Women-led venture capital firms are relatively new players in the VC world, but they are rapidly gaining traction. These firms are founded and run by women, who bring a unique perspective to the table when it comes to identifying and investing in promising startups.

One of the advantages of women-led VC firms is that they tend to invest in companies that are founded by women or that have a diverse leadership team. Studies have shown that diverse teams tend to perform better, so investing in such companies is not only good business but also much-needed.

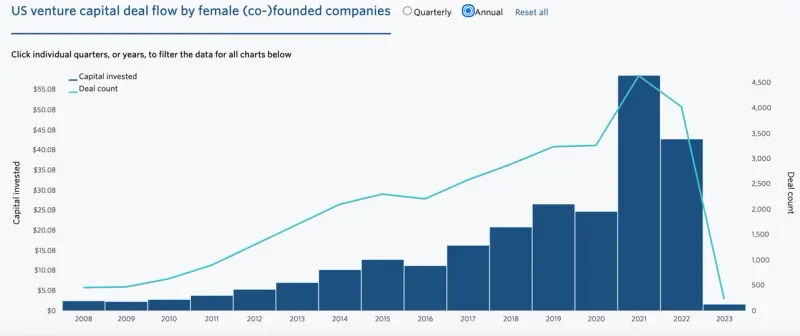

Women-led startups receive only a small fraction of VC funding. According to PitchBook, “In 2022, companies founded solely by women garnered just 2% of the total capital invested in venture-backed startups in the US.”.

This lack of funding has a profound impact on women-led companies, making it harder for them to grow and succeed. To address these issues, it is important to promote diversity in the VC industry. This can be done by supporting women-led VC firms and encouraging more women to enter the industry. It can also be done by promoting diversity in the companies that VC firms invest in, and by challenging the biases that exist in the industry. Women-led VC firms bring a unique perspective to investing and have the potential to promote diversity in the companies they invest in.

Image source: PitchBook

How Women-led VC Firms Are Influencing The Broader Industry

Women-led VC firms have had a significant impact on the VC industry, driving investment trends and promoting more diverse and inclusive practices. With a focus on funding companies led by women and underrepresented minorities, women-led VC firms have increased the visibility and opportunities for these groups, shifting the traditional power dynamic within the industry.

This shift has led to the development of more inclusive practices, such as blind investment pitches and increased emphasis on diversity metrics. Additionally, women-led VC firms have demonstrated that investing in diverse founders is not only socially responsible, but also financially lucrative.

As a result, the broader VC industry has started to recognize the benefits of diversity and inclusion, leading to an increased emphasis on funding diverse founders and promoting more diverse leadership within VC firms themselves.

Related resource: The Femtech Frontier: Opportunities in Women's Health Technology + the VCs Investing

Benefits of Working With Women-led VC Firms

Women-led VC firms have a better understanding of the unique challenges faced by women entrepreneurs, and they often have a broader network of resources and connections to support them.

Women-led VC firms can provide mentorship, access to funding, and networking opportunities that can help women founders overcome barriers to success. Additionally, working with women-led VC firms can help promote diversity and inclusion in the industry, which is critical for building a more equitable and sustainable startup ecosystem.

By investing in women-led businesses, these firms are helping to close the gender gap in entrepreneurship and promote the growth of female-led businesses. Ultimately, partnering with a women-led VC firm can lead to better outcomes for women founders and contribute to a more diverse and inclusive startup ecosystem.

Breaking into the VC industry as a woman can be challenging, but it is not impossible. Here are a few tips for women looking to start their own VC firms:

- Build a strong network: Building relationships with successful investors and entrepreneurs is critical. Attend networking events, conferences, and meetups to connect with potential partners and investors.

- Gain experience: Consider working for a VC firm or startup to gain the necessary experience and knowledge of the industry. This can help build your credibility as a potential VC and provide valuable insights into the investment process.

- Develop a unique investment thesis: Create a unique investment thesis that sets you apart from other VC firms. This will help attract investors and provide a framework for identifying and evaluating potential investments.

- Fundraising: Fundraising is a critical component of starting a VC firm. Start by building a strong pitch and a compelling story that resonates with potential investors. It’s essential to have a diverse group of investors to ensure a well-rounded portfolio.

