economic fluctuations and safeguard the value of their investments.

3. Creating Opportunities in a Distressed Debt Situation

Distressed debt situations, where securities are trading at significant discounts due to a company's financial instability, present unique investment opportunities for those with dry powder. Investors can use their liquid reserves to purchase these securities at a lower cost, betting on the potential for recovery and significant returns on investment. This strategy requires a deep understanding of the distressed assets and the factors contributing to their undervaluation, as well as a readiness to act swiftly when such opportunities are identified. Dry powder enables investors to capitalize on these situations by providing the necessary liquidity to invest in distressed assets, offering a pathway to potentially high returns through strategic acquisitions and restructuring efforts.

Advantages of Dry Powder in Venture Capital

Venture capital and private equity firms use dry powder as a strategic tool, safeguarding their existing portfolios and propelling their investments to new heights. The presence of readily available capital enables these firms to act swiftly and decisively in the face of both opportunity and adversity. Here, we'll explore the key advantages that dry powder offers in the realm of venture capital and private equity, highlighting its role in driving success and mitigating risks.

Enhanced Deal-Making Capacity: With substantial dry powder reserves, venture capital and private equity firms can pursue larger and potentially more lucrative deals. The ability to mobilize funds quickly gives these firms a competitive edge in bidding for high-value targets, facilitating growth and diversification of their investment portfolios.

Flexibility in Investment Timing: The availability of dry powder affords firms the luxury of timing their investments to capitalize on market conditions. They can strategically enter or exit investments based on their assessment of market cycles, optimizing returns on their capital deployment.

Opportunistic Acquisitions: Markets are dynamic, and distressed assets or undervalued opportunities can emerge anytime. Dry powder positions firms to take advantage of these situations, acquiring assets at a discount or investing in companies poised for a turnaround, thus potentially generating significant returns.

Negotiating Leverage: In deal negotiations, a firm's ability to close transactions quickly with available cash can serve as a powerful bargaining tool. This leverage can lead to more favorable deal terms, including price concessions or preferential terms of sale, enhancing the value captured from each transaction.

Risk Management and Stability: During economic downturns or periods of heightened market volatility, dry powder can serve as a stabilizing force. It provides the means for venture capital and private equity firms to support their portfolio companies through financial difficulties, ensuring long-term stability and preventing forced exits at unfavorable valuations.

Related resource: Calculating Your Quick Ratio

Track Fund Performance Data With Visible

Dry powder is the lifeline that enables investors to seize opportunities, navigate downturns, and optimize the growth and resilience of their portfolios. Understanding how to manage and deploy these reserves effectively is crucial in the competitive landscape of investment.

Visible offers insights and tools that can help investors track, manage, and communicate the performance of their portfolios, making it easier to harness the power of dry powder in achieving investment success.

Learn how to get started with Visible to track your crucial fund performance data here.

Related resources:

Private Equity vs Venture Capital: Critical Differences

How To Find Private Investors For Startups

investors

Additional Paid-In Capital: What It Is and How to Calculate It

In venture capital, grasping the concept of Additional Paid-In Capital (APIC) is essential. It represents the premium investors pay over a share's nominal value, indicating their confidence in a company. Beyond a mere balance sheet entry, APIC demonstrates investor support, fueling startup innovation and growth.

What is Additional Paid-in Capital (APIC)

APIC, a critical financial indicator in a company's equity section, shows the excess amount investors pay over shares' par value during events like IPOs or financing rounds.

This metric is particularly significant in the startup and venture capital ecosystem, as it represents a tangible measure of investor confidence and financial commitment to a company's potential for growth and innovation. APIC is not just an indicator of the funds a company has raised; it underscores the premium investors are willing to pay for a stake in the company, beyond the basic valuation of shares. This additional capital can be crucial for startups, offering a vital resource for expansion, research and development, and scaling operations, ultimately influencing the company's strategic direction and growth trajectory.

