D2C brands have disrupted the retail industry and proven success by offering products at a lower price through eliminating the middleman- as well as offering customers an experience and superior support that traditional retailers are unable to compete with.

Along with this new business model, D2C brands are also capable of achieving rapid growth through a digital-first approach which explains why these companies are receiving higher valuations and more VC investments than your traditional retailer. As D2C companies reach out to investors it’s important to know that they focus on companies that can make a case for long-term success, beyond the pandemic eCommerce boom. Those that can create personalized customer experiences that are engaging through an innovative tech stack have been shown to be favored by investors.

Not to worry though, Shopify highlights some promising stats in their article- Why More Brands are Using the Direct-to-Consumer Model, “The growth of the DTC industry isn’t set to die down anytime soon. Data compiled in The Direct-to-Consumer Guide shows e-commerce is expected to account for 6.6% of all consumer packaged good (CPG) sales. The DTC movement accounts for 40% of the sales growth in the sector. By 2022, the number of DTC eCommerce customers will hit an all-time high of 103 million.”

Visible looks to help connect founders with investors all over the world. Below, we highlight 16 of our favorite D2C venture capitalists. Search through these investors and 13,000+ more on Visible’s Connect platform.

Lightspeed Venture Partners

- Location: Menlo Park, California

- About: Lightspeed Venture Partners is a venture capital firm that is engaged in the consumer, enterprise, technology, and cleantech markets.

- Thesis: The future isn’t built by dreamers. It’s built today, by doers.

- Investment Stages: Pre-Seed, Seed, Series A, Series B, Growth

- Popular Investments:

- Cycognito,

- Kodiak Robotics

- Flink

- Netskope

Forerunner Ventures

- Location: San Francisco, California, United States

- About: VC firm investing in transformative B2C & B2B companies defining a new generation of business, with an eye on the consumer.

- Investment Stages: Seed, Series A, Series B, Growth

- Popular Investments:

- Curated

- Humane

- Clay

Bolt

- Location: San Francisco, California, United States

- About: Bolt is a pre-seed and seed-stage venture firm focused on investing at the intersection of the digital and physical worlds.

- Thesis: Investing at the intersection of the digital and physical worlds

- Investment Stages: Pre-Seed, Seed

- Popular Investments:

- Droplette

- Point One Navigation

- Nautilus Biotech

Menara Ventures

- Location: Tel Aviv, Israel

- About: A publicly traded VC investing in early-stage Digital Transformation startups.

- Investment Stages: Pre-Seed, Seed, Series A

- Popular Investments:

- Matics

- Pairzon

- Revuze

- Leo

Maveron

- Location: San Francisco, California, United States

- About: Maveron funds seed and Series A companies that empower consumers to live on their terms. Based in SF and Seattle and invest coast-to-coast.

- Thesis: Maveron funds seed and Series A companies that empower consumers to live on their terms. Based in SF and Seattle and invest coast-to-coast.

- Investment Stages: Seed, Series A, Series B

- Popular Investments:

- BookClub

- Daring Foods

- Thirty Madison

Felix Capital

- Location: London, England, United Kingdom

- About: We are a venture capital firm for the creative class, operating at the intersection of technology and creativity. We focus on digital lifestyle, investing in consumer brands and related enabling-technologies. Our mission is to be a partner of choice for entrepreneurs with big ideas, and help them build strong brands that stand out and have a positive impact on the world.

- Investment Stages: Both early and growth stages

- Popular Investments:

- Leocare

- Rally

- Mirakl

Andreessen Horowitz

- Location: Menlo Park, California, United States

- About: Andreessen Horowitz was established in June 2009 by entrepreneurs and engineers Marc Andreessen and Ben Horowitz, based on their vision for a new, modern VC firm designed to support today’s entrepreneurs. Andreessen and Horowitz have a track record of investing in, building and scaling highly successful businesses.

- Thesis: Historically, new models of computing have tended to emerge every 10–15 years: mainframes in the 60s, PCs in the late 70s, the internet in the early 90s, and smartphones in the late 2000s. Each computing model enabled new classes of applications that built on the unique strengths of the platform. For example, smartphones were the first truly personal computers with built-in sensors like GPS and high-resolution cameras. Applications like Instagram, Snapchat, and Uber/Lyft took advantage of these unique capabilities and are now used by billions of people.

- Investment Stages: Pre-Seed, Seed, Series A, Series B, Growth

- Popular Investments:

- Merit

- Envoy

- Wonderschool

7 Percent Ventures

- Location: London, England, United Kingdom

- About: Early stage tech investing in UK, EU & US. Seeking the most ambitious founders with deeptech or transformative moonshot ideas to change the world for the better.

- Thesis: We invest in early stage tech startups which represent billion dollar opportunities.

- Investment Stages: Pre-Seed, Seed, Series A, Series B, Growth

- Popular Investments:

- Dent Reality

- Breeze, Humanity

- Koru Kids

Flow Capital

- Location: Toronto, Ontario, Canada

- About: Flow Capital provides founder-friendly growth capital for high-growth companies.

- Thesis: Providing venture debt and revenue-based financing for asset-light, high-growth businesses.