- Build a diverse team: Creating a diverse team is critical in the VC industry. Building a team with different backgrounds, perspectives, and experiences can help identify unique investment opportunities and promote more inclusive decision-making.

- Find investments: Identifying promising startups and entrepreneurs is a crucial part of the VC process. Connect with entrepreneurs, attend pitch events, and leverage your network to find investment opportunities.

Resources

- EY Entrepreneurial Winning Women– EY provides program participants evergreen access to our vast resources, rich networks and know-how, helping to strengthen their abilities to become market leaders. At the same time, the program creates a vibrant global community of successful women entrepreneurs and inspiring peer role models who, in 2021, numbered more than 800 across 49 countries.

- Lolita Taub‘s Newsletter (Issue 77: Women’s History Month edition) has great resources for female founders.

- 37 angels– is a community of women investors dedicated to educating early-stage investors and promoting women’s participation in investing.

- WLOUNGE– is a mission-driven organization headquartered in Berlin that supports diversity and women in business and technology. They incubate startups and founders, connect startups, VCs, and corporates to the ecosystem, and facilitate hundreds of deals and investments. They provide innovative services, workshops, round tables, conferences, and leadership programs. WLOUNGE focuses on building partnerships for investment opportunities, founder support, and incubating. They collaborate across the world, including Germany, Europe, Israel, the U.S, China, and Asia. Ultimately, WLOUNGE was established to uplift the tech ecosystem and the women within it.

- Women’s Business Center-WBCs provide free, to low-cost counseling and training and focus on women who want to start, grow, and expand their small business.

- digitalundivided– is the leading non-profit leveraging our data, programs, and advocacy to catalyze economic growth for Latina and Black women entrepreneurs and innovators. Our goal is to create a greater world where all women of color own their work and worth. Our mission moves the entrepreneurial ecosystem forward, to increase funding, access, and opportunities for women of color in business and innovation.

- Tory Burch Foundation– the organization strives to strengthen female entrepreneurship by offering capital, education, and fellowship programs. They collaborate with Bank of America to provide affordable loans via Community Lenders as part of their capital program. Additionally, in partnership with Goldman Sachs’s 10,000 Small Businesses, the foundation furnishes female small-business owners with education in business and management. Furthermore, the Tory Burch Fellows Program encompasses workshops, a year of support, a $10,000 prize, and an opportunity to present a pitch for a $100,000 grant.

- AIm High AI Bootcamp For Female Founders: Now is last chance to apply and join this equity-free 12-week online accelerator, get business support and access to leading VC funds like Molten Ventures, Dawn Capital, Antler, Nauta Capital, Sunfish Partners and more.

- All Raise– All Raise started as a call to action. Today, it’s a community, a movement, and a rallying cry centered on the belief that our personal ambitions can and will include the prosperity of all women.

- Recast Capital– Women-owned platform supporting and investing in emerging managers. Their enablement program is a tuition free educational program 82% of which are female GPs.

- Women founders looking for investors: share your details in Lolita Taub‘s twitter thread here

- 10+ VCs & Accelerators Investing in Underrepresented Founders

Women-led VCs

RevUp Capital

“For women investors and female founders, innovation isn’t always about activism. Often, it’s a matter of necessity,” says Melissa Withers, Managing Director of RevUp Capital. “From the beginning, women in entrepreneurship had to do things differently to create the opportunities we wanted. For all the hardships that come with that, there’s also a measure of freedom in it. Women in the industry aren’t just breaking the rules, they’re playing a new game. Good luck getting that genie back in the bottle.”

About: RevUp Capital invests and supports revenue-driven B2B and B2C companies. Companies receive $350K-500K in non-dilutive cash delivered in tandem with RevUp’s growth platform, which includes strategy and execution support to accelerate market-facing growth.

Thesis: We invest with a singular purpose: to give founders a better shot at success.

Traction metrics requirements: Companies enter our portfolio with $500K-$3M in revenue, a strong growth rate, and plans to reach $10-30M in revenue in 3-5 years. We invest in both B2B and B2C companies. RevUp is committed to investing in women, people of color, and in founders outside of top tier geographies. We believe in you.

Funding stage: Seed, Pre-Seed, Series A

Primetime Partners

Who or what has been most supportive in your journey of leading a women-founded VC firm?

