In the world of business, moving first can be difficult and dangerous. Etsy, the Brooklyn-based marketplace connecting sellers and buyers of handmade and vintage goods, who IPO’d in 2015 is finding this out the hard way.

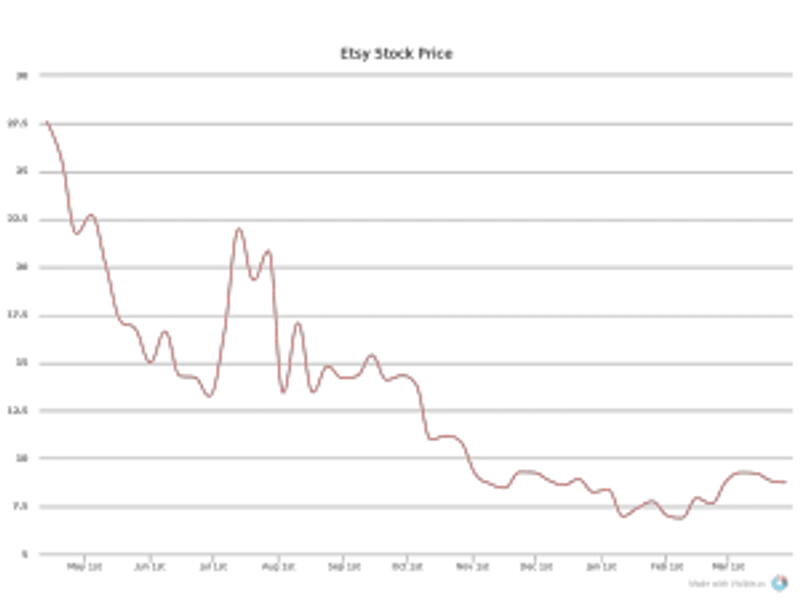

When it went public, Etsy was the largest (and one of the first) B Corporations ever to do so at a market cap of over $3B. Since, Etsy’s value has slipped to under $1B and it is yet to convince investors of its long term viability in light of widening losses and competition from Amazon (“your margin is my opportunity”).

In this week’s Investor Letter, which was included as part of the company’s S-1 filing, CEO Chad Dickerson makes the case for Etsy as a public company and tries to push Wall Street analysts to see past simple profits and also evaluate the company on the community it has built and the economic impact it has had…good luck with that.

The Etsy Economy

Since inception, Etsy has challenged conventional ways of thinking about commerce, business, individuals and communities. I intend to keep our unconventional operating philosophy as we become a public company, and I welcome new investors into our community.

When I joined Etsy almost seven years ago, Etsy was an online marketplace for handmade goods, vintage items and craft supplies that connected sellers and buyers. Even in my early days at Etsy, it was clear to me that the vision for Etsy could extend far beyond the founding idea of the company and have even more potential to impact the world for good.

Vision is just the starting point. I believe Etsy can truly change the world when our vision is met with strong culture, a powerful team and disciplined execution. In my time at Etsy, I’ve put my heart and soul into nurturing a culture and building a team and company that match the ambition of our mission. Today our mission is much more expansive than when Etsy began: to reimagine commerce in ways that build a more fulfilling and lasting world.

The reimagination of commerce means transforming every aspect of how goods are made, bought and sold. We believe that Etsy has the long-term potential to transform the world economy into one that is more people-centered and community-focused—one that values and honors designers and makers and one that creates stronger connections among people who make, sell and buy goods. We see an economy that is more sustainable and transparent—and one that is more joyful. We believe in an economy that transcends price and convenience, one that emphasizes relationships over transactions and optimizes for authorship and provenance. We call this the Etsy Economy.

