Blog

Reporting

Resources to help level up your investor reporting.

All

Fundraising Metrics and data Product Updates Operations Hiring & Talent Reporting Customer Stories

investors

Metrics and data

Reporting

VC Fund Performance Metrics 101 (and why they matter to LPs)

Venture Capital investors expect their portfolio company founders to be on top of their key financial metrics at all times. Why? Because it fosters confidence in investors when CEOs demonstrate they’re making data-informed decisions about the way their company is operating.

On the flip side, Venture Capital investors should be just as familiar with their own key performance indicators, aka fund metrics. A great way to impress Limited Partners is to demonstrate you have a deep understanding of both how fund metrics are calculated and why they matter to LPs.

In this article we define the key fund metrics every fund manager should always have at the ready and why they are important.

Multiple on Invested Capital (MOIC)

Definition: MOIC is considered the most common fund metric and is used to determine the value of a fund relative to the cost of its investments. In other words, it measures the amount gained on investments. Anything above a 1.0x is considered profitable. MOIC can be an effective way for LPs to compare the performance of the Venture Capital funds they’ve invested in; however, because it includes both unrealized and realized value, it’s not a true indicator of fund performance.

How It’s calculated:

(Unrealized Value + Realized Value) / Total Invested into the Fund

Why it matters to LPs: MOIC is a straightforward metric that measures how much value the fund as a whole is generating over time.

Related resource: Multiple on Invested Capital (MOIC): What It Is and How to Calculate It

Gross Total Value to Paid-in-Capital (TVPI)

Definition: TVPI demonstrates the overall performance of the fund relative to the total amount of capital paid into the fund to date. A TVPI of 1.5x means for every $1 an LP invested, they’re projected to get $1.5 in value back as a return.

How It’s calculated:

(Total Distributions + Residual Value) / Paid-in-capital = TVPI

OR

DPI + RVPI = TVPI

Why it matters to LPs: This is an important metric for LPs because it demonstrates how much money they’ve (individually) received back to date from the fund as well as how much they are predicted to receive (residual value) after all the all assets (companies) have been sold as it relates to their (individual) investment. LPs like to use TVPI because it’s straightforward to calculate and hard to manipulate.

LPs will be ok with TVPI’s lower than 1 for the first few years but then will start expecting to see an TVPI of 1 or higher as your company’s hopefully get marked up in value and you start distributing fund back to LPs.

Related Resource: TVPI for VC — definition and why it matters

Residual Value per Paid-in-Capital (RVPI)

Definition: RVPI is the ratio of the current value of all remaining investments (after the GPs have done their mark up and mark downs) within a fund compared to the total contributions of LP’s to date. It essentially tells LPs the value of companies that hasn’t been returned (yet!) compared to how much has been invested.

How It’s calculated:

Residual Value / Paid in Capital = RVPI

Why it matters to LPs:

LPs want to know the likely upside of investments that haven’t been realized yet. For this reason, LPs are likely comparing your RVPI against funds with the same vintage.

Distributions per Paid-in-Capital (DPI)

Definition: DPI is the ratio of money distributed (returned) to LP’s by the fund, relative to the amount of capital LP’s have given to the fund.

How It’s Calculated:

Distributions / Paid-in-capital = DPI

Why it matters to LPs: LPs will be comparing your RVPI and DPI numbers to understand where your portfolio is at in terms of maturity. A high DPI means you’re portfolio is more mature because you’ve already been able to start making distributions back to your LPs as opposed to just have a high residual (potential payout) value.

Internal Rate of Return (IRR)

Definition: IRR is the second runner-up for the most common fund metric. IRR shows the annualized percent return that’s realized (or has the potential to be realized) over the life of an investment or fund. A high IRR means the investment is performing well (or is expected to perform well). If you’re a seed stage investor you should be targeting at least a 30% IRR according to Industry Ventures.

How It’s Calculated:

Because of the advanced nature of this formula it’s best to use an excel based calculator to calculate IRR or a platform like Visible.vc which automatically calculates IRR for you.

Related Resource –> What is Internal Rate of Return (IRR) for VCs

Why it matters to LPs: IRR gives LPs a way to measure the performance (or predicted performance) of their investments before other profitability metrics are available. This metric, unlike the others listed above, takes into account the time value of money, which gives LPs another perspective to evaluate your fund performance and compare it to other asset classes.

Check out the week from Revere VC below to get a better understanding of when each fund metric is relevant.

Venture fund metrics can get confusing.

MOIC, TVPI, DPI, IRR … ????

Beyond formulas, we teach our analysts about when to use them ⬇️

Fund still deploying? MOIC.

Investment window closed? TVPI.

Fund starts harvesting? DPI.

Historical performance when fund is complete? IRR.

— Revere VC (@Revere_VC) February 17, 2023

Tracking and Visualizing Fund Metrics in Visible

It’s important to make sure you understand not only how to calculate your key fund metrics but also why they matter to LPs; this way you can add an insightful narrative about your fund performance in your LP Updates.

Visible equips investors with automatically calculated fund metrics and gives GPs the tools they need to visualize their fund data in flexible dashboards. Dashboards can be shared via email, link, and through your LP Updates.

Visible supports the tracking and visualizing of all the key fund metrics including:

MOIC

TVPI

RVPI

DPI

IRR

and more.

Visible lets investors track and visualize over 30+ investment metrics in custom dashboards.

Over 400+ Venture Capital investors are using Visible to streamline their portfolio monitoring and reporting. Learn more.

founders

Fundraising

Reporting

The Top VCs Investing in BioTech (plus the metrics they want to see)

The biotech industry has always been an attractive sector for VCs to invest in, and 2023 is no different. With high potential for returns, a rapidly growing industry, and advances in technology, biotech is a favorable investment for VCs.

One of the main reasons for this is the high potential for returns. Biotech companies that successfully develop and commercialize new therapies and medical devices can generate significant returns for investors. This is particularly true for companies that develop therapies for diseases with high unmet needs, such as cancer, rare genetic disorders, and chronic diseases.

The biotech industry is also expected to grow significantly in the coming years, driven by advancements in genomics, stem cell research, and regenerative medicine. This presents a significant opportunity for investors to participate in the growth of this industry and benefit from its expansion.

Advances in technology such as gene editing, AI, and digital health are also making it easier for biotech companies to develop new therapies and medical devices, which can improve their chances of success. Additionally, the growing interest in personalized medicine is also a favorable trend, as precision medicine is gaining more traction in the industry. This approach, which is based on the genetic makeup of each patient, has the potential to lead to more effective and efficient treatments for a wide range of diseases, including cancer and rare genetic disorders.

Governments around the world are also investing in biotech research and development and are offering various incentives for biotech companies, which can help to reduce the financial risks for investors. The high demand for healthcare, driven by the increasing aging population and the growing burden of chronic diseases, is also driving the demand for new and more effective therapies and medical devices.

Set up Your Biotech Company for Success

Biotech startups have a lot to consider as they work to develop and commercialize new therapies and medical devices. There are several key steps that biotech startups can take to increase their chances of success.

Identify unmet medical needs

Successful biotech startups begin by identifying unmet medical needs in the market, and then developing products or therapies that directly address these needs. By doing so, they are able to differentiate themselves from competitors and demonstrate a clear value proposition to potential customers and investors.

