You may be interested in better defining your VC Platform approach because you’re thinking about hiring for your first Platform role or you want to strategically determine where to allocate more resources to improve your post-investment support. Whatever the reason, it’s a worthy investment of your time because your VC Platform can help set you apart from other investors in a competitive deal flow environment.

Despite the importance of the topic, not very many frameworks exist to help investment teams and Platform teams figure out how to improve the support they’re providing startups. This article highlights the TOPSCAN method and serves as a useful tool to take a wide lens view at the needs and resources that already exist within your portfolio today.

What is the TOPSCAN Method for Startup Support?

The TOPSCAN method for supporting startups is a hidden gem of a framework first outlined in 2013 in The Journal of Private Equity. It was designed to help investors improve their operational support of startups.

The framework includes seven key management techniques as outlined below:

Using this framework, and the exercise outlined below, you can strategically determine the areas of support that will deliver the most value to your companies and reap the most return for the investment of your VC Platform’s time and non-capital resources.

Using TOPSCAN to Identify your VC Platform Positioning

The objectives of VC Platforms are all about formalizing the post-investment support processes and making them repeatable and reliable. Therefore, you want to make sure you’re scaling your most impactful areas of support.

To discover which areas of support are going to be the most valuable to scale from both your portfolio’s and your fund’s perspective, you should be thinking about where portfolio needs, available resources, and VC brand strategy align.

To do this, consider using this VC Platform Positioning Exercise template as a guide.

VC Platform Positioning Exercise

Portfolio Needs

To get started, navigate to the Portfolio Needs column on the VC Platform Positioning Exercise. Here you’ll begin to answer the question What is the most impactful support you could be providing your companies?

The exercise starts with this column because it is absolutely critical to have a finger on the pulse of what is top of mind for your portfolio companies.

Just as you would never advise one of your portfolio companies to build a product without first understanding their customer, you need to understand your portfolio companies (read: customers) before you start building out your VC Platform approach.

To do this, you could consider:

- Sending out a survey;

- Using Visible.vc’s Request feature to streamline the collection of qualitative responses; Or

- Scheduling a check in call with your founders during which you ask ‘what is the most impactful way we can support you’*

*If you don’t have strong relationships with companies already in place, start by setting up informal check in calls to build rapport instead of a survey.

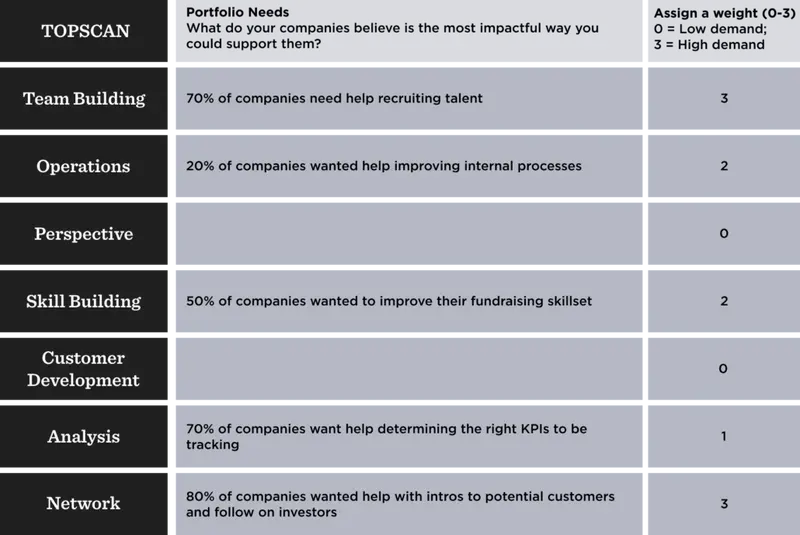

Document the trends you see emerging across the portfolio using the TOPSCAN categories of support which are included in the VC Platform Positioning Exercise. You’ll also want to assign a weight to each category according to the level of demand or need. Portfolio Needs Example:

Available Resources

Next, review and consider which resources for company support already exist at your firm. Your goal should be to answer the question What resources do we have internally and/or how could we source these externally?

