You’ve heard the stories about companies getting funded based on a sketch on the back of a napkin. If your name is Ev Williams or if that napkin sketch is as compelling as Amazon’s, you may have a shot.

If you aren’t a founder of Twitter, Blogger, and Medium or spend your free time saving journalism and launching rockets, people evaluating your business are far less likely to take your proclamations about the future at face value.

In this blog, we write a lot about the importance of storytelling for a company. No matter who you are talking to – team members, investors, potential investors – company storytelling doesn’t stop, it simply changes contexts and mediums. A financial model is one of those mediums through which your company can tell its story, even without the operational history one might assume would be necessary to persuade investors or make smart decisions about the direction of the business.

Related Resource: How to Create a Startup Funding Proposal: 8 Samples and Templates to Guide You

At Visible, we work with VC backed companies on a daily basis. To get a better understanding of what it takes to build a compelling and useful financial model, we turned to our experience and conversations with customers and laid out our findings below.

Why Startup Financial Models are so Important

When Warren Buffett invests in a company, he makes holistic decisions about the quality of the business as if he is buying the whole thing and not simply a decision about the direction the stock might move.

When building a financial model, a similar philosophy applies. Before breaking the business into discrete pieces and asking yourself which direction each will go, first look at the business as a whole and understand both what you as an organization are trying to accomplish as well as what the intended use of the model and startup financial projections you are building will be.

What do we need to accomplish over the next x months…

…in order to put ourselves into a position to successfully raise a Series A round?

…for this partnership with Big Co. to make an impact on our bottom line?

…so that we can hit profitability and maintain optionality over how we finance our future growth (customers vs. investment)?

…for this product or distribution decision (which puts a significant amount of capital at risk) to pay off?

The goal of a financial model is not to be exactly right with every projection. The more important focus is to show that you, as a founding or executive team, have a handle on the things that will directly impact the success or failure of your business and a cogent plan for executing successfully.

There are a few key reasons why it is an important exercise for startup founders to model and project their future growth:

Fundraising

Different investors will have different opinions on financial projections. Some like to see them to see how a founder is thinking about their business. Others won’t ask for them as most startups likely will miss one way or another. Mark Suster of Upfront Ventures puts it similarly:

“See I don’t care if your projections prove wrong over time. I care about your assumptions going in. I care about the thought that you’ve given to the customer problem. I care about how much you’ve thought about market share, competitors, adoption rates, etc.”

However, projections and financials will become more important later in your lifecycle stage. Where a seed round investor might not necessarily care about forecasts in the early days a Series C investor might want to see more concrete data to model growth.

Related Reading: 6 Types of Investors Startup Founders Need to Know About

Related Reading: A Quick Overview on VC Fund Structure

Related Reading: How to Secure Financing With a Bulletproof Startup Fundraising Strategy

Hiring Plans

Building a financial model is a great way to understand how your overall business performance can impact hiring plans (and vice versa). By modeling different scenarios you can see how adding headcount can impact your bottom line.

Go to Market Strategy

In the earliest days of your business, a financial model and marketing sizing exercise will help you wrap your head around go-to-market strategy. This could be finding a more efficient way to acquire customers or maybe a new playbook for handling churn.

With that being said, financial models and projections can take many shapes and sizes…

Types of Startup Financial Model Structures that Work

Financial projections are essential for any business, even if it’s not yet generating revenue. A variety of specific methods exist for performing this task, but they can generally be classified into top-down and bottom-up approaches. Financial analysts often use both methods as checks upon each other.

Among technology companies – especially ones located in a certain geographic region – the very mention of a financial model evokes thoughts of calculator toting, tie-wearing, number crunchers sitting somewhere in a suburban cubicle.

With the direction sentiment is shifting in the early-stage market, this mindset couldn’t be further from reality. A well-constructed financial model displays a professional approach to running your business and shows that you “take seriously the fact that you are deploying other people’s capital.”