Build a strong team

A strong management team with a diverse set of skills and experiences is crucial for biotech startups. This team should be able to lead the company through the complex and dynamic biotech landscape, and make strategic decisions that will help the company grow.

Leverage technology

Advances in technology such as gene editing, AI, and digital health are making it easier for biotech companies to develop new therapies and medical devices. Leveraging these cutting-edge technologies can give startups a competitive edge and improve their chances of success.

Create a clear path to commercialization

Developing a clear path to commercialization and having a strong business model in place are essential for biotech startups. This helps them to attract investment and partners, and to scale their business.

Build partnerships

Building strong partnerships with key stakeholders in the industry, such as pharmaceutical companies, academic institutions, and government organizations can provide access to resources, expertise, and networks that can help the startup to excel.

Have strong regulatory compliance

Successful biotech startups are aware of the regulations and compliance requirements in the biotech industry and they have the necessary processes and procedures in place to ensure compliance. This helps to avoid delays and ensure a smooth commercialization process.

Adapt to market changes

Successful biotech startups are agile and adaptable, and able to pivot their strategies and business models in response to market changes. This helps them to stay ahead of the curve and capitalize on new opportunities as they arise.

Biotech Metrics to Include in Investor Updates

Some specific metrics that biotech companies may include in their investor update include:

Clinical trial progress: The number of patients enrolled in trials, the phase of the trial, and any regulatory milestones that have been achieved or are upcoming.

Pipeline development: This includes compounds or products in development, as well as their potential for revenue or commercialization.

Intellectual property: Patents filed or granted, as well as the strength and potential value of the company’s intellectual property portfolio.

R&D expenses: The progress of research projects to investors.

Scientific publications and presentations: Scientific publications or presentations in which the company or its scientists have participated, as well as the level of visibility and impact of these publications and presentations.

Manufacturing and production: Updates on the progress of their manufacturing and production processes, including capacity and scalability.

Product development: Status on the development of a product, including the progress of preclinical studies, clinical studies, and commercialization.

Market size and potential for growth: The size of the target market for a product and its potential for growth, as well as the competition in the market.

Regulatory: Progress of regulatory approvals and submissions, including FDA, EMA, and other regulatory authorities.

Financial metrics: Such as revenue, operating costs, and burn rate.

The management team and Board of Directors: Any changes or updates to the management team and Board of Directors.

Partnerships and collaborations: New partnerships or collaborations that have been established or are in progress.

Depending on the stage of the company, some of these metrics may not be applicable or relevant and will vary from company to company or industry.

The Future of Biotechnology

The biotech industry is expected to continue to grow and evolve in the coming years, driven by advancements in technology and research. Biotech startups that are able to stay ahead of the curve and capitalize on trends will be well-positioned for success in the future. A few of these key trends are Gene therapy, Regenerative medicine, Personalized medicine, Digital health, and Artificial Intelligence.

Gene therapy is a promising new approach to treating genetic disorders and diseases by directly targeting the underlying genetic causes. Advances in gene editing technology, such as CRISPR, have made it possible to precisely target and repair disease-causing mutations, leading to the development of new gene therapies for a wide range of conditions.

Regenerative medicine is the practice of using cells, tissues, and organs to repair or replace damaged or diseased parts of the body. This field is rapidly advancing, with new therapies being developed for conditions such as heart disease, diabetes, and spinal cord injuries.

The use of precision medicine is gaining more traction, this approach which is based on the genetic makeup of each patient, has the potential to lead to more effective and efficient treatments for a wide range of diseases, including cancer and rare genetic disorders.

The integration of digital technology into healthcare is increasingly becoming a reality, enabling real-time monitoring and data collection, which will help to improve treatment outcomes. Biotech companies are now investing in digital health solutions, including wearable devices, mobile apps, and telemedicine, to improve patient care.

AI is becoming increasingly important in the biotech industry, with companies using machine learning and deep learning to analyze large amounts of data, including genetic data, to identify new drug targets and develop new therapies.

VCs Main Focus Areas in Biotech

Depending on the VC firm’s investment strategy and the portfolio the focus may vary but some general areas of interest include:

Biotechnology: Startups working on developing new drugs, therapies, and diagnostics, as well as those working on advancing biotechnology platforms such as gene therapy, CRISPR, and synthetic biology.

Medical Devices: Such as implantable devices, diagnostic tools, and digital health technologies.

Digital Health: Telemedicine, virtual care, and remote monitoring technologies.

Biotech IT: This includes startups working on developing new software and IT solutions to support the biotech industry, such as bioinformatics, computational biology, and data analytics.

Biotech Services: Such as contract research and development, clinical trial management, and regulatory consulting.

Biotech Agriculture: Startups working on developing new tools and technologies to improve crop yields, reduce waste, and improve food safety.

Biotech Energy: New biofuels, renewable energy, and sustainable materials

VCs Investing in Biotech Companies

8VC

Location: San Francisco, California, United States

About: 8VC aims to transform the technology infrastructure behind many industries.

Investment Stages: Seed, Series A, Series B, Growth

Recent Investments:

Oula

Anduril

Loop

Check out 8VC’s profile on our Connect Investor Database

Arch Venture Partners

Location: Chicago, Illinois, United States

About: ARCH Venture Partners invests primarily in companies co-founded with leading scientists and entrepreneurs, concentrating on bringing to market innovations in information technology, life sciences, and physical sciences. ARCH currently manages five funds totaling over $700 million and has invested in the earliest venture capital rounds for more than 90 companies. ARCH investors include major corporations, financial institutions, and private investors.

Investment Stages: Seed, Series A, Series B, Series C, Growth

Recent Investments:

Synchron

FogPharma

Treeline Biosciences

Check out Arch Venture Partners’ profile on our Connect Investor Database

5AM Ventures

Location: Menlo Park, California, United States

About: 5AM Ventures is a California-based venture capital firm that aims to finance seed- and early-stage life sciences companies.

Investment Stages: Series A, Series B, Growth

Recent Investments:

Escient Pharmaceuticals

CAMP4 Therapeutics

Dianthus Therapeutics

Check out 5AM Ventures’ profile on our Connect Investor Database

Atlas Venture

Location: Cambridge, Massachusetts, United States

About: Atlas Venture is the leading international early-stage venture capital firm, investing in communications, information technology and life sciences companies. Atlas Venture investments are evenly divided between the United States and Europe. Founded in 1980, Atlas Venture has organized six international funds, and currently manages more than $2.1 billion in committed capital.

Investment Stages: Seed, Series A, Series B, Growth

Recent Investments:

Nimbus Therapeutics

Be Biopharma

Triana Biomedicines

Check out Atlas Ventures’ profile on our Connect Investor Database

Forum Ventures

Location: New York City, San Francisco, and Toronto, United States

Thesis: B2B SaaS; Future of Work, E-commerce enablement, Supply Chain & Logistics, Marketplace, Fintech, Healthcare

Investment Stages: Pre-Seed, Seed

Recent Investments:

Sandbox Banking

Tusk Logistics

Vergo

Check out Forum Ventures profile on our Connect Investor Database

OrbiMed

Location: New York City, United States

About: We have been investing globally for over 20 years across the healthcare industry: from early-stage private companies to large multinational corporations. Our team of over 100 distinguished scientific, medical, investment, and other professionals manages over $17 billion across public and private company investments worldwide.