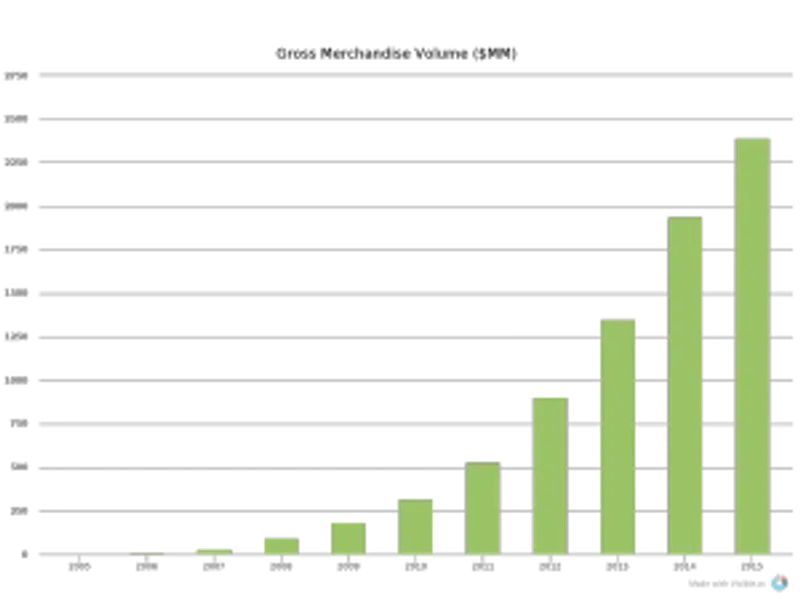

Building the Etsy Economy matters more than ever. For decades now, the conventional and dominant retail model has relentlessly focused on delivering goods at the lowest price, valuing products and profits over community, short-changing the future with the instant gratification of today. I do not believe that this race to the bottom is a sustainable, successful model. Our growing community has made it clear that they desire thoughtful alternatives to mass commerce and impersonal retail and products that better reflect their personal style and values. Person by person, sale by sale, we are building a new model to replace the old. With GMS of $1.93 billion in 2014, I see the Etsy Economy emerging.

Etsy’s Values

If you want to understand Etsy, you’ll have to understand our values.

- We are a mindful, transparent and humane business.

- We plan and build for the long term.

- We value craftsmanship in all we make.

- We believe fun should be part of everything we do.

- We keep it real, always.

Fundamentally, we believe that companies can and should use the power of business to create social good, which is reflected in our status as a Certified B Corporation.

As we noted in the intro, Etsy was the largest (and one of the first) B Corporation ever to do so at a market cap of over $3B. Rally Software, out of Denver, was the first of the group to go public (at a market cap of just over $300MM). It has since been acquired by CA Technologies for $480MM. Natura Brazil (Market Cap: $12.4B) is the world’s largest publicly traded B Corp but it received certification after it was already public

Other well known B Corporations include Ben & Jerry’s, Warby Parker, which could overtake Etsy as the largest B Corp IPO should it choose to take that route.

Our commitment to using business as a force of good manifests itself in the way we run our business.

People often ask me how I choose between the success of our community and the success of our business. My answer is that I don’t have to choose; we have built a business that does well when our community is successful. Making money matters to Etsy because our financial success creates long-term sustainability for our community. The more we invest in our platform, the more we enable Etsy sellers to pursue their craft and grow their businesses and the easier we make it for Etsy buyers to find unique goods. We call this Etsy’s Empowerment Loop.

Community

At Etsy, we believe that our strength and business success rest in the interdependence among Etsy sellers, Etsy buyers, responsible manufacturers and our employees—in other words, our community.

Etsy sellers represent a diverse mosaic of needs and aspirations. Some sellers are first-time small business owners and benefit greatly from our seller support and education programs. The vast majority of sellers on Etsy are one-person shops, and we continue to embrace and develop new ways to support them. Other sellers have grown and need help scaling with the assistance of responsible manufacturers, creating opportunity for other participants in the Etsy Economy. In all cases, we empower each Etsy seller to succeed on her own terms.

I have heard concerns that by allowing our sellers to partner with responsible manufacturers, we are diluting our handmade ethos. I share our community’s desire to preserve what is special about Etsy. After all, Etsy has always served as an antidote to mass manufacturing. We still do. With our vision of responsible manufacturing, we are promoting a new, people-centered model in which artisans can preserve the spirit of craftsmanship and grow responsibly by collaborating with people at small-batch manufacturers to make their goods. This brings more hands together to build both products and more diverse local, living economies. These local, living economies band together into a larger Etsy Economy made up of individuals with diverse roles but all sharing a collective vision of an economy based on community.

When individuals share a collective vision, the power and possibility of community manifest in profound ways. Etsy is, by design, a collection of many small things. As we grow, Etsy becomes a larger collection of individuals and communities, with compounding benefits when they connect with each other. Etsy sellers have self-organized into more than 10,000 groups around the world, known as “Etsy Teams.” They provide local support to each other and collaborate with Etsy on initiatives, such as teaching entrepreneurship to economically disadvantaged people in their communities, lobbying the government on issues important to Etsy sellers, running local craft fairs and translating Etsy’s site into other languages.

