Ford was Founded in 1903 and has been a staple of American culture since. No company has created the stories and memories like those of Ford; the Model T, the assembly line, the Mustang, the Pinto, and most recently “their 2008 comeback”.

We are all too familiar with the financial crisis in 2008. The automotive industry was hit particularly hard and faced challenging questions all while on the brink of collapsing. Alan Mulally, Ford’s newly appointed CEO at the time, stuck to his guns and pulled out a historical comeback. Mulally’s plan, ONE Ford, is prevalent while the company fought to stay afloat in one of the most uneasy times in recent history. Although Alan stepped down in 2014, ONE Ford is still largely influential at Ford and crucial to their company history.

All of the charts, images, quotes, and emphasis below were added by us.

If you like what you see and want to share Visible Investor Letters with friends or colleagues, send them here to sign up.

Ford’s 2008 Letter to Shareholders

A Message from the President and CEO,

In 2008 the automotive industry faced a deep recession in the United States and Europe, the worst worldwide financial crisis in decades and a dramatic slowdown in all major global markets. Like all automakers, Ford Motor Company was adversely impacted by these extraordinarily difficult economic conditions.

However, the plan Ford is operating under – what we call ONE Ford – is helping us endure these current conditions and position ourselves for future success. Our plan has been consistent for the past two years:

- Aggressively restructure to operate profitability at the current lower demand and changing model mix.

- Accelerate the development of safe, fuel-efficient, high-quality new products that customers want and value.

- Finance our plan and improve our balance sheet.

- Work together as one team, leverage our global assets.

ONE Ford has transformed us into a different auto company: different than others today and from ourselves a few years ago. However, the worldwide economic slowdown – driven by tight credit markets and weak consumer confidence – has shaken the foundation of even the strongest companies, in the automotive sector and in every other industry.

A plan so simple it can fit on a business card – yet so influential it overhauled the culture at Ford. ONE Ford was the first step Alan Mulally took when he took over the reigns as Ford’s CEO in 2006. The plan, simply enough, revolved around creating one vision for everyone on the team – not just executives and managers. The fruits of the plan have paid off greatly as Ford has generated record profits while staying lean and innovative.

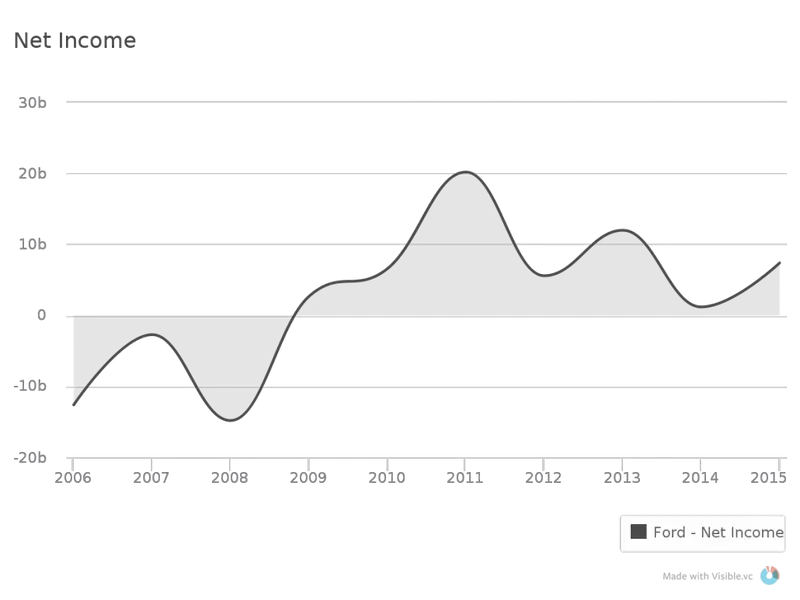

Certainly, the severe economic challenges of 2008 had a significant impact on our results for the year, both in terms of our operating losses and cash flow. After earning a profit in the first quarter of 2008, we had an overall net loss of $14.7 billion for the year, with $6 billion of that coming in the fourth quarter. That compares with an overall net loss of $2.7 billion in 2007. Our worldwide Automotive revenue was $129.2 billion in 2008, compared with $154.4 billion in 2007. At yearend 2008, our total Automotive liquidity was $24 billion, including gross cash of $13.4 billion.

Fortunately, we began aggressive restructuring efforts under ONE Ford before the current crisis began. We eliminated excess manufacturing capacity, closing plants and reducing our workforce. We negotiated a new contract with the UAW to improve our competitiveness. We shifted to a balanced product lineup offering high quality, proven safety, excellent fuel economy and good value.

As part of our ONE Ford plan we also secured credit in advance of the financial market meltdown. As a result of all of these actions and based on our current planning assumptions, we have sufficient liquidity to make it through this global downturn while maintaining our product plans, without the need for government bridge loans. However, as we told Congress in our business plan submission in December 2008, in this environment a number of scenarios could put severe pressure on our Automotive liquidity, causing us to require such a loan – including most importantly a significantly deeper economic downturn, or a significant industry event such as the uncontrolled bankruptcy of a major competitor or major suppliers that caused a major disruption to our supply base or dealers.