Investment Stages: Series A, Series B, Series C

Recent Investments:

Pathalys Pharma

Amolyt Pharma

MBX Biosciences

Check out OrbiMed’s profile on our Connect Investor Database

Polaris Partners

Location: Massachusetts, United States

About: Polaris Partners has a 20+ year history of partnering with entrepreneurs and innovators improving the way we live and work.

Investment Stages: Series A, Series B, Series C

Recent Investments:

Jnana Therapeutics

FOLX Health

CAMP4 Therapeutics

Check out Polaris Partners’ profile on our Connect Investor Database

Third Rock Ventures

Location: Boston, Massachusetts, United States

About: Telescope Partners is an active growth equity firm partnering with best in class entrepreneurs across the technology landscape. We invest ourselves and our capital in companies building long-term, sustainable businesses.

Investment Stages: Series A, Series B

Recent Investments:

Corvia Medical

Terremoto Biosciences

MOMA Therapeutics

Check out Third Rock Ventures’ profile on our Connect Investor Database

Versant Ventures

Location: San Francisco, California, United States

About: Versant Ventures caters to the healthcare sector with early and later stage venture, private equity, and debt financing investments.

Investment Stages: Pre-Seed, Seed, Series A, Series B, Growth

Recent Investments:

iECure

Jnana Therapeutics

Nested Therapeutics

Check out Versant Ventures profile on our Connect Investor Database

Sofinnova Partners

Location: London, United Kingdom

About: Sofinnova Partners is a venture capital firm that invests in the life sciences sector, from seed to later-stage.

Thesis: We invest in people and science to create opportunity. We commit to long-term partnerships with entrepreneurs who are as passionate as we are about pushing the frontiers of innovation to contribute to a better future.

Investment Stages: Seed, Series A, Series B, Series C, Growth

Recent Investments:

Amolyt Pharma

Micropep

Prometheus Materials

Check out Sofinnova Partners’ profile on our Connect Investor Database

F-Prime Capital

Location: Cambridge, Massachusetts, United States

About: F-Prime grew from one of America’s great entrepreneurial success stories. Fidelity Investments was founded in 1946 and grew from a single mutual fund into one of the largest asset management firms in the world, with over $2 trillion under management. For the last fifty years, our independent venture capital group has had the privilege of backing other great entrepreneurs as they built ground-breaking companies, including Atari, Ironwood Pharmaceuticals and MCI.

Investment Stages: Seed, Series A, Series B

Recent Investments:

Neumora Therapeutics

Elicidata

Ashby

Check out F-Prime Capital’s profile on our Connect Investor Database

Start Your Next Round with Visible

We believe great outcomes happen when founders forge relationships with investors and potential investors. We created our Connect Investor Database to help you in the first step of this journey.

Instead of wasting time trying to figure out investor fit and profile for their given stage and industry, we created filters allowing you to find VCs and accelerators who are looking to invest in companies like you. Check out all our investors here and filter as needed.

After learning more about them with the profile information and resources given you can reach out to them with a tailored email. To help craft that first email check out 5 Strategies for Cold Emailing Potential Investors and How to Cold Email Investors: A Video by Michael Seibel of YC.

After finding the right Investor you can create a personalized investor database with Visible. Combine qualified investors from Visible Connect with your own investor lists to share targeted Updates, decks, and dashboards. Start your free trial here.

founders

Fundraising

Reporting

8 Ways to Level Up Your Investor Relations in 2023

Raise capital, update investors and engage your team from a single platform. Try Visible free for 14 days.

2022 has been a challenging year in the startup world. After a hot start to the year, funding and growth has slowed. As Tomasz Tunguz pointed out in the chart below, funding has collapsed since October.

At Visible, we’ve spent 2022 building tools to help founders update investors, raise capital, and track key metrics. With the help of these 6 new features, founders will be able to level up their investor relations and strike when the funding iron is hot. Check them out below:

Share and Comment on Fundraising Pipelines

You can now share a fundraising pipeline via link. This allows you to ask current investors or peers for introductions or information about investors in your pipeline. In turn, your investors or peers can leave a quick comment to help make an introduction to investors they know.

Customize Fundraising Columns and Properties

Our fundraising pipelines have become more flexible so you can further tailor your pipeline to match your fundraise. With customizable fundraising columns and properties, you will be able to select the properties you would like to see at the pipeline level. Check out some of the most popular custom fundraising properties below:

Min & max check size

Who can make/made a connection?

Data room shared?

Investor type

Will they lead?

Log Emails with Potential Investors in Visible

With our BCC tool, founders will be able to simply copy & paste their unique BCC email address into any email. From here, the email will automatically be tracked with the corresponding contact in Visible. This is great for cold emailing investors, nurturing investors, and staying in touch with current investors. To learn how to get BCC set up with your Visible account, head here.

Automatic Fundraising Follow-up Reminders

Over the course of a fundraise, most founders should expect to communicate with 50-100+ investors. In order to best help you stay on top of their ongoing conversations, you can now set email reminders for when to follow up with potential investors. This is a great way to speed up the fundraising process and get back to what matters most — building your business.

Pitch Deck Branding and Custom Domains

Control your fundraise from start to finish. With Visible Decks, you can share your deck using your own domain. Plus you can customize the color palette of your deck viewer to match your brand. You can check out an example here.

Include Pitch Decks in Updates

Keeping current and potential investors in the loop is a great way to speed up the process when you are ready to raise capital. In order to best help nurture current and potential investors, you can now include your Visible Decks directly in Updates. This can help when kicking off a raise, nurturing potential investors, or sharing a board deck with your board members.

Custom Properties as Merge Tags in Updates

As we mentioned above, updating current investors and nurturing potential investors is a great way to speed up a fundraise when the time is right. To best help you customize your Visible Updates, you can now use custom properties as merge tags in Updates. For example, if you’re tracking the city in which your investors live you can use that in an Update.

Improved Dashboard Layout and Widgets

If you’re sharing Visible Dashboards with your team or more involved investors, you can now customize the layout and include additional widgets (like text, tables, and variance reports). This will allow you to give additional context to any of the data your key stakeholders might be looking at regularly.

Our mission at Visible is to help more founders succeed. Over the next 12 months, we’ll be building more tools to help you do just that. Raise capital, update investors and engage your team from a single platform. Try Visible free for 14 days.

founders

Reporting

Wringing Out Investor Updates

A few years ago we interviewed Lindsay Tjepkema, Founder of Casted, about starting a podcast. One of her key tips was to “wring out your content.” If you’re going to take the time to record a podcast, you should take the time to repurpose and distribute that content on different channels.

How to Repurpose Investor Updates

The same is true for investor relations and fundraising. If you’re going to take the time to send an investor update, you can “wring out” your metrics, big wins, asks, audience, etc. to fuel other fundraising materials. An investor update can be re-purposed to help build out other fundraising assets — for example:

Potential Investor Monthly Updates — For a simple hack, take your normal investor update and edit it down to a few key metrics and wins to nurture potential investors.

Pitch Decks — If you’re sharing data in your investor updates, this can be used to help build out the different metrics and data you’ll need in a pitch deck.

