Exploring the Top 10 Venture Capital Firms in New York City in 2024

New York City has firmly established itself as a premier destination for startups and venture capital, offering an unparalleled ecosystem of innovation and investment opportunities. The city's diverse and vibrant entrepreneurial landscape is bolstered by a wealth of resources, including a dense concentration of venture capital firms, accelerators, and incubators.

As a global financial hub, New York provides startups with access to significant funding, strategic partnerships, and a rich talent pool, making it an ideal location for founders looking to launch and scale their businesses. This dynamic environment fosters continuous growth and innovation, positioning New York as a startup and venture capital leader.

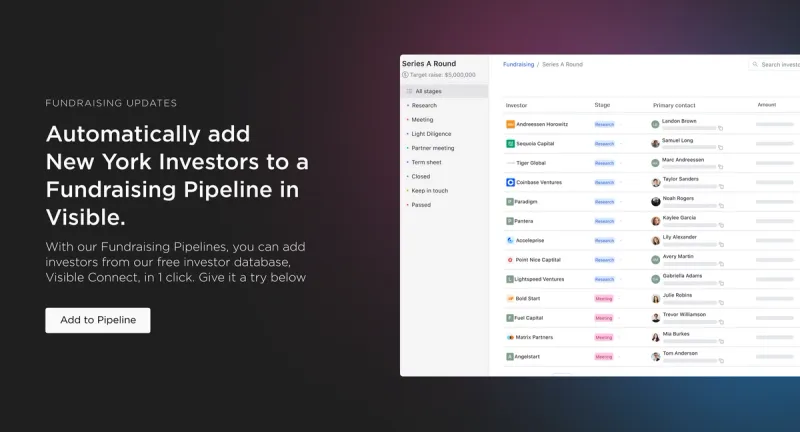

At Visible, we often compare a startup fundraising process to a traditional B2B sales and marketing funnel. At the top of your funnel, you are adding qualified investors. Nurturing them in the middle of the funnel with email, meetings, pitches, etc. And ideally closing them as a new investor at the bottom of a funnel.

Related Resource: How to Find Venture Capital to Fund Your Startup: 5 Methods

Just like a sales and marketing funnel, a fundraising funnel needs to start with the right investors for your business (e.g., a qualified lead or qualified investor). One aspect founders will want to research is the geography of the investors and where they invest.

Check out a few popular venture capital firms located in New York below:

1. Union Square Ventures

According to their website, “Union Square Ventures is a venture capital firm focused on early-stage, growth-capital, late stage, and startup financing.”

Learn more about Union Square Ventures by checking out their Visible Connect Profile here →

Investment Range

Union Square Ventures invests in a large range of companies. Looking at their website and you’ll find that they invest in anywhere between Series A and Series D stages.

Industries

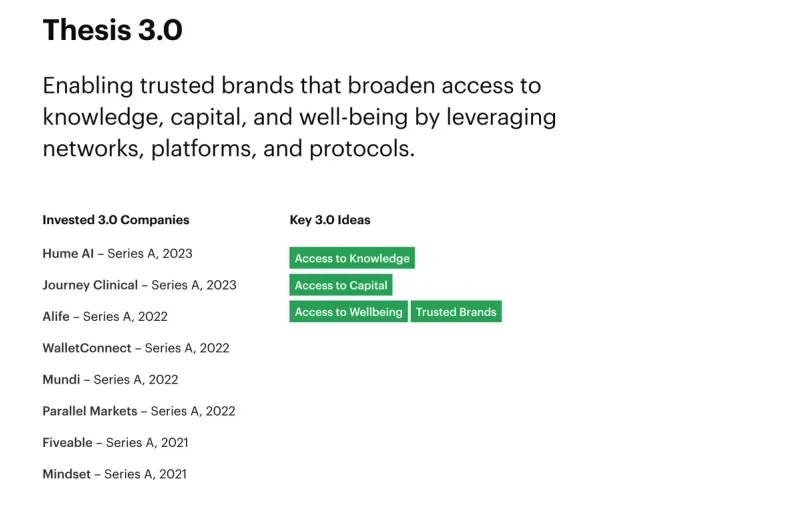

Union Square is self-described as a “thesis-driven” investor. They are currently investing off of their Thesis 3.0: “Enabling trusted brands that broaden access to knowledge, capital, and well-being by leveraging networks, platforms, and protocols.”