A good financial model consists to two things:

- Well thought out projections about the future of the business

- A properly structured, understandable, and dynamic spreadsheet

Bottoms Up Startup Financial Projections

A bottoms-up financial model – where you start with 5 – 15 core assumptions about the business – is most useful for a company contemplating a specific product direction, distribution strategy (i.e. invest in paid advertising), or a certain partnership that could potentially have a major impact on the business.

Top Down Startup Financial Projections

A top-down financial model may be most useful for a company that, for example, knows that it will need to go out and raise $X million in a Series A round 15 months from now and has spent time gathering data on what types of revenue, margins, and growth numbers they need to hit to have a successful fundraise. (Note: If you are a SaaS company, the Pacific Crest SaaS Survey is a great starting point to benchmark yourself)

Maybe in this case, those numbers are $1.5MM in MRR with at least 100% YoY growth. With those in mind, you can work backward to understand how much you need to grow and which distribution channels may provide the best bridge from where you are now to where you need to be.

3 Deliverables Included in Every Financial Model

There is not a one size fits all template for financial modeling. The structure of a model for seed-stage SaaS and a Series C eCommerce company will greatly differ. However, there are a few things that should be included in any solid financial statement, regardless of type:

Financials Statements

Every financial model should weigh your different financial statements. While projected financial statements may not be as vital/accurate in the seed stage/early days of a business, they will become more important and accurate in later stages.

Related Resource: Important Startup Financials to Win Investors

Cash Flow Overview

Cash flow overviews are a vital part of a financial model because it will help you understand the true financial health and cash flow of your business. In the seed stage/early days, cash flow is incredibly important to monitor as you are in search of your first customers.

KPI Overview

Using actual metrics and data from your sales & marketing process is important to any financial model. You want to be able to understand how different go-to-market strategies impact your business and give you an idea of where and how you can grow your funnel (and revenue).

5 Metrics Needed for Every Financial Model

As we mentioned above, not every financial model is the same. However, there are a few key metrics that can be translated across most financial models.

Revenue

At the end of the day, revenue is the lifeline of any business. Bringing new revenue in the door is the basis of every model. In a good financial model, you can use other inputs to help you model how your revenue is impacted in different scenarios.

Cost of Goods Sold (COGs)

No matter if it is the cost of goods sold or your expenses at a software company, COGs are a necessary part of any model. You need to understand what it costs to acquire new customers or build a new product.

Operating Expenses

The expenses that go into operating your business are also a necessary part of a financial model. You need to understand how and where your company is spending. Ideally, you’ll be able to model different scenarios with headcount and hiring plans to model how OpEx can impact your overall revenue.

Burn Rate and Cash on Hand

Going hand-in-hand with OpEx are your burn rate and cash metrics. You can use different hiring and OpEx inputs to help model your cash flow. This will be important when weighing different financing options.

Acquisition Metrics

While the name of acquisition metrics will change names from market to market, the idea behind them is consistent. You should include acquisition metrics so you can model how different GTM strategies and plans will impact your overall financial health.

How to Build Your Startup Financial Model

Bottoms Up Startup Financial Projections

The bottom-up approach uses specific parameters to develop a general forecast of a business’s performance. This method might start the number of people you expect to pass by your business each day, also known as footfall. You would then estimate the percentage of footfall that will enter your store and make a purchase. The next step is to estimate the average value of each purchase to project your annual sales. Bottom up projections are based on a set of individual assumptions, allowing you to determine the impact of changing a particular parameter with relative ease.

You may use a bottom-up approach to select a location for a new business. You can obtain an accurate estimate of the footfall by direct observation. You can also observe similar stores in that area to estimate the percentage of footfall that are likely to enter your store. The prices that your competitors charge will give you a good idea of the price you can expect to charge.

Projections

Some investors tend to prefer a bottoms up projection. As we previously wrote, “The reason being that a top-down approach relies on self-reported data from private companies, which can often be misleading, inaccurate or interpreted incorrectly. A bottom-up approach, however, uses firsthand data and knowledge of your own company and reduces the risk of the data being wrong or taken out of context.”