Additional Paid-In Capital vs. Contributed Capital

APIC denotes funds received beyond a share's par value, differing from contributed capital, which sums all shareholder capital. This distinction illuminates a company's financial wellness and growth potential.

Contributed capital includes both the par value of issued shares, often referred to simply as "capital stock," and APIC. Essentially, it represents the initial and additional equity investments made by shareholders. The par value portion of contributed capital reflects the nominal value of shares, set at the company's inception and usually a minimal figure, serving as a legal requirement in some jurisdictions. APIC, on the other hand, captures the premium investors are willing to pay beyond this nominal value, driven by their belief in the company's future growth and success.

These two components' roles within a company's financial architecture are distinct yet complementary. Contributed capital forms the bedrock of a company's equity structure, signifying the total equity stake held by shareholders. APIC, as a subset, highlights the additional confidence and financial backing investors are prepared to offer, often reflecting the market's valuation of the company's potential beyond its book value.

Related resource: What Are Convertible Notes and Why Are They Used?

Sources of Additional Paid-In Capital

APIC originates from strategic activities such as IPOs, premium stock issuances, and stock-based compensation, which are crucial for securing funds beyond a share's par value. Each source has unique advantages, strategic implications, and impact on the company's overall financial health and equity structure. Understanding these sources provides a clearer picture of how companies leverage investor enthusiasm and market conditions to bolster their financial positions and support their long-term growth and development strategies.

Related resource: From IPOs to M&A: Navigating the Different Types of Liquidity Events

1. Initial Public Offerings (IPOs)

IPOs serve as a critical APIC source for companies going public, marking their first share offering to the public and usually bringing significant capital. IPOs allow companies to access funding from a broader investor base, surpassing the limits of private financing rounds predominantly participated in by venture capitalists and angel investors.

The significance of IPOs in generating APIC lies in the premium price at which shares are often offered to the public. This premium—over and above the par value of the shares—translates into APIC, reflecting the market's confidence in the company's growth prospects. The funds raised through an IPO can dramatically enhance a company's financial position, providing capital for expansion, debt reduction, and other strategic investments.

Moreover, the impact of an IPO on a company's financial position extends beyond immediate capital infusion. Successfully going public can increase a company's visibility, credibility, and ability to attract talent through stock-based compensation. However, it also subjects the company to regulatory requirements, increased scrutiny from investors and analysts, and the pressures of quarterly performance expectations.

IPOs are a crucial milestone for growth-oriented companies, offering a pathway to secure significant APIC that supports their strategic ambitions and solidifies their market standing.

2. Stock Issuance at a Premium

Issuing stocks at a premium is a strategic way to generate APIC, leveraging investor demand. This approach involves selling new shares for more than the stock's par value, with the difference between the sale price and the par value directly contributing to APIC. This strategy not only raises significant funds for the company but also signals strong market confidence and investor willingness to invest at higher valuations, reflecting positively on the company's perceived growth potential and stability.

The strategic nature of issuing stocks at a premium lies in its dual benefit: securing necessary capital for expansion and operational needs while simultaneously bolstering the company's equity base without incurring debt. This method of raising capital is particularly advantageous for companies with a strong brand reputation and clear growth trajectory, as it minimizes dilution of existing shareholdings and avoids the interest costs associated with debt financing.

Moreover, the premium paid over the par value represents investor confidence in the company's future prospects, making it a critical gauge of market sentiment. This strategy also provides companies with flexibility in timing and pricing, allowing them to maximize capital-raising efforts when market conditions are favorable. The APIC generated through such issuances is vital for funding research and development, marketing strategies, and other growth-oriented initiatives, ultimately contributing to the company's long-term success and shareholder value.

Issuing stocks at a premium is a strategic financial decision that is a testament to a company's market position and growth outlook. It plays a crucial role in shaping its financial landscape and supporting its strategic goals.

3. Stock-based Compensation

Stock options and RSUs are key to boosting APIC and attracting and retaining talent. These programs allow employees to share in the company's success through equity or equity-like incentives, aligning their interests with those of the company and its shareholders.