“The other female GPs and investors I have met in NYC community and beyond have inspired me, taught me and humbled me.” – Abby Levy Managing Partner and Founder at Primetime Partners

Thesis: Improving the quality of life for older Adults, aging and longevity.

Funding stage: Seed, Pre-Seed, Series A, Series B

Female Founders Fund

About: Female Founders Fund is an early-stage fund investing in the next generation of transformational technology companies founded by women.

Thesis: Investing in the exponential power of exceptional female talent.

Funding stage: Seed

Supernode Ventures

About: We serve two groups: entrepreneurs and investors. We love connecting both groups together, not only for investing purposes, but also for problem-solving, partnerships and other activities.

Thesis: At Supernode Ventures, we are investing in entrepreneurs to help transform the way people live, work and socialize.

Funding stage: Pre-Seed

Urban Innovation Fund

About: A venture capital firm that provides seed capital and regulatory support to entrepreneurs shaping the future of cities – helping them grow into tomorrow’s most valued companies.

Thesis: The Urban Innovation Fund invests in startups enhancing the livability, sustainability, and economic vitality of our cities.

Funding stage: Pre-Seed, Seed

Ganas Ventures

About: Ganas Ventures invests in pre-seed and seed Web 2 and Web 3 community-driven startups in the US and Latin America.

Funding stage: Pre-Seed, Seed

Steelsky Ventures

About: SteelSky Ventures is an early stage VC fund investing in Women’s Health.

Funding stage: Seed, Series A

Serena Ventures

About: Serena Ventures focuses on early stage companies, and giving them the opportunity to be heard.

Thesis: Serena Ventures invests in founders who are changing the world with their ideas and products.

Funding stage: Series A

Moxxie

About: Moxxie Ventures is a $25M seed-stage fund that invests in founders who make life and work better.

Thesis: Make life and work better. Climate positive.

Funding stage: Pre-Seed, Seed

Overlooked Ventures

About: We support founders who operate early-stage technology companies who are historically overlooked and provide them capital, resources, and connections to scale their business. We’ve been in your shoes. We’re tech founders with 10+ years of experience running companies and making deals. Now we’re authentically supporting entrepreneurs with capital and a founder-friendly focus.

Funding stage: Pre-Seed, Seed

Mendoza

About: Mendoza Ventures is an early and growth stage Fintech, AI, and Cybersecurity venture fund that provides an actively managed approach to VC. We invest in areas where we have deep domain expertise, companies with early revenue, a clear value proposition and using a proven due diligence model. We focus on diversity as playing an important role in our investment decisions, as roughly 75% of our portfolio consists of start-ups led by immigrants, people of color, and women.

Based in Boston, Mendoza Ventures is women owned and the first LatinX-owned venture fund on the East Coast. The firm is run by husband and wife Adrian and Senofer Mendoza, entrepreneurs and prior operators who are veterans of the Boston start-up ecosystem.

Thesis: Started by serial entrepreneurs and investors, Adrian Mendoza and Senofer Mendoza, their investment thesis is this – Focus on helping the startups grow by leveraging the experience of advisors and investors in their respective fields. By giving experience and accountability first, learning more about the team, technology and market, only then can an informed investment be made.

Funding stage: Pre-Seed, Seed

Halogen Ventures

About: Halogen Ventures is an early stage venture capital fund focused on consumer technologies prioritizing a female in the founding team.

Thesis: Halogen Ventures is an early stage venture capital fund focused on female led consumer technology companies.

Funding stage: Early Stage

GingerBread Capital

About: GingerBread Capital invests in the next generation of women founders and entrepreneurs leading high-growth businesses

Funding stage: Series A, Series B, Seed

Forerunner Ventures

About: VC firm investing in transformative B2C & B2B companies defining a new generation of business, with an eye on the consumer.

Funding stage: Seed, Series A, Series B, Growth

Kapor Capital

About: Kapor Capital invests in early stage gap-closing tech enabled startups.

Thesis: Kapor Capital invests in tech-driven early stage companies committed to closing gaps of access, opportunity or outcome for low income communities and/or communities of color in the United States.

Funding stage: Pre-Seed, Seed, Series A, Series B

Vitalize Ventures

About: VitalizeVC was founded in 2017 as a seed-stage venture fund. It was originally launched as a result of continued growth and investment appetite among the IrishAngels investor network. Initially called IrishAngels Ventures, it was rebranded VitalizeVC in 2019.