Check out more about their Thesis 3.0, recent investments, and key ideas below:

2. Insight Partners

According to the Insight Partners website, “Insight accelerates revenue and profit in software companies. Our obsession with software has produced a habit of success. We recognize industry patterns, emerging tech markets and software trends. We’ve accumulated the knowledge to understand the strategies needed to win.”

Learn more about Insight Partners by checking out their Visible Connect Profile here →

Investment Range

Insight Partners will invest across every stage but their bread and butter are “scale-up” companies. Insight will invest anywhere from pre-seed to series C and beyond stages — generally with a check size between $10M and $350M.

Industries

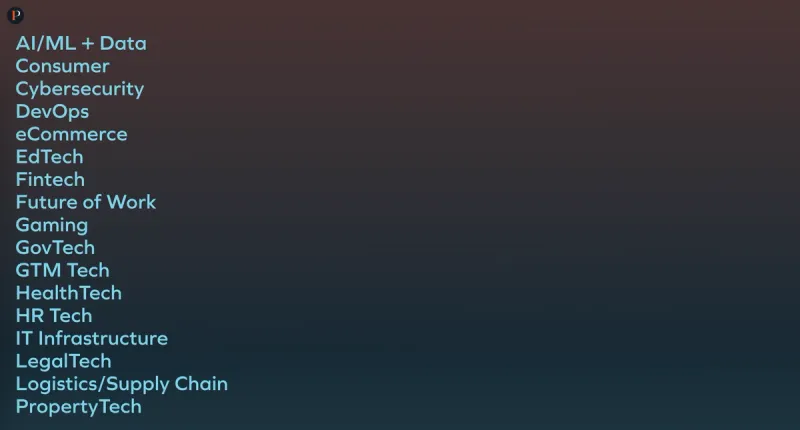

Insight is focused on software companies. However, they invest in a number of different sectors that you can find here (or below):

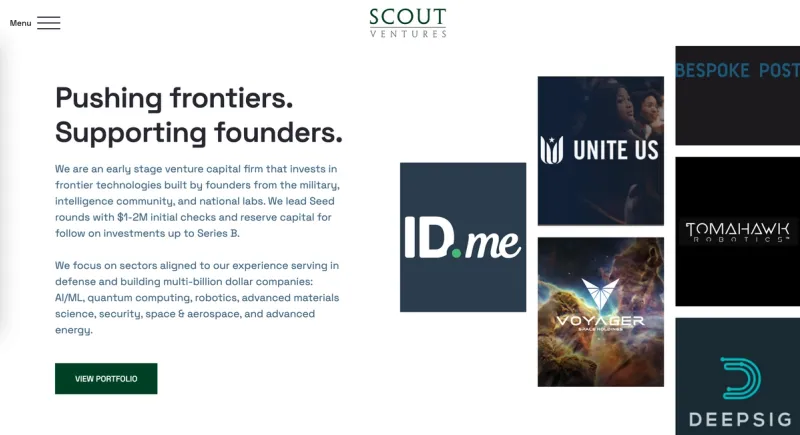

3. Scout Ventures

According to the Scout Ventures website, “Scout Ventures is an early-stage venture capital firm that invests in frontier and dual-use technologies built by veterans, intelligence leaders, and premier research labs. By leveraging our network of professional investors, operators, and experienced entrepreneurs, Scout can effectively execute every aspect of our investment thesis. We’re also paving the way for military veterans and intelligence professionals to access hundreds of millions in government grants and non-dilutive capital. The firm has three locations: Austin, New York City, Washington, DC.”

Learn more about Scout Ventures by checking out their Visible Connect Profile here →

Investment Range

Scout Ventures writes checks anywhere between $100,000 and $3M. According to their website, “We lead Seed rounds with $1-2M initial checks and reserve capital for follow-on investments up to Series B.”

Industries

According to the Scout website, “We focus on sectors aligned to our experience serving in defense and building multi-billion dollar companies: AI/ML, quantum computing, robotics, advanced materials science, security, space & aerospace, and advanced energy.”

4. Greycroft

According to their website, “Greycroft is a venture capital firm that focuses on technology start-ups and investments in the Internet and mobile markets.”

Learn more about Greycroft by checking out their Visible Connect Profile here →

Investment Range

According to the team at Greycroft, “Greycroft typically makes initial investments from $500,000 at the seed stage to up to $30 million from the growth stage. We are an active Series A investor and typically invest between $1 million and $10 million.