Spreadsheet

For example, assume for this example that an average of 10,000 people pass by a particular location each day. About one percent of this traffic in this area enters a store and makes a purchase, and the average total of each sale is about $5. The expected annual sales revenue in this example is therefore 10,000 x 0.01 x 5 x 365 = $182,500. You can then refine this estimate by considering additional factors such as price changes, closing on weekends and seasonal fluctuations.

Template(s)

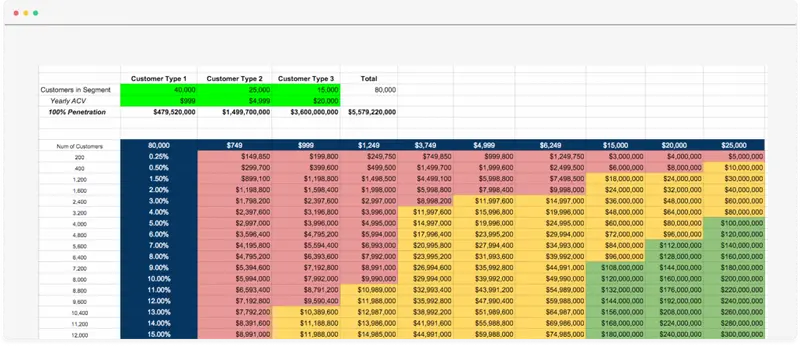

At the end of the day, investors view TAM as a picture of how big your business can be. Correctly modeling the market is vital to proving that your business should be venture-backed.

If you need a little help painting a picture of the market your solution could address, try using our TAM template! It has everything you need to start modeling the market your business can capture.

Top Down Startup Financial Projections

A top-down method of estimating future financial performance uses general parameters to develop specific projection numbers. You’ll often use a top-down approach to determine the market share that your new business can expect to receive. You might start with the market value of your product, narrowing it down to a particular location as much as possible. You would then assume that your business will receive a specific portion of that market and use that estimate to generate a sales forecast.

A top-down approach is comparatively easy since the only parameters it really requires is the total market value for your area and the market share you expect to receive. This method is most useful for checking the reasonableness of the projections resulting from a bottom-up approach. However, top down projections aren’t recommended for preparing detailed forecasts.

Projections

Some investors will be weary when pitched using top down projections. However, this does not mean that there is no value in a top down approach. A top down approach is best used for a new endeavor where you may not have proper data yet. For example, if you are a pre-seed company with little to no revenue, it may be best to share your top down projections using outside and general market data.

Spreadsheet

For example, assume for this example you plan to open a business in an area where the total annual sale value of your product is $2 billion. You believe that your business might get 0.01 percent of that market, resulting in annual sales of $200,000. Note that your financial projection is entirely dependent upon the accuracy of your estimate on the product’s market value and your market share. Furthermore, the top-down approach doesn’t ask you “what if” type questions.

Template(s)

At the end of the day, investors view TAM as a picture of how big your business can be. Correctly modeling the market is vital to proving that your business should be venture-backed.

If you need a little help painting a picture of the market your solution could address, try using our TAM template! It has everything you need to start modeling the market your business can capture.

Common Financial Modeling Mistakes

Failing to hit both of the requirements we mentioned in the last section – well-thought-out projections and a well-constructed spreadsheet – will quickly render your model unusable and will reflect poorly on you as a founder and on your company.

Projections

- Assuming that revenue will come with scale. While this has long been a criticism of social networks and consumer apps hoping to monetize a critical mass of eyeballs through advertising, many companies who have revenue models built into their businesses from the start (think SaaS or Marketplaces models) still falsely assume that revenue, to the extent they need to be sustainable, will happen once they reach x number of users or “decide to turn on the spigot”.