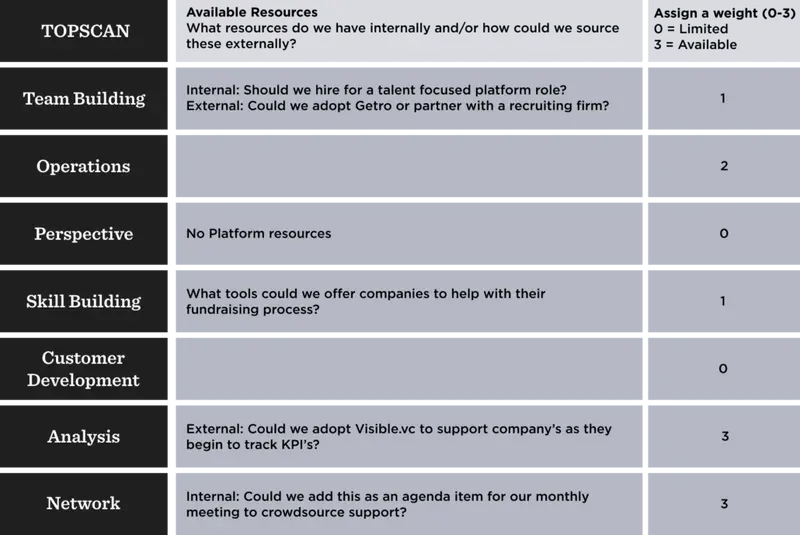

Start mapping out these resources by the TOPSCAN category they’re related to. Take into account which resources your VC Fund has internally versus where it could make sense to partner with a service provider. Assign a weight related to how available the resources already are within your firm.

For example, your portfolio may need help with recruiting but you don’t have resources on staff to support this. In this case, you may consider whether there is a budget to adopt a software or form a partnership to provide this type of support to your companies. Available Resources Example:

Brand Strategy

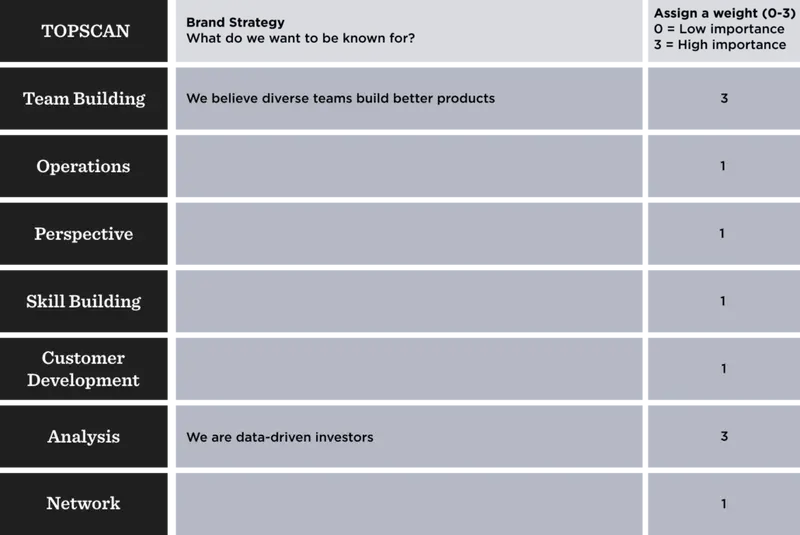

And finally, it’s important to keep in mind your fund’s brand positioning to make sure the resources you’re allocating align with your brand. In this section you’re answering What do we want to be known for?

As Jay Acunzo from NextView Ventures notes “platform only works when you’re known for something.”

Brainstorm within your team until you’ve clarified what it is you want to be known for. Do you want to be known for data-driven decision making? Or maybe you want to be known for identifying and investing in diverse teams. Denote this in the ‘Brand Strategy’ section of the exercise and again assign a weight to each category as you fill them out. Brand Strategy Example:

Once you’ve completed the VC Platform Positioning Exercise, begin looking for overlaps in portfolio needs, available resources, and brand strategy. The areas in which you identify the most alignment should form the basis of your VC Platform approach.

And as Peter Drucker once said, “You cannot manage what you don’t measure”. Be sure to set up KPI’s for your newly defined VC Platform approach so you can measure, analyze, and iterate as needed to refine your approach overtime.

And with building anything new, keep in close communication with your ‘customers’ so you’re confident you’re building something of value.

Other VC Platform articles we love:

Paths into Venture Capital – Decoding the Platform Role

Director of Platform, what does that mean?

Why VCs are investing in Platforms to Compete

Are Newly Formed Roles In VC Firms Differentiators, Table Stakes Or Total BS?