The growth fund targets investing $10 to $30 million on an initial basis and may reserve up to double that amount over time. The growth fund focuses on later-stage companies with proven unit economics, annual revenue growth in excess of 50%, and a management team that is prepared to scale.”

Industries

On the Greycroft website, you’ll find that they invest in a number of different industries — ”We invest across a broad range of Internet sectors. We currently group our portfolio into four verticals: Consumer Internet, Fintech, Healthcare, and Enterprise Software.”

5. RRE Ventures

RRE Ventures has been funding software startups since the 90s. According to their website, “RRE Ventures is a New York-based venture capital firm that offers early-stage funding to software, internet, and communications companies.”

Learn more about RRE Ventures by checking out their Visible Connect Profile here →

Investment Range

The team at RRE invests in a variety of early-stage tech and software companies. According to their Visible Connect profile, they invest in Series A and B companies with an average check size between $4M and $15M.

Industries

According to their website, “RRE invests in early-stage, technology-enabled companies across all sectors and across the country. We back credible teams executing against incredible ideas to build category-defining businesses.” Check it out here or learn more below:

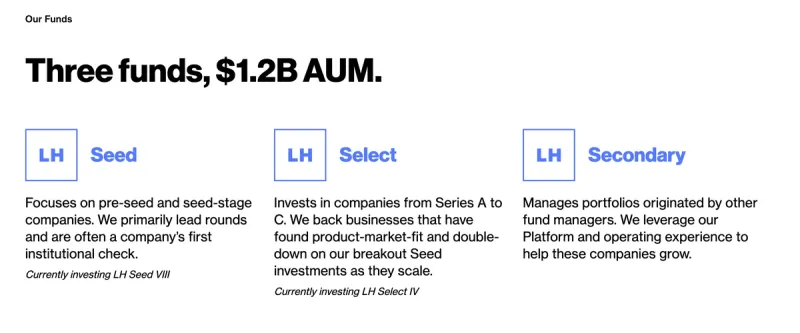

6. Lerer Hippeau

According to their website, “Lerer Hippeau is an early-stage venture capital fund founded and operated in New York City. We invest in good people with great ideas who redefine categories — and create new ones entirely.”

Learn more about Lerer Hippeau by checking out their Visible Connect Profile here →

Investment Range

The team at Lerer Hippeau has 3 funds that invest in pre-seed to Series C and beyond companies.

Industries

The team at Lerer Hippeau is industry-agnostic and will invest in any company — including enterprise and consumer landscapes.

7. Starta

According to their website, “Starta is a venture ecosystem to find, foster, and fund early-stage talent in tech.

Our mission is to provide opportunities to:

- International startups who want to scale globally and raise capital

- Aspiring industry leaders, seeking professional training

- Investors who believe in long-term growth potential and a strong connection with the community

Starta values inclusivity and diversity. Having worked with over 200 startups from all over the world, we intensively focus on bringing equal opportunities and support to the ecosystem.”

Learn more about Starta by checking out their Visible Connect Profile here →

Investment Range

Like many of the other firms on this list, Starta has multiple funds that invest in many stages. Starta operates both an accelerator and early-stage fund intended for seed and series A companies:

Industries

The Starta team has a focus on international startups that are looking to expand and scale their US presence.

8. FirstMark

FirstMark is an early-stage venture capital firm headquartered in New York City. As put by their team, “We are proud to back the ambitious founders of the most iconic companies in the world.”

Learn more about FirstMark by checking out their Visible Connect Profile here →

Investment Range

According to their Visible Connect profile, the team at FirstMark writes checks anywhere between $500k and $15M.

Industries

The team at FirstMark invests in companies of a variety of industries and sectors. They have major focus areas of Enterprise, Consumer, and Frontier companies.

9. Hypothesis

According to the Hypothesis website, “We build and fund companies. We’re a startup studio and seed fund that launches, funds, and scales exceptional companies.”

Learn more about Hypothesis by checking out their Visible Connect Profile here →

Investment Range

As a startup studio, Hypothesis focuses on finding successful founders and co-founders and helps them launch and scale businesses. In addition to capital, Hypothesis portfolio companies receive resources and help with sales and marketing, hiring, product development, follow-up funding, etc.

Industries

The team at Hypothesis will invest in companies across many industries and are focused on “mission-driven” companies and founders.

10. Interlace Ventures

According to the team at Interlace Ventures, “Investing in early-stage commerce- and retail-technology companies gives us unparalleled access to the latest technological innovations and trends across commerce and retail.

We leverage this access by partnering with global brands and retailers to support their innovation efforts.