Data Rooms — Data rooms are a combination of all of the data and assets you’ll share over the course of a fundraise. Including past investor updates is a surefire way to show potential investors your history of regular communication.

Cold Emails to Investors — Investor updates can be a starting point for crafting a cold email to potential investors.

Board Decks — There is likely a lot of crossover between the content in an investor update and a quarterly board meeting. Investor updates can be a great backbone for building out the different slides in a board deck.

Team Updates — A modified version of your investor update is also a great way to keep your team in the loop and build trust.

Investor communication is no easy feat for founders. Taking the time to send monthly updates already puts you ahead of 50% of portfolio companies — taking the few minutes to wring out your investor updates will help you speed up your next raise when you are ready.

Reading List

How to Handle: Keeping Your Investors Updated

Brett Brohl of Bread & Butter Ventures breaks down the 5 components he likes to see in investor updates. Learn more

Investor Outreach Strategy: 9 Step Guide

On the Visible Blog, we share a 9 step guide to help founders develop a plan to reach out to potential investors. Read more

Why You Should Always Send Your Investor Updates

Kera DeMars of Hustle Fund makes the case why founders should send investor updates. Read more

investors

Reporting

Fundraising

Tips for Writing LP Updates for Emerging Managers (with Templates)

The General Partner (GP) and Limited Partner (LP) relationship is built on trust. The best way to establish trust with LPs is through transparency, authenticity, and regular communication. When LP reporting is done well, LPs should easily be able to understand how both the fund and the fund manager are performing and be able to use this information to inform their investment strategies in the future.

The best GPs view sending LP Updates as a relationship-building activity and as a fundraising tool — not as a way to simply check off a requirement from their LPA’s.

For emerging managers, your relationships with initial LPs are of critical importance for your reputation as a fund manager and future fundraising. This rapport forms the basis of the fund manager’s credibility and will surface again when future LPs are doing diligence on the emerging manager. First-time fund managers will need to have clean data to support their track record and positive relationships with current LPs to set themselves up for success in raising additional funds.

The Weekend Fund recently wrote a thoughtful article on How to Write LP Updates with four main takeaways:

Send LP updates consistently

Go beyond the basics

Be authentic

Don’t share sensitive information without portfolio founders’ sign-off

We’ve translated this guidance into actionable steps that can be streamlined with Visible’s Portfolio Monitoring and Reporting tools below.

1. Send LP updates consistently.

Weekend Fund Advice — “One of the biggest mistakes new fund managers can make is not sending LP updates consistently. Most send quarterly updates. At Weekend Fund we send updates approximately every two months. Regular, detailed, and transparent updates builds trust with your LPs, which is particularly important if you want them to write a check into your next fund.”

Visible provides fund managers with tools to make sending updates to LPs on a regular basis easier.

To start, you can Upload Your LP Contacts (including custom contact fields) via CSV within seconds. Then you can create Custom Lists to organize your contacts. We suggest organizing your LPs by Fund and also by whether they’re a current LP or a potential LP.

This means within minutes you have all your contacts organized into custom segments that are useful to you. You can then simply choose which list you want to send an Update to in the future.

Visible also streamlines the creation of your LP Update content by letting you choose from an Update Template Library. You can easily pull a template into your account, further customize it as needed, and save it as your own template to use for future updates.

2. Go beyond the basics.

Weekend Fund Advice — “Of course, you should introduce new investments, share updates from the portfolio, report performance metrics, and other key updates from the fund, but the best updates go a step further to educate and inform LPs. This might include your analysis on the market, perspective on emerging trends, or learnings from experiments.”

Visible’s LP Update editor supports rich text, videos, images, files, and perhaps best of all — custom data visualizations. This means you can visualize your custom fund analytics that will resonate with your LPs and embed them directly into your Update. The data is derived from data hosted within your Visible account and updates your charts in real time.

It’s also a great idea to include a market overview section at the top of your update to shed light on how you’re evaluating and staying ahead of the curve in the markets in which you invest. This is a great way to continue to instill LP confidence in you as the steward of their capital. On top of that, it’s important to remember that “many LPs invest in funds as a learning opportunity. The updates are the primary artifact to support that learning.” (Source)

You can also stand out to LPs by getting creative and embedding a video recording of your recent portfolio updates directly into your Updates. Open the update below to view an example of how a Visible customer incorporates video into their updates —

—> View Update Example with Video Embed

3. Be authentic.

Weekend Fund Advice — In general, people gravitate toward authenticity. Writing with personality is more engaging and magnetic. LP updates are an opportunity to share your unique voice and build your fund’s brand.

The Weekend Fund incorporates authenticity in their updates through their narrative updates and transparency, but also by including personal photos.

Visible lets you embed personal photos directly into your Update in two clicks.

—> View the Weekend Fund’s Update Template

4. Don’t share sensitive information without portfolio founders’ sign-off.

Weekend Fund Advice — “Fund managers often have inside knowledge into how a company is doing. Some founders are extremely sensitive to information shared about their company, even when the news is positive. It’s prudent to get approval for any non-public information shared with LPs.”

Visible recommends explicitly asking for portfolio company’s permission to share information with LPs. One way to do this is by incorporating it into the descriptions of your Request blocks. (How to Build a Request in Visible).

Here’s an example below —

It’s important to remember that as a GP you’re not only competing with other GPs for LP capital but also with every other asset class. So it’s to your advantage to use every tool in your toolkit to stand out and impress LPs.

Over 400+ VC funds are using Visible to streamline their portfolio monitoring and reporting processes.

founders

Reporting

The 5 Metrics VCs Want to See

The world has been consumed by data and metrics — startups are no exception. Founders need to leverage their key data and KPIs to fuel growth, build products, create interest from potential investors, and more.

At Visible, we have a tool built for VC funds to collect data from their portfolio companies and enable GPs to report to their investors (LPs). In order to better help founders determine what metrics they should be tracking, we analyzed our data and found the most common metrics VCs are collecting from their portfolio companies. Check them out below:

The Most Common Metrics

Revenue

Cash

Headcount

Customers / Users

Total Operating Expenses

The 5 metrics above are high level metrics that might sound obvious. However, great founders are able to recall them at anytime. Not knowing your key operating metrics is a ????. These can be used as the backbone for investor updates, board meetings, and determining more granular metrics to track.

P.S. 75% of investors are collecting anywhere between 1 and 10 metrics so chances are your own investor updates should land in the same range.

Reading List

Key Insights from High Alpha’s Finance Leaders

The team at High Alpha shares key takeaways from the finance leaders in their portfolio — they share why efficiency metrics are key in the current market, how data storytelling can be a differentiator, and more. Read more

Time to Refine Your Metrics: Defining Growth and Success at a PLG Company

Mikaela Gluck of OpenView Ventures highlights the key metrics that product-led companies should be tracking. Read more

6 Metrics Every Startup Founder Should Track

On the Visible Blog, we share 6 basic metrics that every founder be tracking and sharing with their stakeholders. Read more

founders

Reporting

Build Stronger Investor Relationships with Video Updates

The following is a guest post from the team at Sendspark. Use Sendspark to connect with customers, investors, team members, and other stakeholders. Learn more here.

Communicating with investors is a skill all founders should hone. Regular and predictable communication is a surefire way to build trust and improve your odds of unlocking an investor’s capital, network, experience, and more. Learn how you can leverage video + email updates to communicate with your investors below:

Why Send Videos in Investor Updates

Whether you’re pitching new investors or updating existing ones, sending videos to investors can help you build investor relationships.