In 2012, Mayor Larry Morrissey reached out to me on Twitter asking how to build an Etsy Economy in his community of Rockford, Illinois. Rockford is a city that has faced challenges familiar to many cities in America and around the world: loss of manufacturing jobs, high unemployment and a struggling economy. We worked with Mayor Morrissey, members of the local Rockford Etsy Team, the public education system, local arts organizations and the public housing authority to launch the Etsy Craft Entrepreneurship Program. This program teaches people with a craft skill that entrepreneurship and economic opportunity are within reach on our platform. We have extended this program to 10 cities around the world and see it as an inspirational model for even deeper community involvement in the coming years.

Our concept of community includes the cities where we live and work, and we run Etsy in a way that supports our own local economy and ecosystem. At our headquarters in Brooklyn, twice a week we serve a meal that we call “Eatsy.” Our approach is to foster community and productivity through a meal, designed for employees to eat together on picnic-style benches. This meal allows employees to engage with each other, within and across teams, and increases team-building and work relationships throughout the company. Eatsy also serves as an end point for company-wide meetings, so that employees can continue the conversation on important workplace topics.

In 2014, we sourced food from over 40 local businesses with an emphasis on our health and ecological impact. We eat on compostable plates, and employees sign up to deliver our compost by bike to a local farm in Red Hook, Brooklyn, where it is turned back into the soil that produces the food we enjoy together. In this way, Eatsy goes into the very soil we live and work on. Eatsy is a metaphor for how I think about many aspects of our business and our relationship to the world around us: regenerative, mindful, interdependent, community-based and fun.

Why Etsy Should be a Public Company

I believe the principles and resources of being a public company align well with the model of shared success that is fundamental to Etsy’s way of doing business, namely that we make money when our sellers make money. Investing in the growth of our business and increasing Etsy’s visibility will help elevate Etsy sellers and attract more buyers, which creates more opportunities for everyone.

This section is perhaps the most interesting since it attempts to answer a question that, to this day, the public markets feel has not been put to rest.

To date, the public markets have shown an unwillingness to accept a company like Etsy where profit seems to take a back seat to impact — unless, of course, that company is Amazon whose scorched earth brand of market expansion appeals a great deal to Wall Street in spite of minimal profits.

Accountability / transparency

Etsy has a long history of providing data to the community, everything from key financial metrics, to our gross happiness index, to our carbon footprint data, to our workplace diversity stats. As a public company, we will be able to provide a higher level of transparency and accountability to a broader number of people.

Community participation

Being a private company means that most people don’t have an opportunity to invest in Etsy. When Etsy is a public company, anyone will be able to own a piece of Etsy, including our sellers, our buyers and anyone else who shares Etsy’s values and mission. These shareholders will be valued members of our community.

Long-term sustainability

We want to be a company that spans generations. Eighty-six of the original companies in the S&P 500 index are still publicly traded after 58 years. I view going public as an important step towards providing Etsy with the capital and long-term corporate structure to achieve similar longevity.

In light of Amazon’s foray into the handmade goods market and Etsy’s struggles as a public company (likely related), there has been some chatter about a buyout. As we noted above, Amazon has a history of scoffing at traditional Wall Street desires and with its acquisition of Zappos in 2009 proved it is willing to take bets on company whose culture seems to be at odds with their own.

Making the world more like Etsy

I believe that Etsy can be a public company that holistically integrates the concerns of people and the planet, the present and the future, profitability and accountability. If we succeed, then other companies might replicate our model. We think the world will be a better place for it.

As a public company, we will continue to concentrate on the long term. Our mission to reimagine commerce is a big goal and it will take time to achieve it; success will be based on strategies that evolve over years and decades, not just quarters. We are more focused on creating long-term results for us and our community than short-term results that lack that promise. I believe this approach will deliver the most sustainable long-term returns to investors.

When we’re public, we do not plan to give quarterly or annual earnings guidance. I think providing quantitative earnings guidance is misaligned with Etsy’s mission. For example, the pressure to hit a quarterly financial target could incent us too heavily to seek near-term gains, which could diminish our ability to fulfill our larger mission over the long-term.

We will continue to be transparent with our investors. Instead of providing guidance in the traditional sense, I plan to talk frequently with our investors about our progress, challenges and opportunities. I welcome investors who share our long-term, community-oriented philosophy.

What’s Ahead

I am intensely grateful to all of the people who have given so much of themselves to build Etsy, and I am excited to welcome new like-minded shareholders to our community.

We are entering a new era. I believe that successful businesses will be those that combine vision, execution and discipline with values, heart and conviction. That is how I plan to lead Etsy and work with our community to build a more fulfilling and lasting world through commerce. Etsy will be entering its second decade this year, and we look forward to many more in our new form as a public company.