We do this through a variety of methods, all of with are tailored after each partner’s individual needs and priorities.”

Learn more about Interlace Ventures by checking out their Visible Connect Profile here →

Investment Range

The team at Interlace invests in pre-seed to series A-stage companies. According to their Visible Connect Profile, they will write checks anywhere between $150k and $600k.

Industries

Interlace has a focus on commerce and retail companies.

11. FJ Labs

FJ Labs is a prominent venture capital firm based in New York City, renowned for its extensive network and hands-on approach to investing. Founded by experienced entrepreneurs Fabrice Grinda and Jose Marin, FJ Labs focuses on creating value for founders and investors. The firm leverages its deep industry expertise and global connections to support startups in achieving their growth potential. FJ Labs is particularly noted for its collaborative ethos, working closely with portfolio companies to navigate the complexities of scaling and market expansion.

Learn more about FJ Labs by checking out their Visible Connect Profile here →

Investment Range

FJ Labs typically invests in pre-seed to Series A rounds, with investment amounts ranging from $50,000 to $500,000. Focusing on early-stage investments, FJ Labs provides critical funding enabling startups to develop their products, gain market traction, and prepare for subsequent funding rounds. Their flexible investment strategy allows them to tailor their support to the unique needs of each startup, ensuring that founders receive the resources necessary to succeed.

Industries

FJ Labs has a diverse investment portfolio, strongly emphasizing marketplaces and network effects businesses. They are particularly interested in industries such as e-commerce, real estate tech, fintech, and mobility. FJ Labs seeks out startups that leverage technology to disrupt traditional markets and create new growth opportunities. Their broad industry focus enables them to identify innovative business models and support visionary entrepreneurs across various sectors.

12. VentureOut

VentureOut is a unique venture capital firm and accelerator based dedicated to bridging the gap between international startups and the US market. With a focus on helping startups expand globally, VentureOut offers a comprehensive suite of services designed to support international entrepreneurs in scaling their businesses in the US. The firm combines investment with an accelerator program that provides mentorship, networking opportunities, and strategic guidance, making it an ideal partner for startups looking to make a significant impact in the American market.

Investment Range

VentureOut typically invests in early-stage companies, with investment amounts ranging from $50,000 to $250,000. Their funding is often coupled with participation in their accelerator programs, which offer startups additional resources to refine their business models, develop go-to-market strategies, and establish a presence in the US. This dual approach of investment and acceleration helps startups gain the momentum they need to succeed in a competitive market.

Learn more about VentureOut by checking out their Visible Connect Profile here →

Industries

VentureOut focuses on various industries, with a particular emphasis on technology-driven sectors. They are especially interested in software, fintech, health tech, and enterprise tech startups. By concentrating on these high-growth areas, VentureOut aims to support innovative companies that have the potential to transform industries and drive technological advancements. Their industry focus and international expertise position VentureOut as a valuable partner for startups seeking to expand their reach and impact in the US market.

13. FirstMark

FirstMark is a distinguished venture capital firm known for its commitment to backing visionary entrepreneurs. With a track record of successful investments, FirstMark partners with startups that have the potential to revolutionize their industries. The firm is dedicated to providing not only capital but also strategic support and access to an extensive network of industry leaders. By fostering close relationships with their portfolio companies, FirstMark helps founders navigate the challenges of scaling their businesses and achieving long-term success.

Learn more about FirstMark by checking out their Visible Connect Profile here →

Investment Range

FirstMark typically invests in seed and early-stage companies, with investment amounts ranging from $500,000 to $10 million. This substantial range allows FirstMark to support startups at various stages of their development, from initial product launches to significant growth phases. Their flexible investment approach ensures that each startup receives the appropriate level of funding to meet its unique needs and objectives.

Industries

FirstMark has a broad investment focus with a strong emphasis on technology and innovation. They are particularly interested in sectors such as enterprise software, consumer technology, fintech, healthcare, and emerging technologies like AI and blockchain. FirstMark seeks out startups that are poised to disrupt traditional markets and create new growth opportunities. By investing in a diverse array of industries, FirstMark aims to support the next generation of transformative companies and help shape the future of technology and innovation.

14. New York Angels

New York Angels is a prominent angel investment group based in New York City, dedicated to providing early-stage funding and mentorship to innovative startups. Comprising a diverse network of seasoned entrepreneurs and business leaders, New York Angels offers a wealth of experience and strategic insight to help young companies grow and succeed. The organization is known for its collaborative approach, working closely with founders to refine their business models, develop market strategies, and connect with additional resources and expertise.