Here are some ways it can help you:

Stand out from the crowd

Build a personal relationship

Show, rather than tell

Save time

Have great communication skills

Let’s dive into the best use cases and strategies that are going to help you close your next round!

When to Send Videos to Investors

1. Investor Outreach

A strong video in your investor pitch can help you get that first conversation.

One question that comes up a lot is should you make a personalized video when pitching investors?

And the answer is a bit nuanced. The world seems to be changing, but right now, I’d still recommend getting a warm introduction to an investor (even if that means cold emailing one of their portfolio founders), and using a video as a supplemental material in your “forwardable email”.

This helps you play it cool, while still getting valuable information across in your blurb and video.

Personalized videos become significantly more important after the first meeting, on your way to closing the deal.

2. Investor Follow Up

Sending a video recap after an investor conversation is a great way to lock in key points. Investors might have had 10 other conversations with strong founders that day, so this short video can remind them what they liked most about you. It can also help you stand out among the competition.

A video recap will give investors a shareable clip to pass around to other partners or decision makers at the firm who didn’t get to speak to you directly. This way, the wonderful aspects that make your pitch unique won’t get lost in translation.

For this video, I’d 100% recommend making it truly personalized to the investor you spoke with. Don’t try to include everything about your business, just the key points that you found best resonated with them during the call.

3. Diligence

When it comes to diligence, video messages can help you speed up the process. Here are some ways you can use video to get to a “yes” faster:

Record over your usage dashboards or product metrics

Request video testimonials from customers who can advocate for your product

Respond to any objections or concerns thoroughly

4. Investor Updates

An investor investing is the first step in a long partnership. Great investor communication over time will help you build a strong partnership, help investors help you, and lead to subsequent checks in future rounds.

Just like in B2B Sales, it’s easier to get your existing customers to pay more than to close new customers. Never take your investors for granted, and continue to keep them informed and excited about what you’re building.

Here are some ways you can strengthen your investor updates with video:

Record yourself discussing your current initiatives

Show off a new feature or product launch

Introduce a new team member or advisor

Request a video from a customer to share why this matters to them

How to Send Videos in Investor Updates

You can send videos in investor updates using Sendspark and Visible together. First, create a free account with Sendspark to easily record videos of yourself or your product.

Sendspark is great for this because…

It’s super fast to record a video of yourself or your product — no editing needed!

Videos will automatically look polished and professional with your own branding and logo

You can add calls-to-action for investors to schedule a meeting, reply with video, or take another next step

You get insight into who’s watching your video, how far they watched, and what actions they’re taking

After creating your video, just paste your video URL into your investor update on Visible. You’ll see the video preview automatically appear in your email, giving you a super polished and professional-looking update. Check out an example below:

Give Visible a free try for 14 days here. Send investor updates, manage your fundraise, and keep tabs on your most important metrics — all from one platform.

Tips for Making Great Investor Videos

Be clear and concise. When it comes to pitching investors, Aaron Blumenthal, Director of Global Accelerator Programs at 500 Startups, says, “every 10 seconds buys you your next 10 seconds.” You need to keep your viewer engaged for the entire length of your video — so make it easy for yourself and keep your video to 20-30 seconds.

Give the gift of information. Whether it’s a pitch, a recap, or an update, reward your viewer with a nugget of information that makes them feel great that they watched the video. That being said, remember rule #1 and don’t try to put everything in the video. Just discuss 1-2 points that are better said or shown than written.

Be conversational. Even if you are recording a video for multiple investors at once, each one is viewing alone, so use singular words like “you” instead of “y’all” to make the experience more intimate and personable. Imagine you are speaking 1×1 to an investor via Zoom — not pitching a room full of people at Demo Day.

Know your video will be shared. This has two implications: (1) don’t put confidential information in your video that you don’t want floating around, and (2) use this knowledge to your advantage with soundbites that you want shared – your vision, your asks, your unique spark, etc. Don’t include content that you wouldn’t want shared among different audiences.

Don’t overthink it. Remember: we are our own harshest critics (especially us founders ????). Investors — especially those who have already invested — love getting these more personal updates. They are not judging you nearly as hard as you are judging yourself (especially if your numbers are up and to the right).

Final Thoughts

When fundraising, and running a business in general, you see a lot of “shoulds.” You should do this, you shouldn’t do that. All great founders do this, and if you don’t, you’ll never succeed. However, that’s not the point of this post. You don’t HAVE to use video when emailing investors. Rather, it’s a great option to have in your arsenal.

My belief is that the founders who win lean into their strengths and indisynchronies. What makes you special? What makes you unique? Video can help you tap into that – and easily communicate who you are, what you’re doing, and why it’s important – in far less time than text. I hope Sendspark helps you have fun and enjoy the ride.

investors

Reporting

[Webinar Recording] ESG Best Practices for VCs

Environmental, Social, and Governance (ESG) principles are becoming a topic of increasing interest in Venture Capital — and for a good reason. Beyond the benefits of long-term, multistakeholder value, the data is clear that environmentally-and-socially responsible companies will outperform in years to come.

On October 4th we discussed ESG best practices for Venture Capital investors with Tracy Barba from 500 Startups and ESG4VC.

Tracy Barba has been working in Venture Capital for the past 25+ years and at the forefront of implementing ESG practices in Venture Capital since 2012. Most recently she joined 500 Startups as their Head of ESG and Global Stakeholder Engagement where she leads the design and implementation of their ESG policy and practices.

We’re grateful she could join us and discuss the following topics:

What is ESG and why is it becoming mainstream now

Best practices for incorporating ESG into your fund processes

Tips for monitoring ESG across your portfolio

Q&A

investors

Reporting

Customer Stories

[Webinar Recording] Building Scalable Portfolio Support

Portfolio support plays an important part in differentiating good investors from great investors. However, it can be hard to be a value-add investor when time and resources are constrained, which is why building scalable support is key.

We were joined by Jessica Lowenstein, Head of Platform at K50 Ventures, and Erica Amatori, Head of Platform at Left Lane Capital for a discussion on:

How each fund defines its approach to support

What systems/processes are needed to scale support

Tips for onboarding new companies into your portfolio

Navigating information flow between the investment team and ops

Advice for new funds thinking about formalizing their approach to support

Visible for Investors is a founders-first portfolio monitoring and reporting platform. Schedule time with our team to learn more.

founders

Reporting

Investor Relationship Management 101: How to Manage Your Startups Interactions with Investors

Building a startup is incredibly difficult. Leading an early-stage startup can almost feel impossible. On top of building a product, successfully selling and marketing a product, hiring top talent, and more – a founder is responsible for engaging with stakeholders across the board (team members, investors, board members, mentors, etc.)

Related Resource: The Complete Guide to Investor Reporting and Updates

Investors might simply seem like a source of capital. However, they can offer so much more. Investors can offer future capital, their own experience, and network to help move your business forward. It is your responsibility as a founder to have a game plan to place to communicate and leverage your investors.

Learn more about building an investor relationship management plan below:

What is Investor Relationship Management?