Stock options allow employees to purchase company stock at a predetermined price, potentially lower than future market value, over a specified period. When employees exercise these options, the difference between the exercise price and the market value at the time of exercise contributes to APIC, reflecting the value added to the company through employee commitment and efforts. This mechanism bolsters the company's financial resources and fosters a sense of ownership and partnership among employees, driving performance and innovation.

RSUs are another form of stock-based compensation where employees receive a set number of shares that vest over time, based on continued employment or meeting certain performance milestones. Upon vesting, the fair market value of these shares, minus any amount the employee pays for them (often nothing), is recorded as APIC. This direct injection of value into APIC underscores the tangible contributions of employees to the company's growth and success.

These stock-based compensation strategies are crucial in a company's financial planning and employee engagement. They not only enhance APIC but also serve as a non-cash way to compensate and incentivize key talent. By effectively using stock options and RSUs, companies can strengthen their APIC, improve their financial positioning, and foster a motivated, performance-driven culture that aligns with the company's long-term objectives.

Calculating Paid-in Capital

Calculating paid-in capital, which includes par value and APIC, reveals shareholders' total equity contributions, offering valuable insights into a company's financial support. This figure is a key component of a company's equity structure, revealing the financial backing it has received from its investors over time. Here's a simplified approach to calculating paid-in capital:

Identify Par Value of Issued Shares: Start by determining the par value per share—a nominal value assigned to stock for legal purposes—and multiply it by the total number of issued shares. This gives you the base value of the equity issued.

Calculate APIC: APIC is the amount over and above the par value that investors have paid for shares. To find APIC, subtract the total par value of issued shares from the total amount actually received from issuing those shares.

Sum Up Total Paid-In Capital: Add the total par value from step 1 to the APIC calculated in step 2. The sum represents the total paid-in capital, reflecting the comprehensive equity contribution by shareholders.

For example, if a company issues 1,000 shares at a par value of $1 per share but sells them for $10 each, the par value of equity is $1,000 (1,000 shares x $1), and the APIC is $9,000 ([$10 - $1] x 1,000 shares). The total paid-in capital, therefore, is $10,000 ($1,000 + $9,000).

This calculation provides a clear picture of the financial resources shareholders have committed to the company, underscoring the importance of initial and additional contributions to its equity base. Understanding this process is crucial for investors aiming to assess a company's financial health and the extent of shareholder support.

Related resource: The Ultimate Guide to Startup Funding Stages

How Additional Paid-in Capital Works

APIC plays a fundamental role in shaping a company's financial structure, acting as a key indicator of the strength and stability of its equity base. APIC is generated when a company issues new shares and sells them at a price above their nominal or par value. The difference between the sale price and the par value is recorded as APIC on the company's balance sheet, under the shareholders' equity section. This mechanism not only provides companies with a vital source of funding without incurring debt but also reflects the market's valuation of the company, often seen as a vote of confidence from investors.

The mechanics of APIC directly influence a company's financial structure by enhancing its equity cushion. This is particularly important for startups and growth-phase companies, which may prefer equity financing to debt to avoid interest obligations and preserve cash flow. A robust equity base, bolstered by significant APIC, can improve a company's borrowing capacity, as lenders often view a strong equity position as a sign of financial health and stability.

Real-world examples illustrate the impact of APIC on companies' financial strategies and market perception. For instance, a tech startup conducting an IPO may price its shares significantly above the par value due to high investor demand, driven by its innovative products and market potential. The resulting APIC from this IPO boosts the company's financial resources for expansion and sends a positive signal to the market about its growth prospects.

Another example can be found in established companies issuing new shares at a premium during secondary offerings. These offerings, aimed at raising capital for strategic initiatives, can significantly increase APIC, demonstrating investor willingness to pay a premium based on the company's past performance and future growth expectations.

