Netflix IPO: A Lesson in Investor Relations from Reed Hastings

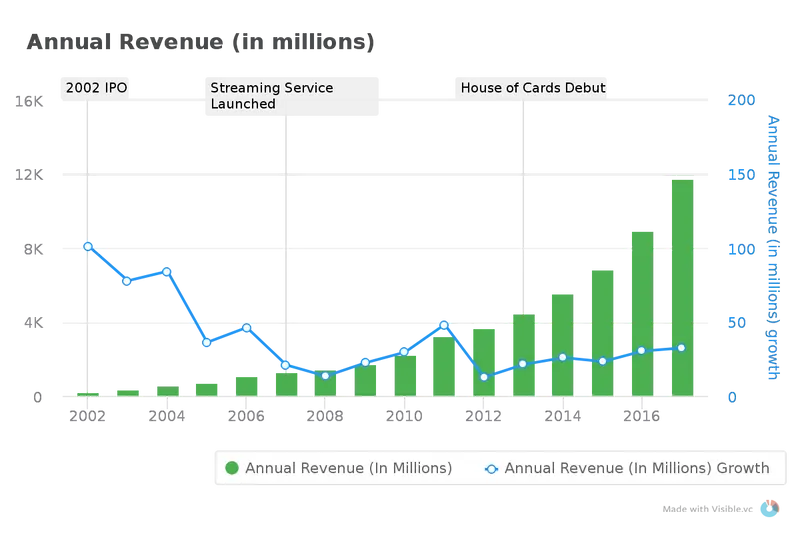

Just a few days away from the 16th anniversary of the Netflix IPO we decided to take a look at the initial investor letter and market sentiment from May 2002. Merely a DVD rental subscription at the time Reed Hastings briefly mentions online streaming and fails to mention creating original content. At the time a “niche business“, Netflix has transformed into a media giant and one of the more intriguing technology companies of our era.

Fast forward to 2018 and the only way I know how to watch a DVD is in a friend’s 2003 Honda Odyssey. Or better yet, I can just pull up the Netflix app on my phone and start streaming Stranger Things, Narcos, or one of their other original productions.

All of the charts, images, quotes, and emphasis below were added by us. You can find the original 2002 letter from Netflix CEO, Reed Hastings, using this link.

The 2002 Netflix IPO Letter to Investors

I’m pleased to report to you that 2002 was a truly remarkable year for Netflix. In this, our first year as a public company, we met or exceeded all of the financial and operational goals we had set for ourselves 12 months earlier. During a time of continuing uncertainty in the technology and financial markets, we were one of only eight technology companies to successfully complete an initial public offering in 2002. And in each of our three subsequent reporting periods as a public company, we outperformed investor expectations for key financial metrics, including revenues, expenses, EBITDA, and free cash flow.

In this climate, the strength of our business model has been resoundingly validated by consumers who, in ever increasing numbers, have found significant enjoyment and value in our online movie rental service. In this letter, I will explain to you how this model works, why it is working so well, and why we believe it will ultimately change the way people experience and enjoy watching movies at home.

First, I’d like to share with you a few highlights from our past year.

THE PERFORMANCE OF THE YEAR.

During 2002, we experienced the kind of rapid growth that many technology companies promised just a few short years ago but few delivered.

In 2002, we doubled our revenue to $152.8 million, from $75.9 million in 2001. We ended the year with approximately 857,000 total subscribers (more than 1 million as of this writing), up 88 percent over the previous year. With positive free cash flow of $15.8 million for 2002 and $104 million of cash and short term investments, we have, and intend to maintain, an extremely strong balance sheet.

Clearly, we are pleased with the results of the past 12 months. In addition to our strong financial performance, our accomplishments also included surpassing, in our first major metropolitan target market of San Francisco, our nationwide goal of 5 percent household penetration.

Since 2002, Netflix has thwarted their expectations of 5% household penetration. As of January 2018, Netflix has made its way into 50%+ of U.S. households with broadband access.

We remain opportunistic in looking for ways to improve our service and our operations. In 2002, we invested in 12 new distribution centers around the U.S., increasing the number of our subscribers who receive their DVDs with next-day service through the U.S. mail. Our marketing initiatives to acquire new subscribers through various channels including banner advertising, direct merchandising, and word-of-mouth remain highly successful. We will continue to evaluate the cost-effectiveness of new channels such as broadcast television as the number of DVD households continues to grow.

Remarkably, Netflix still operates 17 distribution centers. A low from their 50+ they had in 2016. Netflix has continued to own marketing. Transitioning from banner ads and direct merchandising to impressive product (e.g. original content, personalized content, etc.), multi-channel, and email marketing.

BUSINESS BASICS.

Investors are right to ask why a company, regardless of how well it may be doing at present, believes its success will endure. At Netflix, we are encouraged by a number of market trends that indicate strong demand for our service in both the immediate and long-term future.