As we previously mentioned, investors can offer much more than capital. Venture capitalists and startup investors have likely been operators themselves. They will be able to offer future capital, takeaways from their own experiences (and their other investment experiences), and their own network to help with hiring and finding early customers.

Related Resource: The Complete Guide to Stakeholder Management for Startup Founders

At the end of the day, investors are human and value relationships. It is a founder’s duty to properly communicate with investors and strengthen relationships. While each and every founder <> investor relationship is different, a strong relationship management system looks something like this:

Monthly investor updates sent via email

Quarterly board meetings (in person or via Zoom)

One-off calls and conversations

Related Resource: How to Create a Board Deck (with Template)

Of course, all of these are business-centric meetings so it is important to make sure to build personal relationships along the way. Learn more about the key components and benefits of strong investor relationship management below:

Key Components of Investor Relationship Management

Relationships require work. A founder <> investor relationship is no different. The components of building a relationship with investors will vary from person to person but we generally suggest leveraging the following tools as a backbone for your investor relations.

Related Resource: How to Build a Strong Investor Relations Strategy

1) Monthly Investor Updates

At Visible, we have found that companies that regularly communicate with their investors are 300% more likely to raise follow on funding. A monthly investor update can go a long way when it comes to building relationships with investors.

Related Resource: How To Write the Perfect Investor Update (Tips and Templates)

Monthly updates should take no more than a few minutes of your time and can pay dividends down the road. You’ll be able to regularly surface challenges you are facing to get your investors to help on the fly.

Check out a few popular monthly updates for inspiration below:

The Visible “Standard” Investor Update Template

Visible Lite Monthly Update

Y Combinator Investor Update

Related Resource: How to Write the Perfect Investment Memo

2) Quarterly Board Meetings

Monthly updates are great for keeping investors in the loop and getting their input on the fly. Quarterly board meetings are a great opportunity to look back at the quarter and shape your future roadmap and decisions with your board.

Quarterly board meetings will allow you to sit down with vital stakeholders and spend valuable time digging into future decisions and strategies. However, it is important that you as a founder come to a board meeting well prepared and make the most of the time. We recommend sharing some information beforehand so investors can prepare as well.

3) One-Off Meetings

Monthly investors and quarterly board meetings should be the minimum when it comes to building investor relations. Inevitably there will be conversations and questions that arise that will not fit into either. With that said, it is important that you reach out to individual investors for one-off conversations and meetings as needed.

On top of being an opportunity to tap into a specific investor’s capital, network, experience, etc. a one-off meeting is an opportunity to strengthen your personal relationship with them.

4) Tools and Management

At Visible, we oftentimes compare a fundraise and investor relations to a traditional B2B sales and marketing funnel. At the top of your funnel, you are bringing in new investors (leads), building relationships throughout the middle of the funnel, and closing and delighting them at the bottom of the funnel.

Just as a sales and marketing team has dedicated tools we believe the same should for investor relations. With Visible you can find investors, send monthly Updates, share your pitch deck, and manage relationships with our CRM. Give Visible a free try for 14 days here.

Related Resource: Investor CRM: Seamlessly Manage Relationships and Finances

Related Resource: Why a CRM is Essential for Investor Relations

Related Resource: How to Find Investors

Best Practices: Investor Relationship Management Edition

As we’ve previously mentioned, every founder and investor relationship is different. We find that the stage, geography, focus, etc. might impact how to best communicate and build relationships with investors.

However, there are a few best practices that generally stay consistent from relationship to relationship. Check out a few best practices for managing relationships with investors below:

Include Wins and Losses

First things first, investors need a pulse on how your business is performing so they know where they can best help. We suggest sharing both your wins and losses with investors on a monthly basis.

Sharing wins is easy and investors want to help celebrate your accomplishments. Sharing losses is what differentiates okay from great communication. By being able to be transparent and share things you are struggling with investors will be able to build trust with you and your business and help you work through them.

Share Key Metrics

Investors will also want a quantifiable pulse on your business. Sharing a handful of key metrics is a great way to keep investors in the loop. We always recommend working through the specific metrics with your investors. Once you decide what you are going to share, make sure the metrics you are sharing stay consistent from month to month.

Related Resource: 6 Metrics Every Startup Founder Should Track

Make Asks

Arguably one of the most beneficial parts of sending investor updates is the opportunity to make an asks. Investors likely have been in your shoes before (or are working with other companies in a similar position).

Use this as an opportunity to make targeted asks to tap into their capital, experience, and network. We recommend being as specific as possible and making the job as easy as possible for the investor.

Stay Consistent

Keeping things predictable and consistent from month to month is a great way to strengthen trust with investors. For example, you’ll want to make sure you are calculating metrics the same way from month to month or are sharing your Updates around the same time of the month.

Inconsistencies might trigger a red flag and investors will question if something is going south.

Respond Promptly to Investors

Being responsible can go a long way in any relationship. Be sure to respond to your investors as quickly as possible. Even if you do not have an answer being responsive is a great way to strengthen your relationship.

What is an Investor Relations Strategy?

At the end of the day, investor relations mirror any relationship. By communicating with investors and having a strategy in place, you’ll be able to set yourself up for future success.

Related Resource: 6 Helpful Networking Tips for Connecting With Investors

Manage Your Investor Relationships with the Help of Visible

With Visible you can find investors, send monthly Updates, share your pitch deck, and manage relationships with our CRM. Give Visible a free try for 14 days here.

investors

Reporting

A Guide to LP Reporting Best Practices for VCs

The foundation of a great relationship between General Partners and their Limited Partners (LPs) is based on trust and transparency. A great way to foster this dynamic is by sending regular, insightful communications to your LPs.

While it can feel intimidating to go outside the box and share details about your fund performance in addition to the standard LP reporting requirements, this is a great way to stand out as a General Partner. With competition for funding being as intense as it is in today's climate, it's a smart move to go above and beyond to impress LPs and establish a trustworthy reputation as a GP.

A guide to LP reporting best practices for VCs

This guide was created in partnership with Aduro Advisors, a premier Fund Admin led by industry veterans. We partnered with Aduro for a webinar where we discussed the process of reporting to Limited Partners and best practices in-depth. This guide is a summary of that discussion.

The contents of this guide include:

The importance of the LP reporting

LP reporting best practices

Sending LP updates as a fundraising strategy

What to include in an LP Update

A quarterly LP reporting update template

LP update templates for VCs

If you're not sure where to get started with your communication with LPs try checking out LP update templates for VCs or asking other GPs in your network for examples of what they're sharing with LPs.

Some basic LP communication rules to follow include:

1. Send your updates on a regular cadence

2. Go beyond just the basics

3. Be authentic with your communications

4. Don't share sensitive information about your companies

For more tips check out: Tips for Writing LP Updates for Emerging Managers (with Templates)

For more inspiration check out Visible's LP template library for inspiration.

Resources for reporting to LPs for venture capital investors

Check out these additional resources to inspire your next LP communication.

How to Report to Limited Partners with Gale Wilkinson of Vitalize VC

Tips for Writing LP Updates for Emerging Managers (with Templates)

4 Tear Sheet Examples to Give You Inspiration for Your Next LP Report

investors

Reporting

Customer Stories

[Webinar] LP Reporting Best Practices with Aduro Advisors

Braughm Ricke is the Founder and CEO of Aduro Advisors — a premier fund administrator, selected by Fund Managers for its purpose-built software platform, FundPanel.io, and highly-trained service team led by industry veterans.