When Mulally took over as CEO, in 2006, Ford mortgaged all of their assets to finance the loans spoken of above. At the time, Ford was in desperate need to restructure their company as whole and saw the need for “a cushion to protect for a recession or other unexpected event”, as Mulally put it in a separate interview. As an added bonus, staying away from a bailout was solid for marketing and created a positive image of Ford for many consumers.

Staying aligned with their plan, Ford sold off most of their marques in order to stay agile and focus on their most important brand; their own. In the year or so leading up to this annual report Ford sold off their interest in Aston Martin, Jaguar, Land Rover, and Mazda. A few years after the report they would continue the trend and sell off their share in Volvo as well as discontinuing the Mercury line.

We continue to take the decisive actions necessary to lower production to match lower worldwide demand and reduce costs. We expect this will contribute to significantly reduced negative Automotive operating-related cash flow in 2009 as compared with 2008, and position Ford for growth when the economy rebounds. Based on our current planning assumptions, we believe we are on track for total Company and North American Automotive pre-tax results and Automotive operating-related cash flow to be at or above breakeven in 2011, excluding special items. Our ultimate goal remains unchanged: to create a viable Ford Motor Company and a lean global enterprise delivering profitable growth for all.

Looking ahead, we anticipate very weak global industry sales volumes during 2009, with a full-year decline in the range of about 15% from 2008 levels. Significant government policy stimulus is being implemented in most markets and is expected to improve the environment for sales later this year. Financial markets remain under significant stress, however, and further government and central bank actions are needed to provide liquidity and stabilize banks.

For Ford, the year ahead will be marked by an unprecedented number of new product introductions. Consistent with our ONE Ford plan, we are introducing more products that customers want and value.

As other automotive companies were solely focused on gathering capital, Ford’s previously mentioned loans allowed them to continue to invest in the introduction of new products and technologies. This has included the innovation of their hybrid/electric vehicles and renewed success of their staple models, such as the Focus.

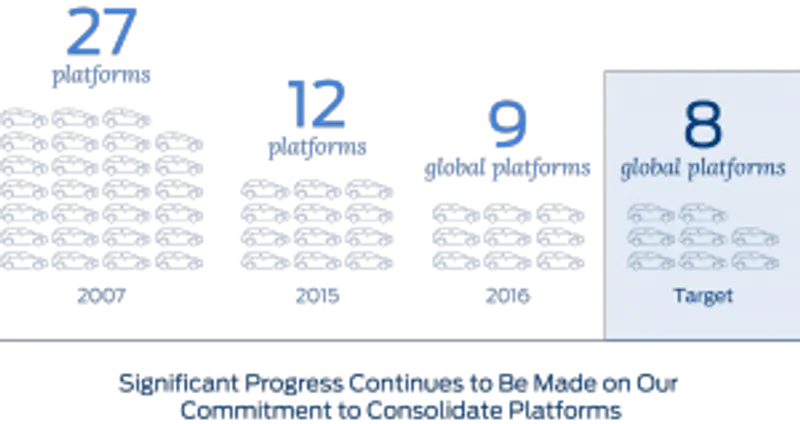

Ford also is on track with its plan to invest in new, smaller, fuel-efficient vehicles and achieve a more balanced global product portfolio. Within the next five years, all Ford vehicles competing in global segments will be common in North America, Europe and Asia, fulfilling a key element of our ONE Ford plan. This includes Ford Fiesta- and Focus-sized small cars, Fusion- and Mondeo-sized midsize cars and utilities, as well as commercial vans. Importantly, every new product will be the best or among the best in its segment for fuel economy, while providing top quality, safety, smart technologies and value.

In another instance of ONE Ford, Mulally touches on the importance of consolidating their platforms and becoming a global company. In the above graphic, pulled from a 2015 Ford corporate update, you can see the continuance of consolidating their platforms. Currently all of Ford models share just 9 platforms and roughly 80% of the same parts; by doing so Ford has been able to create massive economies of scale.

We also are launching the most aggressive vehicle electrification program in the industry. By 2012, we plan to produce at least four high-mileage vehicles that will use the most advanced forms of battery technology in a family of hybrids, plug-in hybrids and battery-powered vehicles.

In addition to producing these vehicles, we are employing a comprehensive approach to electrification that will tackle commercial issues such as batteries, standards and infrastructure. We are working with Southern California Edison, the Electric Power Research Institute and six additional electric utility companies from New York, Atlanta, Detroit and Raleigh to develop plug-in hybrid vehicles and infrastructure.

Despite an extremely difficult year we continue to see many positive developments. These ongoing improvements make us more confident than ever that we have the right plan and are taking the right actions to survive the downturn and emerge as a lean, globally integrated company poised for long-term profitable growth.

As always, we thank you for your support of our efforts.

Alan R. Mulally