- Focusing too much on point estimates and not range estimates – As Taylor Davidson puts it in a post on his own blog, “instead of agonizing over whether your conversion rate will be 2% or 5%, focus on the possible range or conversion rates and evaluate the results based upon the range of estimates, not the point estimate of 2% or 5%.”

- Underestimating Customer Acquisition Costs (CAC) – Just go read this post.

- Not doing your homework – There is a tremendous amount of information available, for free, that can help you gauge your performance and benchmark your growth. We mentioned the Pacific Crest Survey above. Other great resources include AngelList, Mattermark, and the blogs of companies embracing the Radical Transparency movement.

Spreadsheet

- Spending too much time on non-material data points – The Pareto Principle applies here, just as it does to many other undertakings in a startup. While it might seem like spending time optimizing everything in your model will yield the best results, the reality is that going deep on your 5 – 15 core assumptions will yield a much more effective result.

- Failure to design your model for usability – To make your model most effective, you need to pay close attention to how usable the output is for viewers. That means clear explanations, a simple structure, and making sure to follow convention so there are no surprises. We linked to it above but David Teten of ff Venture Capital has a great post on the topic of standardizing the way you build your startup spreadsheets.

- Neglecting to include a sensitivity analysis – This goes back to the idea of understanding what your model outputs look like for a range of estimates. You should also keep in mind that your model should be treated as a flexible, living document. That means that your assumptions shouldn’t be hard-coded. Instead, as Taylor recommends, “create your assumptions so that you can easily change an assumption in one place and all formulas and outputs will recalculate automatically.”

- Displaying only financial statements and neglecting key metrics – Financial statements go a long way in showcasing the overall health of a business. Unfortunately, many models stop at the financial statements. What investors want to see is a synthesized look at those financials that make it easier to evaluate your business. As an example, a good model won’t just showcase projected revenue growth, it will look at how things like customer growth (and churn) and contract size work together to contribute to that top line number.

Best startup financial model resources

Unless you spent the first couple years of your career cutting your teeth inside an investment bank, your best bet is to lean on existing resources for the structural composition (i.e. the spreadsheet) of your financial model.

The Standard Startup Financial Model that Taylor Davidson has put together on Foresight.is has been used by over 15,000 people across the world – from one-person operations just getting started to companies raising large VC rounds or considering acquisitions.

And while we don’t recommend building your model from scratch, it is useful to understand how one can construct a professional financial model. Here are a couple quick resources, recommended by Davidson and us here at Visible:

- Best Practices in Spreadsheet Design by David Teten of ff Venture Capital

- 3 Traits of a Great Financial Model from Mark MacLeod

Finally, if you are looking for a less sophisticated model or something to fit a specific modeling use case (user acquisition, revenue growth, or operations) here is a quick list of resources recommended by Davidson:

- Revelry Labs resourcing spreadsheet for operations modeling

- OpEx Budgeting from IA Ventures

- Viral Marketing modeling from Andrew Chen

- Modeling SaaS Customer Churn, MRR, and Cohorts from Christoph Janz

Related Resource: A User-Friendly Guide to Startup Accounting

Putting Your Financial Model to Work

Mark Suster offers great advice for taking the financial model you have built and using it to help grow your business:

“Financial models are the Lingua Franca of investors. But they should also be the map and the Lingua Franca of your management discussions.”

Financial models play a key role in all of the major discussions you have about your business with all of your key stakeholders. A comprehensive financial model will have within it a number of different pieces that are relevant to different conversations within your company.

The interplay between your revenue growth, your current burn rate, and the amount of money you have in the bank are all useful when putting together a hiring plan. Your assumptions for revenue can be isolated and used as a jumping off point when discussing a change to your distribution strategy. And as mentioned above, the projections you build around your key performance metrics are a crucial part of a successful fundraising process.

In some cases – whether internally with management or externally with investors – the conversation will be high level and in other instances you will need to be more granular. If you have taken the time to thoughtfully prepare your assumptions around the future of your business, your most critical conversations will be more productive and you give yourself a strong advantage in the daily battle for capital and talent.