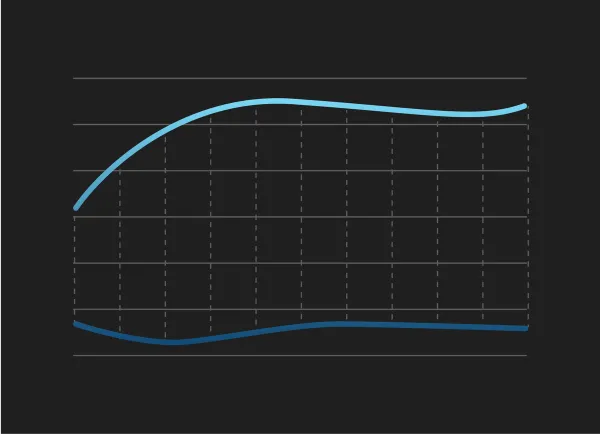

Tomasz Tunguz, VC at Redpoint Ventures, recently shared a chart (above) detailing the best time of the year to raise capital. 2022 looks a lot different than 2021 (and the previous 10 years). After a hot start, the # of deals has collapsed since October.

As fundraising slows and the holidays/New Year approach, founders might want to consider re-grouping and putting together a plan for raising in 2023. Check out 3 ways to get a head start on your 2023 fundraising efforts below:

1. Build the right audience

As we mentioned in a previous Visible Weekly, most founders should expect to communicate with 50-100 investors over the course of a raise. When balancing 50+ conversations it is important to make sure you are spending time on the right investors.

Use Visible Connect, our free investor database, to filter and sort investors by the fields that matter (sweet spot check size, investment geography, fund size, etc.).

2. Track ongoing conversations

50+ conversations is a lot. If you’re running a fundraising process off the cuff, using the last few weeks of the year to set up a pipeline and outreach process will allow you to spend more time on what matters most — building your business. Check out some tips for setting up a Fundraising Pipeline here.

3. Keep investors engaged with updates

If you’re planning on sending an investor update to your current investors at the end of the year, you can use a “lite version” to engage with potential investors (think big wins, fundraising status, high growth metrics, etc). Check out an example here.

Reading List

The Best Time of Year to Raise for Your Startup

Tomasz Tunguz of Redpoint Ventures studies recent funding data to understand the best month to raise venture capital. Read more

3 Tips for Cold Emailing Potential Investors + Outreach Email Template

On the Visible Blog, we share a template to help you craft cold emails for potential investors. Read more

Founder How-To: Writing Forwardable Emails

Stephanie Rich of Bread & Butter Ventures breaks down how founders can best write a “forwardable email” for fundraising. Read more