APIC is a critical component of a company's financial architecture through these mechanisms, enabling strategic growth initiatives, enhancing corporate valuation, and signaling confidence to investors and market analysts. Its role in a company's financial structure underscores the importance of equity financing strategies in corporate growth and investor relations.

How is Additional Paid-in Capital Taxed?

Though not directly taxed, APIC's impact on a company's financial health and shareholders' tax obligations is significant, navigating the complexities of regulatory frameworks. For businesses, APIC enhances the equity base without generating immediate taxable income. It represents capital received from shareholders beyond the nominal value of shares issued and, as such, does not constitute revenue or profit that would be subject to corporate income tax. This capital injection strengthens the company's balance sheet and can support growth and expansion efforts, potentially leading to increased profitability and, by extension, future tax liabilities through higher taxable income.

From an investor's perspective, the tax implications of APIC are primarily associated with capital gains. When investors sell their shares at a price higher than their purchase price, the profit realized is subject to capital gains tax. The initial investment, including any premium paid over the par value (i.e., APIC), forms the basis for calculating these capital gains. It's crucial for investors to accurately track their investment's cost basis, including APIC, to determine the correct amount of taxable gain upon disposition of the shares.

Stock-based compensation plans, which can contribute to APIC, also have specific employee tax considerations. For instance, when employees exercise stock options, the difference between the exercise price and the market value during exercise may be subject to income tax as compensation.

Investors and companies must also stay informed about regulatory changes and tax laws that might affect the taxation of equity transactions and capital gains, as these can vary by jurisdiction and over time. Consulting with tax professionals is advisable to navigate these complex areas effectively and ensure compliance with current tax laws while maximizing tax efficiency.

Track Fund Performance Data With Visible

By leveraging Visible, investors can track critical portfolio company and investment data all from one place. Learn how to get started with Visible to track your crucial investment data here.

investors

A Complete Breakdown of the Contributed Capital Formula + Examples

In the dynamic landscape of business finance, the contributed capital formula stands as a cornerstone for investors seeking to evaluate a company's financial health and growth potential. By quantifying the equity shareholders invest in exchange for stock, this formula offers a clear insight into the resources a company has at its disposal to fuel expansion, innovation, and stability.

Defining Contributed Capital

Contributed capital, also known as paid-in capital, refers to the cash and other assets that shareholders provide to a company in exchange for ownership or stock. This financial measure includes funds from initial public offerings (IPOs), direct listings, direct public offerings, and secondary offerings, as well as issues of preferred stock. Additionally, it encompasses the receipt of fixed assets or the reduction of liabilities in exchange for stock.

Contributed capital is a key component of a company's equity structure, reflecting the total financial investment made by shareholders to acquire their stake in the company. It is reported on the company's balance sheet under the shareholders' equity section, typically split into two accounts: the common stock account, representing the par value of issued shares, and the additional paid-in capital account, reflecting the premium paid by investors over the par value of the shares.

Building Blocks of the Contributed Capital Formula

Understanding contributed capital and its significance is just the beginning. As we delve deeper into the financial anatomy of a company, it becomes clear that contributed capital's value is built upon two foundational elements: common stock and additional paid-in capital. These components contribute to the total financial investment made by shareholders and provide insights into a company’s equity structure and financial health.

Common Stock

Common stock represents the basic ownership shares in a company, providing shareholders with voting rights and a claim on a portion of the company's profits through dividends. It's a foundational component of contributed capital, symbolizing the equity investors contribute to a company in exchange for a stake in its ownership.

When companies issue common stock, the par value (a nominal value assigned to the stock for legal purposes) and any amount received over this par value from shareholders constitute the company's contributed capital. This is because the total value of common stock issued (including its par value and the premium paid by investors over this par value) directly contributes to the equity section of a company's balance sheet.

In essence, common stock acts as the initial building block of contributed capital, indicating both the legal capital that a company must maintain and the additional resources provided by shareholders to support the company's operations and growth. This aspect of contributed capital is crucial for investors as it reflects their basic ownership in the company and forms the basis for additional equity contributions, like additional paid-in capital, further enhancing the company's financial structure.