Funding stage: Seed, Series A

BBG

About: BBG Ventures is a seed and pre-seed venture fund leading investments in female & diverse founders who are uniquely qualified to solve the toughest challenges facing new consumers, workers, and employers.

Thesis: The next generation of breakout companies will solve problems for the 99% and build solutions for key emerging populations in America. With today’s consumer being intersectional, more conscious, multi-generational, and often underserved; we believe that the founders who intuitively understand her are the ones poised to fix our broken systems. These founders have a natural competitive advantage — which means we do too. We look for companies that drive systems change, build 10X better consumer solutions, or address new buying behaviors across the biggest categories of consumer spending that are ripe for reinvention, focusing on: Healthcare Transformation, the Work and Learning Revolution, Climate & Consumption, Overlooked Consumers, and Fintech. We seek out companies making large-scale behavior change possible by improving access, enhancing affordability, or reducing friction in the consumer experience.

Funding stage: Seed, Pre-Seed

StandUp Ventures

About: StandUp Ventures is a Toronto-based, seed stage venture capital fund focused on investing in high growth ventures with at least one female founder in a key leadership role.

We believe that women led companies think outside the box, recruit great talent, and serve bigger markets. We invest in seed-stage, for-profit technology companies with at least one woman in a C-level leadership position within the company and an equitable amount of ownership.

Thesis: We’re dedicated to curious, confident, and fearless entrepreneurs building ground-breaking technology companies. We partner with ambitious founders across Canada to break through from Seed to Series A.

Funding stage: Seed

Amboy Street Ventures

About: The world’s first venture capital fund focused on Sexual Health & Women’s Health Technology startups.

Amboy Street Ventures is an active investor and adds value above and beyond capital. Its dedicated Value Enhancement Team supports portfolio companies with marketing & branding, sales & distribution, product development & scientific innovation and public education resources through its position within the Healthy Pleasure Group, an ecosystem dedicated to solving the problems that startups face in the Sexual Health and Women’s Health Tech market.

Thesis: Amboy Street Ventures invests in the Seed and Series A rounds of Sexual Health & Women’s Health Technology startups that are progressing the industry in America and Europe.

Funding stage: Seed and Series A

SoGal Ventures

About: As the first female-led millennial venture capital firm, SoGal Ventures represents how far our generation has come, and how deep our impact on the world can be. We believe in the power of diversity, borderless business, and human-centric design. We invest in seed stage diverse founding teams in the U.S. and Asia, and aim to be the first institutional investor for our portfolio companies. Our investments paint the future picture of how we live, work, and stay healthy.

Thesis: Next generation of living, working and staying healthy, created by and for the rest of us.

Funding stage: Pre-Seed, Seed

Urban Innovation Fund

About: A venture capital firm that provides seed capital and regulatory support to entrepreneurs shaping the future of cities – helping them grow into tomorrow’s most valued companies.

Thesis: The Urban Innovation Fund invests in startups enhancing the livability, sustainability, and economic vitality of our cities.

Funding stage: Seed, Pre-Seed

Recast Capital

About: Recast Capital is a platform supporting and investing in emerging managers in venture capital. As our name suggests, we are breaking the traditional mold and doing things a bit differently.

Thesis: Our founders experienced first-hand the shift that was taking place in venture and came together with a clear view of what was needed in the industry: an institutional-grade intermediary to help investors access the opportunity presented by emerging managers, and create a way to support those managers in the process.

Funding stage: Pre-Seed, Seed

Start Your Next Round with Visible

We believe great outcomes happen when founders forge relationships with investors and potential investors. We created our Connect Investor Database to help you in the first step of this journey.

Instead of wasting time trying to figure out investor fit and profile for their given stage and industry, we created filters allowing you to find VCs and accelerators who are looking to invest in companies like you. Check out all our investors here and filter as needed.

After learning more about them with the profile information and resources given you can reach out to them with a tailored email. To help craft that first email check out 5 Strategies for Cold Emailing Potential Investors.

After finding the right Investor you can create a personalized investor database with Visible. Combine qualified investors from Visible Connect with your own investor lists to share targeted Updates, decks, and dashboards. Start your free trial here.