Braughm joined Visible.vc on May 10, 2022 to discuss best practices for engaging with and reporting to limited partners. A summary of the insights from the webinar is captured in a report co-created by Visible and Aduro.

The topics covered in the report include:

The importance of the LP Reporting

LP Reporting Best Practices

Updates as a Fundraising Strategy

LP Reporting Content Breakdown

[Template] Quarterly LP Reporting Update

Visible for Investors is a founders-first portfolio monitoring and reporting platform. Schedule time with our team to learn more.

investors

Reporting

Customer Stories

How to Report to Limited Partners with Gale Wilkinson of Vitalize VC

Stay engaged with your founders right from your pocket. Monitor your portfolio and be the value-add investor you want to be with Visible for Investors. Learn more

One of the core responsibilities of a general partner (GP) is to report with both their Limited Partners (LPs) and portfolio companies. Gale Wilkinson, Founder of Vitalize Venture Capital, joined us to break down how their team engages with and reports to their LPs.

Why send LP Reports?

Just like any relationship, the LP <> GP relationship is all about trust. In order to better establish a relationship and improve the odds of raising capital for a future fund, GPs and venture funds need to have a system in place to report to and communicate with their LPs.

>> Check out Visible’s LP Template Library here.

Raise Future Capital

Not only are venture funds and general partners competing against other venture funds for LP capital, they are also competing against other asset classes. Of course, LPs will look back at your performance of previous investments but will also be judging you and your skills as a partner. Having a proven history of strong performance and communication is a surefire way to increase a GPs odds of raising funds.

Help Portfolio Companies

Different limited partners will offer different skill sets and opportunities. All portfolio companies are looking for help — that might be customer introductions, fundraising options, and hiring. Limited Partners can be a great source for VCs to help out portfolio companies. In turn, this only improves a founder’s relationship with the fund and improves their odds of success.

Due Diligence

Some limited partners will have a proven track record or expertise in the market. Because of this, they might understand the space even further and can help when it comes to due diligence and vetting potential investments. As Gale shares above, they have an LP that has expertise in workflow tech and help them with due diligence in the space.

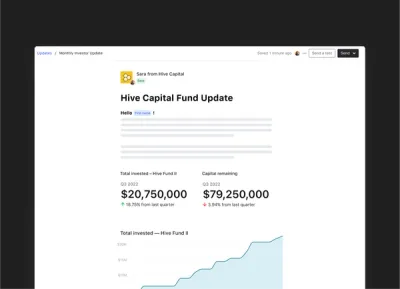

How to create a tear sheet for your LPs

Gale and the team at Vitalize have done an incredible job of using tear sheets to help keep their LPs in the loop. The Vitalize team uses both the qualitative and quantitative data they collect from their portfolio companies and create a single page tear sheet for each company they can share with their LPs. Check out a few example tear sheets below:

A few things they include in their tear sheets:

Company Information

LPs are generally busy and have investments across many different asset classes. In order to help with them understand what a portfolio company does, be sure to include a quick description and the reason why you invested.

Qualitative Updates

The team at Vitalize also likes to include qualitative updates from each portfolio company. This is generally tied to revenue milestones but can also cover financing rounds and major hires.

Investment Information

Of course, LPs want to see the financials and information behind an investment. The team at Vitalize includes basic investment information like initial investment dates, capital invested, Vitalize’s value, and more.

Core Metrics

Using the KPIs and data that the Vitalize team collects from their portfolio companies they build a simple table that shows a companies quarterly performance. A few of the metrics the Vitalize team tracks and shares are:

Revenue

COGs/COS

Gross Margin %

Total Expenses

EBITDA

Cash Balance

Months of Runway

LP Reporting Templates to Get You Started

Ready to take your LP reporting to the next level? Check out our LP Reporting Templates to get you started. Or schedule a call with our team to learn more here.

founders

Fundraising

Reporting

Valuing Startups: 10 Popular Methods

Every startup is aiming for a high valuation for their business. In business, valuation is the process of evaluating the present value of the asset in hand, in this case the overall value that a startup is worth. For startups, there are a variety of popular methods folks use to evaluate a business and determine its overall valuation. Different valuation methods are used for different reasons. To help break it down, we’ve outlined 10 popular methods for valuing startups.

Related Reading: Pre-money vs Post-money: Essential Startup Knowledge + 409a Valuation: Everything a Founder Needs to Know

1. The Berkus Method

Startups are risky. Less than 10% of startups make it past the first year of existence so determining the valuation of a startup, especially a brand new one with only months of lifespan can be extremely challenging. The Berkus Method is an attempted way to assess value without the traditional revenue metrics that many methods take into account for more mature organizations.

The Berkus Method quantifies value by assessing qualitative qualities instead of quantitative ones. Value is assessed in the Berkus Method with five main elements. The elements considered within the Berkus Method include value business model (base value), available prototype to assess the technology risk and viability, founding team members and their abilities or industry knowledge, strategic relationships within the space or team, existing customers or first sales that prove viability. A quantitative value can be tied to each relevant quantitative factor with the Berkus Method.

Source: Angel Capital Association

Pro Tip: When To Use This Method

The Berkus Method should be used pre-revenue. It can be a valuable valuation method when a new startup is formed with expert founders or former successful startup leaders at the helm or when a strong, viable product is in place. In these examples, there is enough qualitative information at hand to justify a quantitative value.

Related Resource: What is Pre-Revenue Funding?

2. Comparable Transactions Method

This valuation method at the highest level is essentially valuing the business based on what consumers would currently pay for it. This is one of the most conventional methods of valuation. To make a comparable transaction valuation, an investor or evaluator will look at companies of a similar size, revenue range, industry, and business model and see what they were valued at or sold for. This method is looking at validation from what others were willing to pay for similar companies in an acquisition or merger and use that to make a fair, or comparable, offer on the company seeking valuation.

Pro Tip: When To Use This Method

The most common scenario where the Comparable Transaction Method might be used is through a big M&A (Merger and Acquisition) deal.

3. Scorecard Valuation Method

When a company hasn’t produced any revenue yet, as an early-stage startup, it can be hard for investors to make a solid bet on the probability of their investments’ success. The Scorecard Valuation Method is one method that relies on the past investments of others taking similar bets and risks on pre-revenue startups. Similar to the comparable transaction method, the scorecard valuation method looks at similar startups or companies in the company at questions’ industry.

This valuation method looks at these similar companies and sees what types of valuation they received by other investors. From there, the median will be calculated from the value of all the similar companies’ valuations and this median will determine the average value of the target company. In addition to the median value placed on the competitive landscape, scorecards are looking at the strengths and weaknesses of the market as assessed by other investors and scoring their investment in question weighted with the following criteria compared to the other companies in the space:

Board, entrepreneur, the management team – 25%

Size of opportunity – 20%

Technology/Product – 18%

Marketing/Sales – 15%

Need for additional financing – 10%

Others – 10%

A company may be valued higher than the median with the scorecard method if the size of opportunity or board/management team is exceptional quality or vice versa, maybe docked if the tech is strong but the leadership is assessed as in-experienced.