Additional Paid-in Capital

Additional paid-in capital (APIC) represents the amount of money shareholders have paid for shares that exceed the par value of those shares. It's a key component of the contributed capital formula, acting as a surplus that reflects the additional investment shareholders are willing to make over and above the basic value of the shares. This component is crucial because it shows investor confidence and support for the company, indicating that shareholders value the company more highly than its stated nominal value.

In the contributed capital formula, APIC is combined with the value of common stock (which accounts for the par value of the shares) to give the total contributed capital. This total is a critical indicator of the financial resources provided by shareholders, used by the company for growth and operations. For instance, if a company issues shares with a par value of $1 but sells them for $10 each, the $9 surplus per share is recorded as additional paid-in capital. This extra contribution by shareholders over the par value is a testament to their belief in the company's potential for future growth and profitability.

Understanding APIC is vital for investors as it provides insights into the company's funding structure and the value shareholders place on the company's stock beyond its face value. It factors into the contributed capital formula by highlighting the additional financial support the company has received from its investors, offering a more comprehensive view of a company's equity financing and the confidence investors have in its long-term success.

Related resource: The Ultimate Guide to Startup Funding Stages

The Contributed Capital Formula

As we transition to a deeper understanding of the contributed capital formula, it's crucial to recognize its role in the financial landscape of a company. This formula (contributed capital = common stock + additional paid-in capital) encapsulates the essence of shareholder investment, merging the foundational elements of common stock and additional paid-in capital into a comprehensive measure of financial support investors provide. Here's a breakdown of its components:

Common Stock: This component represents the initial equity stake shareholders have in a company, denoted by the par value of issued shares. It's the base level of investment that shareholders commit to, offering them ownership and often voting rights within the company. The par value is a nominal amount, typically set at a minimal level, which serves as the legal capital that a company must maintain.

Additional Paid-in Capital (APIC): APIC goes beyond the basic investment denoted by common stock, representing the premium that investors are willing to pay above the par value of the shares. This premium reflects the investor's confidence in the company's future prospects and growth potential. It's a critical indicator of the value that shareholders place on the company, above and beyond its stated nominal value.

Understanding both components within the contributed capital formula offers investors a clearer picture of a company's equity structure and the financial commitment of its shareholders. It showcases not just the basic valuation of the company through its common stock but also the additional value investors see in it, as reflected by the additional paid-in capital. This comprehensive view is vital for making informed investment decisions and assessing a company's financial health and growth potential.

Example of the Contributed Capital Formula

With a solid grasp of the foundational elements that constitute contributed capital—common stock and additional paid-in capital—it's time to see these components in action through a practical example.

Consider a scenario where a company decides to issue 100,000 shares of common stock, each with a par value of $1. However, due to investor demand or the perceived value of the company, these shares are sold for $2 each. In this case, the company successfully raises $200,000 in contributed capital through this issuance. Here, the common stock account on the balance sheet would reflect $100,000, corresponding to the par value of the shares issued. Simultaneously, the additional paid-in capital account would also record $100,000, representing the excess amount over the par value investors paid for their shares.

This example demonstrates the direct contribution of both components—common stock and additional paid-in capital—to the total contributed capital, offering a clear view of how shareholder investments are quantified and reported in financial statements.

Significance in Financial Reporting and Decision-Making

Contributed capital is not just a figure on the balance sheet but a critical metric that influences corporate strategies, investor perceptions, and the financial narrative of a company. Understanding the significance of contributed capital in these arenas empowers investors and decision-makers to evaluate a company's financial health and strategic positioning more effectively. As we delve into this discussion, we'll uncover how contributed capital impacts a company's balance sheet, its importance in financial reporting, and its influence on investor decisions, highlighting the interconnectedness of financial metrics and corporate success.

