At Visible, we often compare a venture capital fundraise to a traditional B2B sales and marketing funnel.

At the top of your funnel, you add qualified investors to your pipeline (via cold and warm outreach). In the middle of the funnel, you nurture and pitch potential investors with emails, updates, pitches, meetings, etc. At the bottom of the funnel, you are hopefully closing your new investors.

Related Resource: How to Find Venture Capital to Fund Your Startup: 5 Methods

In order to best help you fill the top of your “fundraising funnel,” we’ve put together a list of a few popular VC firms located in Miami. Check them out below:

1. Ocean Azul Partners

As the team at Ocean Azul Partners put on their website, “We are an early-stage venture capital firm passionate about helping entrepreneurs bring innovative technology solutions to market. We’re operators who are determined to use our successes and lessons learned to provide significant value to the teams with which we work. We are proud to support entrepreneurs building unique solutions that will shape the futures of their industries.”

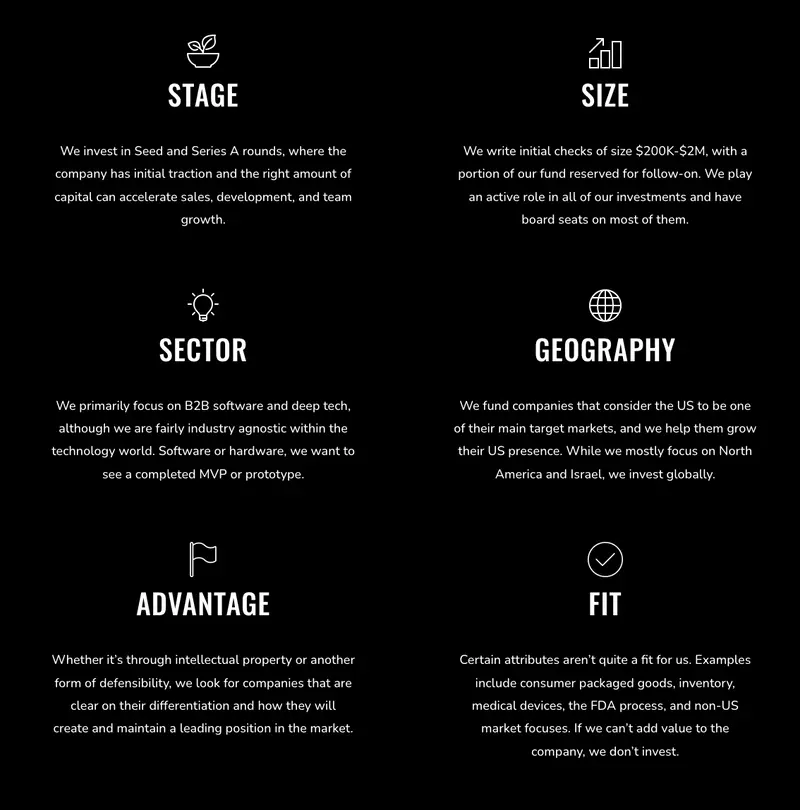

Investment Range

As put on their website, “We write initial checks of size $200K-$2M, with a portion of our fund reserved for follow-on. We play an active role in all of our investments and have board seats on most of them.”

Industries

The team at Ocean Azul primarily focuses on B2B software.

Related Resources: The 12 Best VC Funds You Should Know About

2. Guild Capital

As the team put on their website, “Guild Capital is an early-stage venture capital firm. Founded in 2009, we have been dedicated to venture further than conventional Silicon Valley-based VC patterns to look for growth-stage teams who can evolve into great companies.”

Investment Range

The team at Guild does not publicly state their investment range but does look to companies that have “generated early revenue” or those that have not generated revenue that shows signs of momentum.

Industries

The team at Guild does not have a specific industry but shares their thesis for industries and markets by stating, “We believe in businesses bringing industry-contrarian solutions to large addressable markets. In general, we prefer markets that are not ‘winner-takes-all.”

3. Starlight Ventures

As put on their website, “We are an early stage venture firm designed to address humanity’s biggest challenges and opportunities through breakthrough technology. We aim to enable long-term human flourishing: a prosperous civilization that responds effectively to large-scale opportunities and existential threats alike.”

Investment Range

The team at Starlight does not publicly state their investment range.

Industries

The team at Starlight does not publicly state-specific industries but rather invest in companies that impact long-term human flourishing.

4. Fuel Venture Capital

As put by their team, “Fuel Venture Capital has brilliantly executed against this mission and has become known and trusted as leaders who are founder-focused and investor-driven. Our world-class venture executives have deployed over $400MM of capital from our global LP base following a disciplined “Phased Investment Thesis” managing risk while driving return on investment.”

Investment Range

The team at Fuel invests across multiple stages as put below:

Industries

The team at Fuel invests across many industries but ultimately look to, ‘disruptive global, tech-driven companies.”

5. LAB Miami Ventures

As put by their team, “LAB Ventures is a VC Fund and Startup Studio dedicated to accelerating early-stage real estate and construction technology companies… We invest in early-stage real estate and construction technology companies. We invite investors with an interest in these sectors to join our growing network and stay on the leading edge of tech trends.”

Investment Range

The team at LAB does not publicly state their investment range but typically invests in pre-seed, seed, and series A rounds.

Industries

As put by their team, “Our focus is on early-stage technology businesses that serve the Real Estate and Construction industries – Property Technology, or “PropTech” for short. We take a very broad view of what is included in PropTech, but have a preference for software over hardware, recurring revenue, and enterprise over the consumer.”

6. Krillion Ventures

As put by their team, “Krillion Ventures is a Miami-based venture capital fund that actively invests in early-stage technology companies solving problems in healthcare, financial services, and real estate.”

