Customer Development was introduced by entrepreneur Steve Blank in the early 90s. Since its inception, customer development has become core curriculum for startup founders and operators. Customer Development is one of the parts that make up a “lean startup,” an idea introduced by Steve Blank and Eric Ries.

As the customer development framework has become a widely used approach in the startup world, we’ve decided how the process can be applied to a key facet of building a startup: investor development. In order to better understand investor development, it is important to understand customer development.

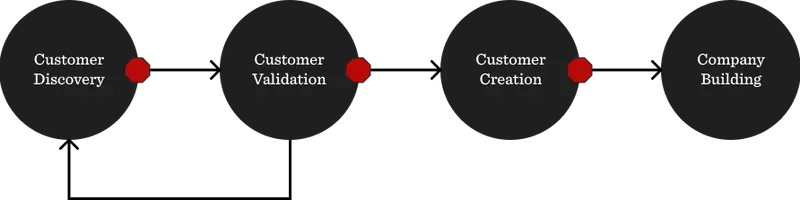

As Steve Blank puts it in his book, The Four Steps to the Epiphany, “Broadly speaking, customer development focuses on understanding customer problems and needs, customer validation on developing a sales model that can be replicated, customer creation on creating end-user demand, and company building on transitioning the company from one designed for learning and discovery to a well-oiled machine engineered for execution.”

The customer development framework can be broken down into the 4 steps below:

- Customer Discovery — “The goal of Customer Discovery is just what the name implies: finding out who the customers for your product are and whether the problem you believe you are solving is important to them.”

- Customer Validation — “Customer Validation is where the rubber meets the road. The goal of this step is to build a repeatable sales road map for the sales and marketing teams that will follow later.”

- Customer Creation — “Customer Creation builds on the success the company has had in its initial sales. Its goal is to create end-user demand and drive that demand into the company’s sales channel.”

- Company Building — “Company Building is where the company transitions from its informal, learning and discovery-oriented customer development team into formal departments with VPs of Sales, Marketing and Business Development.”

Finding and marketing to new customers is hard. To help with this, it is important to note the four steps are recursive and iterative. As Steve Blank writes, “The nature of finding and discovering a marketing and customers guarantees that you will get it wrong several times. Therefore, unlike the product development model, the Customer Development model assumes that it will take several iterations of each of the four steps until you get it right.”

What is Investor Development?

As founders and investors often stress, raising venture capital is very much a structured process. And more times than not, a process full of nos and disappointments. Just as the Customer Development model assumes it will take several iterations until you get it right, the same can be said for pitching and closing investors.

Elizabeth Yin, founder of the Hustle Fund, says, “an experienced fundraiser knows that the goal in going into your first fundraising meeting is to ask lots of questions and walk away understanding what next steps make sense. You should understand your potential investor’s pain points. Is there something you can solve for a potential investor by having him/her invest in your company? Do you have a solution for those pain points?”

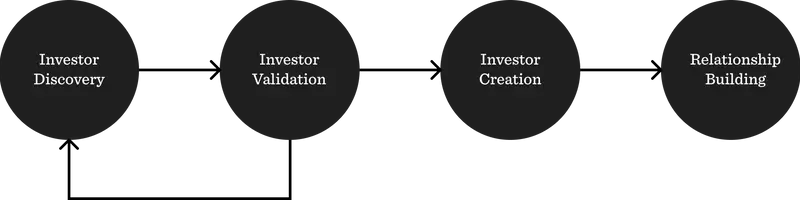

Following the core principles of the Customer Development model and Elizabeth’s idea mentioned above, a founder can easily systemize their fundraising process using the four investor development steps below:

- Investor Discovery — Investor discovery is the process of identifying targeted potential investors and whether your company/product/service can solve your investor’s needs and requirements.

- Investor Validation — Investor validation is where founders iterate on what they learned in the discovery stage and tailor their pitch and begin targeted outreach and conversation. Validation proves that investors are reacting positively to your company/product/service by investing capital.

- Capital Creation — Capital creation builds on the success from the first 2 stages and creates a scalable process for the current, and future, fundraises. Checks are being written and demand is being created for follow-on and future investors.

- Relationship Building — Relationship building is when your fundraising and investor relations process has matured. Formal expectations have been set between you, the founder, and your current and future investors.

Note, that this is an iterative process (just like the Customer Development Model). If you believe your company cannot satisfy a potential investor’s requirements, ask questions to understand why and reiterate your solution to solve their investment pain points and requirements.

Investor Discovery

Investor discovery is the start of your fundraising journey. Before you begin the investor discovery stage it is important to identify who you believe your target investors to be by creating an ideal investor persona and list of targeted investors.

The discovery process will happen during your first meeting with a new investor. A first-time founder may be tempted to begin their meeting with a company pitch and paint a picture of why their company is worthy of being venture-backed. However, this should be a time to understand the investor’s needs. Ask plenty of questions and pull together your learnings to tailor your solution and pitch to their needs.

As Elizabeth Yin sums it up, “Your job in the first meeting with a potential investor is to ask a lot of questions—a la customer development style—to understand how you might be able to tie your story to their problems and interests. And so your pitch should not be stagnant, and although you may have created a deck before the meeting, it’s important to tie your talking points together as a solution to the problems you learn about in that meeting.”

Investor Validation

The next step in the process is to validate your solution and scale your process to other investors you’ve identified. As mentioned above, the first meeting with every investor should be about uncovering their pain points and requirements to tailor your pitch for each investor. The same holds true for the validation stage, but with an emphasis on rolling out your learnings and dialing in your pitch as you uncover different strengths of your business and your pitch from each new meeting.

By completing both investor discovery and investor validation, you confirm that your company/product/solution is worthy of being venture-backed. These steps verify that your business model is feasible, the market is of interest to investors, establishes your price, and creates the perceived value to the market, and investors.

Capital Creation

To create capital you need to have proved your company is worth of being venture-backed. By completing investor discovery and investor validation you have likely confirmed your company is ready to be venture-backed. Capital creation is when checks from initial investors are being cashed. By validating the value of your company, a new sense of demand will be created for your company, new opportunities with co-investors and future investors will arise.

It is important to note that new opportunities will arise for a future round. However, by taking your learnings from the first discovery and validation, you’ll be to engage these investors for a later fundraise.

Relationship Building

The final stage is relationship-building. The relationship-building stage is when your investor relations and fundraising processes have matured. You’ll have an established rhythm for communicating and engaging with your current investors as well as an approach for reaching out to prospective investors.

Investors are invested in your success as a company and have validated that you are fulfilling a pain point. It is your duty to show that you’re taking their commitment seriously and sharing how you’re deploying their capital and ensuring they can help create value along the journey.

All in all, it is vital to create a process that allows you to iterate and improve along the way. At the end of the day you are selling your company to a potential customer (read: investor) and communication is at the center of the relationship. Interested in learning more about investor development? Check out other ideas on our Founders Forward blog here.