Related resource: Venture Capital Metrics You Need to Know

Balance Sheets and Contributed Capital

Contributed capital is prominently displayed on the balance sheet under the shareholder's equity section, offering a snapshot of the financial stake that shareholders have in the company. This section of the balance sheet is crucial because it provides insight into the company's funding structure, showing the amount of capital directly contributed by shareholders through the purchase of stock.

The presentation of contributed capital on the balance sheet has several key significances:

Financial Health Indicator: The size of contributed capital can be a significant indicator of a company's financial health and its ability to raise funds from investors. A higher contributed capital suggests strong investor confidence and a solid foundation of financial support for the company's operations and growth initiatives.

Equity Structure Insight: It offers investors and analysts insight into the company's equity structure. By analyzing the components of contributed capital, stakeholders can understand the mix of common stock and additional paid-in capital, providing clues about the company’s fundraising history and shareholder commitments.

Regulatory and Legal Compliance: The balance sheet's presentation of contributed capital also ensures compliance with financial reporting standards and regulations. It provides transparency about the company's equity financing, which is crucial for legal purposes and for maintaining investor trust.

Basis for Financial Ratios: Contributed capital is a key element in calculating financial ratios that assess a company's leverage and financial stability, such as the debt-to-equity ratio. These ratios are important for investors making decisions about buying or selling stock in the company.

Comparison Across Industries: The amount of contributed capital can vary significantly across different industries, making it a valuable metric for comparing companies within the same sector. Investors can use this information to gauge a company's market position and its competitiveness within the industry.

Influence on Investor Decisions

Understanding the contributed capital formula is pivotal for investors as it offers a direct lens into a company's equity structure and the financial commitment of its shareholders. This knowledge can significantly influence investment decisions, and here's how:

Valuation Insight: The contributed capital figure helps investors evaluate the market valuation of a company compared to the actual capital invested by shareholders. A higher contributed capital may indicate that investors are willing to pay more than the nominal value of shares, suggesting optimism about the company's future growth prospects.

Financial Stability: A robust contributed capital amount signifies a strong equity base, implying greater financial stability. Companies with substantial contributed capital are often perceived as having a lower risk of default, making them more attractive to risk-averse investors.

Investor Confidence: The amount of additional paid-in capital over the par value of common stock reflects investor confidence in the company's potential. Investors looking for companies with strong growth potential can use this as a gauge to make informed decisions.

Shareholder Equity Structure: By dissecting the contributed capital into common stock and additional paid-in capital, investors can understand the shareholder equity structure. This understanding helps in assessing how a company finances its operations and growth—through debt or equity—and its implications for future returns.

Benchmarking and Comparative Analysis: Investors can compare the contributed capital across companies within the same industry to gauge which companies are better capitalized and potentially more competitive. This comparison can be a deciding factor when choosing where to invest.

Liquidity and Exit Potential: For investors interested in liquidity and exit strategies, understanding how contributed capital has been raised over time can provide insights into the company’s market liquidity and the potential ease of selling the investment in the future.

Related resource: From IPOs to M&A: Navigating the Different Types of Liquidity Events

Comparing Contributed Capital Across Industries

By examining how contributed capital varies across different industries, we can uncover patterns and variances that inform strategic investment decisions. This comparative analysis not only highlights industry-specific financial health and investor confidence but also aids in identifying sectors with robust growth potential or those that are more equity-driven in their financing approach. Engaging in this cross-industry examination enriches our understanding of the financial landscape, guiding investors toward making informed choices in a diverse and complex market environment.

Industry Standards and Variances

Contributed capital can significantly vary across industries due to several factors that reflect the unique financial structures, capital requirements, and investor behaviors within each sector. Here’s an overview of why these variances occur and what they signify:

Capital Intensity: Industries like manufacturing, utilities, and telecommunications require substantial initial capital investments to cover infrastructure, equipment, and technology. Consequently, companies in these sectors might have higher levels of contributed capital to meet these upfront costs. In contrast, service-oriented or software industries may require less physical capital, leading to lower contributed capital needs.