Investment Range

The team at Krillion Ventures does not publicly list their investment range but gives the following information, “We invest in companies that can demonstrate proof of concept and are seeking capital to accelerate their growth. We make follow-on investments in our portfolio companies on a deal-by-deal basis.”

Industries

The team at Krillion is focused on companies in the health tech space.

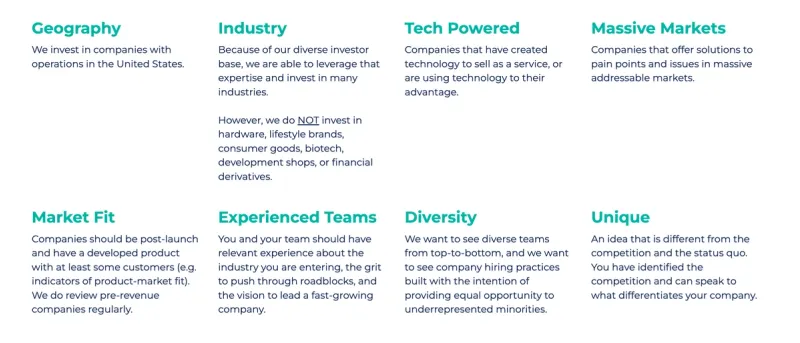

7. Miami Angels

As put by the team at Miami Angels, “We bring together exceptional entrepreneurs and accomplished accredited investors to fuel success.

Our group is comprised of over 150 angel investors, many of whom have been entrepreneurs themselves. Beyond providing capital, we collaborate with our founders to ensure they have access to talent and future funding.”

Investment Range

The team at Miami Angels does not publicly state what their investment range is. You can learn more about their investment criteria below:

Industries

As put on their website, “Because of our diverse investor base, we are able to leverage that expertise and invest in many industries.

However, we do NOT invest in hardware, lifestyle brands, consumer goods, biotech, development shops, or financial derivatives.”

8. Secocha Ventures

As put by their team, “Secocha Ventures is an Investment Firm focused on early stage Consumer Products & Services, Fintech & Healthcare Technology companies.”

Investment Range

The team at Secocha Ventures does not publicly disclose their investment range. They do mention, “We invest in startups raising their Pre-Seed, Seed, or Series-A rounds.”

Learn more about the Secocha Ventures investment criteria below:

Industries

As shown above, the team at Secocha Ventures states, “We invest in FinTech, HealthTech, and Consumer Products & Services.”

Related Resources: Private Equity vs Venture Capital: Critical Differences

9. Third Sphere

As put by the team at Third Sphere, “We use early stage capital to upgrade systems. That starts with finding the sectors currently not working with consideration for people, businesses, or general public responsibility – everything from infrastructure to supply chains. Because ensuring our future takes more than reducing carbon emissions.”

Investment Range

The team at Third Sphere has multiple funds. For their venture fund, they explain their range and criteria as, “A real investment is about more than capital. We invest at the earliest stages (pre-seed & seed), stay close to our founders, and work with them from the onset of our relationship to build relationships with other founders, investors, and customers. From crafting a clear, eye-catching subject line to navigating a pitch, our emphasis on coaching leads to productive, inventive, and valuable relationships that bring ideas to life. Our community is more than just a nice idea – it’s a system designed to work for you.”

Industries

Third Sphere breaks down their industries and markets into the following:

10. TheVentureCity

As put by their team, “TheVentureCity is a global, early-stage venture fund that refuses to follow the conventional crowd. We offer promising founders investment with bespoke data insights and operating expertise – designed for product-led growth.”

Investment Range

According to their Visible Connect Profile, the team at TheVentureCity typically writes checks between $1M and $4M.

Industries

As put on their website, “We are generalists, but index high on Fintech, HealthTech, AI/ML/Data and B2B SaaS. We like businesses that are “needed” and are not just “nice to haves”.”

Find out How Visible Can Help Your Startup Today

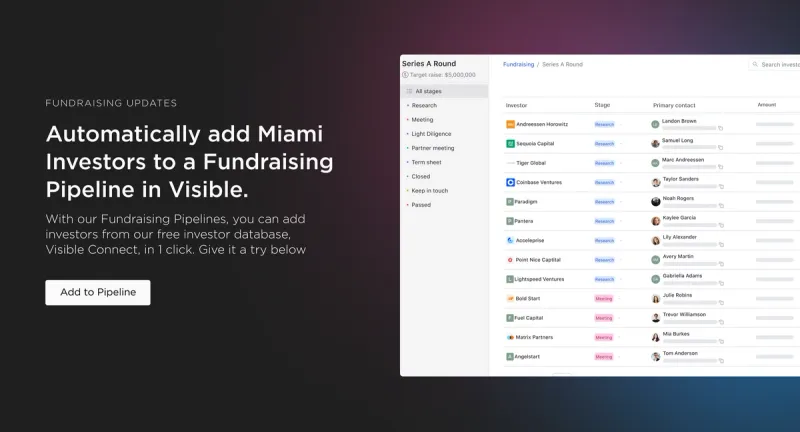

At Visible, we oftentimes compare a fundraise to a B2B sales and marketing funnel. At the top of your funnel, you are finding new investors. In the middle, you are nurturing and pitching potential investors. At the bottom of the funnel, you are working through diligence and, ideally, closing new investors.

Related Resource: A Quick Overview on VC Fund Structure

With the introduction of data rooms, you can now manage every aspect of your fundraising funnel with Visible.

- Find investors at the top of your funnel with our free investor database, Visible Connect

- Track your conversations and move them through your funnel with our Fundraising CRM

- Share your pitch deck and monthly updates with potential investors

- Organize and share your most vital fundraising documents with data rooms

Manage your fundraise from start to finish with Visible. Give it a free try for 14 days here.