Learn more about New York Angels by checking out their Visible Connect Profile here →

Investment Range

New York Angels typically invests in seed and early-stage companies, with investment amounts ranging from $250,000 to $1 million. By focusing on the crucial early stages of a startup's development, New York Angels provides the necessary capital to help companies validate their business ideas, build their initial products, and gain market traction. Their investment approach is designed to offer startups the financial support they need to reach critical milestones and prepare for subsequent funding rounds.

Industries

New York Angels has a broad investment focus, with a particular interest in technology-driven sectors. They frequently invest in industries such as software, fintech, health tech, consumer products, and media. This diverse industry focus allows New York Angels to support a wide array of innovative startups, fostering growth and innovation across multiple sectors. By backing companies that leverage technology to create new solutions and disrupt existing markets, New York Angels aims to contribute to the advancement of the entrepreneurial ecosystem in New York City and beyond.

15. New York Venture Partners

New York Venture Partners (NYVP) is a leading venture capital firm based in New York City, focused on supporting early-stage startups with a combination of capital, mentorship, and strategic resources. Known for its hands-on approach, NYVP aims to help founders build scalable businesses by providing more than just funding. The firm's extensive network and industry expertise enable it to offer valuable insights and connections, making NYVP a vital partner for startups looking to navigate the complexities of growth and market entry.

Learn more about New York Venture Partners by checking out their Visible Connect Profile here →

Investment Range

New York Venture Partners typically invests in seed and early-stage companies, with investment amounts ranging from $100,000 to $1 million. This investment range is designed to provide startups with the essential funding required to develop their products, refine their business models, and achieve early market traction. NYVP's focus on early-stage investments ensures that startups receive the support they need during the critical phases of their development.

Industries

NYVP has a diverse investment focus, particularly on technology and innovation-driven sectors. They are especially interested in industries such as artificial intelligence, machine learning, digital media, consumer internet, and enterprise software. By targeting these high-growth areas, New York Venture Partners aims to back startups that have the potential to disrupt traditional markets and introduce groundbreaking technologies. Their broad industry focus allows them to identify and support promising startups across a wide range of fields, fostering innovation and entrepreneurial success in the New York City area and beyond.

16. Primary

Primary is a prominent venture capital firm based in New York. It is dedicated to investing in early-stage startups and helping them grow into market leaders. Known for its data-driven approach and hands-on involvement, Primary provides comprehensive support to its portfolio companies. The firm leverages its deep industry knowledge and extensive network to offer strategic guidance, operational expertise, and valuable resources. Primary's commitment to building long-term partnerships with founders makes it a trusted ally for startups navigating the challenges of scaling and achieving sustainable growth.

Learn more about Primary by checking out their Visible Connect Profile here →

Investment Range

Primary typically invests in seed and Series A rounds, with investment amounts ranging from $1 million to $5 million. This substantial investment range allows Primary to provide the necessary capital for startups to develop their products, expand their teams, and accelerate their go-to-market strategies. By focusing on early-stage investments, Primary ensures that founders receive the financial support they need during the critical phases of their company's development.

Industries

Primary has a strong focus on technology-driven sectors, particularly those with the potential for significant market disruption. They are especially interested in industries such as SaaS, e-commerce, fintech, health tech, and proptech. Primary seeks out startups that leverage innovative technologies to solve complex problems and create new market opportunities. Their industry focus allows them to identify and support high-potential startups across various fields, fostering innovation and driving growth in the New York City startup ecosystem.

Get Connected With Investors Today

At Visible, we oftentimes compare a fundraise to a B2B sales and marketing funnel. At the top of your funnel, you are finding new investors. In the middle, you are nurturing and pitching potential investors. At the bottom of the funnel, you are working through diligence and ideally closing new investors.

Related Resource: The 12 Best VC Funds You Should Know About

With the introduction of data rooms, you can now manage every aspect of your fundraising funnel with Visible.

- Find investors at the top of your funnel with our free investor database, Visible Connect

- Track your conversations and move them through your funnel with our Fundraising CRM

- Share your pitch deck and monthly updates with potential investors

- Organize and share your most vital fundraising documents with data rooms

Manage your fundraise from start to finish with Visible. Give it a free try for 14 days here.

Related Read: Private Equity vs Venture Capital: Critical Differences

Related Resource: 11 Top Venture Capital Firms in Boston