Growth and Investment Opportunities: High-growth industries, such as technology and biotech, often attract more equity investment as investors seek to capitalize on potential high returns. This results in higher contributed capital as companies issue more stock to fund rapid expansion and development projects.

Risk Profiles: Industries with higher volatility and risk may show different patterns of contributed capital. Investors in these industries might demand higher returns for their investment, reflected in the premium over par value paid, thus affecting the additional paid-in capital component.

Regulatory Environment: Certain industries are subject to stringent regulatory requirements that necessitate significant compliance and operational investments. Industries like pharmaceuticals, banking, and energy might accumulate higher contributed capital as a buffer against regulatory risks and to finance compliance infrastructure.

Market Maturity: Mature industries with stable cash flows and limited growth opportunities might rely less on equity financing (thus showing lower contributed capital), preferring debt financing or reinvestments from retained earnings. Conversely, emerging industries may heavily leverage equity financing to fuel growth, leading to higher contributed capital.

Investor Expectations: The investor base of an industry can influence its contributed capital. Industries favored by venture capitalists and angel investors, such as technology and green energy startups, might exhibit higher contributed capital due to the nature of venture investments, which are equity-based and often at a premium to support innovation.

These variances in contributed capital across industries highlight the importance of contextualizing financial metrics within specific sector dynamics. Investors leveraging this understanding can make more informed decisions by considering the absolute numbers and the industry context that shapes these figures. This nuanced approach allows for a better assessment of a company's financial health, growth prospects, and the inherent risks and opportunities within its industry landscape.

Interpreting Deviations From Industry Norms

When certain companies exhibit contributed capital figures that significantly deviate from their industry norms, it can signal various strategic, operational, and market positioning aspects. Here are several insights into what these deviations might indicate:

Innovative Business Models: Companies that break away from traditional industry models often attract more investment due to their potential to disrupt markets. Higher contributed capital in such cases reflects investor enthusiasm for innovative approaches and the promise of future returns, distinguishing these companies from their more conventional counterparts.

Exceptional Growth Prospects: Firms that demonstrate extraordinary growth potential, either through proprietary technology, market share expansion, or unique product offerings, might attract higher levels of contributed capital. This deviation can indicate investor confidence in the company's future profitability and market dominance.

Strategic Financing Choices: A significant deviation might also reflect a company's strategic financing decisions. For example, a firm may prefer equity financing to preserve liquidity and avoid debt, leading to higher contributed capital. Alternatively, a lower contributed capital relative to industry norms could indicate a reliance on debt financing or internal funding mechanisms like retained earnings.

Market Conditions at the Time of Funding: The economic and market conditions when capital was raised significantly impact contributed capital levels. Companies that issued equity during bullish market periods may have secured higher contributed capital due to more favorable investor sentiment and valuation expectations.

Corporate Lifecycle Stage: Early-stage companies, especially in high-growth industries like tech startups, might show higher contributed capital as they issue stock to fund rapid expansion. In contrast, more mature companies might exhibit lower contributed capital if they've relied more on reinvesting earnings rather than issuing new equity.

Regulatory and Tax Considerations: In some cases, deviations in contributed capital might arise from regulatory incentives or tax considerations unique to a company or sub-sector, encouraging different capital structuring approaches.

Ownership and Control Strategies: Companies keen on avoiding dilution of ownership might limit equity issuance, resulting in contributed capital figures that deviate from industry norms. This approach might be indicative of founders or principal owners prioritizing control over external financing.

Understanding these deviations requires investors to look beyond the numbers and consider broader strategic, market, and operational contexts. By doing so, investors can identify potential red flags and uncover opportunities where a company's unique approach to capital structure and financing strategies might offer competitive advantages or higher growth potentials.

Track Your Fund Performance Data With Visible

By leveraging Visible, investors can track critical portfolio company and investment data all from one place. Learn how to get started with Visible to track your crucial investment data here.

Product Updates

View allOperations

View all

founders

What is a Capital Call?