- Investment Stages: Series A, Series B, Series C, Alt. VC, Growth

- Popular Investments:

- Ask.Vet

- Kovo HealthTech Corporation

- Everwash

Quadia

- Location: Geneva Paris, Switzerland

- About: Founded in 2010, Quadia specializes in direct impact investments, though equity, debt and funds. In line with its mission «we finance the solutions for a regenerative economy», Quadia targets companies which have positioned their business model and strategic development on products and services that contribute to a regenerative economy. These transformative companies operate in the areas of sustainable food, circular products & materials, and clean energy.. An internal impact management methodology is implemented by Quadia in collaboration with each portfolio company, allowing it to go beyond simple measurement of impact, promoting an environmental and social transition among all its stakeholders. Since its creation, Quadia has financed over 45 companies, projects and investment funds for the equivalent of EUR 220 million.

- Investment Stages: Seed, Series A, Series B, Series C, Growth

- Popular Investments:

- Hungry Harvest

- The Renewal Workshop

- Dott. CETIH

SuperAngel.Fund

- Location: New York City, New York, United States

- About: SuperAngel.Fund is an early stage fund that invests in Consumer, PropTech & Future of Work. The fund is led by Ben Zises who was the first investor and founding advisor to quip, Caraway & Arber, before each had its name. The fund launched on January 1, 2021 and currently has more than 100 investors. To date, I’ve invested over $6m into 50+ companies, including my angel, syndicate and fund investments.

- Thesis: Consumer (CPG, eCommerce infrastructure), PropTech & Future of Work.

- Investment Stages: Pre-Seed, Seed, Series A, Series B, Growth

- Popular Investments:

- Hurry

- Haus

- Caraway

Related Resource: 12 New York City Angel Investors to Maximize Your Funding Potential

CRV

- Location: Palo Alto, California, United States

- About: Charles River Ventures is one of the oldest and most successful venture capital firms. Companies like Cascade, CIENA, Chipcom, NetGenesis, Parametric Technology, Sonus, Speechworks, Stratus Computer, Sybase, Vignette and dozens more have gone from idea to reality with the financial, managerial and visionary backing of CRV. The firm’s investment returns are consistently among the highest of venture capital.

- Thesis: We are an equal partnership – figuratively and economically.

- Investment Stages: Seed, Series A, Series B, Growth

- Popular Investments:

- Fractional

- Cord

- Cradlewise

Cowboy Ventures

- Location: Palo Alto, California, United States

- About: Cowboy Ventures is a seed-stage focused fund investing in digital startups.

- Thesis: We seek to back exceptional founders who are building products that “re-imagine” work and personal life in large and growing markets – we call it “Life 2.0″

- Investment Stages: Seed, Series A, Series B

- Popular Investments:

- Drata

- Mon Ami

- Hone

Craft Ventures

- Location: San Francisco, California, United States

- About: Craft Ventures is an early-stage venture fund specializing in the craft of building great companies.

- Thesis: We invest in outstanding teams that are creating market-defining products.

- Investment Stages: Seed, Series A, Series B

- Popular Investments:

- Trusted

- SUPERPLASTIC

- Voiceflow

Creandum

- Location: Stockholm, Stockholms Lan, United States

- About: Creandum is a leading European early-stage venture capital firm investing in innovative and fast-growing technology companies.

- Thesis: We are a venture capital advisory firm powering innovation from Stockholm, Berlin, and San Francisco.

- Investment Stages: Pre-Seed, Seed, Series A, Series B, Growth

- Popular Investments:

- Lokalise

- Cake

- Pleo

- Craft Docs

To learn more about Lightspeed Venture Partners, check out their Visible Connect Profile here.

Start Your Next Round with Visible

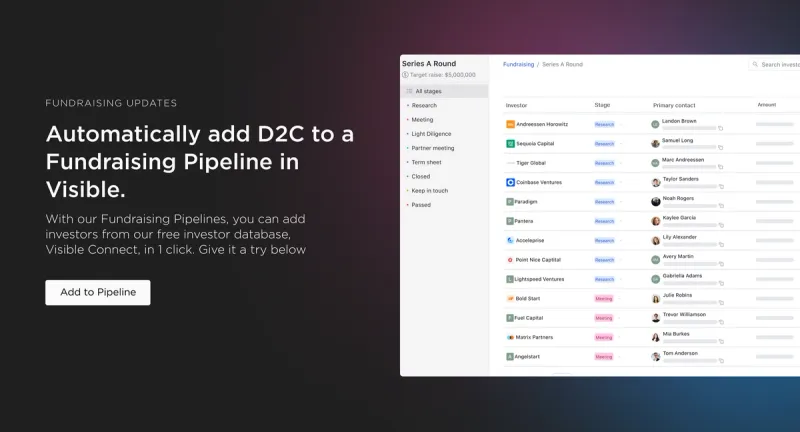

We believe great outcomes happen when founders forge relationships with investors and potential investors. We created our Connect Investor Database to help you in the first step of this journey.

Instead of wasting time trying to figure out investor fit and profile for their given stage and industry, we created filters allowing you to find VC’s and accelerators who are looking to invest in companies like you. Check out all our D2C investors here and e-commerce here.

After learning more about them with the profile information and resources given you can reach out to them with a tailored email. To help craft that first email check out 5 Strategies for Cold Emailing Potential Investors.

After finding the right Investor you can create a personalized investor database with Visible. Combine qualified investors from Visible Connect with your own investor lists to share targeted Updates, decks, and dashboards. Start your free trial here.

Other Helpful D2C Resources

- Billion-Dollar Brand Club

- Get all the strategies and insights you need to take your brand direct to consumer in Shopify’s The Direct to Consumer Guide.

- ProfitWell’s Direct To Consumer Statistics & Trends to Grow Your DTC Business

- Twitter Threads about #dtc + @DTCNewsletter

- Sharma Brands is a firm that invests, advises, and operates to build brands.