What is a pre-money valuation?

In the world of startups, valuation of your startup is discussed constantly. Understanding that valuation, however, can be a bit confusing depending on where you are in your funding and startup journey. The valuation of your startup will shift significantly (as will the risks) as soon as you decide it’s the right time to take on funding. Now whether a founder or founding team decides to take on angel investors, venture capital backing, or bootstrap your business, if funding is involved a startup will have a pre-money valuation and a post-money valuation. Understanding this difference is essential startup knowledge.

The definition of this type of valuation is fairly straight-forward. Pre-money valuation is what a startup is worth without external funding or prior to a round the startup is actively raising. This is the valuation given to a potential investor before a funding round to showcase what the company is currently worth. The pre-money valuation of a company will shift overtime. It will be different before initial funding vs. before a Series A for example.

What is a post money valuation?

On the flip-side of a pre-money valuation, a post-money valuation is what the startup is worth after that next round of intended funding takes place. This will have some significant change because the new investors receive a percent value of the company. Post-money valuations are a more set amount based on true money worth of the company. There are no potential factors within a post-money valuation.

Pre-money vs post-money valuation for startups

While the difference might seem clear between pre-money and post-money valuation for startups, there are a few things to keep in mind when understanding valuation in general and why these numbers really are so significantly different.

Valuation, in general, is fluid. It is speculative and flexible. Valuation is completely driven by the market and opinions of various players in the game. Entrepreneurs and existing investors will want a high valuation. They believe in the idea already and want to make sure their shares aren’t diluted when new funding is taken on. New investors, however, will want to assess all risk and ensure they aren’t overpaying or overvaluing and risking their financials. They way that an investor positions their pre-money valuation can affect the post-money valuation and ultimately the founders, investors, and all current shareholders valuation.

Timing is Everything

As stated, pre-money valuation is set prior to the investment round while post-money valuation is a fixed valuation after the round is complete. Because of timing, post-money valuation is a lot simpler. That number will always be fixed. Although post-money valuations are simpler, pre-money is more commonly used.

Pre-money valuations can flex so much because of the timing and number of factors in place that could affect the valuation in any given scenario. Pre-money valuations are affected by employee share open plan expansion, debt-to equity conversions, pro-rata participation rights, and of course the value and market opportunity seen by current stakeholders and founders. To break down some of these terms: ESOP (employee share open plan) are the plans given to employees of the company to vest as shareholders. Debt-to-equity conversion is any potential situation where debt taken on by the startup is promised to be paid back by a value amount of stock. Pro-rata participation rights are the rights (typically not contracted) to previous investors to invest in future rounds at a set level to maintain ownership rights.

Timing is everything for pre-money valuation because it will affect the post-money valuation. If a startup is growing rapidly, doing really well in the market, and the potential is obvious because of demand in the market or interest from other investors, a founder may be able to get a really great pre-money valuation. If the founder is looking for funding to bail out the company or because growth is only possible with more capital, then that could affect the desirability of the startup and therefore lead to a lower pre-money valuation.

Price per share or PPS is the focus. The market price per share of stock, or the “share price,” is the most recent price that a stock has traded for. It’s a function of market forces, occurring when the price a buyer is willing to pay for a stock meets the price a seller is willing to accept for a stock. A solid PPS is the goal for any company taking on funding to set themselves up for a successful IPO or acquisition at some point.

This is ultimately an understanding of what an investor will pay per share for a startup. The PPS is the pre-money valuation divided by the fully diluted capitalization. The PPS and pre-money valuation are directly proportional (one goes up, the other goes up). So, the greater the pre-money valuation, the more an investor will pay for each share, but the investor will receive less shares for the same investment amount.

Every startup founding team wants to make sure they are setting themselves up for a successful end game so timing their funding to line up with excellent pre-money and post-money valuations is critical.

Why the differences matter

The differences of pre-money and post-money valuations matter. Outside of timing, the main difference between pre-money and post-money valuation is the insight they provide to investors. A pre-money valuation provides value into the potential shares issues while post-money valuation provides a hard, clear, and fixed numeric value equating to the current value of the difference. A hypothetical, potential value pre-money leading to a set value post-money. The difference is critical for founders to understand.

Why are pre-money and post-money valuations Important?

Ultimately, pre-money valuation and post-money valuation matter because these valuations also have the biggest impact on determining the percentage of a company an investor is going to acquire for a given investment, as well as the percentage of the company the existing stockholders will retain.

Having a deep understanding of pre-money and post-money valuations will certainly help during negotiations as well. On top of being an integral part in the dynamics of a deal it is also an easy way to portray to potential investors that you understand the mechanics of a startup and cap table.

A pre-money valuation can make or break your post-money valuation. Understanding what factors go into a pre-money valuation can help a founder make an informed decision when choosing to take on new investors or not and ultimately retain a solid post-money valuation they can stay excited about.

How to calculate pre-money and post-money valuations?

Now that the differences and importance of pre-money valuation and post-money valuation is clear, breaking down how to actually calculate these values is the next step in building out essential startup knowledge.

Calculating Pre-Money Valuations

Pre-Money valuation is pre-funding so it’s important to keep that in mind when calculating this valuation out. The catch to this is to factor in the post-money valuation you want to get your company to – that is critical into calculating the pre-money valuation you are going to pitch to investors.

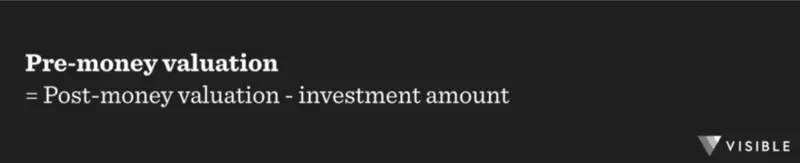

The formula to use for this is: Pre-money valuation = Post-money valuation – investment amount

Understanding what factors you have in play that will be attractive to investors and then incorporating that into your projected goal post-money valuation will lead you to understanding what investment amount to seek and how to ultimately present a pre-money valuation to investors.

Calculating Post Money Valuations

Getting to your post-money valuation is much simpler than calculating your pre-money valuation. The main thing to keep in mind for calculating the post-money valuation is understanding what percentage of your company the new investor will receive and ultimately understanding how that takes away the value overall.

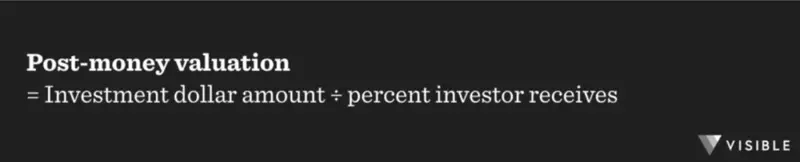

A good way to think about calculating post-money valuation is by using this formula:

Post-money valuation = Investment dollar amount ÷ percent investor receives

The post-money valuation will be a fixed dollar amount and does not flux in the way a pre-money valuation can be adjusted.

Ultimately, it’s important to understand pre-money valuations and post-money valuations if you are ever going to be involved in a startup at any level. Employees should understand this when considering their stock options and how their company presents those to them. Founders need to understand this to intelligently grow their business and of course investors need to understand these valuations to make smart investments and walk away with high-potential earnings.

Raise capital, update investors and engage your team from a single platform. Try Visible free for 14 days.