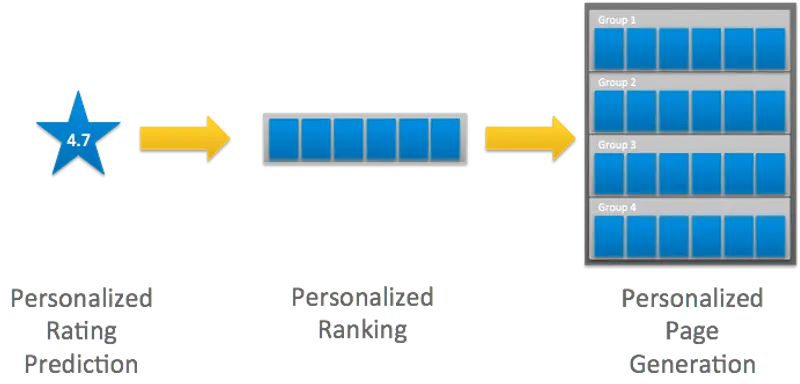

For starters, consumers are becoming increasingly comfortable with the Internet. The widespread adoption of broadband technologies means a smoother web experience for more people across the U.S. In particular, people are coming to appreciate the more personalized recommendations that are enabled by software (compared to, for example, recommendations from video store clerks who may know nothing about their customers’ movie tastes) as well as the ease and security with which purchases may now be made online.

Netflix has stayed true to this idea and continues to dominate competitors in algorithmic based content curation (more below).

Second, as hardware improves and costs come down, the growth of DVD as the medium of choice for at-home movie entertainment is accelerating. We expect that household penetration of DVD, already the fastest-growing consumer electronics product in history, will climb from its approximately 40 million TV households currently to over 100 million in the next three years.

As DVD ownership has become more mainstream, so has our subscriber base. In 1998 the demographic profile of our initial target subscriber was a classic early adopter: predominantly affluent, technologically-savvy, and male. Today, women make up more than half of our subscribers, while the household income of members joining today is roughly half that of subscribers who joined two years ago.

MERCHANDISING MAGIC.

The result of these trends is a market that we currently dominate with a highly visible brand presence. It is also a market that we believe will continue to mature, along with our Company. To ensure that we take advantage of this momentum, we are continually developing our understanding of how people browse and select movies.

The key to our phenomenal consumer acceptance and business success is the sophisticated software that powers our website. Here, our subscribers are able to browse through 14,500 film titles—virtually every movie available on DVD, including both the latest and most popular TV series as well as hard-to-find documentaries—and place the ones they want to receive on a rental list that they continually replenish with new choices.

In the past year we have significantly improved our ability to merchandise our titles to match the tastes of our subscribers. Beyond the richness of our inventory and the robustness of our distribution software lies what we believe is the true strength of the Netflix model: a proprietary system for personalizing movie recommendations for each subscriber via a remarkably powerful and innovative rating system. Instead of using someone else’s tastes to guide a subscriber’s choices, Netflix builds a profile of each person’s movie likes and dislikes to truly personalize a DVD recommendation.

Evolution of the Netflix personalization approach

“We want our recommendations to be accurate in that they are relevant to the tastes of our members, but they also need to be diverse so that we can address the spectrum of a member’s interests versus only focusing on one. We want to be able to highlight the depth in the catalog we have in those interests and also the breadth we have across other areas to help our members explore and even find new interests. We want our recommendations to be fresh and responsive to the actions a member takes, such as watching a show, adding to their list, or rating; but we also want some stability so that people are familiar with their homepage and can easily find videos they’ve been recommended in the recent past.” – From a 2015 Netflix Technology Blog Post

The result is more often than not the movie-lover’s discovery of a personal “gem”: a movie that a subscriber has perhaps never even heard of and which may turn out to be a genuine favorite. This kind of match expands the audience for both acclaimed and lesser-known films—award winners that made their debut on DVD through Netflix and have gone on to find broad distribution, as well as smaller, low-profile movies from independent filmmakers and distributors.

Subscribers rented fully 97 percent of the movie titles we carried in the fourth quarter of 2002. To help achieve such remarkably broad inventory utilization, we’ve added new areas on our website, such as the Critic’s Pick page and the Netflix Top 100 page, that make it easier for subscribers to discover interesting content. For customers who know what they want to watch, we’ve made the search function more intuitive, with better ranking of search results and more obvious results listings. And we’ve made it easier for subscribers to answer their questions and resolve problems online, which has reduced our service costs.

LOOKING AHEAD.

Our vision is to change the way people access and view the movies they love. To accomplish that, on a large scale, we have set a long-term goal to acquire 5 million subscribers in the U.S., or 5 percent of U.S. TV households over the next four to seven years. By then, we expect to generate $1 billion in revenue and $100 to $200 million in free cash flow.

In the shorter term, a year from now, I expect to be able to report to you that we ended the year 2003 with 25 operational U.S. distribution hubs, initiated international expansion into Canada, and generated total revenue of more than $235 million.

We are fortunate to have in place an extremely strong management team that has both the experience and the vision to propel the Company forward in what we believe will be a dynamic new market. As we continue to roll out and improve our service, we are optimistic that we have the potential for even greater gains ahead.

The coming year promises to be an exciting one for Netflix, and we hope that you’ll be with us to enjoy the show. On behalf of the management team and dedicated staff at Netflix, I would like to thank you for your continued support over the past year, and I look forward to your continued participation as a member of the Netflix family.

Sincerely,

Reed Hastings – Chief Executive Officer, President, and Co-Founder