Pro Tip: When To Use This Method

This method may be used by a startup that is in a crowded space such as marketing tech, sales tech, fintech etc.. and is pre-revenue; With a lot of similar or adjacent companies raising rounds and receiving valuations, a scorecard can be used successfully because there are is a lot of adjacent validation in the market.

4. Cost-to-Duplicate Approach

Startups are a risky investment for many reasons, but one big one is that it typically takes a lot of capital to run and scale a business and many startups struggle to manage their run rate and burn rate efficiently.

The Cost-to-Duplicate Approach to valuation considers all costs and expenses associated with the startup. The costs and expenses reviewed include the development of the product and the purchase of physical assets. A fair market value is then determined based upon all the expenses at hand. The negative of using this type of valuation approach is that it does not consider the future growth and potential of the company, only the current efficiency based on expense and it also doesn’t take into account intangible assets such as the talent of the leadership team, brand, patents, etc.

Pro Tip: When To Use This Method

The Cost-to-Duplicate Approach might be the right approach to asset valuation when the product is simple and won’t require a lot of expensive development, the team is lean and the burn rate of capital is extremely slow or even non-existent. Lean startups with one or two folks at the helm, or with a founding team that isn’t taking a salary yet could use this method to justify their first infusion of cash to start taking a salary or start making bigger financial moves.

5. Risk Factor Summation Method

Every venture capital fund or any investment firm is spending time unpacking the potential risks of each and every new investment they make. The Risk Factor Summation Method is used with risk as the primary method for evaluation. This approach values a startup by taking into quantitative consideration all risks associated with the business that can affect the return on investment.

An initial value is calculated (possibly even using one of the other methods discussed in this post) and then the risks are assessed, deducting or adding to the initial value calculation based on said risks to the return. Some of the different kinds of risks that are taken into account are management risk, political risk, manufacturing risk, market competition risk, investment and capital accumulation risk, technological risk, and legal environment risk.

Pro Tip: When To Use This Method

This method is often used by investors when looking at a new space or as a second pass on assessing the value of a potential investment.

6. Discounted Cash Flow Method

This method is predicting the valuation of a company based on its assumed future cash flows. The hope is that the DCF (Discounted Cash Flow) is above the current cost of investment resulting in projected positive return and higher valuation. A discount rate is used to find the value of present future cash flows.

For example, the discount rate might be the average rate of return that shareholders in the firm are expecting for the given year. That percent (maybe 5%, 10%, etc.) is then used to make a year-over-year assumption. This hypothetical informs investors that based on the current cash flow and discount rate chosen to asses, the expected cash flow can be anticipated from this investment.

Pro Tip: When To Use This Method

This is a great valuation method to use for a company that has relatively predictable and stable up and to the right growth up until the time of investment.

Related resource: Discounted Cash Flow (DCF) Analysis: The Purpose, Formula, and How it Works

7. Venture Capital Method

This method is one of the most common, if not the most common method used for evaluating startups that are pre-cash flow and seeking VC investment. The VC Method looks at 6 steps to determine valuation:

Estimate the Investment Needed

Forecast Startup Financials

Determine the Timing of Exit (IPO, M&A, etc.)

Calculate Multiple at Exit (based on comps)

Discount to PV at the Desired Rate of Return

Determine Valuation and Desired Ownership Stake

Its ultimately a quick, rough estimate informed by as much information as is available based on the market, comps, any existing quantitative and qualitative info from the company at hand, and an assumed amount of risk from the VC Firm.

Related Resource: A User-Friendly Guide on Convertible Debt

Pro Tip: When To Use This Method

Most startups should expect that this valuation method will be applied when seeking early rounds of funding, especially from popular venture capital funds.

8. Book Value Method

The Book Value of a company is the net difference between that company’s total assets and total liabilities. The idea of this valuation method is to reflect what total value of a company’s assets that shareholders of that company would walk away with if that company was completely liquidated. Book Value is equated to the carrying value on a balance sheet. To calculate book value, look at the total common stockholder’s equity minus the preferred stock and then divide that number by the number of common shares in a company.

Pro Tip: When To Use This Method

This valuation is extremely helpful in determining if a company’s current stock value is under or overpriced when attempting to determine overall valuation.

9. First Chicago Method

Named after the VC arm of The First Chicago Bank, this valuation method uses a combo of multiple-based valuation and discounted cash flow to make a valuation of a company. Essentially, this method allows you to take into account many different possible outcomes for the business into the valuation – to keep it simple, you can think of this method as taking into consideration the business’s best case scenario, worst-case scenario, and average scenario.

Looking at all 3 scenarios, an estimate is made as to how likely each scenario is. Next, you multiply the probabilities by their respected values and add them up. This gives you a weighted average valuation from the combo of the 3 most likely scenarios – valuing the business on the average of what will probably happen.

Pro Tip: When To Use This Method

This valuation method is recommended for dynamic, early-stage growth companies. It’s used when companies have a future with many possible outcomes that could come about based on the next decisions made.

10. Standard Earnings Multiple Method

A multiple is a fraction in which the top number (the numerator) is larger than the bottom number (the denominator). The earnings of a business are defined as income or profit. The Standard Earnings Multiple Method looks at the earnings of the business over an industry-standard multiple. Every industry and sector may have a slightly different average multiple.

Pro Tip: When To Use This Method

One common scenario where this method is used is to measure stock pierce earnings with price/earnings ratio, which measures stock price to earnings. P/E ratio tells what the market (stock buyers) are willing to pay for the company’s earnings with a higher ratio indicating that people are willing to pay more.

Share Your Startup Valuation With Visible

Use Visible to communicate with your current investors. Raise capital, update investors and engage your team from a single platform. Try Visible free for 14 days.

Related Resources:

A Complete Guide on Founders Agreements

Who Funds SaaS Startups?

Types of Venture Capital Funds: Understanding VC Stages, Financing Methods, Risks, and More

Top Creator Economy Startups and the VCs That Fund Them

investors

Reporting

Customer Stories

[Webinar Recording] Best Practices for Portfolio Monitoring & Reporting With Gale Wilkinson

As more capital flows into venture as an asset class, investors increasingly compete for LP dollars and space on the cap table from the best founders they work with. Gone are the days when capital is enough of a differentiator for a VC fund to get on a hot startup’s cap table.

Considering the average VC + Founder relationship is 8-10 years (longer than the average marriage in the US) — founders are beginning to look for a true partner out of a VC fund. For a VC fund or emerging fund manager to stand out among other funds, they need to have the optimal data and systems in place.

Gale Wilkinson, Managing Partner and Founder of Vitalize Ventures, has led investments in over 70 companies and deployed $50M+ of capital. During her time at Vitalize and Irish Angels, Gale has turned into a leader in the space as emerging managers and founders turn to her for advice on all aspects of fund and startup building.

Gale joined us on February 15, 2022 to discuss how and why VC funds should build a system to track and monitor their portfolio companies.

Topics discussed during the webinar include:

The history and founding of Vitalize Ventures

The resources, network, communities, that has Gale has leveraged as she grows her managing partner skillset

How she put together the Vitalize tech stack

What metrics and data she collects from portfolio companies

How she reports portfolio performance to her LPs

Visible for Investors is a founders-first portfolio monitoring and reporting platform. Schedule time with our team to learn more.

Unlock Your Investor Relationships. Try Visible for Free for 14 Days.

Start your free trial